Why is financial and economic education important? The role of the Banco de España

Financial education seeks to improve the general public’s financial literacy, giving them the tools and information they need to take informed decisions. The Banco de España supports financial education through a range of initiatives targeted at different population groups, bolstering their financial well-being and the stability of the financial system overall.

14/05/2024

As we move forward in life, we plan our future and take decisions that often have an economic or financial bearing. We work out a budget, for example, or sign contracts for banking products. Having some basic financial understanding is key to making these decisions. If you want to know how financial education can help you and find out more about what we’re doing in this field, keep reading.

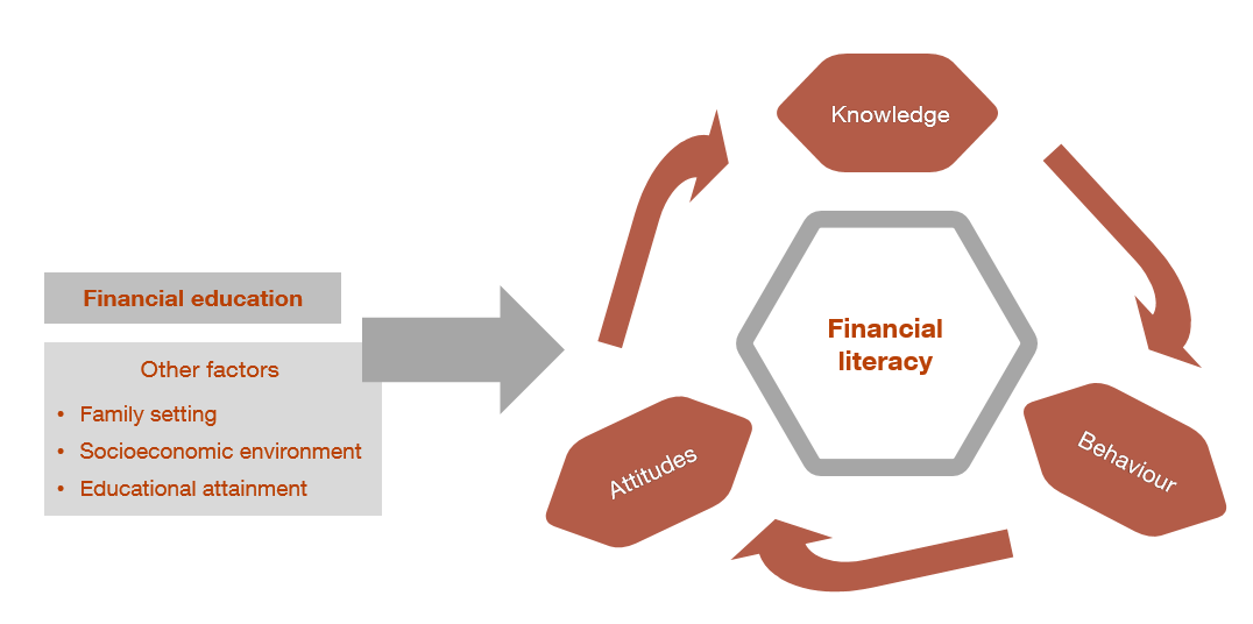

When we talk about “financial literacy”, we mean more than just financial and economic knowledge. As Figure 1 shows, other aspects, such as your behaviour and your attitudes also play a part.

Figure 1

FINANCIAL LITERACY AND FINANCIAL EDUCATION

SOURCE: Banco de España.

Let’s look at buying a house, which is the biggest financial decision most of us will ever make. If you have to take out a mortgage, your financial literacy is going to help you make the best decision with regard to the amount, term and type of loan. How? By helping you to:

- understand how macroeconomic variables (like inflation) influence interest rates and how these affect your mortgage and your ability to pay your instalments;

- act responsibly, consulting experts and comparing options;

- be cautious when making decisions.

All the above will help you make better decisions about your mortgage and many other things, helping to protect your financial health![]() .

.

To better understand what financial literacy is, check out the three questions in the following financial skills quiz on the three aspects mentioned above.

Improving financial literacy through financial education

Financial education refers to ways of expanding people’s financial literacy, to improve individual and collective well-being through informed financial decision-making. It seeks to narrow the information gap between financial intermediaries and customers, prevent excessive indebtedness and encourage appropriate marketing of financial products.

At the same time, financial education seeks to bolster institutional trust, improve the general public’s lifetime financial planning and ultimately contribute to the stability of the financial system.

The need to promote financial education became clear following the 2008 global financial crisis, which revealed that financial products were being offered and acquired without the appropriate information or proper assessment of the associated risks.

From then on, national strategies for financial education began to be put in place. The OECD![]() published principles

published principles![]() and defined competence frameworks that targeted children and young people

and defined competence frameworks that targeted children and young people![]() and adults

and adults![]() . These were recently approved by the European Commission. They set out what a citizen of the European Union should know in terms of personal finance planning, financial risks and the economic environment.

. These were recently approved by the European Commission. They set out what a citizen of the European Union should know in terms of personal finance planning, financial risks and the economic environment.

How financially literate are Spaniards? The Survey of Financial Competences![]() , conducted by the Banco de España, provides an answer to this question. The results for 2021, published recently, show that many people are unfamiliar with basic financial concepts such as inflation

, conducted by the Banco de España, provides an answer to this question. The results for 2021, published recently, show that many people are unfamiliar with basic financial concepts such as inflation![]() , interest

, interest![]() or managing financial risk

or managing financial risk![]() . Just 19% of those surveyed correctly answered the three questions on these topics. The results show that there is plenty of room for improvement.

. Just 19% of those surveyed correctly answered the three questions on these topics. The results show that there is plenty of room for improvement.

Who is responsible for financial education? Banco de España initiatives

The national strategies call for a wide range of stakeholders to be involved in the design of financial education programmes:

- public authorities: ministries, central banks and financial supervisors;

- other public or private stakeholders: educational institutions, consumer associations, media outlets, non-profit organisations and the financial industry.

In 2008 the Banco de España and the National Securities Market Commission (CNMV![]() ) launched the Spanish national strategy, set out in the Financial Education Plan

) launched the Spanish national strategy, set out in the Financial Education Plan![]() . In 2022 the two initial promoters were joined by the Ministry of Economy, Trade and Enterprise. The Financial Education Plan also has a broad network of partners

. In 2022 the two initial promoters were joined by the Ministry of Economy, Trade and Enterprise. The Financial Education Plan also has a broad network of partners![]() that assist in specific educational programmes. Among these, the agreement

that assist in specific educational programmes. Among these, the agreement![]() between the Financial Education Plan and the Ministry of Education, Vocational Training and Sport stands out for its focus on the younger generations.

between the Financial Education Plan and the Ministry of Education, Vocational Training and Sport stands out for its focus on the younger generations.

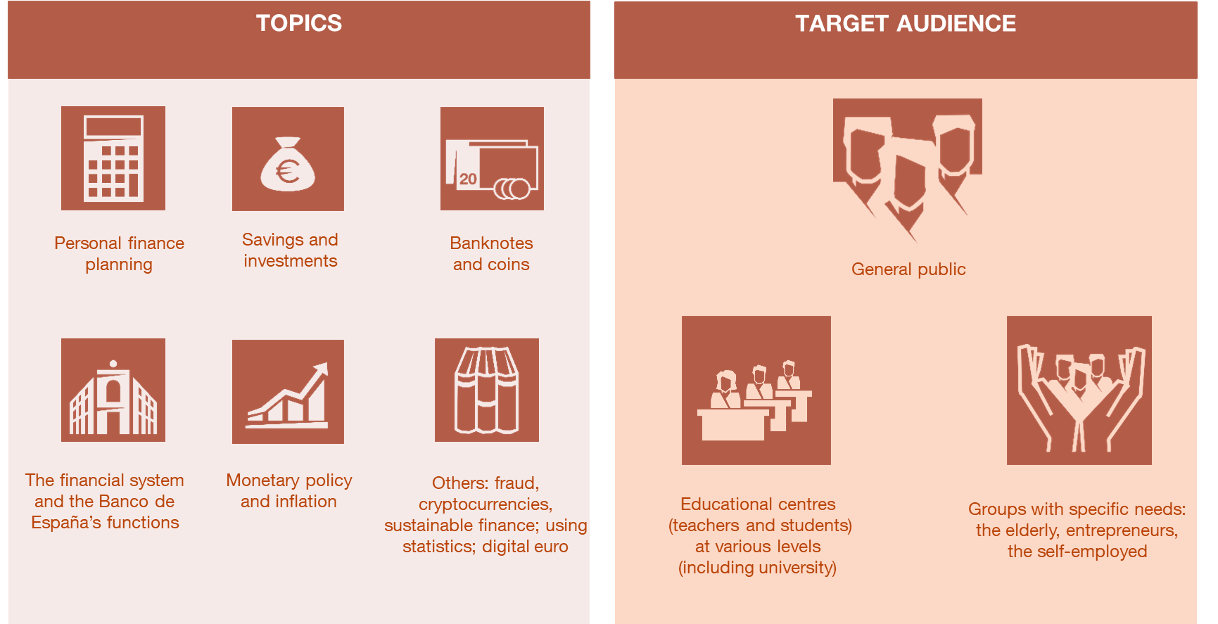

Our initiatives cover a wide range of actions targeting different population groups

The Banco de España is committed to promoting financial education, as set out in its Strategic Plan 2024![]() , in keeping with its role as a promoter of the Financial Education Plan.

, in keeping with its role as a promoter of the Financial Education Plan.

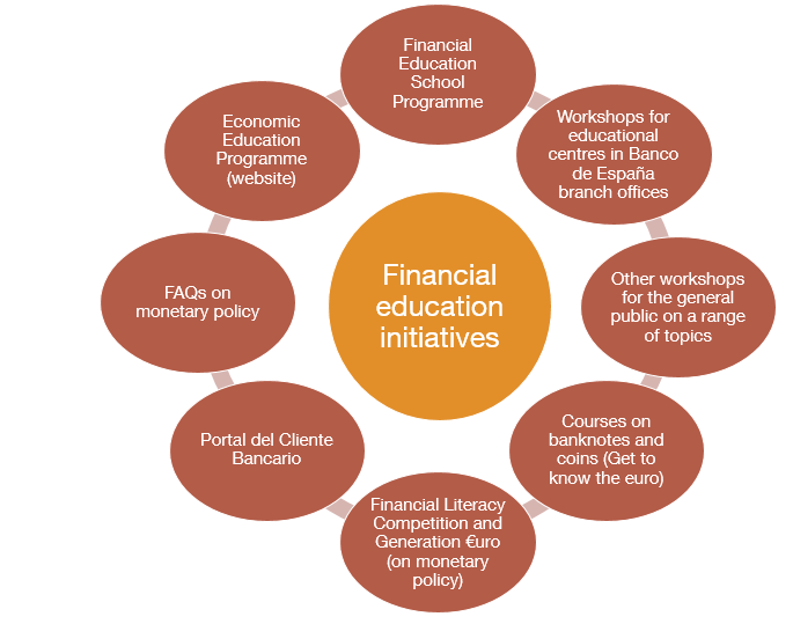

As Figure 2 shows, our initiatives – undertaken under the Plan or independently – are targeted at a broad audience nationwide. Figure 3 and the Banco de España’s 2023 Institutional Report![]() set out details of our main activities in this field. Most of the material is in Spanish.

set out details of our main activities in this field. Most of the material is in Spanish.

Figure 2

THE BANCO DE ESPAÑA´S FINANCIAL EDUCATION INITIATIVES: TOPICS AND TARGET AUDIENCE

SOURCE: Banco de España.

Figure 3

THE BANCO DE ESPAÑA'S INITIATIVES

NOTE: Links to the Banco de España’s initiatives (most are in Spanish): Financial Education School Programme![]() and Financial Literacy Competition

and Financial Literacy Competition![]() , Workshops for schools (such as hazQTRente

, Workshops for schools (such as hazQTRente![]() , Central Banking and Supervision

, Central Banking and Supervision![]() ), Courses on banknotes and coins (Get to know the euro

), Courses on banknotes and coins (Get to know the euro![]() ), Generation €uro students´ award

), Generation €uro students´ award![]() , Portal del Cliente Bancario,

, Portal del Cliente Bancario, ![]() FAQs about monetary policy

FAQs about monetary policy![]() , Economic Education Programme

, Economic Education Programme![]() .

.

Personal finance planning has been the main focal point of the Banco de España’s educational initiatives. Others have provided information on matters directly related to our mandate as a central bank, such as monetary policy. However, as highlighted in the OECD competence frameworks, the macroeconomic environment (inflation, economic activity, employment) can affect our day-to-day financial decisions.

The Banco de España has launched a new economic education programme that seeks to spread knowledge of economic and financial issues

Indeed, we have recently launched an economic education programme![]() . This new initiative aims to spread knowledge of economic and financial issues among the non-expert adult population, addressing the key economic factors in households’ consumption and investment decisions. The first subject covered is inflation, now available on our website, to be followed, among others, by financial risks and labour income.

. This new initiative aims to spread knowledge of economic and financial issues among the non-expert adult population, addressing the key economic factors in households’ consumption and investment decisions. The first subject covered is inflation, now available on our website, to be followed, among others, by financial risks and labour income.

Progress has been made in the field of economic and financial education, but we must continue to broaden our outreach. Here we refer not only to content, which must be adapted to the changing environment, but also to the identification of target groups and the use of new communication channels. Evaluation programmes are also vital, to assess the effectiveness of the initiatives adopted and, where appropriate, to shift the focus of financial education policies.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.