The main challenges facing the Spanish economy and how to tackle them

The Spanish economy continued to grow markedly in 2023 and the outlook is favourable, albeit in a context of global uncertainty. Nevertheless, we continue to face structural challenges with far-reaching effects that make it difficult to reach euro area living standards. The Banco de España’s Annual Report discusses these issues and economic policies to address them.

30/04/2024

The Spanish economy showed strong momentum in 2023. GDP grew by 2.5%, compared with 0.4% in the euro area, and activity was 3% higher than before the pandemic. What’s more, growth forecasts are favourable: 1.9% in 2024 and in 2025![]() , above projections for the euro area, although uncertainty remains high. Nevertheless, from a broader viewpoint, the Spanish economy faces structural challenges that make it difficult to reach the per capita income of our European peers. The Banco de España’s Annual Report 2023

, above projections for the euro area, although uncertainty remains high. Nevertheless, from a broader viewpoint, the Spanish economy faces structural challenges that make it difficult to reach the per capita income of our European peers. The Banco de España’s Annual Report 2023![]() , published recently, delves more deeply into these challenges and presents the economic policy options to tackle them, which we go over in this post.

, published recently, delves more deeply into these challenges and presents the economic policy options to tackle them, which we go over in this post.

Low productivity and the low employment rate are the main reasons for the lack of convergence with Europe

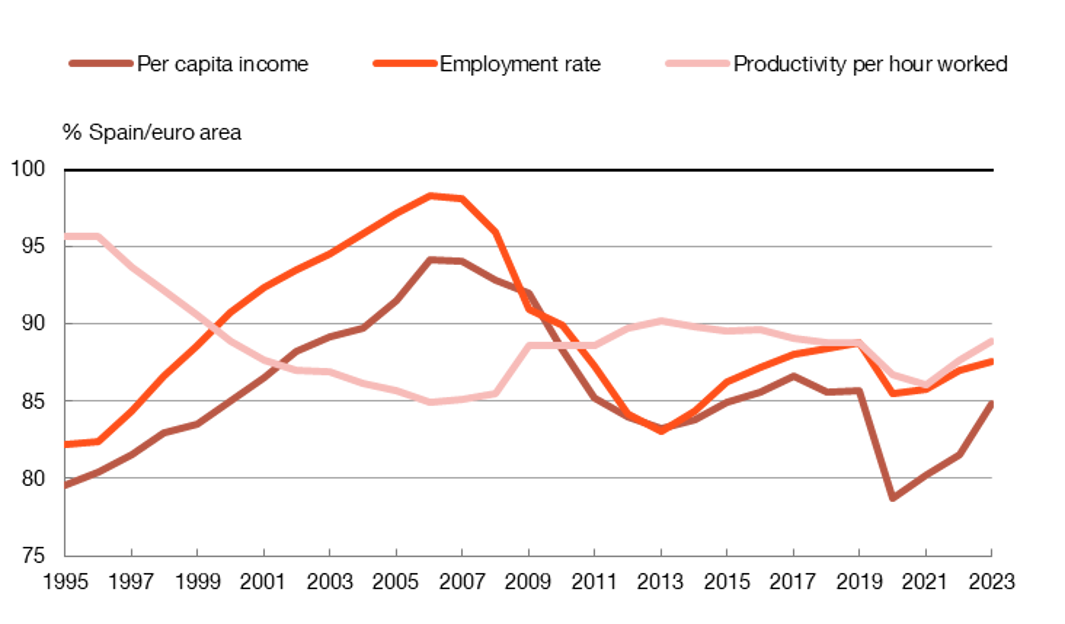

Chart 1

SPAIN'S SCANT CONVERGENCE WITH THE EURO AREA

SOURCE: Eurostat.

NOTES: Flash estimates for 2023.

-Per capita income: Spain's GDP per capita vis-à-vis the 19 euro area countries (data)![]() expressed in current prices and purchasing power parity (PPP)

expressed in current prices and purchasing power parity (PPP) ![]() terms (Eurostat data).

terms (Eurostat data).

-Employment rate: total employment (data)![]() divided by working age population, aged 15 to 64 (data)

divided by working age population, aged 15 to 64 (data)![]() . The line shows the ratio of Spain to the euro area.

. The line shows the ratio of Spain to the euro area.

-Productivity per hour worked: GDP per capita (data)![]() divided by total number of hours worked (data)

divided by total number of hours worked (data)![]() . The line shows the ratio of Spain to the euro area.

. The line shows the ratio of Spain to the euro area.

As Chart 1 shows, Spain has stopped steadily converging on the rest of Europe since the financial crisis that began in 2007. The current gap stands at around 15 percentage points (pp) in GDP per capita. The main reasons are low productivity and employment. These factors are closely linked to other sizeable challenges facing the Spanish economy and are summarised in Figure 1.

Figure 1

THE MAIN CHALLENGES FACING THE SPANISH ECONOMY AND HOW TO TACKLE THEM

SOURCE: Banco de España.

Productivity and employment and their connection to other challenges facing the Spanish economy

The Spanish economy’s main structural problem is low productivity. Productivity per hour worked in Spain has stayed between 10% and 15% below that of the euro area since 2008. What is behind this low productivity?

- Business size and demographics: our corporate landscape is unusual owing to (i) a high share of small firms, which tend to be less productive and (ii) a lower churn rate (business entries and exits), which also hampers productivity gains. How can growth and business demographics be improved? Some solutions are: alleviating the regulatory burden

, fostering market unity, reconsidering some regulatory thresholds and enhancing access to non-bank financing.

, fostering market unity, reconsidering some regulatory thresholds and enhancing access to non-bank financing. - Human capital: despite gains in recent decades, the educational attainment level of the Spanish population remains below the European average. Raising the level of human capital demands a far-reaching overhaul of our education system. There are three essential steps: encourage students to remain in the education system; improve universities by tying funding to targets of excellence and tailoring the courses on offer to meet demand; and expand the dual vocational training programme

, in conjunction with ongoing worker training.

, in conjunction with ongoing worker training. - Physical and technological capital and innovation: innovative firms are relatively few and spending on research, development and innovation is low. How can investment and corporate innovation be boosted? By improving the efficiency of tax incentives for innovation and carefully selecting investment projects for the Next Generation EU (NGEU)

programme. It is also crucial that venture capital markets grow within the framework of the European Union’s capital markets union, which must move forwards

programme. It is also crucial that venture capital markets grow within the framework of the European Union’s capital markets union, which must move forwards .

. - Institutional framework: the quality of institutions and economic agents’ trust in them are key determinants of long-term growth. Indicators

of institutional trust and quality in Spain have declined since the financial crisis. To reverse this trend, the effectiveness and efficiency of general government – including the judiciary – must improve. Public policies must also undergo further evaluation.

of institutional trust and quality in Spain have declined since the financial crisis. To reverse this trend, the effectiveness and efficiency of general government – including the judiciary – must improve. Public policies must also undergo further evaluation.

With regard to the employment rate, 65.9% of the working-age population was employed at end-2023, 4.5 pp below the euro area level. This gap is mainly the result of a high unemployment rate (11.8%). In spite of the marked fall in recent years, unemployment remains twice that of the European Union (5.9%). This problem, which is particular to the Spanish labour market, exists alongside other issues facing the other advanced economies.

- The first is the technological shift associated with developments in robotics and artificial intelligence. This change is going to transform how work is distributed and organised. It will have a positive impact on productivity, but will weigh on employment in certain sectors and occupations

.

. - The second is the ageing of the working population, which will hurt employment and activity rates and productivity

. The ageing issue is the consequence of the declining birth rate and greater longevity. In the century to date, the average employee age has risen by six years, from 37.5 to 43.5.

. The ageing issue is the consequence of the declining birth rate and greater longevity. In the century to date, the average employee age has risen by six years, from 37.5 to 43.5.

In response to these challenges, priority must be given to revising labour market policies![]() .

.

Active policies, which aim to improve employability, are needed to absorb the disruptive effects of technological change and to support older workers. As regards passive policies, unemployment benefits should afford the unemployed appropriate protection, but not deter job-seeking and labour mobility.

To facilitate the necessary reallocation of workers, further progress should be made on defining objective grounds for dismissal and reducing uncertainty in such processes. In addition, collective bargaining should allow for some degree of flexibility to enable employment conditions (including working hours) to adapt to firms’ individual circumstances.

Figure 1 (cont.)

THE MAIN CHALLENGES FACING THE SPANISH ECONOMY AND HOW TO TACKLE THEM

SOURCE: Banco de España.

The vulnerability of public finances

The report also analyses fiscal imbalance and high public debt![]() , probably the Spanish economy’s greatest vulnerabilities. At end-2023 public debt-to-GDP stood at a historically very high level of 108%, around 10 pp above pre-pandemic levels and more than 30 pp above the euro area average. Also, the budget deficit has a high structural component that has worsened since the pandemic, increasing from 3.1% of GDP in 2019 to 3.7% in 2023.

, probably the Spanish economy’s greatest vulnerabilities. At end-2023 public debt-to-GDP stood at a historically very high level of 108%, around 10 pp above pre-pandemic levels and more than 30 pp above the euro area average. Also, the budget deficit has a high structural component that has worsened since the pandemic, increasing from 3.1% of GDP in 2019 to 3.7% in 2023.

This situation brings to the fore the urgent need for a medium-term fiscal consolidation plan to bolster the sustainability of public finances. This plan would have to be in line with the recently approved EU fiscal framework![]() . In the case of Spain, our estimates suggest that compliance with that framework would require an annual average reduction in the primary structural deficit (i.e. excluding interest payments) of 0.5 pp of GDP between 2025 and 2031.

. In the case of Spain, our estimates suggest that compliance with that framework would require an annual average reduction in the primary structural deficit (i.e. excluding interest payments) of 0.5 pp of GDP between 2025 and 2031.

How can such an ambitious plan be undertaken? As this is a medium-term plan, it should be based on economic, political and social consensus. It is necessary to increase the efficiency and optimise the distribution of public spending to promote robust and equitable economic growth. On the revenue side, it is crucial that the plan be underpinned by a comprehensive review of the tax system![]() . Lastly, to ensure that fiscal consolidation does not hinder economic growth, it is essential to carry out a rigorous selection of the investment plans, including those financed with NGEU funds

. Lastly, to ensure that fiscal consolidation does not hinder economic growth, it is essential to carry out a rigorous selection of the investment plans, including those financed with NGEU funds![]() , and to implement structural reforms to correct some of the Spanish economy’s shortcomings.

, and to implement structural reforms to correct some of the Spanish economy’s shortcomings.

In the longer term, ageing will have a negative impact on public finances, especially as it causes pension expenditure to rise. A new pension system reform was carried out between 2021 and 2023. Although subject to considerable uncertainty, analysis of this report points to the greater long-term expenditure obligations not having been fully offset by the revenues raised. Should it be necessary to activate the escape clause (included in the reform to balance the system’s revenues and expenditure), a correction solely based on an increase in social security contributions![]() could be detrimental for employment and the competitiveness of the Spanish economy.

could be detrimental for employment and the competitiveness of the Spanish economy.

Some additional challenges

Another important challenge is the existence of pockets of vulnerability among certain cohorts, which is largely related to housing affordability ![]() difficulties. In particular, housing costs (especially in the rental segment) place young people and immigrants in an economically vulnerable position. Indeed, Spain is the country with the highest percentage of tenants at risk of poverty or social exclusion

difficulties. In particular, housing costs (especially in the rental segment) place young people and immigrants in an economically vulnerable position. Indeed, Spain is the country with the highest percentage of tenants at risk of poverty or social exclusion![]() . The measures adopted to address this problem should envisage a broad time horizon, involve the different tiers of government and focus on boosting the housing supply market, particularly in the rental market. Some short-term measures, such as price controls, may generate adverse effects on supply in the medium term.

. The measures adopted to address this problem should envisage a broad time horizon, involve the different tiers of government and focus on boosting the housing supply market, particularly in the rental market. Some short-term measures, such as price controls, may generate adverse effects on supply in the medium term.

The fight against climate change![]() and the green transition are two of the biggest challenges facing our society. And Spain is one of the most exposed developed countries. All policies and economic agents should contribute to addressing this challenge. Consequently, we must immediately adopt a mitigation strategy that is ambitious, orderly and predictable, and which should be global if it is to be effective. In addition, special attention should be paid to mitigating distributional effects; otherwise, the strategy could be conditioned by episodes of social unrest.

and the green transition are two of the biggest challenges facing our society. And Spain is one of the most exposed developed countries. All policies and economic agents should contribute to addressing this challenge. Consequently, we must immediately adopt a mitigation strategy that is ambitious, orderly and predictable, and which should be global if it is to be effective. In addition, special attention should be paid to mitigating distributional effects; otherwise, the strategy could be conditioned by episodes of social unrest.

The banking sector has shown notable resilience to various shocks in recent years, largely as a result of its sound financial position at the outset. Contributing to this has been the international regulatory framework of the last few years![]() , whose effectiveness has been borne out. But we must not fall into complacency. Banks should therefore take advantage of their strong profitability to improve solvency. This will help preserve their intermediation capacity in the event of new shocks. Banks should also continue to address the many medium and long-term challenges facing them, not least those associated with technological change and those arising from climate change.

, whose effectiveness has been borne out. But we must not fall into complacency. Banks should therefore take advantage of their strong profitability to improve solvency. This will help preserve their intermediation capacity in the event of new shocks. Banks should also continue to address the many medium and long-term challenges facing them, not least those associated with technological change and those arising from climate change.

Addressing the significant economic challenges facing the European Union and Spain requires ambition and major political agreements

The agenda of economic reforms needed will have a greater impact if it is accompanied by greater economic integration in the European Union (EU), enabling us Europeans to jointly address the major challenges we face. The world today is more complex and integrated than when the European single market or even the Economic and Monetary Union (EMU) was created: there is greater global economic and geopolitical competition, making it even more necessary for the EU to make the most of its potential scale through its integration. The way to achieve this is a more integrated single market and a more complete EMU.

In short, the economic challenges facing the EU and Spain are very significant. Europe is lagging behind the other major economies and Spain has, for over a decade, been unable to converge in a sustained manner with Europe. Reversing these trends requires ambition and major political agreements to ensure that the reforms needed can be sustained. The analysis and proposals contained in the Annual Report 2023 aim to contribute to the social debate to reach a broad consensus.