The Banco de España raises the capital buffers for systemic banks

Systemic banks are key for the stability of the financial system. They are thus subject to specific additional regulatory capital buffers. For 2024 onwards, the Banco de España has raised the minimum buffers for Santander and BBVA, in line with the new framework set in place by the ECB.

Capital is key to ensuring that banks are safe and sound for their customers![]() . This is particularly true of systemic banks, which, given their size and complexity, can upset the entire system if they falter. The minimum capital buffers imposed on these banks are higher and help make the financial system more stable. In this post we look at the requirements for Spain's systemic banks and the changes coming in 2024, when some will have higher buffer requirements.

. This is particularly true of systemic banks, which, given their size and complexity, can upset the entire system if they falter. The minimum capital buffers imposed on these banks are higher and help make the financial system more stable. In this post we look at the requirements for Spain's systemic banks and the changes coming in 2024, when some will have higher buffer requirements.

The minimum capital buffers imposed on systemic banks help make the financial system more stable

The 2008 global financial crisis showed just how serious the fallout from the bankruptcy of a systemic bank like Lehman Brothers could be. This episode led the Basel Committee on Banking Supervision![]() , more than a decade ago, to draw up new international regulatory standards. These standards require bigger capital cushions at systemic institutions, whether global (global systemically important institutions or “G-SIIs”

, more than a decade ago, to draw up new international regulatory standards. These standards require bigger capital cushions at systemic institutions, whether global (global systemically important institutions or “G-SIIs”![]() ) or in a particular country (other systemically important institutions or “O-SIIs”

) or in a particular country (other systemically important institutions or “O-SIIs”![]() ). The EU and Spanish banking regulations now include these standards in the form of two requirements: the G-SII and O-SII capital buffers.

). The EU and Spanish banking regulations now include these standards in the form of two requirements: the G-SII and O-SII capital buffers.

What do we hope to achieve with the additional buffers for systemic banks?

- To make banks more solvent, i.e. better able to fulfil their remit as financial intermediaries, particularly in adverse or unforeseen circumstances.

- To promote prudent management, encouraging banks to consider the impact of their decisions on the financial system as a whole.

- To counter any advantage they may gain from accessing funding at a cheaper rate than other institutions. This is because, given their systemic importance, they are more likely to receive government support if they run into difficulties.

The Banco de España is responsible for setting the capital buffers for Spain’s systemic banks

The Banco de España is responsible for setting the capital buffers for Spain’s systemic banks (O-SIIs). Nonetheless, the European Central Bank (ECB) has the power to tighten the decisions adopted by any of the 21 national authorities of the banking union![]() .

.

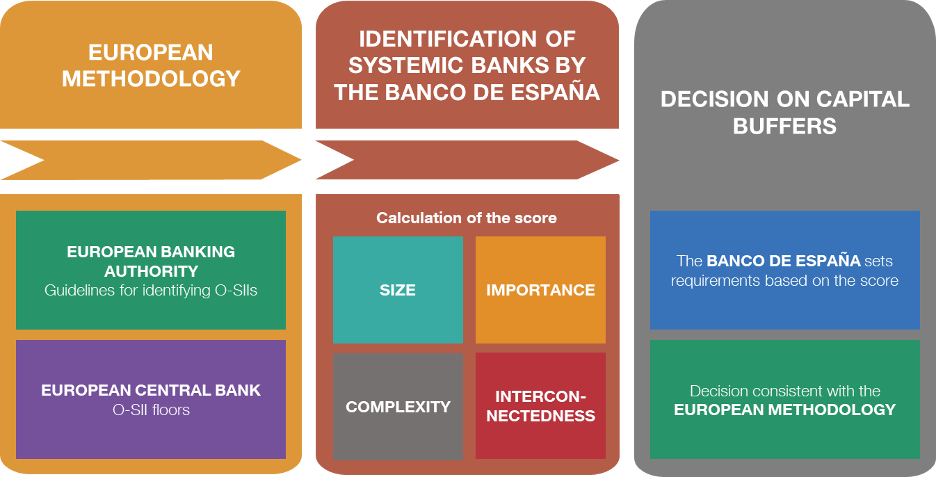

Every year, the Banco de España calculates a systemic importance score for each bank, using the European Banking Authority's methodology![]() (see Figure 1).

(see Figure 1).

Figure 1

HOW ARE SYSTEMIC BANKS’ CAPITAL BUFFERS SET?

SOURCE: Banco de España.

NOTE: The figure shows the process for setting additional capital buffers for other systemically important institutions (O-SIIs). To calculate the score each category is weighted by 25%.

The scores are based on a set of indicators dealing with four aspects of the banking business: size, complexity, interconnectedness and the importance of the intermediary services provided. Each aspect is weighted equally. Institutions above a specific threshold are identified as an O-SII, and must set aside a capital buffer, which increases in line with the score received.

There are currently four O-SIIs: Santander, BBVA, CaixaBank and Sabadell. Santander is also considered a global systemic institution (G-SII).

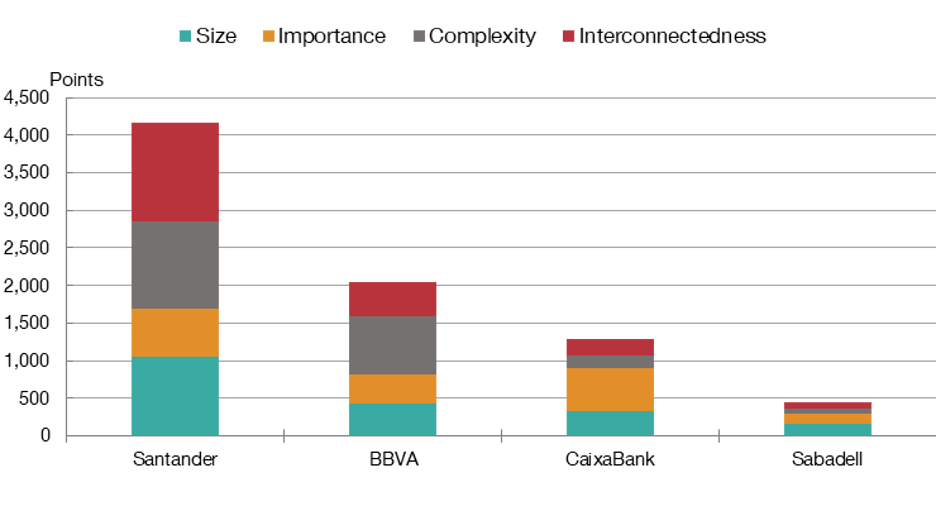

As Chart 1 shows, size and importance have a greater relative weight at CaixaBank and Sabadell. Meanwhile, a more complex business model and greater interconnectedness count for more in the case of Santander and BBVA. The total systemic importance scores vary considerably across the institutions.

Chart 1

SYSTEMIC BANKS' 2024 SCORE (O-SII). BREAKDOWN BY COMPONENT

SOURCE: Banco de España

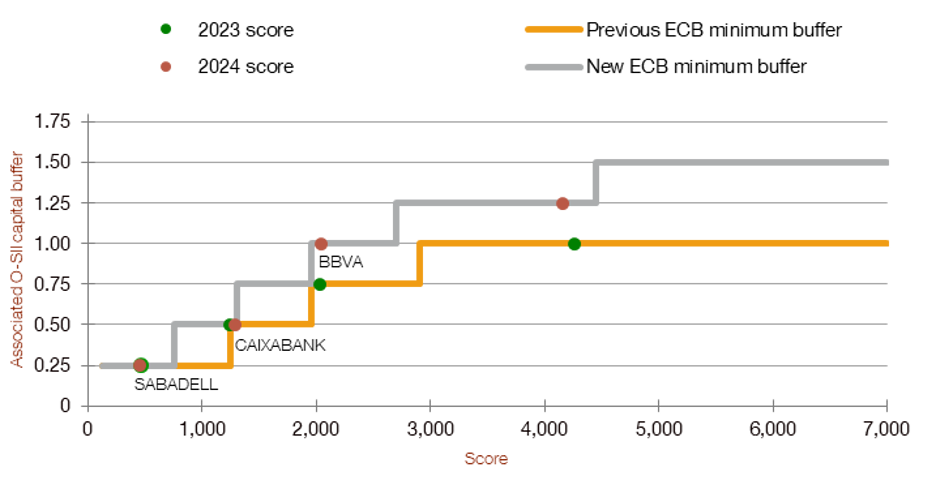

In November 2022 the ECB approved a revision of its methodology for assessing capital buffers for O-SIIs ![]() (149 KB). The revised framework sets stricter minimum requirements, particularly for high-scoring institutions, as can be seen in Chart 2. In line with the new ECB framework, the Banco de España has increased these capital requirements

(149 KB). The revised framework sets stricter minimum requirements, particularly for high-scoring institutions, as can be seen in Chart 2. In line with the new ECB framework, the Banco de España has increased these capital requirements ![]() (218 KB) for Santander and BBVA by 0.25 percentage points, as of January 2024, to 1.25% and 1% of their risk-weighted assets

(218 KB) for Santander and BBVA by 0.25 percentage points, as of January 2024, to 1.25% and 1% of their risk-weighted assets![]() , respectively. The capital buffers for CaixaBank and Sabadell will remain at their 2023 levels (0.5% and 0.25%, respectively).

, respectively. The capital buffers for CaixaBank and Sabadell will remain at their 2023 levels (0.5% and 0.25%, respectively).

Chart 2

SPANISH SYSTEMIC BANKS' CAPITAL BUFFER AND SCORE

SOURCE: Banco de España.

NOTE: The lines of the chart compare the ECB’s previous (2016-2023) and current (from 2024) minimum capital buffer frameworks for other systemically important institutions (O-SIIs). The dots show the score awarded to the financial institutions by the Banco de España in 2023 and 2024.

This requirement must be met with the most loss-absorbing form of capital, in other words, common equity tier 1 (CET1) capital.

These buffers come on top of the other capital requirements, most of which are applicable to all institutions. Thus, the minimum capital requirement in 2023 for Spanish systemic institutions is 8.9% on average, compared with 8% at other institutions.

What will these additional requirements entail?

Raising capital buffer floors for Santander and BBVA will be good for financial stability in the medium term, as shown by recent research by the Banco de España![]() . The Spanish banking system as a whole would have less need to recapitalise in the event of a severe financial crisis, thus freeing it up to continue lending to firms and households.

. The Spanish banking system as a whole would have less need to recapitalise in the event of a severe financial crisis, thus freeing it up to continue lending to firms and households.

However, the regulatory change could entail costs for the two affected institutions in the short term. To comply with the capital requirements, they may have to:

- set aside a larger share of their profits;

- issue additional capital on the markets and/or

- cut back on lending.

Our estimates suggest that the costs of the additional capital requirement will be small

However, our estimates suggest that the costs of the additional requirement will be small. First, Santander and BBVA have capital headroom above the regulatory requirements, which is enough to cover the additional amount from the outset without having to resort to any of the above options in the short term. Second, even if they did, the adverse impact on lending and economic activity would be very limited, given the small size of the required increase.