Everything you need to know about the ECB’s strategic review

After a year’s work, the Eurosystem central banks have approved the updated monetary policy strategy. This review was necessary in light of the rapidly changing world we are living in. Below I will try to explain what it is, what it is for, what has changed since the 2021 review and why it matters to you.

01/07/2025

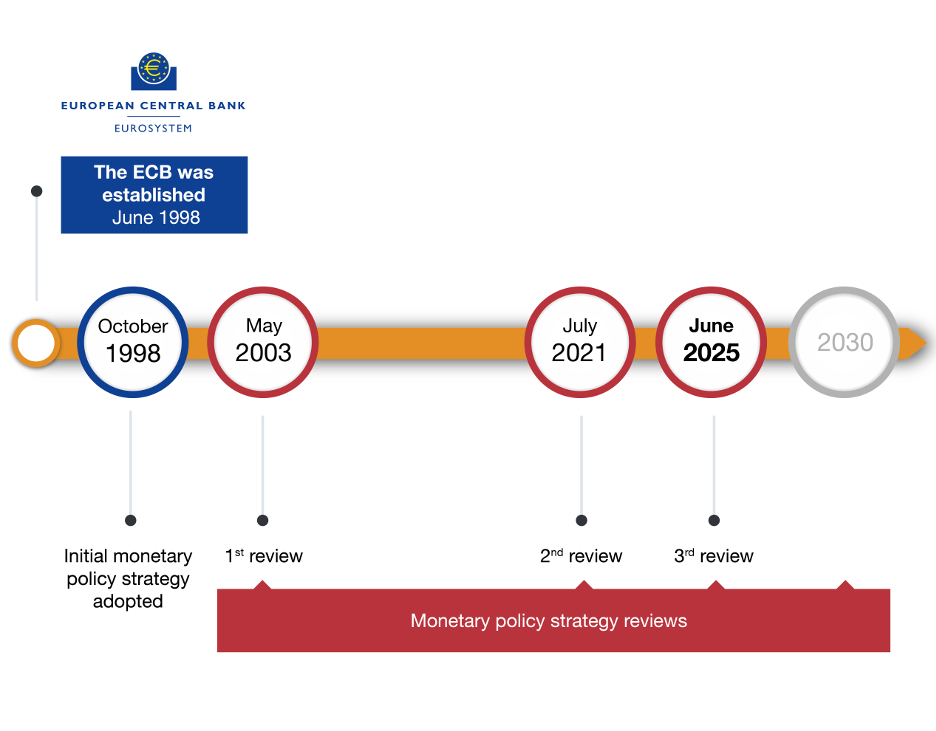

Did you use to think that monetary policy was dull and static? The events of recent years and this strategic review unequivocally prove otherwise. The Eurosystem national central banks (including the Banco de España) and the European Central Bank (ECB) have worked for the past year on updating our monetary policy strategy, only four years after the previous review. The aim is to adapt it to keep up with the times and to fulfil our mandate more effectively. This review is no minor issue, as we explain below. Bear in mind that since the ECB was established in 1998, its monetary policy has only been reviewed twice, in 2003 and 2021.

Figure 1

OVERVIEW OF THE ECB’S MONETARY POLICY STRATEGY

SOURCE: Banco de España

NOTE: After the 2021 review it was decided that these would be periodic. The next review is scheduled for 2030.

But what exactly is the monetary policy strategy![]() ? It is our “guide” for meeting the price stability objective in the euro area. It could be defined as the ten commandments of our monetary policy, the outcome of our comprehensive analysis. In them we have delineated the monetary policy tools, indicators and intermediate targets that are the most appropriate at any given moment.

? It is our “guide” for meeting the price stability objective in the euro area. It could be defined as the ten commandments of our monetary policy, the outcome of our comprehensive analysis. In them we have delineated the monetary policy tools, indicators and intermediate targets that are the most appropriate at any given moment.

The monetary policy strategy is our guide for meeting the price stability objective in the euro area. The review will help guide our future work and serves as a communication channel with the public at large

What is the review for? In general, it helps us update our “guide” to steer our future decisions. In practice, it serves two purposes:

- First, it helps those of us who are responsible for monetary policy decisions (i.e. the members of the ECB’s Governing Council

) to have an analytical framework that translates real or expected economic scenarios into potential decisions.

) to have an analytical framework that translates real or expected economic scenarios into potential decisions. - Second, it serves as a communication channel with the public at large

, so that we are as transparent as possible in our decision-making.

, so that we are as transparent as possible in our decision-making.

Why should it be reviewed? The monetary policy strategy must be flexible so that it can adapt to important changes in the economy. This means that it needs to be reviewed periodically, as we established after our 2021 review. In addition, in recent years we have witnessed shocks on an unprecedented scale and have gone from a long period of very low inflation to the highest inflation rates in the history of the euro and the subsequent disinflation process. The world has changed dramatically since the previous review and we need to catch up to meet these challenges.

To put this in context, the 2021 review![]() took place in an environment of low (even negative) interest rates, with inflation below 2%. However, after COVID-19 and the invasion of Ukraine, supply chains suffered disruptions and energy and food prices surged. These shocks drove inflation up to levels not seen for decades. The ECB responded with a firm monetary policy stance

took place in an environment of low (even negative) interest rates, with inflation below 2%. However, after COVID-19 and the invasion of Ukraine, supply chains suffered disruptions and energy and food prices surged. These shocks drove inflation up to levels not seen for decades. The ECB responded with a firm monetary policy stance![]() and, despite the volatility, long-term inflation expectations remained stable, proving that the strategic framework was sound.

and, despite the volatility, long-term inflation expectations remained stable, proving that the strategic framework was sound.

The latest strategy review comes at the right time, to help us respond to a complex environment. Most of the initial features remain unchanged, some are confirmed and others (such as taking into account risks and uncertainty) are new.

This review comes at the right time. It is necessary to respond effectively to the current environment, marked by geopolitical fragmentation, climate change, the rise of artificial intelligence and population ageing. This setting could lead to more frequent inflation shocks that are harder to anticipate. But we also need to be prepared for the future, as these factors can make prices change more than usual, making it difficult to keep them stable. All of this means that we must have our toolbox ready to respond to this new environment.

Key features of the new monetary policy strategy

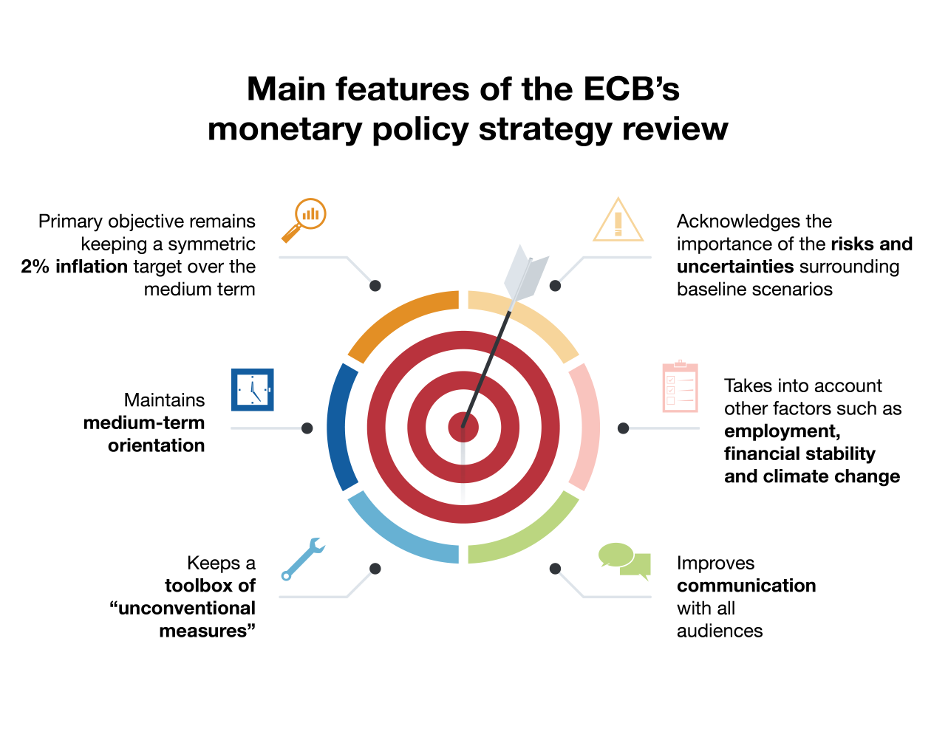

Below, we explain everything you need to know about the ECB's latest strategy review, very briefly, to keep you on your toes (Figure 2). Most of the initial features remain unchanged, some are confirmed and others are new.

Figure 2

WHICH ARE THE MAIN FEATURES OF THE NEW ECB'S MONETARY POLICY STRATEGY?

SOURCE: Banco de España

First, our primary objective is still to target a symmetric inflation rate of 2% over the medium term![]() . Does symmetry matter? Yes, it does, since inflation that is too low is viewed just as negatively as inflation that is too high. Having a clear target has been key to keeping inflation expectations anchored over the last few years, even during the recent high-inflation episodes.

. Does symmetry matter? Yes, it does, since inflation that is too low is viewed just as negatively as inflation that is too high. Having a clear target has been key to keeping inflation expectations anchored over the last few years, even during the recent high-inflation episodes.

DID YOU KNOW...?

That the ECB's definition of its inflation target has changed over time:

- 1998: in its initial monetary policy strategy

the ECB defined price stability as annual inflation of below 2%, as measured by the Harmonized Index of Consumer Prices (HICP)

the ECB defined price stability as annual inflation of below 2%, as measured by the Harmonized Index of Consumer Prices (HICP) .

. - 2003: in the first review

the target was defined as inflation “below, but close to, 2% over the medium term.”

the target was defined as inflation “below, but close to, 2% over the medium term.” - 2021: in the second review

the quantitative measure was more accurate and a symmetric medium-term inflation target of 2% was defined, where positive and negative deviations were considered equally undesirable.

the quantitative measure was more accurate and a symmetric medium-term inflation target of 2% was defined, where positive and negative deviations were considered equally undesirable.

Second, our medium-term orientation remains unchanged, meaning that we do not have to respond automatically to temporary deviations from the target. This flexibility is essential to avoid unnecessary adverse effects on growth and employment when confronted with supply shocks.

Third, in addition to policy rates![]() , which are still the primary tool for steering monetary policy, the ECB will continue to keep a toolbox of what we call “unconventional” measures

, which are still the primary tool for steering monetary policy, the ECB will continue to keep a toolbox of what we call “unconventional” measures![]() like asset purchase programmes, targeted longer-term financing operations, negative interest rates and forward guidance. These measures have proved very useful in the past, especially when rates were close to zero. The ECB thus undertakes to continue to respond swiftly in terms of selecting, designing and implementing new instruments, thoroughly assessing their proportionality first. For instance, in 2022 it created a new Transmission Protection Instrument (TPI)

like asset purchase programmes, targeted longer-term financing operations, negative interest rates and forward guidance. These measures have proved very useful in the past, especially when rates were close to zero. The ECB thus undertakes to continue to respond swiftly in terms of selecting, designing and implementing new instruments, thoroughly assessing their proportionality first. For instance, in 2022 it created a new Transmission Protection Instrument (TPI)![]() to ensure that monetary policy is conducted smoothly across all euro area countries. That said, before these tools are used, they will be carefully assessed to avoid any unwanted side effects.

to ensure that monetary policy is conducted smoothly across all euro area countries. That said, before these tools are used, they will be carefully assessed to avoid any unwanted side effects.

The fourth feature is the most innovative, as we acknowledge the importance of basing our decisions not only on the most likely course of inflation and economic activity (the baseline scenario), but also taking into account the prevailing risks and uncertainty, and the need to use appropriate scenario and sensitivity analyses.

DID YOU KNOW...?

- That monetary policy decisions can be made taking into account both the baseline and alternative scenarios.

- Alternative scenarios explore the implications of certain events for the projected course of inflation and growth. Current examples are an escalation of the conflict in the Middle East or higher tariffs.

- Sensitivity analyses examine how our projections would be affected by changes in key assumptions such as oil prices and wage growth.

Fifth, although keeping prices stable remains the priority, the ECB addresses other factors such as employment, financial stability and climate change, which will continue to form part of its economic and financial analyses.

Last but not least, we have improved the way monetary policy is communicated to different audiences, and will continue to do so using channels such as blogs, podcasts and videos that explain our decisions in a clear and user-friendly way.

In short, our mandate remains the same: to maintain price stability. This is also our best contribution to economic growth in the euro area and we have the right tools in place to fulfil it as effectively as possible. However, as this is an ongoing task, we will continue to adapt to an ever-changing global environment and will review our monetary policy strategy again in 2030.