Who (really) foots the tax bill?

Taxpayers can sometimes pass at least some of their tax burden on to others. Understanding who really bears the cost is key to improving the Spanish tax system. Encouraging micro data-based research into “tax incidence” would be helpful.

11/10/2023

Who bears the cost of taxes? The answer may seem obvious: the taxpayer. Workers pay tax on their wages, companies on their profits and consumers on their purchases. In practice, however, things are not quite so straightforward: sometimes tax burdens can be passed on to others.

Studies of “tax incidence” provide insight into who really foots the tax bill

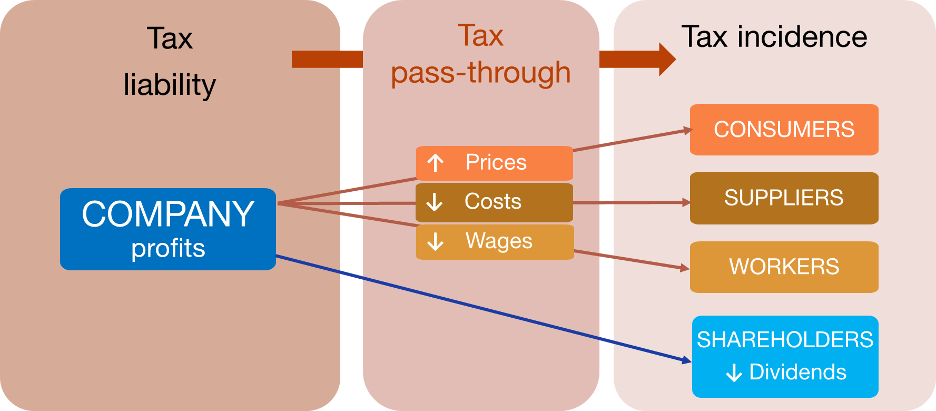

For instance, as Figure 1 illustrates, companies may attempt to lessen the impact on shareholders of a higher corporate tax rate by shifting the burden on to consumers (by raising prices), suppliers (by paying less for what they buy) and even workers (through lower wages).

Figure 1

TAX INCIDENCE: HOW CORPORATE TAX IS PASSED THROUGH

SOURCE: Banco de España.

A company’s ability to pass on the tax burden will depend on a broad range of factors, including the level of market competition, workers’ wage bargaining power and the mobility of tax bases across international borders.

The evidence for tax pass-through

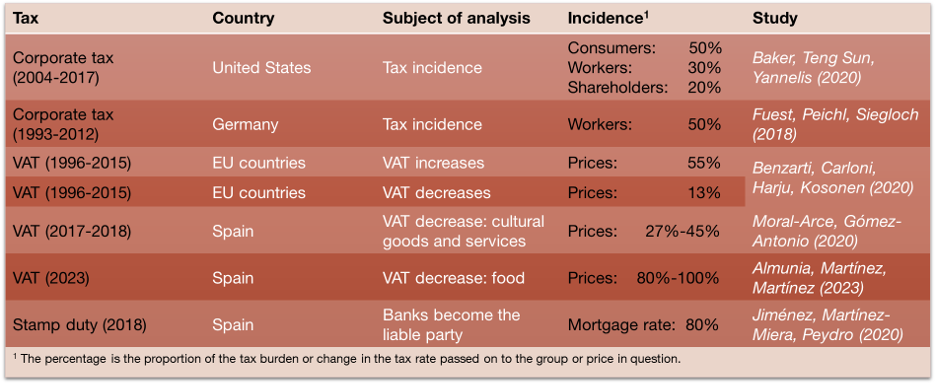

Studies of "tax incidence" (how the tax burden is shared) provide insight into who really foots the tax bill. Such studies have proliferated in recent years thanks to researchers being granted access to corporate and individual tax records. Table 1 lists some of the more recent papers drawing on such tax micro data.

Table 1

RECENT STUDIES ON TAX INCIDENCE REVEAL A SIGNIFICANT PASS-THROUGH

SOURCES: References in the table and Banco de España.

In the case of corporate taxes, evidence for the United States![]() suggests that half of the tax burden falls on consumers through higher prices, 30% is passed on to workers via lower wages and just 20% is borne by shareholders in the form of lower dividends. Conversely, in Germany

suggests that half of the tax burden falls on consumers through higher prices, 30% is passed on to workers via lower wages and just 20% is borne by shareholders in the form of lower dividends. Conversely, in Germany ![]() workers bear half of the tax burden, with the pass-through to low-skilled workers, who have less bargaining power, being especially pronounced.

workers bear half of the tax burden, with the pass-through to low-skilled workers, who have less bargaining power, being especially pronounced.

As for value added tax (VAT), one particular study examines VAT developments across different European Union countries between 1996 and 2015. According to the findings, the burden-sharing between consumers and companies responded differently to VAT increases than to VAT decreases. Specifically, when VAT rates were raised, companies passed 55% of the tax increase through to consumers in the form of higher prices. However, when VAT was lowered, only 13% of those tax reductions were passed through as lower prices.

There is significant capacity to pass on tax burdens in the cases examined

In Spain, where researchers have limited access to tax micro data, studies of tax incidence are thin on the ground.

One study found that a VAT reduction on cultural goods and services![]() in 2017 led to a modest decline in consumer prices. By contrast, the VAT rate cut on selected foods

in 2017 led to a modest decline in consumer prices. By contrast, the VAT rate cut on selected foods ![]() introduced in early 2023 has been largely passed through to lower shelf prices.

introduced in early 2023 has been largely passed through to lower shelf prices.

The last of the studies listed in Table 1 examines the impact of the 2018 stamp duty reform![]() , which shifted the liability for paying this tax from the mortgage borrower to the lender. However, the authors found that 80% of that stamp duty was passed back to the borrower in the form of higher interest rates, with the pass-through to lower earners being more pronounced.

, which shifted the liability for paying this tax from the mortgage borrower to the lender. However, the authors found that 80% of that stamp duty was passed back to the borrower in the form of higher interest rates, with the pass-through to lower earners being more pronounced.

These studies reveal significant capacity to pass on tax burdens in the cases examined.

Tax reform and the study of tax incidence

In the coming years Spain faces the challenge of shoring up the sustainability of its public finances. This will require a number of measures, not least a comprehensive reform of the country’s tax system.

In view of this, a deeper examination of tax incidence is now required. Purposeful efforts to open tax micro data to researchers would help bring this about.

More exhaustive analysis of tax incidence would provide insight into who really foots the tax bill in Spain. This is crucial both for the present design of the tax system and for any potential reform.

Efforts to open tax micro data to researchers would provide insight into who really foots the tax bill in Spain

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.