The boom in Spanish exports since 2008: what do we export and where to?

Between 2008 and 2023, Spanish exports grew as a share of GDP from 26% to 39%. This extraordinary growth was broad-based across products and destinations. However, the increasing fragmentation of international trade flows might threaten the future performance of Spanish exports.

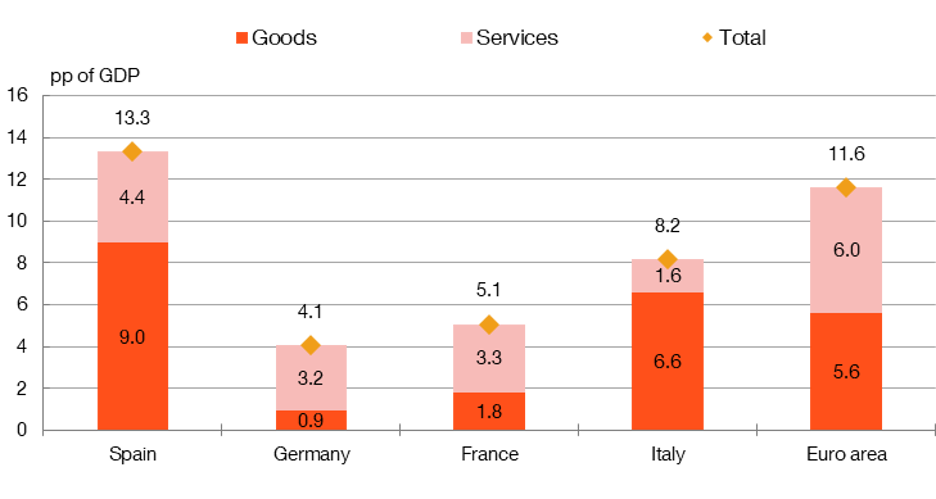

The figures speak for themselves: between 2008 and 2023, Spanish exports grew by almost 50% in real terms, with their share in GDP rising by 13 percentage points (pp), from 26% to 39%. This growth far outstripped that in other major euro area economies (see Chart 1). Indeed, in 2023 Spanish exports accounted for a larger share of domestic GDP than those of Italy or France, and were just 9 pp behind those of Germany, halving the gap compared with 2008.

Chart 1

CHANGE IN EXPORTS AS A SHARE OF GDP BETWEEN 2008 AND 2023

SOURCES: Eurostat and INE.

Since the global financial crisis, Spanish exports as a share of GDP have increased by 13 percentage points, far more than in the other major European economies

The Banco de España has explored the reasons behind Spain’s recent export success in a number of publications (such as here![]() and here

and here![]() ). Broadly speaking, it can be attributed to two main factors:

). Broadly speaking, it can be attributed to two main factors:

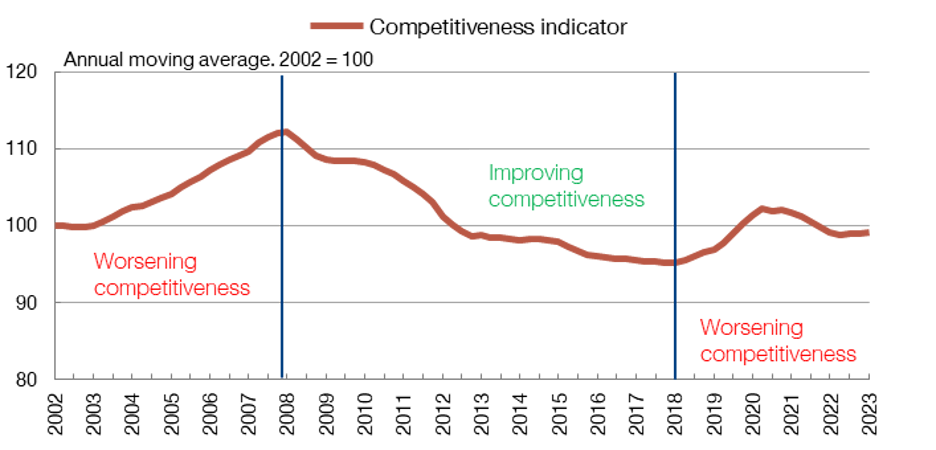

- The country’s greater competitiveness (see Chart 2); and

- Spanish companies’ greater orientation towards international markets, evidenced by the steady rise in the number of firms that export regularly.

Chart 2

THE COMPETITIVENESS GAINS HAVE STALLED IN RECENT YEARS

SOURCES: ECB, INE and Banco de España.

NOTES:

- The competitiveness indicator is Spain’s unit labour cost (ULC) relative to the rest of the euro area.

- An increase (decrease) reflects competitiveness gains (losses).

- Quarterly data. The annual moving average includes four quarters.

So what products does Spain export more of today than it did in 2008? And who is buying them? In this post we answer those questions and discuss a number of factors that could shape the future of Spanish exports.

What does Spain export more of today?

Spain’s robust exports growth over the past fifteen years has been broad-based across products, coming in both goods and services.

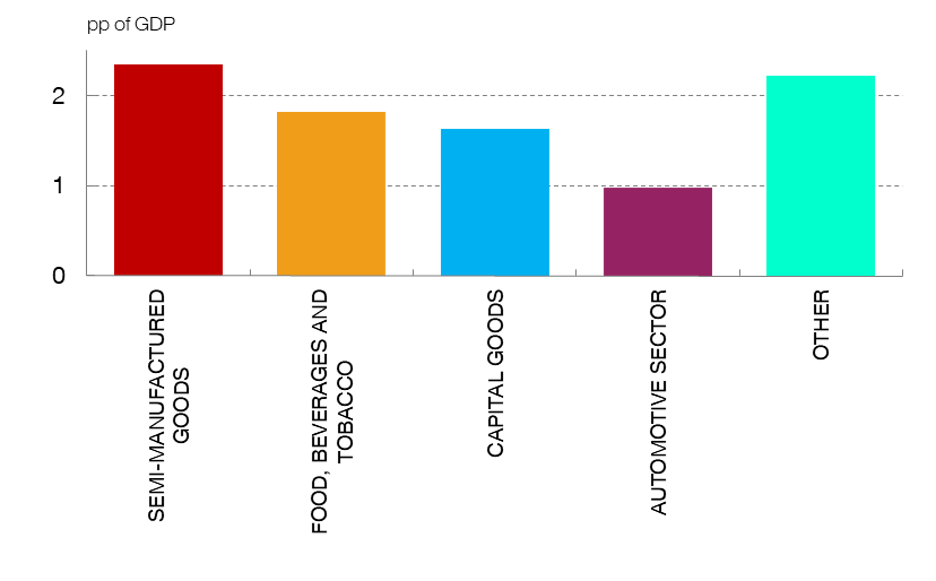

- In 2023 goods exports made up 68% of total sales abroad and accounted for 26.4% of GDP, up by 9 pp compared with 2008. As Chart 3 illustrates, the growth was spearheaded by the following sectors:

- - semi-manufactured goods, chemicals and metal products;

- - the food industry;

- - capital goods (mainly transport equipment); and

- - the automotive sector.

Chart 3

INCREASE IN GOODS EXPORTS AS A SHARE OF GDP BETWEEN 2008 AND 2023

SOURCE: Ministerio de Economía, Comercio y Empresa.

NOTES:

- "Semi-manufactured goods" includes metals, chemical products, paper, building materials and other semi-manufactured goods.

- "Other" includes energy products, commodities, consumer durables, consumer manufactures and other goods.

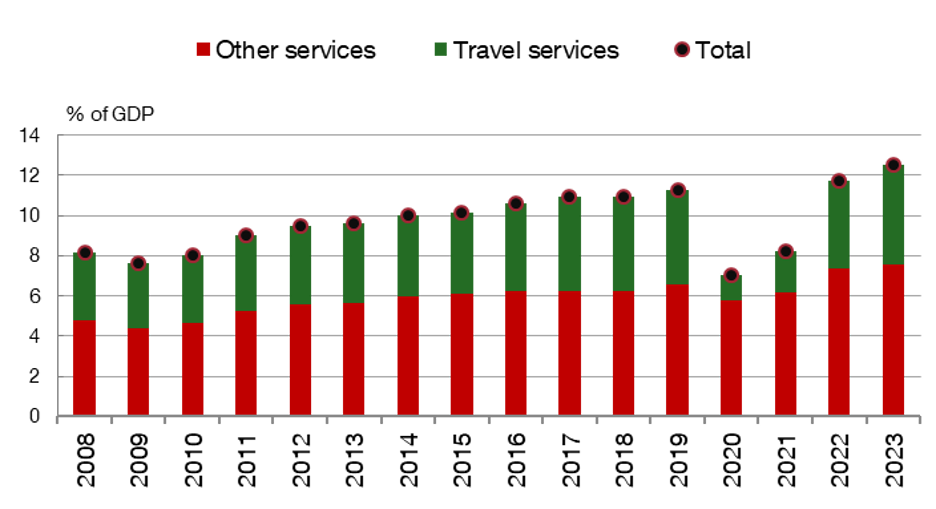

- Services exports recorded even sharper growth. From 2008 to 2023 they increased by 66%, with their share in GDP rising from 8.2% to 12.5%. This surge was driven by strong growth in the exports of both travel and non-travel services (see Chart 4):

- - The recovery in tourism receipts following the pandemic

(rising to 4.9% of GDP in 2023) has cemented Spain’s status as the world’s second-leading destination in terms of foreign travellers and their spending.

(rising to 4.9% of GDP in 2023) has cemented Spain’s status as the world’s second-leading destination in terms of foreign travellers and their spending. - - Exports of non-travel services

(which will be the topic of a future blog post) represented 7.6% of GDP in 2023.

(which will be the topic of a future blog post) represented 7.6% of GDP in 2023.

- - The recovery in tourism receipts following the pandemic

Chart 4

SERVICES EXPORTS BETWEEN 2008 AND 2023

SOURCE: INE.

Where are we selling all these products?

Not only are we exporting more goods and services, but we’re also selling them to a wider array of destinations.

First up, let’s take a look at goods. In 2008 Spain’s goods exports were highly concentrated on the euro area (above all France, Germany and Italy). In 2023 the euro area remained the main destination of Spanish goods exports, accounting for 55% of the total, but now Spain exports relatively more to countries like Morocco, the United States, China and Türkiye. Overall, these countries received 12.1% of Spain’s goods exports in 2023, up more than 4 pp from 2008.

Spanish services exports are now also reaching a more diverse range of global markets. For instance, the share of travel services exports to North and South America has increased, especially after the pandemic.

What factors might influence export growth in the future?

Spanish export growth since 2008 reflects the Spanish economy’s considerable adaptability and competitiveness on international markets following the global financial crisis. This has resulted in an improvement in Spain’s external accounts![]() :

:

- Although it remains high, the goods trade deficit has decreased considerably in this period.

- Spain has run an overall trade surplus since 2011, thanks to the increasing services surplus.

- The current account

has also run an appreciable surplus since 2012.

has also run an appreciable surplus since 2012. - As a result, over the last decade Spain’s negative net international investment position

– which is the balance of its claims on, and liabilities to, the rest of the world – has almost halved, from 96% to 51% of GDP.

– which is the balance of its claims on, and liabilities to, the rest of the world – has almost halved, from 96% to 51% of GDP.

Spanish export growth has been broad-based, with sales increasing for numerous goods and services and to multiple destinations

In any event, looking ahead, we shouldn’t take the high export growth for granted. In particular, there are several risks to watch out for:

- On the international front, the current geopolitical landscape is marked by high uncertainty, rising trade tariffs and growing trade fragmentation. All this could adversely affect Spanish exports over the coming years.

- Domestically, unit labour costs have risen more in Spain than in the euro area since the outbreak of the COVID-19 pandemic (see Chart 2). A persistent slide in this competitiveness indicator (such as that observed up to 2008) could lead to Spanish exports losing momentum and to the external balance deteriorating.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.