Which ECB interest rate affects my loan or mortgage?

The European Central Bank sets three key interest rates. We explain which of these three currently affects the cost of our loans and mortgages most directly. Funnily enough, it’s not the one the media focus on most.

25/10/2023

Every six weeks, analysts, investors and the media await the monetary policy decisions of the European Central Bank (ECB) with bated breath, especially its decisions on the main instrument it uses to tighten or loosen its monetary policy, i.e. its key interest rates![]() . This is not surprising as these rates have a direct impact on our pockets.

. This is not surprising as these rates have a direct impact on our pockets.

But, why “interest rates”? Is there more than one key ECB interest rate? Strangely enough for some there are in fact three. We will explain which they are and which is currently the one we should pay most attention to. This is the one that most directly affects money market interest rates and is passed through to the cost of our bank loans and mortgages.

The monetary policy decisions of the ECB have a direct impact on our pockets

Picture the scene. It’s quarter to three in the afternoon on a Thursday with a meeting of the ECB’s Governing Council. The ECB president, Christine Lagarde, announces at the usual press conference that the “Governing Council has decided to set the three key ECB interest rates”![]() at a certain level. These interest rates are (from the highest to the lowest):

at a certain level. These interest rates are (from the highest to the lowest):

- The marginal lending facility rate

,

, - The main refinancing operations (MRO) rate

and

and - The deposit facility rate

.

.

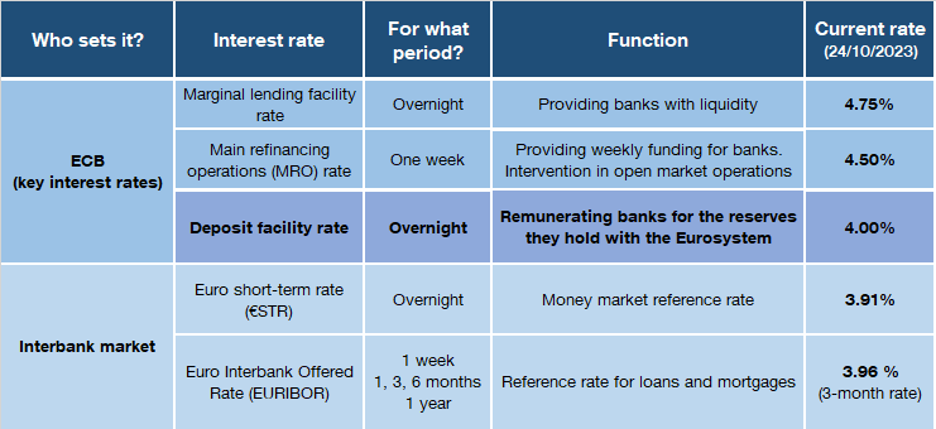

The three short-term interest rates detailed in Table 1 specify how much banks will have to pay to borrow from, or how much they will earn by depositing their money with, the ECB.

Table 1

Key ECB and interbank market interest rates

SOURCE: Banco de España.

How do key ECB interest rates affect the cost of borrowing?

As soon as the ECB’s rates are announced, the monetary policy transmission mechanism kicks into gear.

First, the key interest rates determine (along with the amount of liquidity in the banking system, as we shall see later) the interbank market rate, the interest rate at which banks lend to each other.

Banks can lend each other money for different periods. If the loan is overnight, the reference interest rate![]() is the Euro short-term rate (€STR). For longer periods, such as three or 12 months, the reference rate is the EURIBOR for the relevant period.

is the Euro short-term rate (€STR). For longer periods, such as three or 12 months, the reference rate is the EURIBOR for the relevant period.

The next stage of monetary policy transmission sees the interbank market interest rates passed on to the cost of the loans and mortgages that banks grant to households and businesses.

In Spain, for example, the one-year EURIBOR is usually the reference rate for variable-rate mortgages, while the three-month EURIBOR is usually the reference rate for variable-rate loans to businesses.

The deposit facility rate is, at the moment, the ECB reference rate to focus on

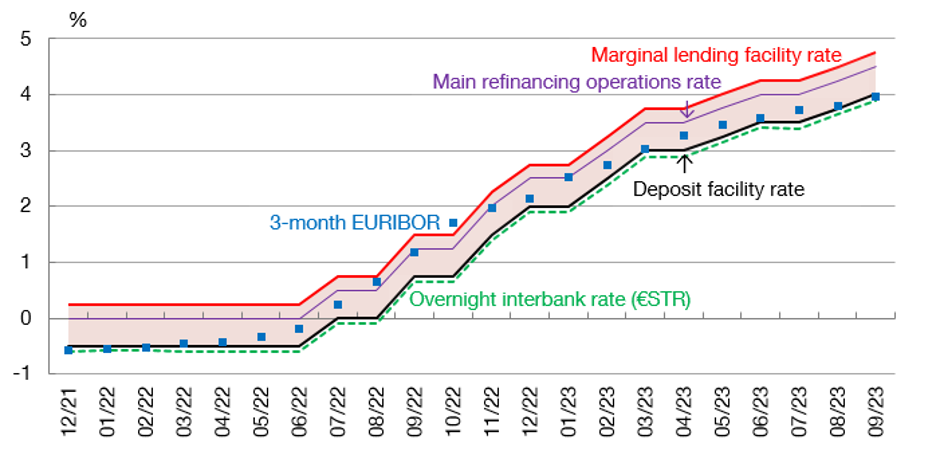

In recent years the ECB interest rate that interbank rates have followed most closely is the deposit facility rate (see Chart 1).

Chart 1

KEY ECB AND INTERBANK MARKET INTEREST RATES

SOURCES: Banco de España and Refinitiv Datastream.

NOTE: The pink band represents the key ECB interest rate corridor. This corridor is determined by the difference between the marginal lending facility rate and the deposit facility rate. The main refinancing operations (MRO) rate stands between them. During the period shown, the overnight interbank rate (€STR) has closely followed the deposit facility rate. The three-month interbank rate (EURIBOR) stands above the €STR, since it incorporates a term premium. Data are for the last day of the relevant month.

In other words, the deposit facility rate is, at the moment, the ECB reference rate to focus on. For some years it has been set at 50 basis points below the main refinancing operations (MRO) rate, the one usually highlighted in the media.

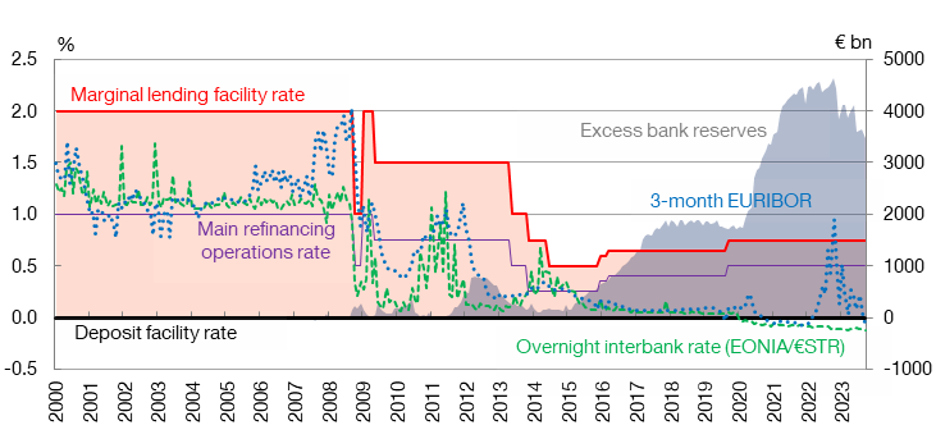

Does this mean that the media have been getting it wrong all these years? Not exactly. Before the financial crisis, the ECB interest rate that interbank rates followed most closely was indeed the MRO rate (see Chart 2).

Chart 2

WIDTH OF THE ECB INTEREST RATE CORRIDOR AND RELATIVE POSITION OF THE INTERBANK RATE

SOURCES: Banco de España and Refinitiv Datastream.

NOTE: The chart shows the key ECB interest rate corridor and interbank market rates in relation to it. The width of the corridor has changed over time. In October 2019, the ECB began to publish the €STR instead of the EONIA as its overnight reference rate. The excess bank reserves are the reserves that commercial banks hold at the ECB beyond the minimum reserve requirements. They indicate a situation of elevated liquidity at the end of the period. Data are for the last day of the month.

The main reason for this change was the ECB’s adoption of monetary policy measures in the years following the global financial crisis![]() that caused its balance sheet to swell and left the banking system awash with liquidity (the shaded area in Chart 2). This pushed down interbank rates, which ended up moving away from the MRO rate and towards the deposit facility rate.

that caused its balance sheet to swell and left the banking system awash with liquidity (the shaded area in Chart 2). This pushed down interbank rates, which ended up moving away from the MRO rate and towards the deposit facility rate.

Looking ahead, if the current levels of excess liquidity are reduced, the main refinancing operations rate may become important again.

But, take note. For the time being, the key ECB interest rate that matters for our loans and mortgages is the deposit facility rate, which currently stands at 4%.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.