Inflation affects us all differently. What determines how each of us feels the squeeze?

We all feel the squeeze of inflation, but some feel the pinch more than others. Inflation affects us through different channels that impact our ability to save. Drawing on a rich dataset, we find that in 2021 both the level of labour income and, above all, age explain how inflation affects different Spanish households differently.

03/09/2024

Whether we’re working or unemployed, a student or a pensioner, a high or low income earner, a saver or a borrower, we’ve all felt the pinch of rising inflation in recent years. But some of us have felt it more than others. Inflation![]() can be defined as the rise in the prices of the basket of goods and services that a representative household consumes. However, some prices rise more than others and no household is exactly "the representative household". Inflation can therefore impact us all very differently. Through which channels? Who feels the pinch more and who less? Did some households benefit from the inflationary surprise in Spain in 2021?

can be defined as the rise in the prices of the basket of goods and services that a representative household consumes. However, some prices rise more than others and no household is exactly "the representative household". Inflation can therefore impact us all very differently. Through which channels? Who feels the pinch more and who less? Did some households benefit from the inflationary surprise in Spain in 2021?

Inflation and its channels of impact

Inflation affects our purchasing power, our wealth and, ultimately, our ability to save, which is what we’re going to analyse in this blog post.

The real value of the disposable funds that we can save is determined not only by our assets and debts, but also by our income and spending in a given period.

Inflation affects our ability to save through three channels: income, wealth and the consumption basket

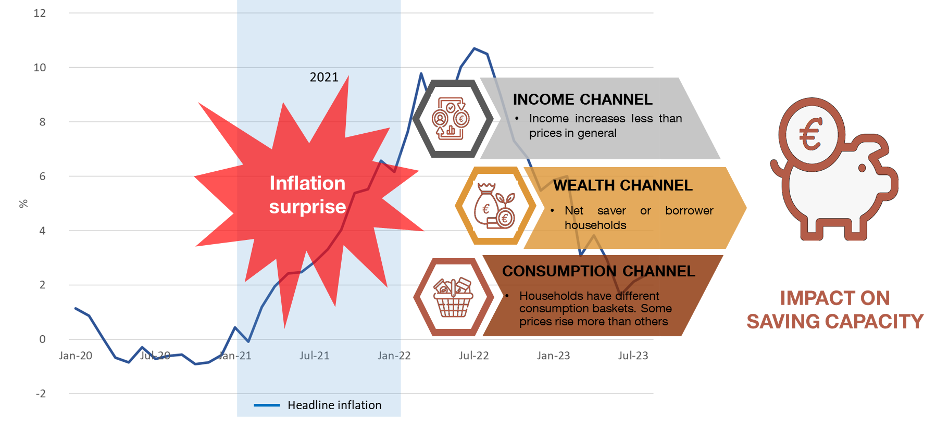

Inflation affects our ability to save through three channels (see Figure 1):

Figure 1

INFLATION IN 2021 AND ITS CHANNELS OF IMPACT ON HOUSEHOLDS

SOURCE: Banco de España

- The labour income channel is the most intuitive: inflation reduces real wages. If the price of a household’s consumption basket increases but its wages don’t increase (or they do, but not at the same pace), the household will need to spend more of its income to consume the same goods and services, reducing its ability to save and accumulate wealth.

- The wealth channel, i.e. through our assets (financial assets, real estate, etc.) and debts. Via this channel, inflation generally makes borrowers “richer” and savers and lenders “poorer”. Why? Because inflation simultaneously reduces the real value of debts (e.g. mortgages) and of assets.

This is easier to understand with an example. Suppose you borrowed €10,000 from a bank to buy a car. The real value of that debt is no more than the amount of goods and services that you can buy with that sum of money; in this case, and at the time you applied for the loan, a car worth €10,000. If (car) prices rise, you’ll still owe the bank €10,000, but the real value of that debt will decrease, as you wouldn’t be able to afford your car today with those €10,000. As a borrower, you come out ahead.

The opposite tends to occur for assets. Suppose you’ve got €10,000 in a bank account or deposit. This asset’s real value declines with inflation, as higher prices mean that those €10,000 saved at the bank will buy you less.

- The consumption basket channel, i.e. via differences in consumption patterns. Changes in product prices vary and no household’s consumption basket is identical to the representative household’s. In other words, how each household experiences inflation depends on its particular consumption basket. For example, if apple prices rise more than orange prices, those households that consume more apples will experience higher inflation.

The three channels in figures: how did rising inflation in 2021 affect Spanish households?

The channels described affect people differently depending on their level of income and age, among other characteristics. To assess the net impact of inflation on different population groups, the three channels must be considered together.

For this purpose, detailed individual and household level data are needed. A recent paper![]() by researchers at the Banco de España and BBVA Research uses anonymised

by researchers at the Banco de España and BBVA Research uses anonymised![]() BBVA customer-level data to analyse the impact of the upward inflationary surprise in 2021

BBVA customer-level data to analyse the impact of the upward inflationary surprise in 2021![]() on Spanish households through the three channels described.

on Spanish households through the three channels described.

Age - more than income level – determined the different impact of inflation on different households in Spain in 2021. Older people, who tend to have more savings, were the hardest hit

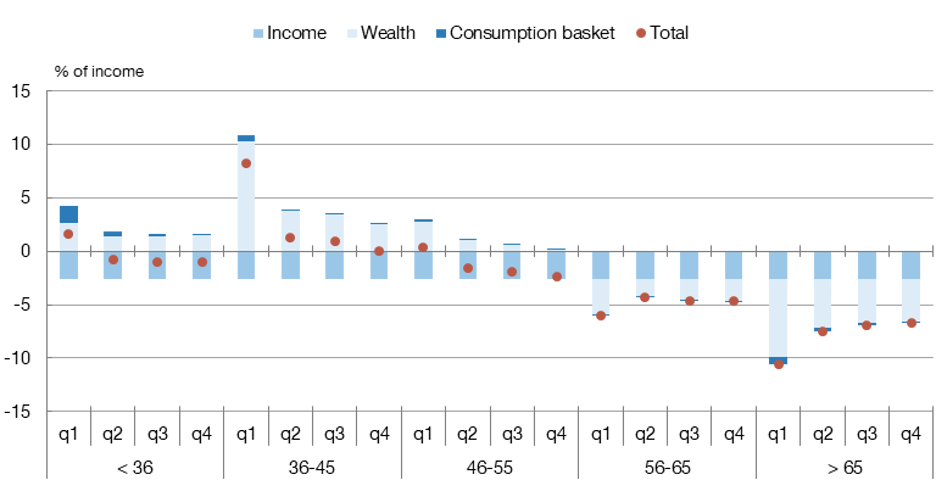

Chart 1 shows the main findings, by labour income bracket within each age group. The bars depict how inflation has impacted saving through each respective channel, while the dots reflect the aggregate effect of the three channels. In all cases the impact is shown as a percentage of labour income.

Chart 1

THE THREE CHANNELS OF IMPACT OF INFLATION IN 2021, BY AGE AND LABOUR INCOME

SOURCE: Ferreira, Leiva, Nuño, Ortiz, Rodrigo and Vázquez (2024)![]()

NOTES:

-The bars depict the average individual in each income quartile within the different age groups. The impact is measured as the percentage change of labour income of the inflationary surprise in Spain in 2021. The different shades of blue denote the effect of the respective channels.

-The quartiles (q1-q4) of the income distribution are defined as follows: within each age group, bank customers are sorted in ascending order from lowest to highest income, generating a distribution: q1 includes customers with income in the lower quartile of the distribution; q2, customers between 25% and 50%; q3 captures customers between 50% and 75%; and q4 reflects those customers in the upper quartile.

The following conclusions can be drawn from the chart:

- In 2021 the wealth and income channels were quantitatively more important than the consumption basket one.

- The size of the channels and of the total impact of inflation varies depending on household income level, but, above all, on age:

- In general, middle-aged individuals (36-45) were largely unaffected by inflation in 2021 in net terms. This is because they are generally borrowers, as many of them have a mortgage. For them, losses through the income channel, which affected all households, were offset by their gains through the wealth channel. Indeed, for young and middle-aged lower income households, the overall impact was positive.

- By contrast, the over-65s were the hardest hit by the surge in inflation in 2021, in particular those with lower incomes. This is because they are generally savers, with a very sizeable portion of their savings in deposits and current accounts. The real value of these assets falls with inflation, while that of other assets, such as housing and shares, may even rise.

Bear in mind that this analysis doesn’t tell the whole story of the impact of inflation on Spanish households, so these findings must be interpreted with caution.

First, our paper![]() refers to just one year, 2021, and just one country. The IMF

refers to just one year, 2021, and just one country. The IMF![]() has applied the same methodology to a broad group of countries in a recent publication

has applied the same methodology to a broad group of countries in a recent publication![]() . Its findings show that the impact of the different channels varies significantly across countries, depending on their socioeconomic structure and the distribution of consumer spending.

. Its findings show that the impact of the different channels varies significantly across countries, depending on their socioeconomic structure and the distribution of consumer spending.

Second, our paper doesn’t consider the impact of inflation on economic activity, employment or dividends.

Lastly, it doesn’t take into account the fiscal measures![]() that the Spanish authorities rolled out in 2021 to cushion the effects of inflation on the most vulnerable households.

that the Spanish authorities rolled out in 2021 to cushion the effects of inflation on the most vulnerable households.

In any event, the paper highlights that age - more than income level - was the key factor behind inflation affecting different Spanish households differently in 2021. This is because as we get older we transition from being borrowers to being savers. As a result, the impact of inflation through the wealth channel – which is quantitatively very sizeable – shifts from positive to negative.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.