After the flash floods in Spain, how did the Banco de España respond to the financial consequences?

The flash floods last autumn caused severe human, economic and environmental damage in eastern Spain. The Banco de España took a number of steps in response, including assessing and closely monitoring the financial situation in the area to identify the needs of households and businesses and any risks to the financial system.

On 29 October 2024 a very powerful cut-off low![]() hit eastern Spain, causing severe flooding. In total 235 lives were lost and hundreds of thousands of people were affected, mainly in Valencia province. The economic impact has also been profound and long-lasting. Within the scope of its functions, the Banco de España took urgent measures to mitigate the damage

hit eastern Spain, causing severe flooding. In total 235 lives were lost and hundreds of thousands of people were affected, mainly in Valencia province. The economic impact has also been profound and long-lasting. Within the scope of its functions, the Banco de España took urgent measures to mitigate the damage![]() , specifically to keep the payment system up and running and ensure that people had access to cash. It also carried out comprehensive real-time assessment and monitoring

, specifically to keep the payment system up and running and ensure that people had access to cash. It also carried out comprehensive real-time assessment and monitoring![]() of economic and financial developments in the area affected. In today’s blog post we focus on the financial impact of the flash floods and the Banco de España’s response.

of economic and financial developments in the area affected. In today’s blog post we focus on the financial impact of the flash floods and the Banco de España’s response.

Natural disasters can affect local economies through several channels, by:

- Limiting or even disrupting economic activity during and after the disaster;

- Damaging or destroying infrastructure and the assets and wealth of households and firms, causing most harm to the most vulnerable households and small businesses;

- Driving up missed debt payments;

- Restricting access to credit just when people need it the most to get back to normal.

All these channels combined can aggravate the collapse in activity, consumption and employment, prolonging the economic impact and hampering recovery. That is why a rapid response is needed, to assess and mitigate the damage, facilitate access to credit and allow economic and financial conditions to return to normal.

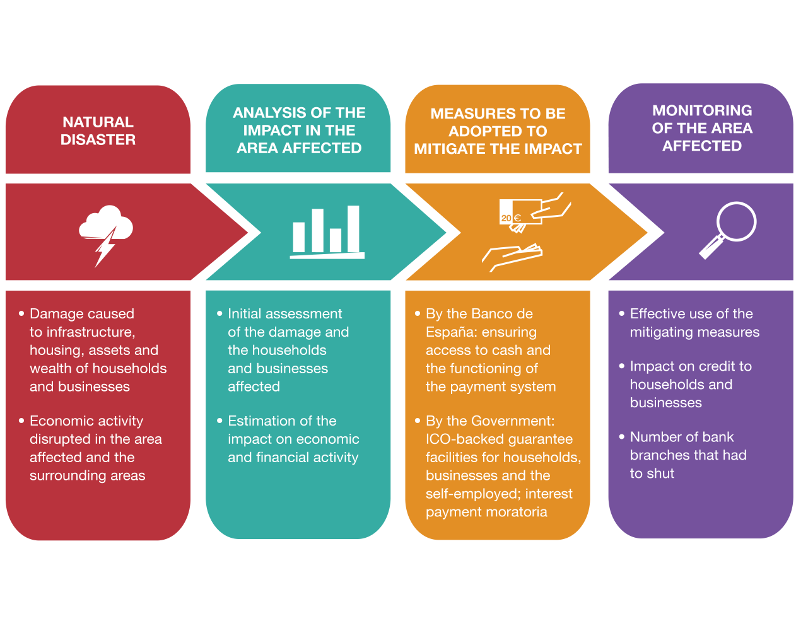

Figure 1 describes how the Banco de España conducted this financial analysis and monitoring.

Figure 1

HOW DOES THE BANCO DE ESPAÑA RESPOND TO A NATURAL DISASTER?

SOURCE: Devised by authors.

Impact analysis: financial exposure of the area affected

Impact analysis is one of the first steps the Banco de España takes after a natural disaster. To assess the financial impact of the flash floods, the risks were analysed considering the following criteria:

- who are the borrowers affected (households, businesses, etc.)?

- how is the risk distributed geographically?

- which financial institutions are affected?

- what type of financing is affected (mortgage loans, consumer loans, credit facilities, advance payments to suppliers, etc.)?

We assessed the financial impact of the flash floods, taking into account the characteristics of those affected and how their different types of loans are distributed

The data used by the Banco de España come mostly from the Central Credit Register (CCR)![]() , a database that compiles information on customers’ loans, credits and guarantees provided by each reporting bank. We also collected data from the Ministry of Economy, Trade and Enterprise, for information on compensation claims, and from open source platforms such as PortWatch

, a database that compiles information on customers’ loans, credits and guarantees provided by each reporting bank. We also collected data from the Ministry of Economy, Trade and Enterprise, for information on compensation claims, and from open source platforms such as PortWatch![]() , for information on imports/exports in the affected region.

, for information on imports/exports in the affected region.

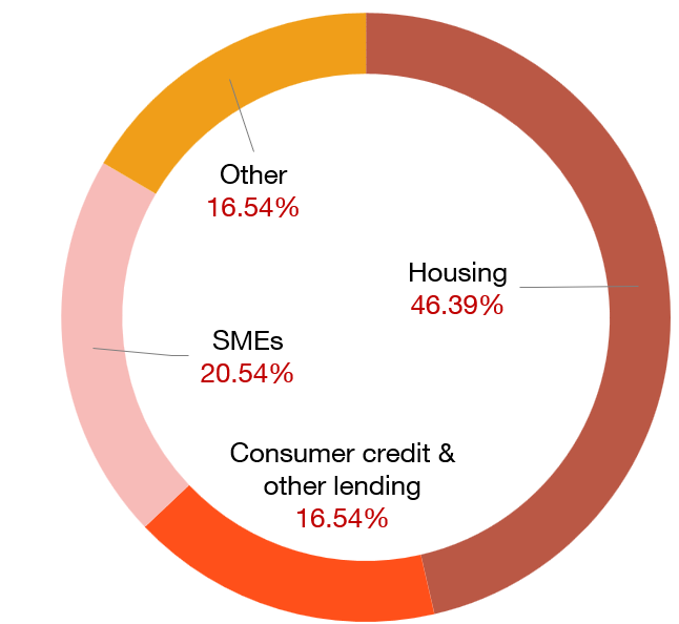

Chart 1 presents the distribution of financing by borrower and purpose in the area affected by the flash floods, with more than half corresponding to households, mainly for house purchase.

Chart 1

DISTRIBUTION OF FINANCING TO HOUSEHOLDS AND BUSINESSES IN THE AREA AFFECTED

SOURCES: Banco de España and CCR.

Monitoring of the situation and the measures taken

We have closely monitored financial and economic activity in the area affected, to gain a real understanding of the scale of the disaster. We have also followed the mitigation measures implemented, to assess how – and how effectively – they have been used.

DID YOU KNOW …?

In response to the flash floods and the damage they caused, the Spanish Government took urgent measures![]() (Royal Decree-Law 6/2024) that sought not just to protect people, but also to help restore normality and prevent a sharper economic downswing in the areas affected.

(Royal Decree-Law 6/2024) that sought not just to protect people, but also to help restore normality and prevent a sharper economic downswing in the areas affected.

Among other measures, Royal Decree-Law 6/2024 includes:

- An ICO guarantee facility

, to mobilise financing for households, businesses and the self-employed, by making it easier for them to access liquidity and obtain new lending to alleviate the damage caused by the flash floods.

, to mobilise financing for households, businesses and the self-employed, by making it easier for them to access liquidity and obtain new lending to alleviate the damage caused by the flash floods. - Loan moratoria

for consumers, the self-employed and SMEs affected, suspending their loan repayments and interest payments to help ease their debt burden.

for consumers, the self-employed and SMEs affected, suspending their loan repayments and interest payments to help ease their debt burden.

Our analysis is based on several indicators calculated using CCR data:

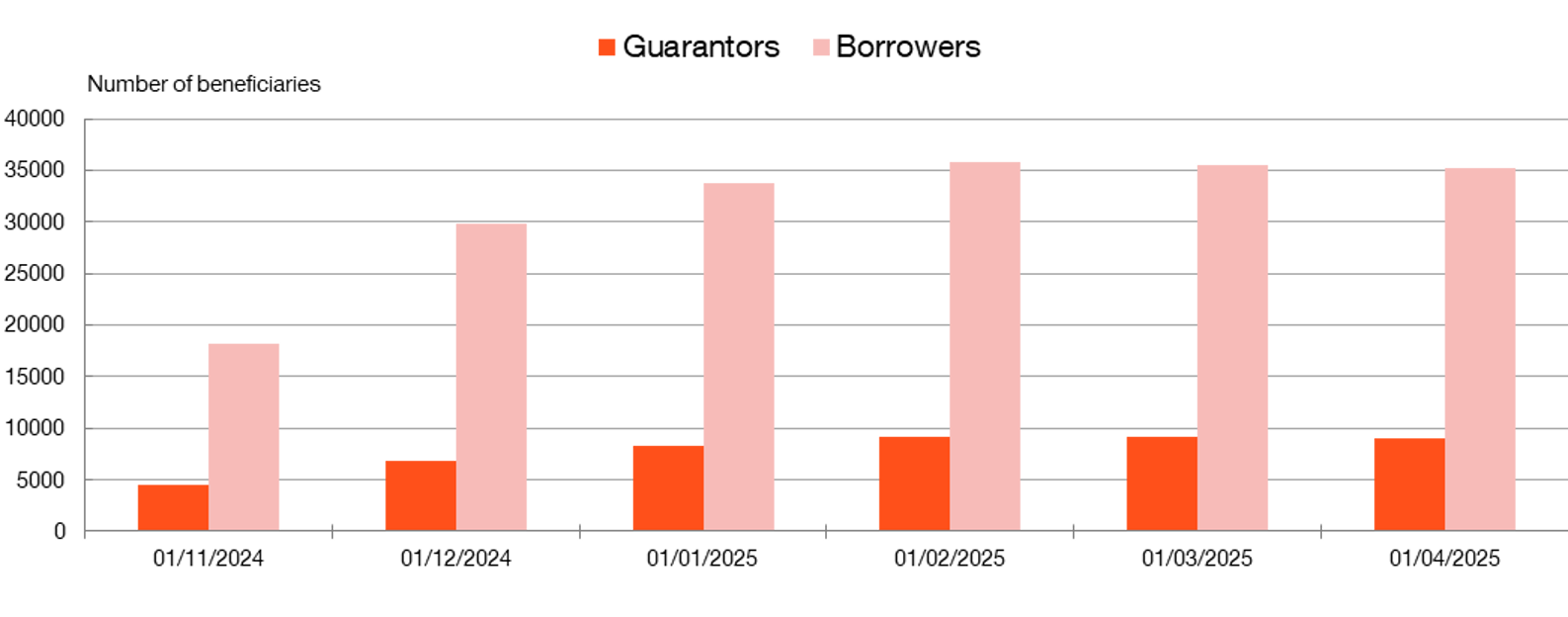

- By analysing the use of the measures introduced, we can verify agents’ real needs for financial support. Chart 2 shows the number of beneficiaries that have made use of the loan moratoria.

Chart 2

BENEFICIARIES OF THE LOAN MORATORIA AFTER THE FLASH FLOODS

SOURCES: Banco de España and CCR.

- We use credit scores to analyse how the disaster has impacted the economy of individuals and businesses and to identify potential financial difficulties and business continuity risks in the areas affected.

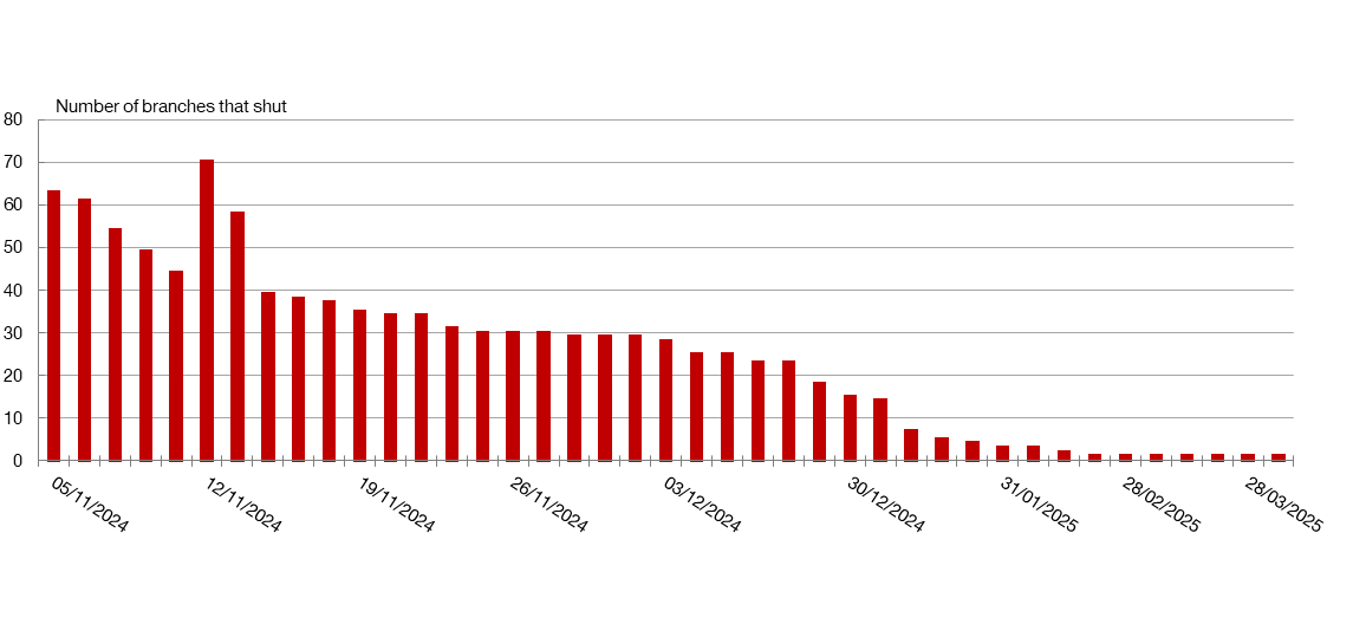

- Close monitoring of the banks with the greatest exposures in the area affected. Chart 3 shows the number of branches that had to shut in the area affected.

Chart 3

BRANCHES AFFECTED IN THE AREA

SOURCE: Banco de España.

The indicators used focus on the measures deployed, the credit quality of the loans granted and the changes in the number of bank branches affected by the disaster

We have also undertaken more sophisticated studies to better assess the situation and the impact. When analysed together, this information helps to identify patterns and make informed decisions to support the area’s economic recovery.

DID YOU KNOW ...?

- Our latest Financial Stability Review

compares the volume and quality of lending extended to households and businesses in the areas affected since the flash floods with that granted in other areas.

compares the volume and quality of lending extended to households and businesses in the areas affected since the flash floods with that granted in other areas. - The comparison was made using CCR

data and difference-in-differences

data and difference-in-differences econometric techniques.

econometric techniques. - The findings show that:

- lending in the area affected has grown considerably since December 2024, which seems to be cushioning the economic impact;

- credit risk has increased somewhat, with a temporary uptick in loans showing a significant increase in credit risk (stage 2 loans) and a moderate rise in non-performing loans.

- We will need to continue monitoring credit, drawing on studies of similar disasters, to identify any possible delayed effects.

In short, analysing and monitoring the financial situation after a natural disaster is essential to ensure a rapid and efficient response that will help mitigate the negative impact and boost the recovery. This approach will make the Spanish economy more resilient to future challenges.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.