The digital euro: what is it and what’s in it for us

The growing use of electronic means of payment, such as cards and mobile payments, has led the Eurosystem to consider issuing a digital euro to complement cash. Here we explain what a digital euro would be and its advantages if eventually adopted.

Since they were first introduced in January 2002, euro banknotes and coins have been the face of our single currency and the only public means of payment available to all euro area citizens. However, the physical form of cash means that it cannot benefit from the advantages offered by the increasing digitalisation of our economy and society. This has led the Eurosystem to consider issuing a digital euro to complement cash. Two years after the project was launched![]() , the Governing Council of the European Central Bank (ECB) has just given the green light to starting the preparation phase

, the Governing Council of the European Central Bank (ECB) has just given the green light to starting the preparation phase![]() . Although no final decision has yet been taken, now is a good moment to ask precisely what a digital euro is and what’s in it for us.

. Although no final decision has yet been taken, now is a good moment to ask precisely what a digital euro is and what’s in it for us.

To understand what a digital euro is, let’s consider how it resembles, and how it differs from, the euro we know:

- How would it be like banknotes? It would also be issued by the Eurosystem, a public body, and individuals and businesses would be able to use it to make payments.

- How would it differ? Essentially in its form: instead of carrying it in your purse or wallet, to be physically handed over when paying, the digital euro would be in an account and you would make payments using devices such as cards and mobiles.

- So would it be the same as the money in my bank account? The way you use it would be the same, but it would be public and backed by the central bank.

Why a digital euro?

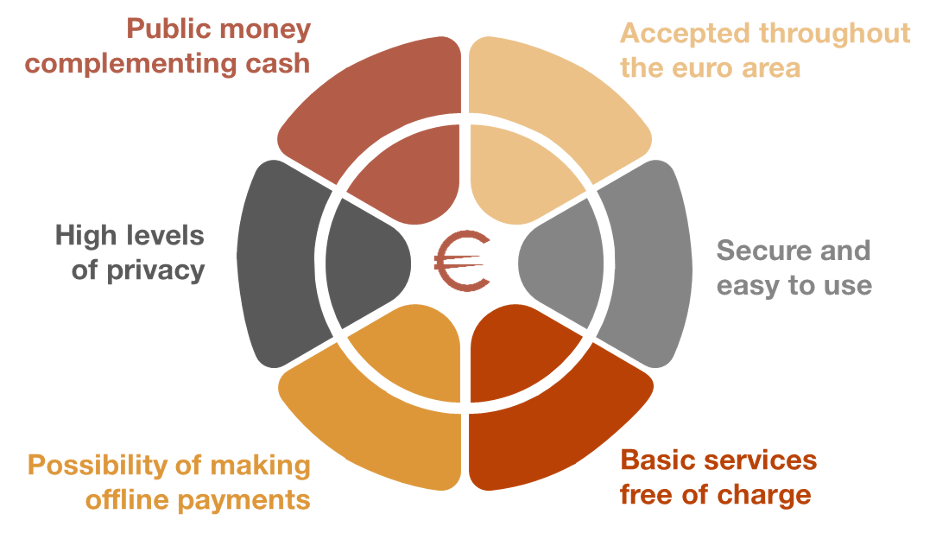

Figure 1

ADVANTAGES OF THE DIGITAL EURO

SOURCE: Banco de España.

Figure 1 sums up the advantages of a digital euro.

Currently, banknotes and coins are the foundation for people’s trust in the monetary system. This trust is based on the knowledge that we can, at any time, obtain cash and use it easily, securely and free of charge to pay any person or business in the euro area. Accordingly, guaranteeing access to digital money issued by the central bank that preserves these basic features of cash would help to maintain trust in our currency in this new environment.

The digital euro would be a means of payment accepted throughout the euro area, and would offer free-of-charge and easy-to-use basic services

Also, the infrastructure that allows us to make electronic payments (machines, connections, protocols, etc.) is a key part of our financial system. The Eurosystem aims to ensure that it is robust and always available. The digital euro would be based on public European infrastructure, which would strengthen the European financial system and make it more independent of foreign alternatives.

The offline mode, for making payments in digital euro without an Internet connection, which would be offered alongside the online mode, would also help to achieve this. The offline mode would provide a back-up solution amidst connectivity outages and would allow digital payments to be used in remote areas where they are currently not an option.

In short, the digital euro would be a means of payment accepted, like banknotes and coins, throughout the euro area, and would offer free-of-charge and easy-to-use basic services (account opening, top-ups, payments, etc.).

Another important consideration for users is privacy. The level of privacy of the offline digital euro would be the same as for cash, since only users would be able to see information on their payments. The online digital euro would work in the same way as electronic payments do today: users would access digital euro through banks, and only they would be able to see users’ personal information. The Eurosystem would process payments, but without knowing who is behind each transaction.

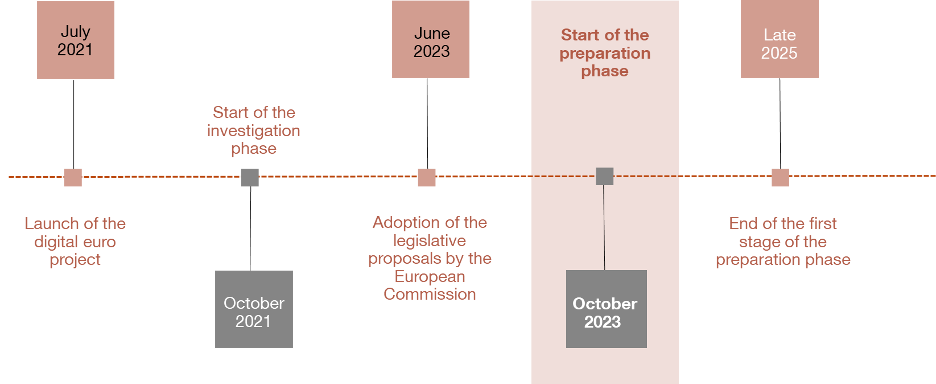

The next steps

As seen in Figure 2, the Eurosystem has been working for two years to define exactly what the digital euro should be and how to make it available to citizens. The ECB resolution of 18 October launches the next phase of the project: making all the preparations necessary to issue a digital euro if the decision is made to go ahead in the future.

Figure 2

THE DIGITAL EURO PROJECT TIMELINE

SOURCE: Banco de España.

These preparations are numerous and complicated, not only for the Eurosystem but also for lawmakers. In this connection, on 28 June the European Commission adopted two legislative proposals![]() ; once approved, this legislation would provide the basis for a possible launch of the digital euro.

; once approved, this legislation would provide the basis for a possible launch of the digital euro.

The ECB resolution launches the next phase of the project: making all the preparations to issue a digital euro if the decision is made to go ahead in the future

The aim is clear: to be ready to complement the range of payment solutions – including cash – available to citizens. The digital euro would be an additional option, ensuring that citizens also have access to public money, with all its guarantees, in an increasingly digital environment.