The countercyclical capital buffer: what is it, why has it been revised and what does it mean for banks?

The countercyclical capital buffer (CCyB) mitigates the risk posed by the macro-financial cycle to the banking system as a whole. The CCyB gradually raises banks’ solvency requirements when this risk is intermediate or high and lowers them when such systemic risks materialise. In so doing, it enhances banks’ loss-absorbing capacity and enables a stable supply of financing to the economy.

04/06/2024

Capital buffers make banks more resilient to a range of financial shocks. The countercyclical capital buffer![]() (CCyB) is designed to mitigate risks arising from the macro-financial cycle. Unlike other capital requirements, the CCyB is a macroprudential instrument. It is not set for each bank depending on its individual risks, but is rather applied sector-wide on the basis of cyclical systemic risks

(CCyB) is designed to mitigate risks arising from the macro-financial cycle. Unlike other capital requirements, the CCyB is a macroprudential instrument. It is not set for each bank depending on its individual risks, but is rather applied sector-wide on the basis of cyclical systemic risks![]() , which affect the financial sector as a whole and vary over time. How does the CCyB work? Why have we changed how it’s set? What does this change mean in practice?

, which affect the financial sector as a whole and vary over time. How does the CCyB work? Why have we changed how it’s set? What does this change mean in practice?

Why does the CCyB exist?

Banking supervisors require banks to meet certain minimum capital requirements![]() to guarantee their solvency. Some of these requirements are driven by microprudential considerations, that is, they are based on each bank’s particular characteristics and risk profile.

to guarantee their solvency. Some of these requirements are driven by microprudential considerations, that is, they are based on each bank’s particular characteristics and risk profile.

However, following the 2008 financial crisis, a new macroprudential![]() approach was taken to banking regulation and supervision. To be specific, macroprudential policy sets additional capital requirements, known as macroprudential capital buffers, to protect the banking system against systemic risks.

approach was taken to banking regulation and supervision. To be specific, macroprudential policy sets additional capital requirements, known as macroprudential capital buffers, to protect the banking system against systemic risks.

In addition to its macroprudential nature, the CCyB is unusual for being the only buffer whose level is designed to vary over time.

Why is it countercyclical? The risks to banks fluctuate over the economic and financial cycle. When the real economy and/or the financial system are in an expansionary phase, economic agents are more optimistic and more willing to take on risk. When the wheel turns and the economic and financial environment deteriorates, as a result of a recession or a financial crisis, for example, defaulting on a loan or a mortgage is more likely. Under those circumstances, banks face such risks materialising, which can inflict significant losses on the financial system as a whole.

The CCyB is designed to cover such cyclical risk. In particular, the CCyB is designed to be activated when cyclical systemic risk is detected (normally in the cycle’s expansionary phase) and then released (that is, reduced, maybe even entirely) in crises.

The countercyclical capital buffer covers cyclical systemic risks. It strengthens bank solvency and economic and financial stability

What does the CCyB do?

- It bolsters the banking system’s solvency when cyclical systemic risk builds up.

- It allows banks to have additional financial resources to absorb losses and continue lending during crises.

- It strengthens economic and financial stability, helping to:

- smooth the peaks and troughs of economic cycles;

- curb the excessive build-up of cyclical systemic risks in expansionary periods;

- avoid recessions deepening during crises.

Changes to the framework for setting the CCyB

The Banco de España is responsible for setting the CCyB in Spain each quarter. Nonetheless, the European Central Bank has the power to tighten the decisions adopted by any of the 21 national authorities of the banking union![]() .

.

The CCyB was introduced in 2016. The Banco de España has recently revised its CCyB decision-making framework. Until now, this framework would only activate the CCyB when a high level of cyclical systemic risks was detected.

This approach was conceived immediately after the global financial crisis, which was preceded by years of extreme cyclical imbalances. Since then, however, evidence has been mounting that there are benefits to activating this buffer earlier in the macro-financial cycle.

In fact, more and more macroprudential authorities have been tailoring their CCyB-setting frameworks in recent years to enable activation of the buffer when cyclical risks are at a lower level. This means that the CCyB can be built up more gradually, which minimises its activation costs and enhances its role in steadying the economic and financial cycle.

Against this backdrop, the Banco de España has overhauled the framework for setting the CCyB.

The first step was to develop an array of indicators for cyclical systemic risks, beyond those linked to the credit cycle. These indicators are fleshed out with other quantitative and qualitative information to more robustly identify such risks. This analysis allows us to distinguish between three levels of cyclical systemic risk: low, standard (for intermediate risks) and high. Cyclical systemic risk will in practice be at a low level when such risks actually materialise.

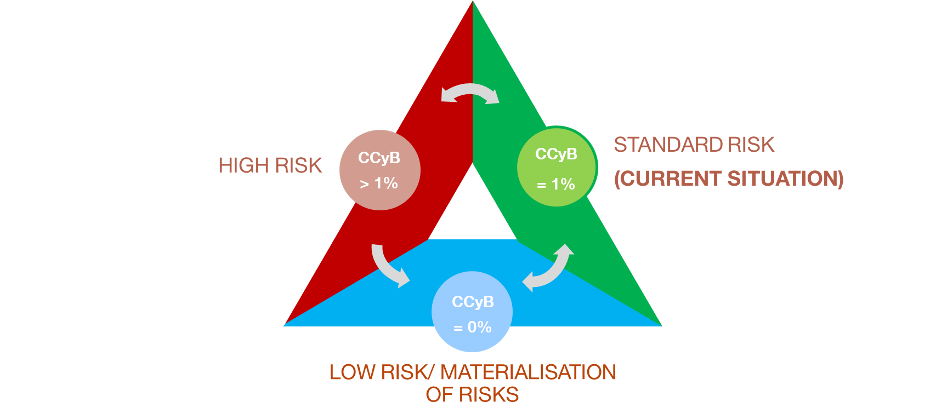

In addition, we have calibrated a CCyB rate of 1% for when cyclical risks are at a standard level. The CCyB rate would be raised above this level when cyclical risk is high, and the buffer would be released, generally in full, when risks materialise (see Figure 1). In such a situation, and where the risk level is low, the CCyB rate would be set at 0%.

Figure 1

CYCLICAL SYSTEMIC RISK PHASES AND THE CCyB RATE

SOURCE: Banco de España

NOTE: The figure depicts the current framework. Under the previous framework, the countercyclical capital buffer (CCyB) would only have been activated with a high level of risk. The arrows denote the possible risk sequences, although they do not necessarily always have to change in the directions depicted.

Thus, the framework operates sequentially. When the buffer is released, the Banco de España will announce its expectations of when it will start to be built up again. This will never take place until the cyclical systemic risks have returned to an intermediate level. The Bank will also give a year’s notice, as established in the legislation, and the buffer will be built up gradually.

The countercyclical capital buffer will be gradually raised to 1% from 2024 Q4

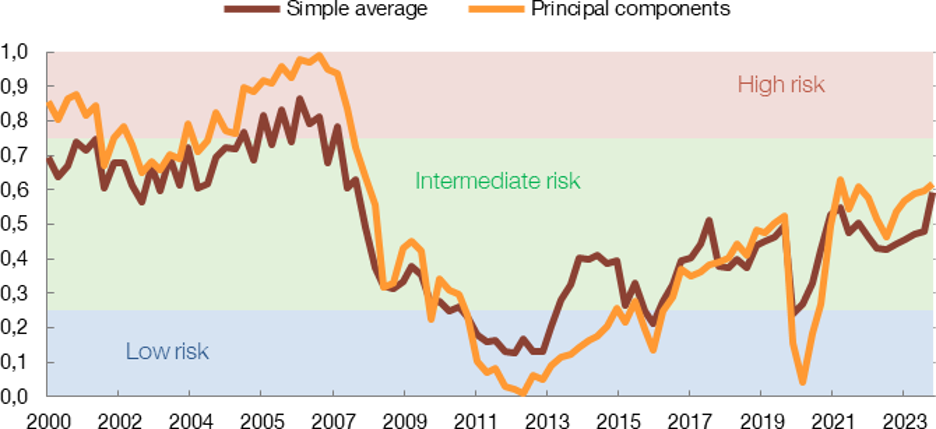

Cyclical risks are currently at a standard level (see Chart 1). As a result, the Banco de España has launched the procedure to gradually raise the CCyB to 1%:

- The initial proposal is to raise the CCyB to 0.5% from 2024 Q4, although this measure will only be binding from 1 October 2025.

- Thereafter, if cyclical systemic risks remain at a standard level, the CCyB rate will be raised to 1% from 2025 Q4, with banks needing to comply with this higher requirement from 1 October 2026.

The Banco de España may adjust or even walk back this plan if key incoming data justify such a decision.

Chart 1

COMPOSITE INDICATOR OF CYCLICAL SYSTEM RISK

SOURCES: Datastream, INE, Banco de España.

NOTE: Data updated at December 2023. The brown line shows the aggregation using simple averages of the risk indicators and the orange line the aggregation using principal components. A principal component is a statistical indicator![]() that summarises a broad set of variables. The indicators are defined on a scale of 1 to 10 depending on the percentile with respect to its historical distribution. The bands correspond to the levels of cyclical systemic risk that the indicators signal.

that summarises a broad set of variables. The indicators are defined on a scale of 1 to 10 depending on the percentile with respect to its historical distribution. The bands correspond to the levels of cyclical systemic risk that the indicators signal.

What effects will the new framework have?

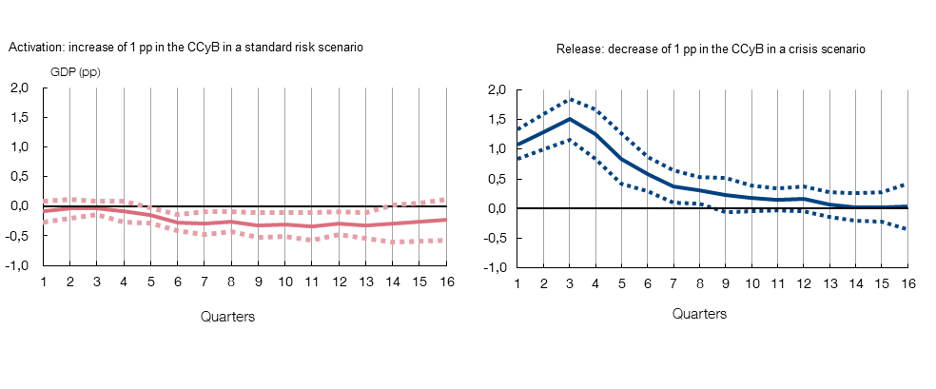

Activating the CCyB in phases where cyclical risk is at a standard level, as is currently the case, has a low cost in terms of both diminishing lending – as evidenced by recent studies![]() – and lower economic activity – as indicated by the available models

– and lower economic activity – as indicated by the available models![]() and shown in Chart 2.

and shown in Chart 2.

Chart 2

COSTS AND BENEFITS OF ACTIVATING AND RELEASING THE CCyB: IMPACT ON GDP GROWTH

SOURCE: Banco de España.

NOTE: The lines denote the impact (in percentage points, pp) of the increase (left-hand panel) and release (right-hand panel) of 1 pp in the CCyB on the annualised GDP growth over the previous 16 quarters. If the dotted lines lie on each side of the horizontal line at zero, the impact cannot be considered statistically significant. At the starting point we assume GDP growth and a level of financial risk in keeping with a standard risk scenario (left-hand panel) and a macro-financial crisis scenario (right-hand panel), drawing on the historical evidence in Europe between 1990 and 2019. For more details, see Estrada et al. (2024)![]() .

.

The CCyB requirement of 0.5% from 2024 Q4 is also expected to have a very small impact on GDP, for various reasons:

- Banks will have almost two years to satisfy the requirement.

- Banks can use their capital headroom over the current requirements to satisfy the new requirement.

- Banks could retain some of their current high profits to bolster their solvency.

Conversely, in the event of a crisis in the future, releasing the CCyB would have a highly positive impact, improving the course of GDP (see the right-hand panel of Chart 2). Why? Releasing the CCyB increases the difference between banks’ capital level and the required level. Therefore, as recent papers![]() show, banks will be more willing to lend to the economy because failing to comply with the capital requirements is less likely. This will cushion the fall in GDP during crises.

show, banks will be more willing to lend to the economy because failing to comply with the capital requirements is less likely. This will cushion the fall in GDP during crises.

In conclusion, the changes in the operative framework to improve the effectiveness of the CCyB will strengthen bank solvency while having a very minor economic impact. Meanwhile, the estimated benefits of releasing the buffer in the event of a crisis will be far greater, thus making the Spanish economy more stable.