Bizum and the success of instant credit transfers in Spain

The digitalisation of the economy has transformed how we communicate, consume and pay, increasing demand for instant payment services that are available 24/7. With instant credit transfers accounting for over 50% of all transactions processed, Spain is spearheading the global surge in the use of this payment method.

21/03/2024

You’ve probably said “I’ll Bizum you” recently, but it’s a phrase that was only coined in the last eight years, giving us an idea of the profound transformation payment methods have undergone in such a short period of time. The surge in instant credit transfers is a global phenomenon, but their roll-out in Spain has been particularly rapid. How do they work? What are the keys to their success in Spain?

With instant credit transfers![]() , the money is available in the payee’s account in just a few seconds, 24/7, 365 days a year. This immediacy and consistent availability offer consumers and businesses and general government huge advantages.

, the money is available in the payee’s account in just a few seconds, 24/7, 365 days a year. This immediacy and consistent availability offer consumers and businesses and general government huge advantages.

Instant credit transfers also allow innovative payment solutions to be developed for mobiles (and other devices). So we can order instant payments just as quickly, safely and conveniently as when we use other common electronic means of payment, such as cards.

The Eurosystem’s role in promoting instant payments

The development of instant payments requires a robust and carefully designed infrastructure. The Eurosystem and the Euro Retail Payments Board![]() have supported their consistent roll-out in Europe. The upshot was a new payment instrument called SEPA Instant Credit Transfers

have supported their consistent roll-out in Europe. The upshot was a new payment instrument called SEPA Instant Credit Transfers![]() , launched in November 2017. Since then, consumers and businesses have been able to send and receive instant credit transfers in euro throughout Europe, within the Single Euro Payments Area (SEPA)

, launched in November 2017. Since then, consumers and businesses have been able to send and receive instant credit transfers in euro throughout Europe, within the Single Euro Payments Area (SEPA)![]() . The same rules, conditions and standards apply to all users across Europe.

. The same rules, conditions and standards apply to all users across Europe.

In 2019 the Eurosystem published its retail payments strategy![]() , which was revised in 2020 and 2023 and is aligned with the new Regulation of the European Parliament on instant credit transfers.

, which was revised in 2020 and 2023 and is aligned with the new Regulation of the European Parliament on instant credit transfers.

One of its main goals is to continue promoting the full deployment of SEPA Instant Credit Transfers in Europe, foreseeing that they may ultimately replace traditional transfers in the medium to long term. This strategy will boost competition, efficiency and innovation, paving the way for new payment solutions, use cases and value-added services.

Spain: Bizum and the reasons for its success

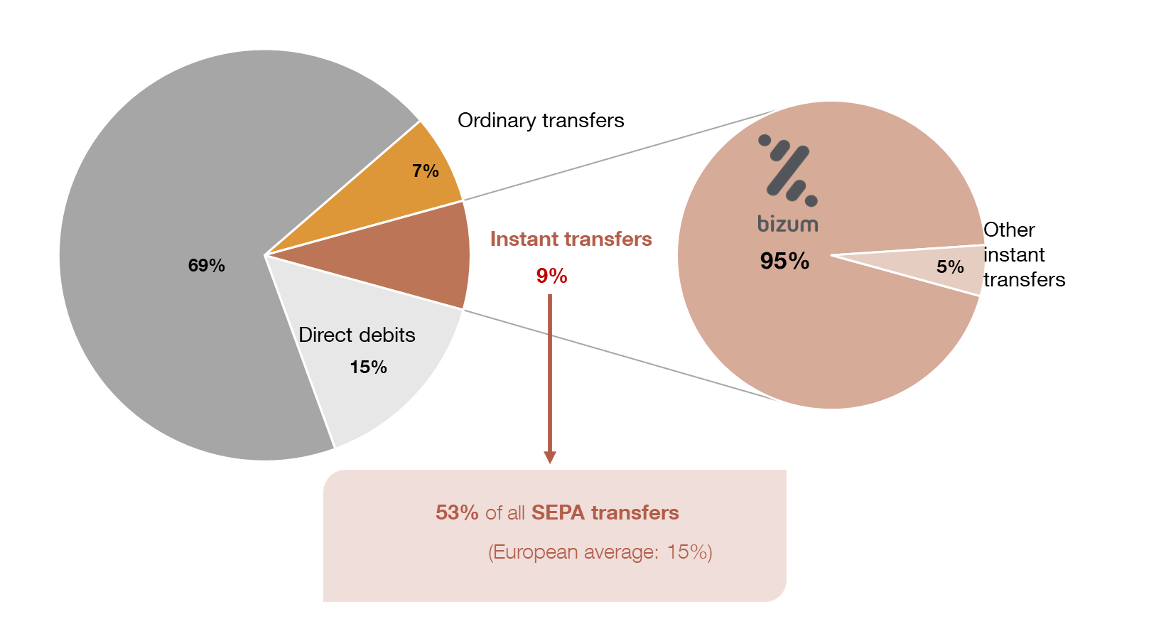

Spain is a trailblazer in the adoption of instant credit transfers and a leader in Europe. So much so that instant credit transfers account for 53% of all transfers processed in Spain (see Chart 1), compared with the European average of around 15%.

Spain leads Europe in instant transfers (53% of all transfers, compared with the European average of 15%)

Chart 1

MAJOR PAYMENT CHANNELS BY VOLUME AND BREAKDOWN OF INSTANT TRANSFERS

SOURCES: Banco de España, Iberpay, STMP and Bizum.

A key part of this growth has been the warm reception Bizum![]() has received. The result of a collaborative initiative by the Spanish financial sector, Bizum has been able to meet the growing demand for real-time financial services from mobile-savvy consumers. This collaborative endeavour is the distinguishing feature compared with other European countries, where a sectoral agreement of this scale has been absent. The high degree of accessible accounts at most Spanish banks and the easy, mobile number-based user experience have done the rest.

has received. The result of a collaborative initiative by the Spanish financial sector, Bizum has been able to meet the growing demand for real-time financial services from mobile-savvy consumers. This collaborative endeavour is the distinguishing feature compared with other European countries, where a sectoral agreement of this scale has been absent. The high degree of accessible accounts at most Spanish banks and the easy, mobile number-based user experience have done the rest.

The collaborative endeavour, the high degree of accessible accounts and the straightforward user experience all explain Bizum’s success

Bizum launched in November 2016, backed by the Banco de España, in its role as a catalyst for change, promoter of retail payment efficiency and overseer of payment systems![]() . In a brief period of time, Bizum has become the preferred SEPA Instant Credit Transfers-based mobile payment solution. Like other payment instruments, such as ordinary transfers and direct debits, the interbank settlement of these transfers takes place via the National Electronic Clearing System (SNCE

. In a brief period of time, Bizum has become the preferred SEPA Instant Credit Transfers-based mobile payment solution. Like other payment instruments, such as ordinary transfers and direct debits, the interbank settlement of these transfers takes place via the National Electronic Clearing System (SNCE![]() by its Spanish initials), operated by Iberpay

by its Spanish initials), operated by Iberpay![]() .

.

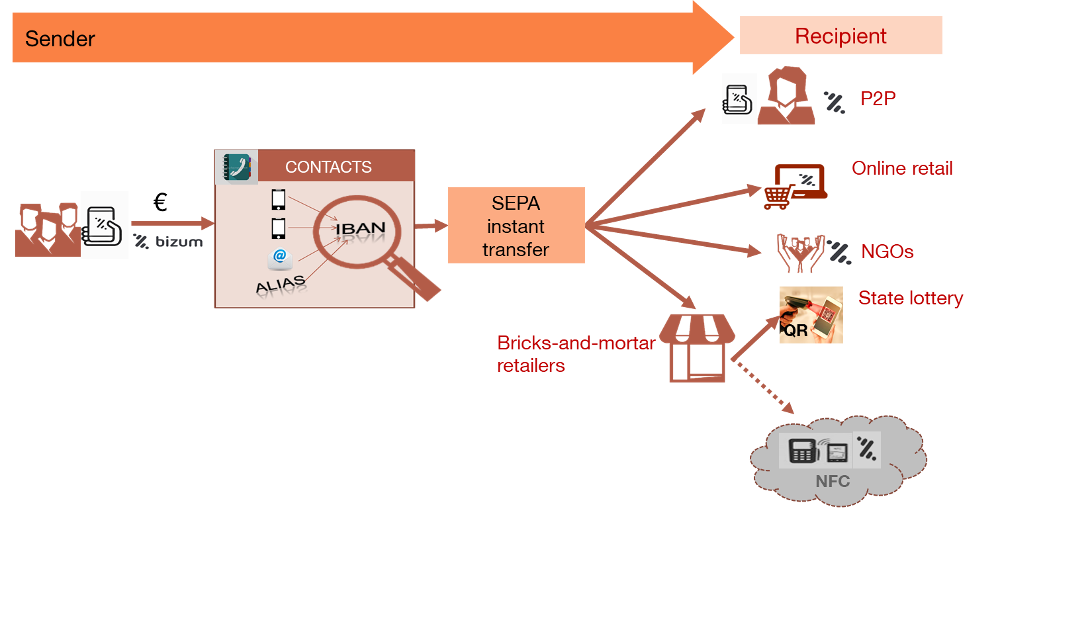

Sending and requesting money is straightforward using Bizum (see Figure 1). Just enter the recipient’s mobile phone number (or choose one of your contacts) and specify the amount to be transferred in the banking app on your mobile. The key is the mobile phone number proxying the IBAN![]() of the recipient’s account, allowing a SEPA instant credit transfer to be activated. This transfer will be paid and fully available in the recipient’s account in a matter of seconds.

of the recipient’s account, allowing a SEPA instant credit transfer to be activated. This transfer will be paid and fully available in the recipient’s account in a matter of seconds.

Figure 1

HOW DOES BIZUM WORK?

SOURCE: Bizum.

NOTE: NFC = near-field communication: a short-range high-frequency wireless communication protocol for data exchange between nearby devices; the arrow and cloud drawn with dotted lines indicate possible future uses.

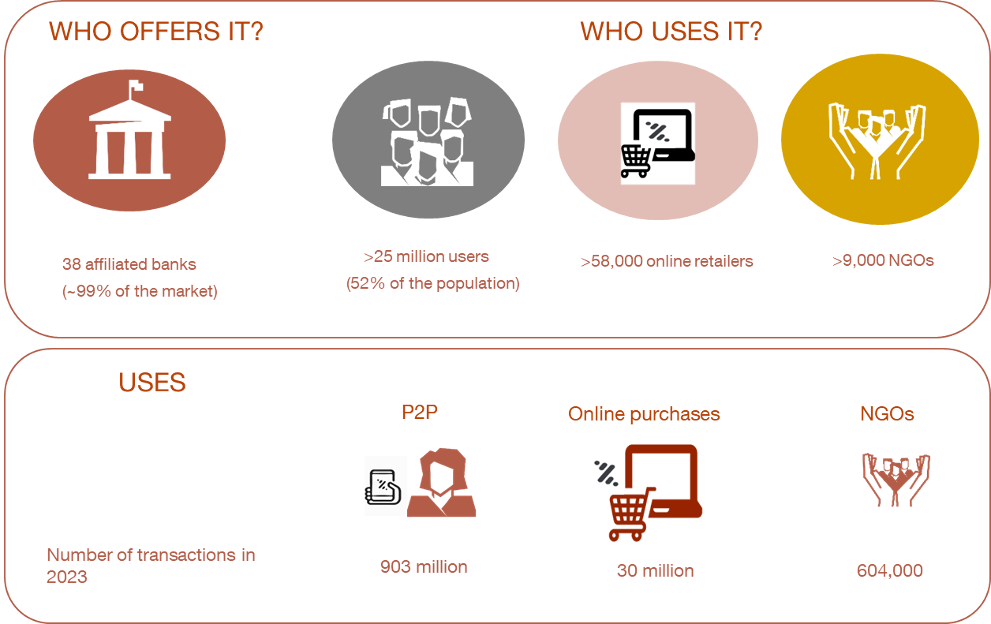

Figure 2 outlines Bizum’s main figures. It took off from the very beginning for easy, fast and safe person-to-person (P2P) payments, but in recent years it is also gaining prominence in e-commerce and in donations to NGOs. Bizum has recently expanded into Andorra and entered negotiations for a potential interconnection with similar solutions in Portugal and Italy![]() , which would further extend its scope.

, which would further extend its scope.

Figure 2

BIZUM IN NUMBERS

SOURCE: Bizum.

Bizum’s potential doesn’t stop there. In the medium term, other bricks-and-mortar stores are expected to join Spanish lottery premises in using QR codes and other technologies, such as NFC ![]() , for contactless phone payments at points of sale..

, for contactless phone payments at points of sale..

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.