The banking union: what is it and how does it benefit us?

While incomplete, the banking union is already a reality and a key component of European integration. But what is it? Why does it matter? And how does it benefit us? The Deputy Governor answers these questions and looks at what still needs to be done.

The banking union was created in 2014 to ensure that the European banking system is robust, transparent and safe, and to make headway towards a genuine economic and monetary union in Europe![]() . While the project may seem abstract and hard to grasp, it has tangible and important benefits for you, as a member of the public and a bank customer. This post explains why.

. While the project may seem abstract and hard to grasp, it has tangible and important benefits for you, as a member of the public and a bank customer. This post explains why.

The 2008 global financial crisis laid bare the weaknesses of the financial sector. The European sovereign debt crisis that followed highlighted the link between a country’s fiscal vulnerability and the vulnerability of its banks, and the importance of breaking the bank-sovereign nexus. Against this complex backdrop, in 2012 the European authorities embarked on the project to create a banking union![]() .

.

What is the banking union and what does it involve?

All euro area member states are part of the banking union. Figure 1 illustrates the union’s key components:

- Its foundations, the single rulebook, and

- Its three pillars:

Figure 1

THE BANKING UNION

SOURCE: Banco de España.

NOTE: The third pillar’s lighter tone denotes that the European Deposit Insurance Scheme remains incomplete.

The single rulebook and the first two pillars are already operational.

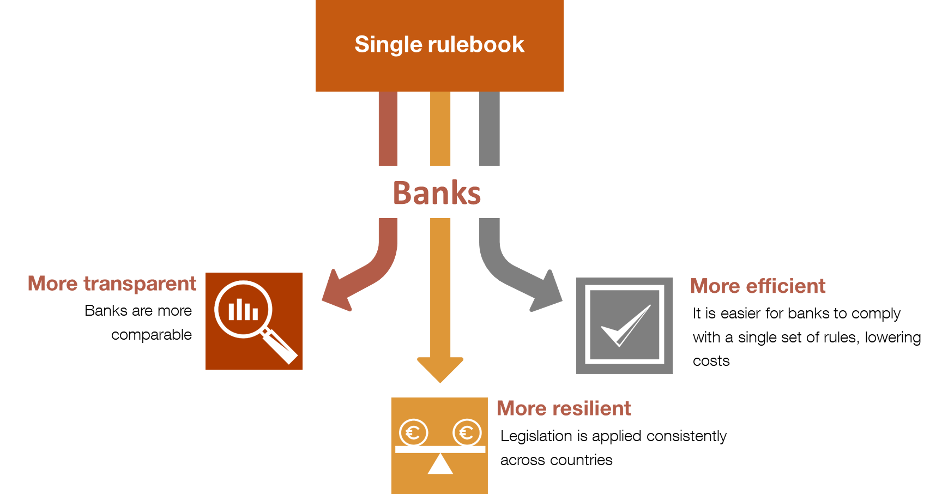

The single rulebook includes capital, liquidity and governance requirements for banks, depositor protection and the regulation to prevent and manage bank failures. These rules are applied consistently across the euro area and help make banks more transparent, resilient and efficient (see Figure 2).

Figure 2

THE SINGLE RULEBOOK IMPROVES THE EUROPEAN BANKING SYSTEM

SOURCE: Banco de España.

The SSM is the European banking supervisory authority. It comprises the European Central Bank and the national authorities, one of which is the Banco de España.

The SSM verifies compliance with regulations and applies consistent supervisory criteria and methodologies.

The supervisory approach is risk-based, i.e. the risks specific to each bank come under the spotlight. The macroeconomic environment in which banks operate is also considered. To do so, the SSM regularly establishes supervisory priorities![]() and activities.

and activities.

The SRM, comprising the Single Resolution Board (SRB![]() ) and the Single Resolution Fund (SRF

) and the Single Resolution Fund (SRF![]() ), provides a common framework for resolving failing banks

), provides a common framework for resolving failing banks![]() .

.

The SRF is funded by contributions paid in by European banks. It is intended to help recapitalise or wind up failing banks, thus mitigating the negative impact on the economy.

Why does the banking union matter for European citizens?

- Our banks are now stronger, more solvent and more resilient.

- They are also subject to a bank crisis management framework, meaning a lower burden on the taxpayer in the event of bank failures.

- As customers, we also benefit from more efficient and competitive banks, thanks to the greater integration and consistency under the banking union. More efficiency and greater competition mean lower costs and a better service.

- As savers, we enjoy greater financial protection via strengthened deposit guarantee schemes

for a higher amount that is consistent across Europe.

for a higher amount that is consistent across Europe. - Lastly, the banking union is an essential step towards financial integration in Europe, which is good for economic growth.

As customers, we benefit from more efficient and competitive banks. More efficiency and greater competition mean lower costs and a better service

What still needs to be done?

Despite the headway made, the banking union is incomplete. The final pillar (the EDIS, which protects European citizens’ deposits wherever they may be) is still missing.

A European deposit guarantee scheme would help eliminate the current fragmentation and would prevent a delicate situation in a country from spreading to its banks.

Sadly, the necessary political consensus still does not exist and there is no timetable for implementation of the EDIS. As a stepping stone, work is under way on a new bank crisis management and deposit insurance framework![]() . This framework improves on aspects of the deposit guarantee schemes and fosters their use in bank resolution processes.

. This framework improves on aspects of the deposit guarantee schemes and fosters their use in bank resolution processes.

The standardisation of national insolvency rules would also pave the way for a single European banking market. This would push forward the capital markets union![]() , another major European project currently in the works.

, another major European project currently in the works.

European banks are now better placed to tackle the challenges currently facing us

In any event, European banks are now stronger, a prerequisite for maintaining the necessary financial stability and economic growth. We are now also better placed to tackle the challenges currently facing us, such as the need to steer funding towards a more sustainable and digital economy.

The banking union has a pivotal role to play, but some key components still need to be completed before a truly European banking system exists.