Supporting the euro’s international role: Eurosystem reserve management services

The euro is the second largest foreign exchange reserve currency. Eurosystem reserve management services are provided by most euro area national central banks (the Banco de España being one of them) to central banks and international organisations outside the euro area that hold euro-denominated reserves.

Foreign exchange reserves![]() are a safeguard for countries against crises, with nearly all nations holding a significant cushion of reserves. The dollar is the leading reserve currency, with the euro a distant second. However, recent shifts in US economic policy have aroused some scepticism about the dollar keeping this role. In this environment, the euro (as a safe and stable currency), alongside the Eurosystem

are a safeguard for countries against crises, with nearly all nations holding a significant cushion of reserves. The dollar is the leading reserve currency, with the euro a distant second. However, recent shifts in US economic policy have aroused some scepticism about the dollar keeping this role. In this environment, the euro (as a safe and stable currency), alongside the Eurosystem![]() reserve management services (ERMS

reserve management services (ERMS![]() ) could play a more prominent role. What do these ERMS comprise? Who uses them? What are their benefits for the customers and for the Eurosystem?

) could play a more prominent role. What do these ERMS comprise? Who uses them? What are their benefits for the customers and for the Eurosystem?

DID YOU KNOW …?

According to the International Monetary Fund![]() , euro-denominated international reserves accounted for 20.03% of the global total at end-2024.

, euro-denominated international reserves accounted for 20.03% of the global total at end-2024.

The majority (57.3%) are dollar-denominated, while some other reserve currencies –yen (5.8%), pound sterling (5%), and renminbi (2.2%)– trail well behind.

Countries use foreign exchange reserves for key strategic purposes. For instance, they participate in foreign exchange markets to uphold their own currency's value, make external debt payments and respond effectively to financial crises. They play a stabilising role during crises and help preserve confidence in a country's economy and currency.

Reserves must primarily be invested in a range of safe assets and currencies –requirements that the euro meets exceptionally well– and be properly managed.

Holders prioritise four key aspects in managing their foreign exchange reserves:

- Liquidity: immediate availability when needed, including easy conversion to cash without loss of value.

- Safety: low exposure of assets to drops in value, volatility and other risks.

- Returns: an adequate level of remuneration.

- Confidentiality: no leaks of market-sensitive information.

Countries generally entrust management of their reserve holdings to sound and secure institutions with proven expertise. A country’s central bank typically controls and manages its reserves, although specialised intermediaries, both public (e.g. other foreign central banks or the Bank for International Settlements) and private (e.g. international central securities depositories, ICSDs![]() ), can also be involved.

), can also be involved.

Since 2005, the Eurosystem has provided euro-denominated reserve management services to public institutions outside the euro area under a harmonised regulatory framework![]() . This framework is frequently updated in line with customers’ changing needs and market developments.

. This framework is frequently updated in line with customers’ changing needs and market developments.

Who provides and who uses ERMS?

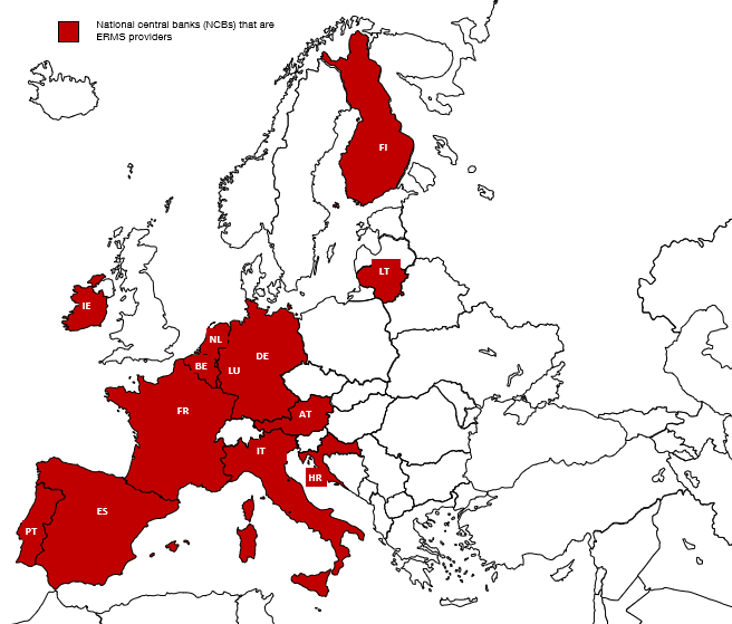

13 of the 20 Eurosystem NCBs currently voluntarily provide all or a subset of ERMS, coordinated by the European Central Bank (ECB) (Chart 1). The Banco de España![]() is among them.

is among them.

Chart 1

EUROSYSTEM NCBs PROVIDING ERMS

SOURCE: Banco de España.

Eurosystem reserve management services have been provided since 2005. 13 out of the 20 Eurosystem national central banks, including the Banco de España, are ERMS providers

ERMS customers include other central banks and authorities located outside the euro area and international organisations outside the European Union (EU), established by or under the authority of an international treaty.

The number of accounts opened by ERMS customers has been increasing in recent years, from 260 in 2020 to 287 in 2024.

DID YOU KNOW …?

To be accepted as customers, institutions and organisations must comply with applicable EU and national legislation on sanctions or restrictive measures and for the prevention of money laundering and terrorist financing and confirm their compliance to the ERMS provider.

If customers fail to comply with the aforementioned obligations, are subject to sanctions or restrictive measures or fail to comply with any ERMS terms and conditions, the ERMS provider may limit, suspend or exclude them from the provision of ERMS.

How do ERMS work?

Customers can select with which ERMS provider (i.e. national central bank, NCB) they wish to establish a contract, as well as the specific services they require – confident in the knowledge that all customers are treated on a level playing field.

ERMS customers benefit from a trustworthy and efficient manager for their euro-denominated reserves and the Eurosystem thus helps to cement the euro's international role

Customers’ details are confidential. ERMS providers disclose to the ECB any relevant information on the provision of ERMS and the ECB may share it within the Eurosystem when necessary. Customer consent is generally required for the disclosure of its identity to the Eurosystem, which only happens for specific purposes.

ERMS-managed reserve assets are euro-denominated cash and securities included in the Eurosystem list of eligible marketable assets, with some exceptions.

The range of standardised services is extensive, as shown in Figure 1, and includes services related to cash, securities and more.

Figure 1

TYPES OF EUROSYSTEM RESERVE MANAGEMENT SERVICES (ERMS)

SOURCE: Banco de España.

NOTE: These services do not include strategic decisions on what are the most advantageous or appropriate investments to make for customers. However, the ERMS provider may make suggestions to customers as to the timing and execution of a transaction to avoid conflicts with the Eurosystem’s monetary and exchange rate policy and will not be liable for any consequences that such suggestions may have for the customer.

ERMS services are not free: ERMS providers charge certain fees and costs to their customers, but also remunerate them at published rates for their cash deposits and investments.

The Eurosystem seeks to design ERMS terms and conditions such that they do not affect euro liquidity, market functioning or monetary policy conduct. To this end, limits are set on the amount and remuneration of certain deposits and investments.

What are the advantages of ERMS for customers? Figure 2 outlines these advantages, which are based on three factors:

- the Eurosystem operating as a single system in providing these services;

- the central and prominent position of the Eurosystem in the euro area;

- ERMS synergies with other services also provided by the Eurosystem.

Why does the Eurosystem provide such services? ERMS allow the Eurosystem to achieve a dual objective:

- strengthen the euro's international role and use as a reserve currency;

- meet the management needs of its customers, holders of euro-denominated reserves.

Figure 2

ADVANTAGES OF ERMS FOR CUSTOMERS

SOURCE: Devised by author.

In conclusion, in the Eurosystem ERMS customers have a trustworthy and efficient manager for their euro-denominated reserves. The Eurosystem, in turn, meets these customers’ needs and contributes to bolstering financial stability and the role of the euro in the global financial system. Through the harmonised regulation of ERMS, the Eurosystem ensures a level playing field for all customers. The design of the services prevents them from interfering with the Eurosystem's monetary policy, exchange rate policy or market functioning. The Banco de España has cemented its role as an ERMS provider, nearly 20 years after their launch.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.