How does the Banco de España manage its financial risks?

Achieving price stability – the main aim of a central bank – involves financial risks for these institutions, which have increased over recent years. The type of risks, and the way they are managed, are rather different from those of commercial banks. In any case, for the Banco de España, it is vital that risks are efficiently managed and adequate risk coverage ensured.

25/09/2024

Unlike commercial banks, central banks act in the public interest. Their aim is not to make a profit, but rather to carry out their mandate; in particular, maintaining price stability. This does not mean that the cost of doing this does not matter. Quite the opposite: given that public money is at stake in the event of any profit or loss, their aims should be achieved at the lowest possible cost to the taxpayer. Managing financial risks is essential for the Banco de España to achieve its aims as efficiently and cheaply as possible. How does a central bank handle these risks? What are the differences compared with commercial banks? What are the key principles of proper risk management?

Managing financial risks. Central banks and commercial banks

Central banks and commercial banks are both called banks, but their functions and aims bear little resemblance to each other. That said, when it comes to risk management they face similar challenges.

In both cases, the job of financial risk management is preventive and not well known. A bit like the fire brigade, whose work we only see when a fire breaks out, while all the fires they prevent and how they do so go largely unnoticed. Similarly, risk management teams spend most of their time preventing the risks they manage from materialising and preparing to mitigate the effects of the crises that happen unavoidably from time to time.

The work done by the Financial Risk Department at the Banco de España is preventive and not well known. Like the fire brigade, which spends most of its time preventing fires, it avoids risks materialising

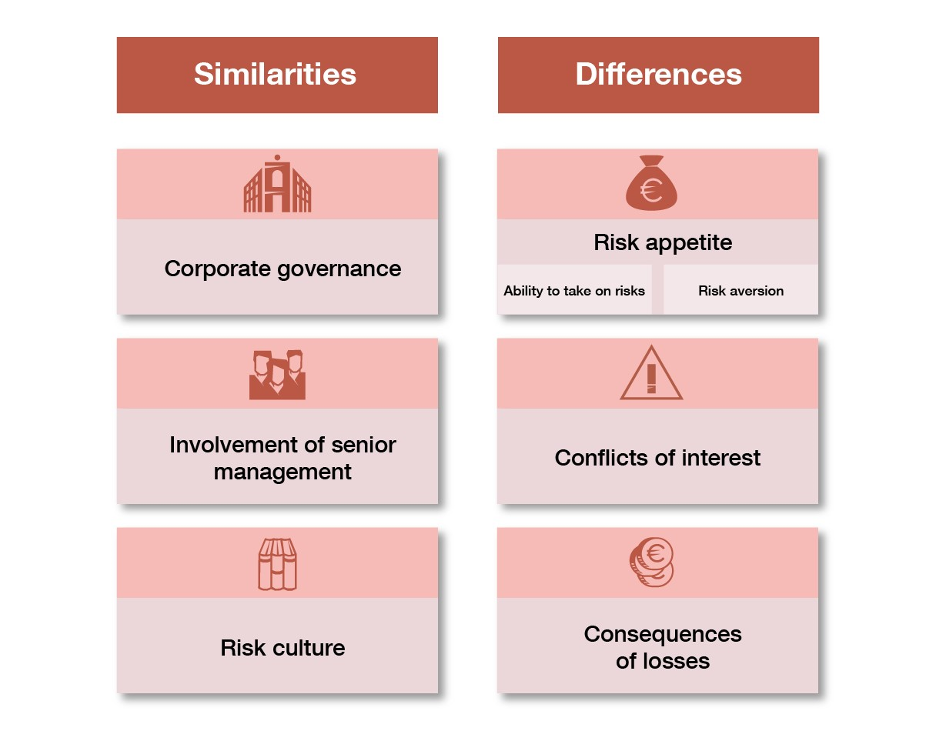

Central banks and commercial banks are required to apply similar standards for governance, senior management involvement and risk culture![]() , including adequate protection against financial risks. But central bank risk management has an even greater challenge: their monetary policy decisions may affect their own investments and financial risks.

, including adequate protection against financial risks. But central bank risk management has an even greater challenge: their monetary policy decisions may affect their own investments and financial risks.

There are also differences, as seen in Figure 1. A very important one is how each decide on the level of risk they assume. The ability of a normal bank to bear risk is limited by its capital, while central banks have more room for manoeuvre and can bear whatever risks they need to in order to achieve their aims. These risks are mainly part and parcel of implementing their monetary policy. What’s more, the risks central banks face can change rapidly, as we shall see later on.

Figure 1

FINANCIAL RISK MANAGEMENT. COMMERCIAL BANKS VERSUS CENTRAL BANKS

SOURCE: Banco de España.

Other differences include less conflict of interest in the central bank departments that take risks and the consequences of any losses. Commercial banks can go bankrupt, something that cannot happen to central banks. However, their independence may be affected and their credibility and reputation damaged, making it more difficult for them to achieve their aims.

How have the Banco de España’s financial risks and their management evolved?

The 2008 global financial crisis made it even more important to adequately assess, control and manage central bank risks. The provision of liquidity to banks and the Eurosystem’s bond purchase programmes, introduced in 2009 and stepped up from 2015, have considerably inflated central bank balance sheets.

The risks faced by central banks, and the importance of adequately managing them, have grown since the 2008 global financial crisis

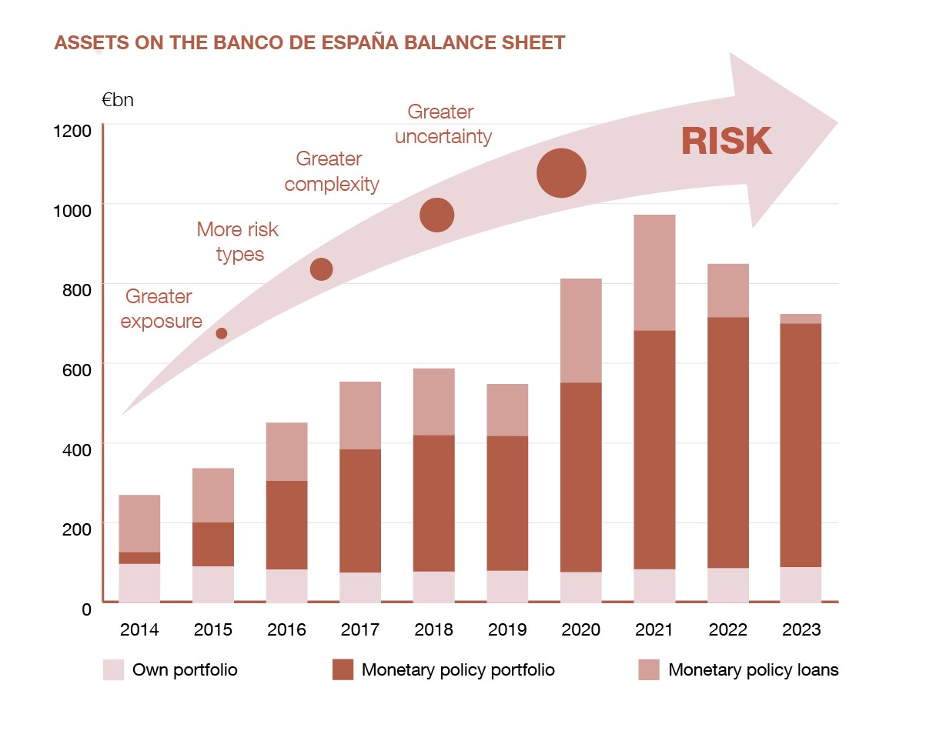

Chart 1 shows that the Banco de España’s asset portfolio grew six-fold between 2014 and 2022, to exceed €700 billion, while liquidity provision through reverse transactions reached close to €300 billion. The size of these figures gives some idea of the greater exposure to financial risks. At the same time, the assets purchased are increasingly varied and complex and the environment is more uncertain. Together, these factors entail a substantial increase in the risks borne and highlight the importance of proper risk management.

Chart 1

FINANCIAL RISKS GROW WITH THE BALANCE SHEET

SOURCE: Banco de España.

To be specific, every financial instrument that is used to implement monetary policy comes with risks that must be managed and monitored. For example, in the case of bonds acquired through purchase programmes, the main risk is that the issuer fails to pay. However, when providing liquidity to commercial banks through reverse transactions, collateral is required to minimise the risk of loss. Central banks are, by their very nature, better placed than other agents to accept collateral that is, in principle, less liquid. The Banco de España has an in-house assessment system for non-financial corporations![]() , which rates some 900,000 firms whose loans can be used as collateral if they meet specific credit quality criteria.

, which rates some 900,000 firms whose loans can be used as collateral if they meet specific credit quality criteria.

In addition, some financial risks have become more prominent, such as balance sheet interest rate risk ![]() and climate change risks.

and climate change risks.

In short, risk management in central banks has expanded and grown more complex and has done so in an environment of greater uncertainty![]() . In this context, the main role of central bank risk management is to ensure the most suitable implementation of monetary policy with the least possible risk. To achieve this, the Eurosystem has designed a stringent risk control framework

. In this context, the main role of central bank risk management is to ensure the most suitable implementation of monetary policy with the least possible risk. To achieve this, the Eurosystem has designed a stringent risk control framework![]() . In addition, the Banco de España has a management and monitoring model that covers all the risks to which it is exposed. Figure 2 shows the steps involved in the management of each risk category.

. In addition, the Banco de España has a management and monitoring model that covers all the risks to which it is exposed. Figure 2 shows the steps involved in the management of each risk category.

Figure 2

THE RISK MANAGEMENT CYCLE IN THE BANCO DE ESPAÑA

SOURCE: Banco de España.

In any case, alongside efficient risk management to contain costs, central banks must be ready to bear possible losses on their own. If there is a fire, we expect that the fire brigade will have enough water on hand to put it out. In the same way, it is essential that central banks have the resources they need to handle the potential consequences of the risks they face in the performance of their functions.

Recently, many central banks, the Banco de España included, have borne significant losses as a result of implementing monetary policy.![]() We have been able to cope with these negative results by falling back on provisions set aside in previous years.

We have been able to cope with these negative results by falling back on provisions set aside in previous years.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.