The Banco de España didn't report profits in 2023. Why not?

The last decade’s unconventional monetary policies, coupled with the interest rate hikes since 2022 to tame inflation, mean that the Banco de España has not posted a profit for the first time in its history. While this situation is set to persist for another year or so, it will in no way interfere with our ability to do our job.

27/03/2024

Much like companies, central banks have a balance sheet and an income statement. And yet, unlike businesses, their aim is not to make a profit, but rather to deliver on their mandate: to maintain price stability. That said, the Banco de España has always posted profits, which are then passed on to the Treasury. However, this was not the case in 2023, when (thanks to the use of provisions) it broke even. Why is it that we normally make a profit, and what happened this time round? Is the same true of other central banks? Is this situation likely to last?

The Banco de España’s balance sheet and profits

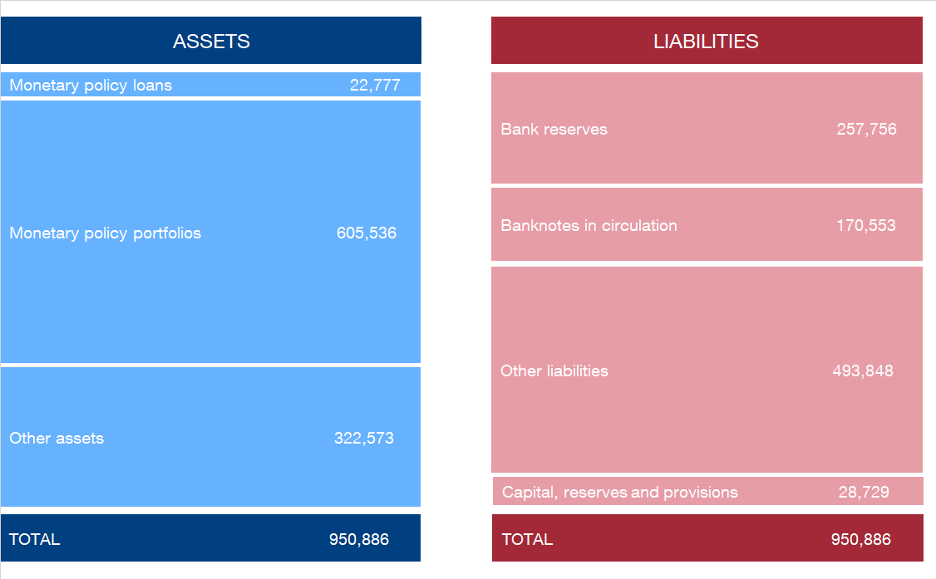

To answer these questions, let’s first take a look at the Banco de España’s balance sheet at the end of 2023 (see Figure 1).

The asset side of the balance sheet is largely the result of conducting European Central Bank (ECB) monetary policy![]() : monetary policy loans and the monetary policy portfolio. The liability side shows the sources used to finance the assets. For our purposes here, it is worth highlighting the deposits (or bank reserves

: monetary policy loans and the monetary policy portfolio. The liability side shows the sources used to finance the assets. For our purposes here, it is worth highlighting the deposits (or bank reserves![]() ) that credit institutions hold at the Banco de España, and the central bank’s own funds: capital, reserves and provisions.

) that credit institutions hold at the Banco de España, and the central bank’s own funds: capital, reserves and provisions.

Thanks to this balance sheet structure, central banks typically make a profit![]() . More often than not, the return on assets is greater than the cost of liabilities. For instance, the banknotes issued by central banks are a zero-interest-bearing liability.

. More often than not, the return on assets is greater than the cost of liabilities. For instance, the banknotes issued by central banks are a zero-interest-bearing liability.

Figure 1

SIMPLIFIED BALANCE SHEET OF THE BANCO DE ESPAÑA AS AT 31 DECEMBER 2023

SOURCE: Banco de España

NOTE: Figures in millions of euro. "Other assets" and "Other liabilities" mainly consist of intra-Eurosystem balances. Although the amounts recognised on the Banco de España's balance sheet are high, they are offset at consolidated Eurosystem level and amount to zero.

Profits in recent years

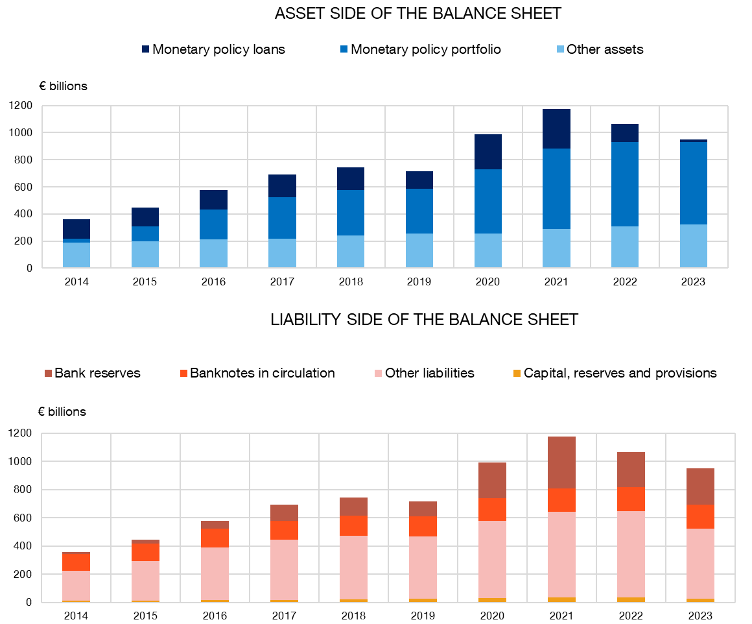

Chart 1 shows how, in line with the rest of the Eurosystem, the Banco de España’s balance sheet has expanded considerably in recent years.

Chart 1

THE BANCO DE ESPAÑA'S BALANCE SHEET AND ITS MAIN HEADINGS

SOURCE: Banco de España.

This rapid growth can be attributed to the “unconventional” monetary policy measures![]() deployed to fight below-target inflation. Chief among them:

deployed to fight below-target inflation. Chief among them:

- the asset purchase programmes![]() , which included a mix of government and corporate debt and which enlarged the monetary policy portfolio;

, which included a mix of government and corporate debt and which enlarged the monetary policy portfolio;

- the long-term financing granted to financial institutions![]() , increasing the volume of monetary policy loans.

, increasing the volume of monetary policy loans.

These measures were stepped up in 2020 in response to the pandemic crisis.

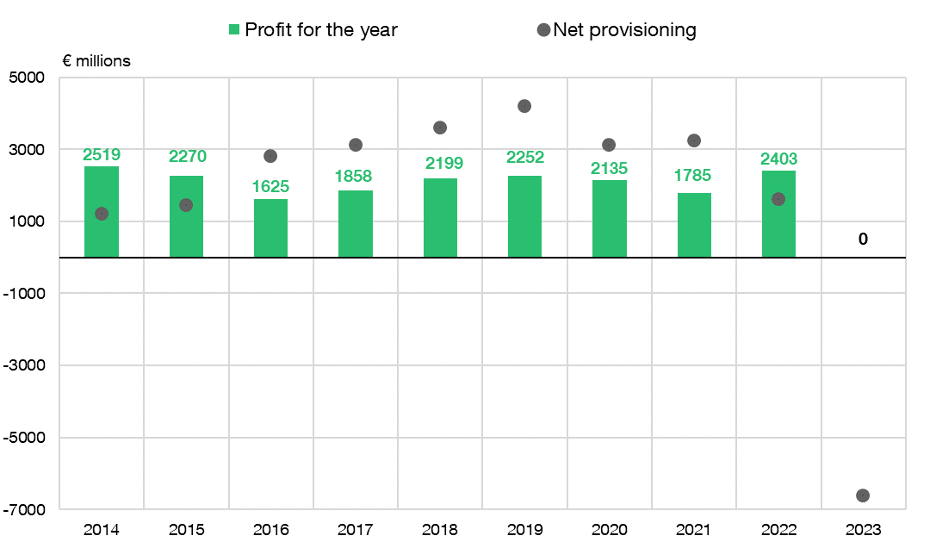

As shown in Chart 2, throughout this period of balance sheet growth (2014 to 2022) the Banco de España posted sizeable profits: €2,116 million a year on average. The same can be said of the other Eurosystem central banks.

Chart 2

THE BANCO DE ESPAÑA'S PROFITS OVER THE LAST DECADE

SOURCE: Banco de España.

NOTE: Net profit for the year is determined after recording provisions for financial risks. The build-up of provisions lowered the Banco de España's net profit in recent years. Conversely, the release of provisions in 2023 has absorbed the losses, resulting in profit for the year of zero.

Where did these robust profits come from? With policy interest rates in negative territory over this period, central banks were charging (rather than paying) institutions for holding their deposits. This came on top of the (small, but positive) returns on the considerable monetary policy portfolio. Such income far outstripped the expenses incurred on the negative interest rate loans extended to banks.

Monetary policy normalisation and its impact on the bottom line

So why have profits now dried up at the Banco de España, the ECB ![]() and so many other central banks

and so many other central banks![]() ? The answer also lies in the mismatch between income and expenses, only now expenses outweigh income.

? The answer also lies in the mismatch between income and expenses, only now expenses outweigh income.

The monetary policy portfolio has long maturities and was mostly purchased when interest rates were low. For years to come this portfolio will generate income at low fixed interest rates that will be unaffected by the policy interest rate rises. By contrast, any change in policy interest rates immediately feeds through to the cost of short-term bank deposits.

Policy interest rate rises have an immediate impact on the cost of liabilities. Conversely, the income earned on assets only gradually reflects the higher rates.

The swift policy interest rate hiking cycle launched in 2022 is having an immediate impact on the cost of central bank liabilities, including the Banco de España’s. By contrast, the effect of the higher rates is reflected in the income earned on the monetary policy portfolio much more slowly.

This mismatch between the return on assets and the cost of liabilities is, however, temporary. How long it will last will depend on how quickly official interest rates are cut, which will hinge on how fast inflation comes down. In any event, the mismatch will gradually shrink as monetary policy assets are redeemed, or are reinvested at the current higher market rates. The balance sheet has in fact been shrinking since 2022![]() .

.

The Annual Accounts of the Banco de España![]() show that expenses outweighed income by €6,612 million in 2023. The release of provisions for this amount means that profit for the year is zero. Financial costs also look likely to exceed financial revenue in 2024.

show that expenses outweighed income by €6,612 million in 2023. The release of provisions for this amount means that profit for the year is zero. Financial costs also look likely to exceed financial revenue in 2024.

What does the lack of profits mean?

Monetary policy is designed with the goal of maintaining price stability. The Banco de España’s other decisions are part of its functions under the Law of Autonomy![]() . The possible ramifications for the profit and loss account have no bearing on any of these decisions.

. The possible ramifications for the profit and loss account have no bearing on any of these decisions.

However, mindful of the inherent risks in unconventional monetary policy measures, the Banco de España has adopted a prudent provisioning policy to deal with these risks (see Chart 2).

In 2022, before the risks materialised, the Bank’s provisions amounted to €33 billion. Based on the likely scenarios, this buffer should be more than enough to cover the temporary mismatch between financial revenue and costs.

The release of some of the provisions covers the temporary mismatch between financial costs and revenue, resulting in profit for 2023 of zero.

Each year the Banco de España pays its profits in to the Treasury, increasing fiscal revenues. However, this year will be an exception.

In any event, financial costs will only temporarily outweigh revenue. In the meantime, the provisions will prevent the Bank from reporting a loss. As a result, at no point will the solidity of the Bank’s financial position or its ability to perform its functions and act with the independence required of a central bank be in jeopardy.