Lessons learned from the 2023 banking crises

In 2023 three US banks and one Swiss bank failed, requiring the authorities to step in. The impact was limited, but the episode shows how deficient risk management and inadequate governance can result in liquidity problems that spread rapidly. We can learn lessons from these cases that help us mitigate risks in the future.

13/03/2024

Depositors’ loss of confidence in a bank can spread to and topple others, especially if there are weaknesses in their business model, risk management and governance arrangements. March 2023 saw the beginnings of a crisis of this type which affected several banks. What were the causes? How did supervisors and regulators respond? What lessons are to be learned?

Timeline and causes of the crisis

The crisis, which we analysed in detail in this article![]() , was triggered by a bank run on Silicon Valley Bank in California. The turmoil spread like wildfire to other banks, prompting three US banks and one Swiss bank to fall like dominoes.

, was triggered by a bank run on Silicon Valley Bank in California. The turmoil spread like wildfire to other banks, prompting three US banks and one Swiss bank to fall like dominoes.

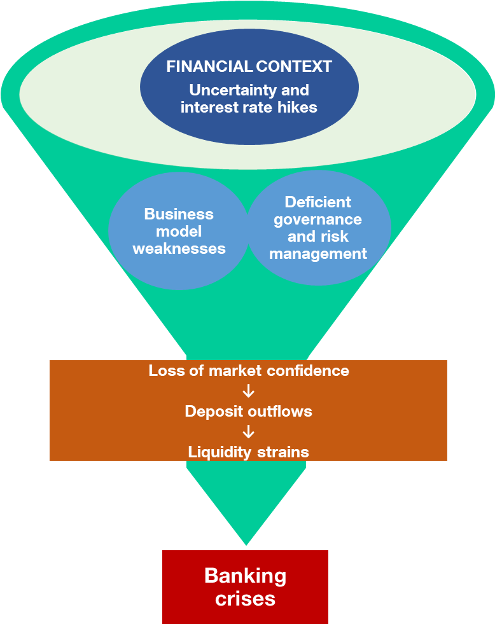

Figures 1 and 2 show the timeline and summarise the causes of the crises, respectively.

Figure 1

TIMELINE OF HOW THE BANKING CRISES UNFOLDED BETWEEN MARCH AND MAY 2023

SOURCE: Alonso, Anguren, Manzano and Mochón (2023)![]() .

.

Figure 2

CAUSES OF THE MARCH-MAY 2023 BANKING CRISES

SOURCE: Alonso, Anguren, Manzano and Mochón (2023)![]() .

.

The problems arrived amid inflationary pressures and financial market instability due to the deteriorating economic situation. Policy interest rate hikes to combat inflation laid bare the imbalances on US banks’ balance sheets:

-

On the liabilities side, the deposits were subject to high turnover and, largely, were not covered by deposit guarantee schemes. This lack of deposit insurance required high deposit rates in order to attract customers.

-

On the assets side, the debt securities portfolio acquired prior to the interest rate hikes had very long maturities and earned interest at much lower rates than those of March 2023. As a result of the monetary tightening, the portfolio’s market price fell due to the inverse relationship between bond prices and interest rates.

These imbalances eroded confidence in the solvency of these banks, prompting deposit outflows. The decline in deposits forced the banks to sell some of the portfolios at the low market price, incurring losses. Events came to a head despite the authorities injecting extraordinary liquidity. The problems also spread to Credit Suisse, which had been experiencing management and governance issues.

In short, the affected banks had traits in common: their growth was based on unsustainable business models and there were vulnerabilities in their governance arrangements, interest rate and liquidity risk management and their funding structure. Strength in these areas is key to preventing episodes such as those observed in 2023.

The affected banks shared vulnerabilities in their governance arrangements, management and funding structure

The role of supervisors

It is also important to analyse the role of banking supervision![]() and the existing regulation

and the existing regulation![]() at the global level, an issue which supervisory bodies and regulators are focusing on. Were they aware of the existing problems? What lessons were learned?

at the global level, an issue which supervisory bodies and regulators are focusing on. Were they aware of the existing problems? What lessons were learned?

The national supervisors had detected many weaknesses and shortcomings. However, as highlighted![]() by the Basel Committee on Banking Supervision

by the Basel Committee on Banking Supervision![]() , action was not taken quickly enough, owing to slow internal supervisory processes regarding decision-making or a lack of sufficiently effective supervisory and sanctioning measures.

, action was not taken quickly enough, owing to slow internal supervisory processes regarding decision-making or a lack of sufficiently effective supervisory and sanctioning measures.

The crises brought to light areas where there was room for improvement which are not equally applicable to all countries because of differences between them. These include:

- Full implementation of Basel III

standards, with proportionality and sufficient resources.

standards, with proportionality and sufficient resources. - Analysis of business model sustainability.

- Supervision of liquidity lines in stress scenarios, considering the potential degree of deposit turnover.

- Paying attention to interest

and market risk

and market risk .

. - Availability of an agile and flexible range of supervisory measures suitable for the severity of each case and an improvement in the management processes in the event of non-compliance.

The role of regulation

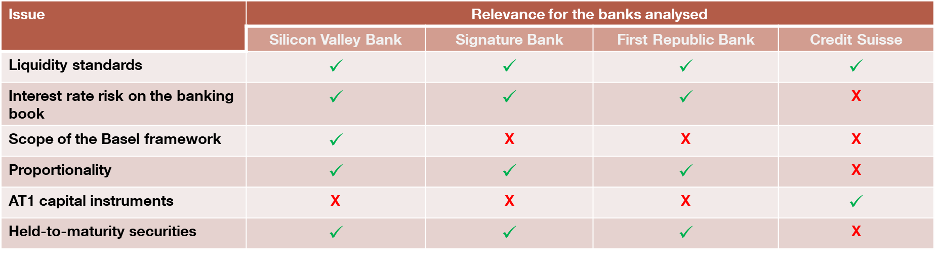

In its analysis![]() the Basel Committee also addressed regulatory issues and initial lessons in this field, which are summarised in Figure 3. The Basel III framework has protected the global banking system, underlining that its full and consistent implementation

the Basel Committee also addressed regulatory issues and initial lessons in this field, which are summarised in Figure 3. The Basel III framework has protected the global banking system, underlining that its full and consistent implementation![]() at international level is a priority.

at international level is a priority.

Figure 3

THE BANKING TURMOIL AFFECTED VARIOUS AREAS OF THE BASEL FRAMEWORK

SOURCE: Basel Committee on Banking Supervision (Report on the 2023 banking turmoil![]() ).

).

NOTE: Additional Tier 1 (AT1) capital absorbs losses after the highest quality capital, Common Equity Tier 1 (CET1, common shares and retained earnings), according to the Basel III capital criteria![]() . In the case of Credit Suisse, the AT1 capital instruments were completely written down to absorb losses before CET1, prompting uncertainty over the regulatory framework.

. In the case of Credit Suisse, the AT1 capital instruments were completely written down to absorb losses before CET1, prompting uncertainty over the regulatory framework.

Basel III has protected the global banking system. Its full and consistent implementation is a priority

The Basel Committee highlighted other issues, such as:

- Scope and proportionality. The failing US banks were not subject to the Basel III framework in full, since in the United States it only applies to the larger and global systemically important banks. Hence the importance of applying the framework in a proportionate and consistent manner commensurate with banks’ risk profile and systemic importance.

- Liquidity standards. Bank liquidity is sensitive to abrupt changes in market sentiment and may become a problem if leverage is high or there are large imbalances in loan maturities or net interest income does not cover costs. Vulnerability increases with changes in customer behaviour fuelled by technology and social media. This has prompted regulators to initiate an analysis of the adequacy of the design of these standards.

- Treatment of interest rate risk

. Monetary policy tightening and its effect on interest rate risk management make it necessary to analyse the adequacy of the current treatment, based on a supervisory (Pillar 2

. Monetary policy tightening and its effect on interest rate risk management make it necessary to analyse the adequacy of the current treatment, based on a supervisory (Pillar 2 , according to Basel III) and market information (Pillar 3

, according to Basel III) and market information (Pillar 3 ) approach.

) approach.

What plans does the Basel Committee have?

The Basel Committee has homed in on strengthening supervisory effectiveness to ensure that these problems can be identified and corrected promptly. It is also analysing and assessing the functioning of the regulatory framework before deciding on the suitability of adjusting specific areas of it. The aim is to ensure that the banking sector is better prepared to withstand similar turmoil in the future.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.