Six intense years at the helm of the Banco de España. How have we responded to the challenges we have faced?

In his farewell as Governor, Pablo Hernández de Cos shares his vision about the Banco de España’s role during his term of office (2018-2024). These years have been marked by a succession of unprecedented events, such as the pandemic and economic and inflationary swings.

10/06/2024

Today, at the end of my mandate, I step down as Governor of the Banco de España, a position I have been honoured to hold since June 2018. I would like to start with a personal reflection on what this period, fraught with upheaval, has entailed for the Banco de España and how we have dealt with it as an institution.

The Banco de España’s priorities are to meet the basic objectives we have been entrusted with – price stability![]() and financial stability

and financial stability![]() – and to contribute to improving economic policy-making through our analysis of the Spanish economy and its international environment

– and to contribute to improving economic policy-making through our analysis of the Spanish economy and its international environment![]() .

.

Our task is inherently complex, but these six years have been particularly daunting.

These six years have been marked by a more uncertain and complex environment. The Banco de España has helped shape economic policies to address this juncture in Spain, Europe and the world

A turbulent period, strewn with challenges

In 2018, Spain’s economy was regaining momentum![]() in the wake of the 2007 global financial crisis, exacerbated in Europe by the subsequent fiscal crisis

in the wake of the 2007 global financial crisis, exacerbated in Europe by the subsequent fiscal crisis![]() . These crises had a strong impact on our economy and our financial system. Also, admittedly, on its reputation and trustworthiness.

. These crises had a strong impact on our economy and our financial system. Also, admittedly, on its reputation and trustworthiness.

A succession of shocks, which led to major disruptions, a stumbling economy and the collapse of per capita income, ground the recovery to a halt (see Charts 1 and 2).

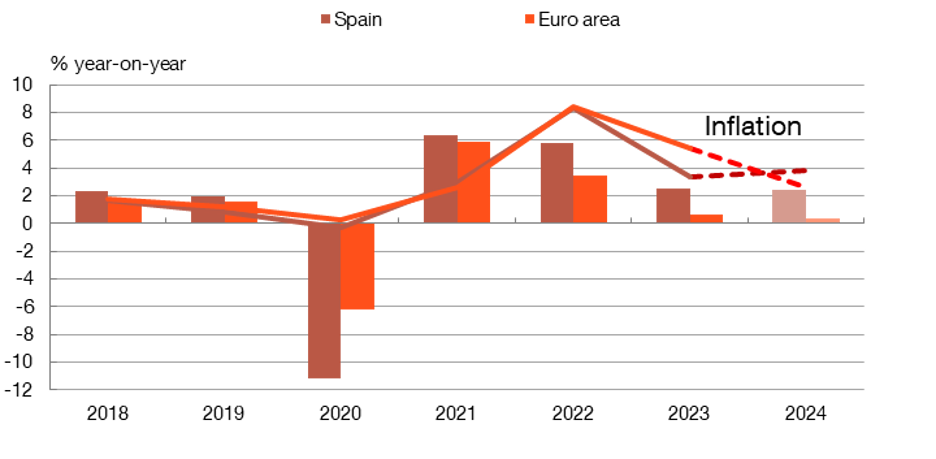

Chart 1

ECONOMIC ACTIVITY AND INFLATION HAVE EXPERIENCED LARGE SHOCKS BETWEEN 2018 AND 2024

SOURCES: INE and Eurostat

NOTE: The figures provided for 2024 are the flash estimate of the year-on-year growth of GDP in Q1 and the year-on-year rate of the leading indicator of inflation (the harmonised index of consumer prices (HICP)) for May.

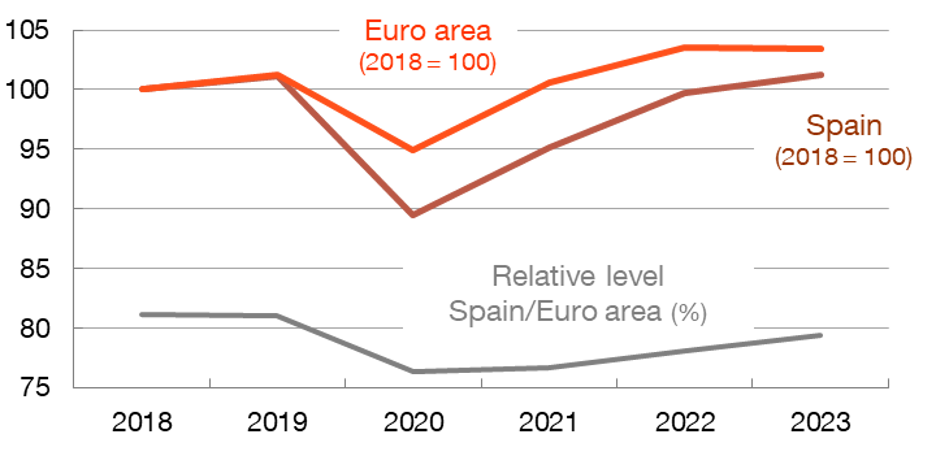

Chart 2

CHANGES IN REAL PER CAPITA INCOME, 2018-2023

SOURCE: Eurostat.

NOTE: GDP per capita in real terms for Spain (brown line) and the euro area (orange line). The level for the initial year (2018) is set at 100 and the changes with respect to this initial level are shown. The grey line depicts Spain's level of per capita income relative to the euro area, expressed as a percentage.

The first and most important shock was the COVID-19 pandemic![]() in early 2020, which brought global activity to a standstill. In 2021, as the economy was beginning to recover, inflation came back with a vengeance

in early 2020, which brought global activity to a standstill. In 2021, as the economy was beginning to recover, inflation came back with a vengeance![]() , after decades of lying dormant (see Chart 1). Russia’s invasion of Ukraine stoked inflation and hindered the recovery

, after decades of lying dormant (see Chart 1). Russia’s invasion of Ukraine stoked inflation and hindered the recovery![]() . In 2023 a banking crisis

. In 2023 a banking crisis![]() in the United States and Switzerland threatened the global financial system, although its impact was ultimately limited. More recently, Gaza has become a further source of uncertainty.

in the United States and Switzerland threatened the global financial system, although its impact was ultimately limited. More recently, Gaza has become a further source of uncertainty.

These events have strengthened other dynamics that were already transforming the global economy:

- The need for the financial sector to adapt to the post-2007 changes in financial regulation and crisis management

, while facing the challenge of financial innovation.

, while facing the challenge of financial innovation. - An increasingly globalised world

through trade, capital and information flows but, at the same time, with a growing risk of fragmentation and profound geopolitical changes and risks.

through trade, capital and information flows but, at the same time, with a growing risk of fragmentation and profound geopolitical changes and risks. - The climate emergency, which has become a key social and economic policy priority.

- The acceleration of technological change, for example in artificial intelligence, which affects all the economic and social dimensions.

- Demographic dynamics leading to a more elderly society.

- An increased mistrust of institutions and global political polarisation.

All of this has resulted in a more uncertain and complex environment which, on the domestic front, is reflected in numerous (new and old) challenges for the Spanish economy. We have recently analysed them in our Annual Report 2023![]() and summarised them in this blog

and summarised them in this blog![]() .

.

The Banco de España has contributed decisively to economic policy-making to address this complex situation. Not only in Spain, but also at European level, as in the case of the Eurosystem’s monetary policy![]() , banking supervision (through the Single Supervisory Mechanism

, banking supervision (through the Single Supervisory Mechanism![]() ), macroprudential oversight (through the European Systemic Risk Board

), macroprudential oversight (through the European Systemic Risk Board![]() ) and the resolution of institutions (through the Single Resolution Mechanism

) and the resolution of institutions (through the Single Resolution Mechanism![]() ). And even globally, for example, through the Financial Stability Board

). And even globally, for example, through the Financial Stability Board![]() or the Basel Committee on Banking Supervision

or the Basel Committee on Banking Supervision![]() , which I have had the honour of chairing since 2019.

, which I have had the honour of chairing since 2019.

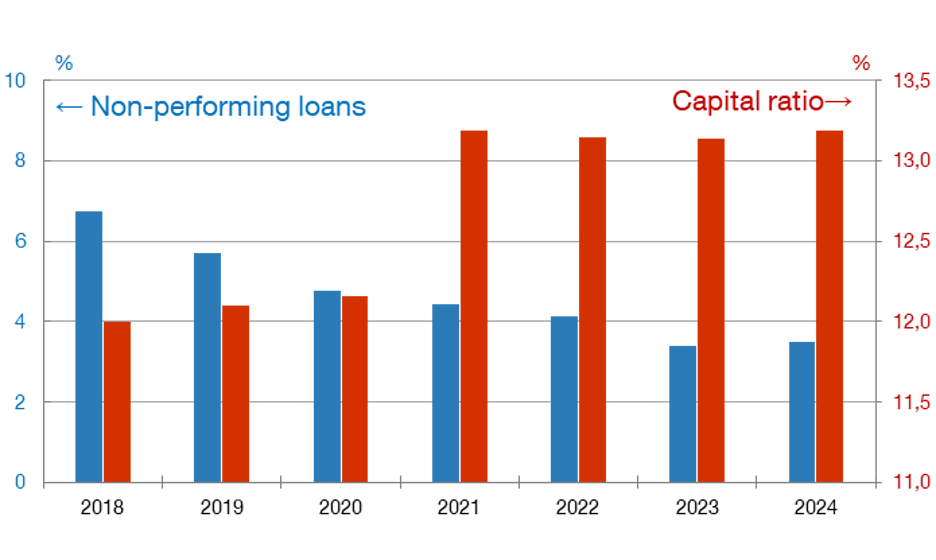

After so many shocks, the economic situation has stabilised and per capita income has returned to its pre-pandemic level. The fight against inflation is on the right track and this has allowed us to start cutting interest rates at the meeting of the Governing Council of the European Central Bank (ECB) on 6 June (which was also my last). Meanwhile, financial stability has been preserved and our banking system’s solvency and liquidity levels are now higher than before (see Chart 3).

Chart 3

THE INDICATORS OF FINANCIAL STABILITY HAVE IMPROVED IN RECENT YEARS

SOURCE: Banco de España.

NOTE:

-The data correspond to the aggregate of Spanish deposit institutions at end-Q1 each year.

-The non-performing loan ratio is calculated as the ratio of non-performing loans to total loans for the entire resident private sector (households, non-financial corporations and financial corporations).

-The CET1 capital ratio is calculated as the ratio of common equity tier 1 (mainly ordinary shares and reserves) to risk-weighted assets.

However, Europe is falling behind the other major world economies. And Spain has failed to achieve sustained convergence in per capita income with our European peers for more than a decade. Reversing these trends will require ambition and reaching major political agreements. All this in a context of uncertainty and change that requires us to remain vigilant.

What has been the key to addressing these and other internal challenges at the same time?

The Banco de España is a sound institution. Its strength is underpinned by its deeply rooted institutional values (see Figure 1) and its highly-qualified staff, who are firmly committed to public service. Two main pillars stand out among these values: analytical rigour and independence.

Figure 1

BANCO DE ESPAÑA'S INSTITUTIONAL VALUES

SOURCE: Banco de España.

These ingredients undoubtedly help. But in a large and complex institution, strategic planning is critical to responding to major challenges.

Strategic planning and the external evaluation of our actions are essential to respond to these major challenges, modernise the Banco de España and help us become an outstanding central bank committed to society

The Banco de España’s Strategic Plan 2024![]() (our first) has allowed us to define our vision for the future and guides our actions. Not only has it helped us to respond to challenges and fulfil our mission, but also to modernise the Banco de España, whose ambition is to become an outstanding, dynamic and trustworthy central bank that is committed to society.

(our first) has allowed us to define our vision for the future and guides our actions. Not only has it helped us to respond to challenges and fulfil our mission, but also to modernise the Banco de España, whose ambition is to become an outstanding, dynamic and trustworthy central bank that is committed to society.

The five main objectives of the Plan are shown in Figure 2.

Figure 2

THE BANCO DE ESPAÑA’S STRATEGIC PLAN 2024. THE FIVE MAIN OBJECTIVES

SOURCE: The Banco de España launches its Strategic Plan 2024![]() .

.

A key component is transparency, which is crucial for building trust in the Banco de España. In this respect we have strengthened our accountability to the public in the last few years – before parliament and through public interventions and the open evaluation of our work.

We recently carried out an accountability exercise under the Strategic Plan 2024![]() , whose main initiatives are summarised in Figure 3.

, whose main initiatives are summarised in Figure 3.

Figure 3

MAIN INITIATIVES AND ASSESSMENT OF THE STRATEGIC PLAN 2024

SOURCE: Banco de España.

Our independent external evaluation programme![]() is another important pillar in promoting transparency. It is also key to putting our commitment to continuous improvement into practice.

is another important pillar in promoting transparency. It is also key to putting our commitment to continuous improvement into practice.

Over the years we have made significant efforts to reach out to the public and raise our international profile, thereby improving our external image.

Another central pillar of our strategy, although less visible from the outside, is the internal changes we introduced to improve our effectiveness and efficiency, make our work more consistent and allow for more flexibility.

Overall, we believe that in these years we have contributed to boosting the presence, impact and external influence of the Banco de España in its various areas of operation, as well as to significantly improving the flexibility, agility and efficiency of its internal organization.

Looking ahead, flexibility and adaptability will remain essential. Further progress will therefore be needed in these dimensions to ensure that the Banco de España can provide a cross-cutting, comprehensive and agile response to the myriad challenges it will face over the coming years.

It has been a privilege to be the Governor of the Banco de España and lead such a skilled team of people committed to the institution’s objectives, which ultimately strive to improve our citizens’ well-being. My last words are of gratitude to all of them, with the conviction that they will maintain this same commitment to public service in the new chapter that is now beginning.