The Banco de España’s branch offices. 150 years open to the public

The Banco de España branch network dates back to 1874, 150 years ago. Back then the branch offices were instrumental in garnering widespread acceptance of banknotes as a means of payment. Their role is different today, but they remain essential for distributing banknotes and coins to the general public.

30/05/2024

“The Banco de España shall establish branch offices in the principal cities of the nation to serve the needs of commerce and facilitate the circulation of banknotes”

Decree-Law of 19 March 1874

The Banco de España’s branch offices play an instrumental role in putting the banknotes and coins used by the general public into circulation. Their functions, number and structure may have changed over time, but their core mission remains one of public service, constantly adapting to society’s evolving needs. In this blog post we discuss the origins of our branch offices and the services that they offer you.

Why were the Banco de España’s branch offices set up?

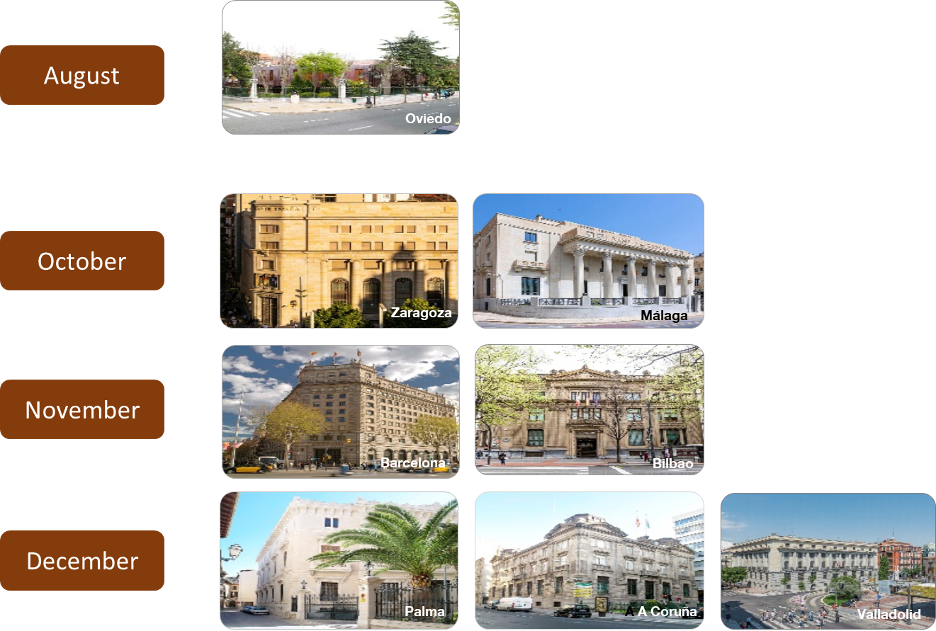

Eight of the fifteen offices that currently make up the Banco de España branch network![]() turn 150 in 2024.

turn 150 in 2024.

These branches were established by virtue of a Decree-Law dated 19 March 1874, instigated by the then Finance Minister José de Echegaray![]() , who was also Spain’s first ever Nobel laureate... albeit in the field of literature.

, who was also Spain’s first ever Nobel laureate... albeit in the field of literature.

That decree granted the Banco de España the monopoly on issuing banknotes, a privilege it had formerly shared with private banks.

The issuance monopoly required the creation of regional offices, marking the start of the branch offices’ enduring legacy. Besides the main headquarters in Madrid, two branches were already operating in Valencia and Alicante. Both had been opened in 1858 in the absence of any private initiatives to establish issuing banks in these major cities.

The Decree-Law presented private issuing banks with a choice: either merge with the Banco de España or continue to operate under their own trade name but without the power to issue banknotes. This was no easy decision for the banks, nor one they arrived at quickly, since it meant surrendering an attractive business. Indeed, the Government twice extended the deadline for accepting the merger.

The issuance monopoly required the creation of regional offices: eight branches in 1874 alone

These extensions provided a window for negotiations that ultimately resulted in the establishment of eight branch offices in 1874 (see Figure 1). The first branch opened that very summer in Oviedo, followed in the final third of the year by offices in Zaragoza, Málaga, Barcelona, Bilbao, Palma and A Coruña. A branch office was also opened in Valladolid, where no private issuing bank was present.

Figure 1

THE ORIGINS OF THE BRANCH NETWORK. BRANCH OFFICES OPENED IN 1874

SOURCE: Banco de España.

The network expanded rapidly in the following years. By 1892 the number of branch offices had reached 58, just over one for each province, and the network progressively grew further, eventually peaking at 70 offices in 1957.

In their initial years the branches were instrumental in establishing banknotes as an accepted means of payment across the country. They also played a significant role in the success of the Banco de España’s transfer service, which channelled the bulk of monetary flows between provinces from 1884 to 1930 and was key to the effective integration of the Spanish financial market during the late 19th and early 20th centuries.

In their early years, the branches were instrumental in establishing banknotes as an accepted means of payment. Today they remain crucial to put them into circulation

The branch offices also enriched the architectural heritage![]() of the host cities and continue to do so to this day.

of the host cities and continue to do so to this day.

What do the Banco de España branches do today?

Over time, our branches have adapted to economic, social and technological shifts. As a result, their functions have changed, as have those of our main headquarters in Madrid, whose services they complement.

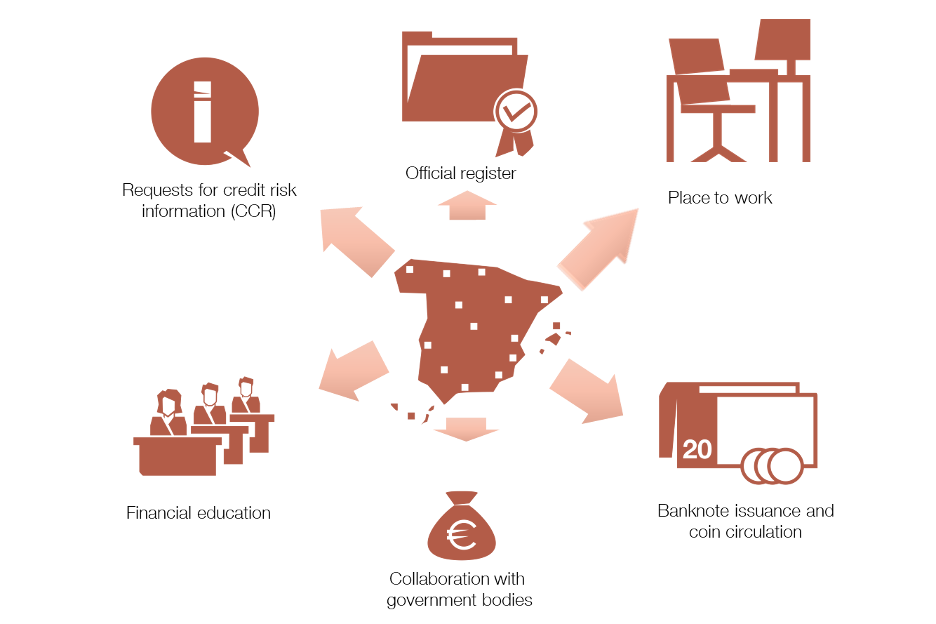

Today, the Banco de España branches work with credit institutions and provide various services to the public (see Figure 2).

- Issuing euro banknotes and circulating euro coins.

- Withdrawing, exchanging, safekeeping, handling and recirculating euro banknotes and coins.

- Promoting the authenticity and quality of currency in circulation; supervising and controlling the handling and recirculation of banknotes and coins by banks and other institutions.

- Providing payment services to account holders at the Banco de España.

- Subscribing government debt.

- Collaborating in the collection of taxes for government bodies and agencies with a current account at the Banco de España.

- Handling requests for information on natural and legal persons’ credit risk - Central Credit Register (CCR).

- Registering incoming and outgoing correspondence, documents and applications at the Banco de España.

- Receiving requests, enquiries and complaints submitted to the Banco de España by the public and banking service users.

Figure 2

MAIN FUNCTIONS OF THE BRANCHES AND WHERE THEY ARE

NOTE: The map shows the central office in Madrid and the current 15 branches: A Coruña, Alicante, Badajoz, Barcelona, Bilbao, Las Palmas, Málaga, Murcia, Oviedo, Palma, Santa Cruz de Tenerife, Seville, Valencia, Valladolid and Zaragoza. The CCR![]() is the Banco de España’s Central Credit Register.

is the Banco de España’s Central Credit Register.

Our extensive branch network also allows us to meet other community needs. For example, in the area of financial education, where the branches host training programmes on cash and finance for the general public and professionals. Indeed, a substantial increase financial and economic education![]() initiatives is expected in the coming years.

initiatives is expected in the coming years.

The Banco de España’s most important achievements over this century and a half have left their mark and are reflected in a branch network that reaches out to society. The branches contribute to the Banco de España’s image as a dynamic and committed central bank and a leader in its field.

In short, there is plenty of reason to celebrate the 150-year anniversary of eight of our branches. The Banco de España’s branches are not merely part of the institution's history. Quite the opposite, they are evolving hubs that play a key role in both its present operations and future direction, fuelled by their unwavering commitment to its strategic values - transparency, independence, public service and excellence.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.