The capital markets union: a necessary step to boost investment in Europe

Europe needs more productive investment to bolster its economic growth. This requires diversifying its funding sources beyond access to bank loans and, inevitably, further developing and integrating European capital markets.

14/08/2024

Europe needs to invest more to continue to grow in the future. To this end, improving financing flows to firms and deepening and integrating European capital markets are key. The European capital markets union (CMU)![]() project pursues that objective. Yet despite the headway made over the last decade, it still seems out of reach. Why are capital markets and their integration so important for Europe? What is the CMU and which are its main features? Where do we stand now and where are we headed?

project pursues that objective. Yet despite the headway made over the last decade, it still seems out of reach. Why are capital markets and their integration so important for Europe? What is the CMU and which are its main features? Where do we stand now and where are we headed?

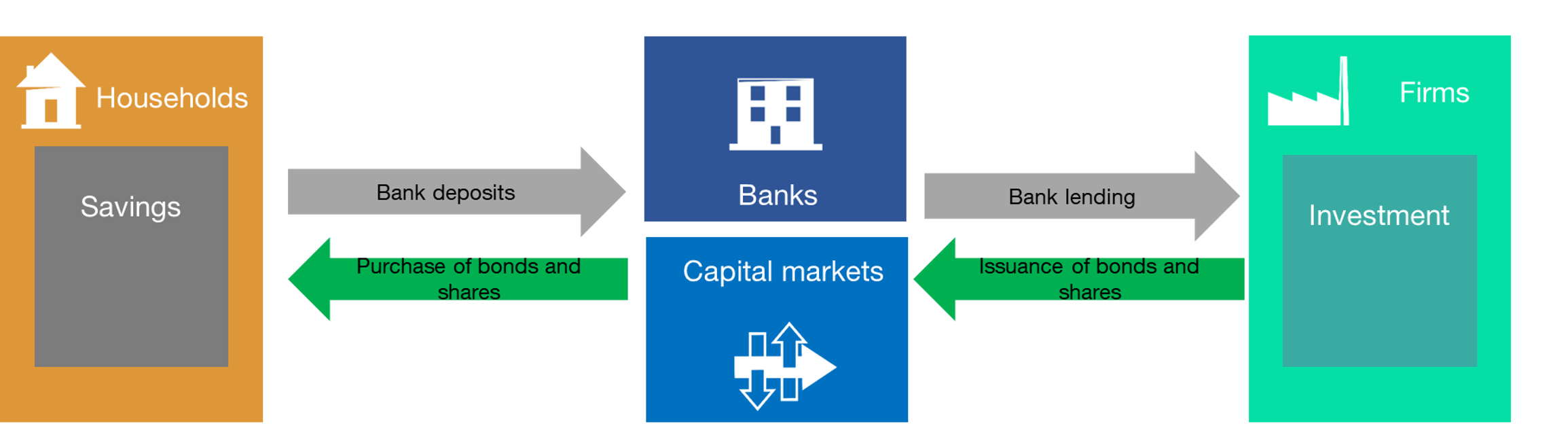

In any economy, savings (for instance, those of households that build up funds for retirement) are channelled towards those who need funds for spending or investing (such as firms that want to expand their productive capacity) either through banks or through capital markets.

Figure 1 illustrates these two possibilities. In the first case, households deposit their savings at banks, which in turn use those funds to lend to firms that wish to invest. In the second case, households purchase financial assets, such as bonds or shares, which firms have previously issued and are traded on the capital markets. In both cases, the funds flow from households that save towards firms that invest (whether via banks or capital markets).

Figure 1

HOW ARE HOUSEHOLD SAVINGS CHANNELLED TO FIRMS? BANKS AND CAPITAL MARKETS

SOURCE: Banco de España.

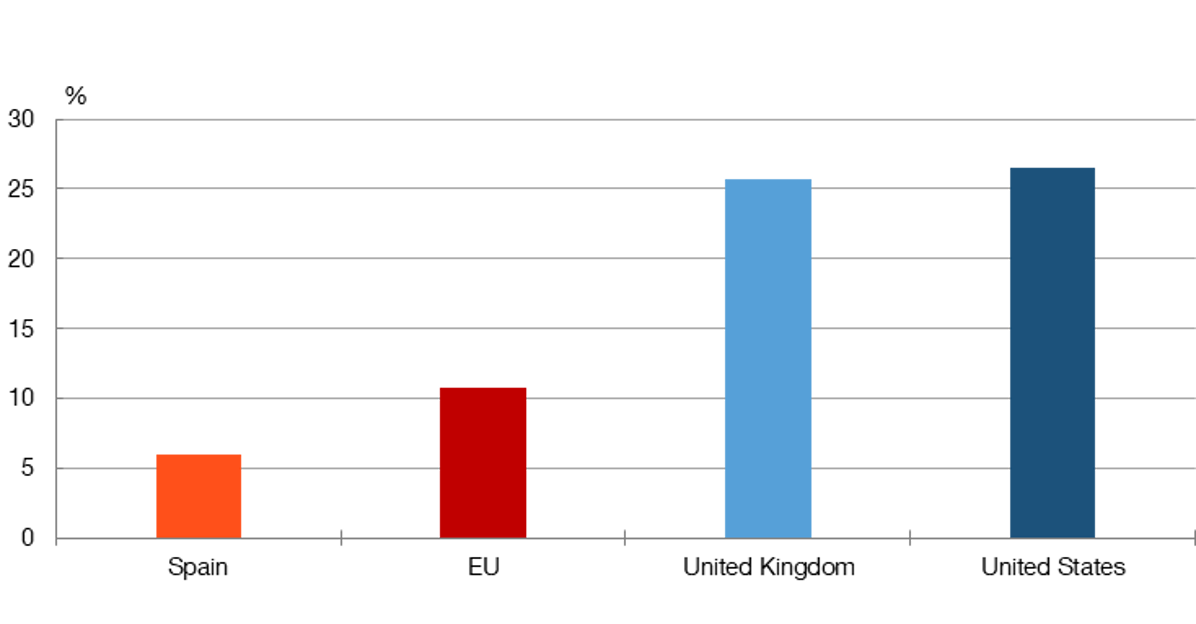

In the European Union (EU) bank lending is more prevalent than financing through capital markets. Thus, Chart 1 shows that the relative share of capital markets in corporate financing is, overall, much lower in Europe than in the United States and the United Kingdom.

Chart 1

THE RELATIVE IMPORTANCE OF CAPITAL MARKETS: BOND AND SHARE ISSUANCE AS A PERCENTAGE OF TOTAL FINANCING TO FIRMS

SOURCE: Dealogic and corresponding central banks.

NOTE: Annual average, between 2020 and 2023 H1.

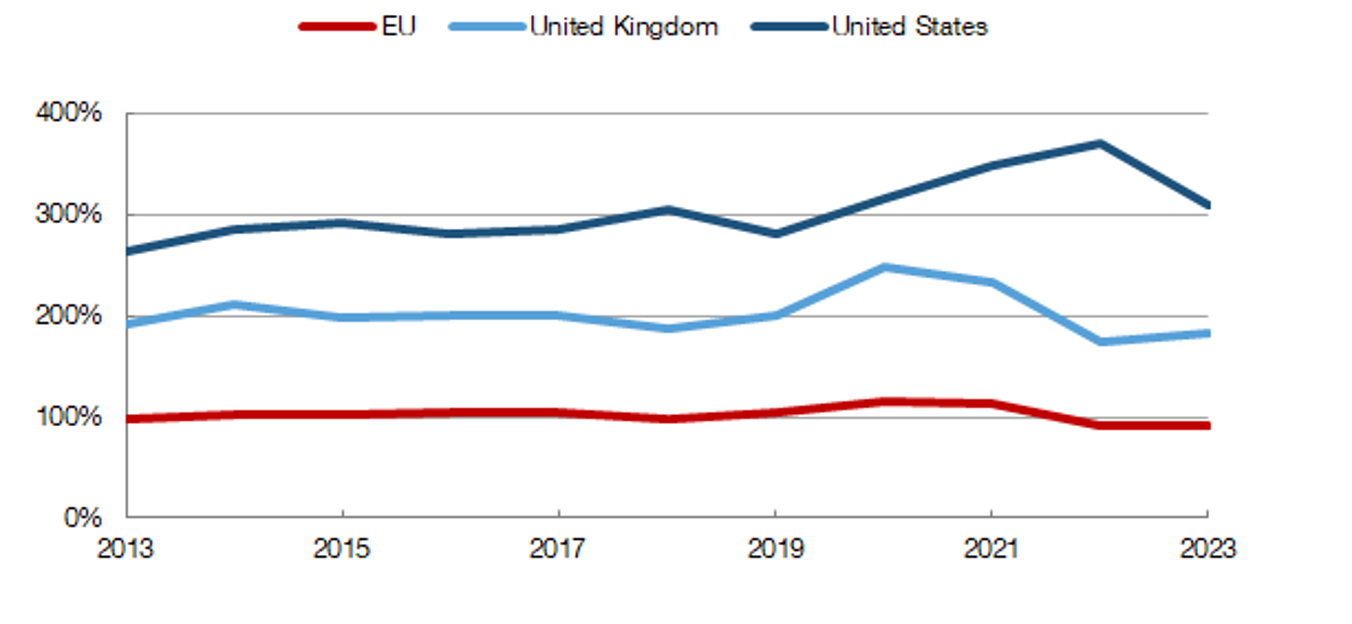

Likewise, Chart 2 shows that, excluding bank deposits, the volume of financial assets held by households is also much lower in the EU than in the United States and the United Kingdom.

Chart 2

HOUSEHOLDS’ FINANCIAL ASSETS AS A PERCENTAGE OF GDP

SOURCE: AFME, Capital Markets Union Key Performance Indicators – Sixth Edition 2023.

NOTE: Households' financial assets exclude cash, deposits and unlisted shares. The data for 2023 relate to H1.

Why would further developing capital markets boost investment in the EU?

Larger markets would allow firms to access a broader base of savers and to raise funds at a lower cost.

Younger firms would be the ones to benefit the most, as they tend to be less able to access bank lending than older firms. This is because, among other reasons, they usually have less collateral to obtain a loan.

Also, since young firms tend to be more prone to investing and innovating, deeper and more integrated capital markets would also boost investment and aggregate productivity in the economy.

When was the capital markets union launched and where does it stand today?

Not only are European capital markets small, they are also fragmented. And this is despite the deepening and integration of national capital markets having been a part of the European project since its inception.

Underdeveloped and fragmented capital markets in Europe hamper investment and economic growth

In 2015 the Juncker Commission![]() revitalised the project, coining the term CMU

revitalised the project, coining the term CMU![]() . Since then, intense regulatory activity has been deployed to pursue this objective.

. Since then, intense regulatory activity has been deployed to pursue this objective.

However, the prevailing perception is that, overall, the initiatives implemented to date have been insufficient in scope and ambition to effectively reduce the fragmentation, which stems from a wide range of factors (regulatory, tax, etc.).

In light of this situation, the European authorities have decided to provide fresh impetus to the CMU project through bolder initiatives.

There appears to be a fresh push to drive the CMU forward, but the Member States must make a determined political commitment

Why? First, because, as mentioned above, the gradual strategy adopted to date hasn’t worked. And there is a broad consensus that the underdeveloped and fragmented European capital markets partly explain why the EU economy is lagging behind its global peers. In addition, the new challenges that have emerged in recent years – such as the digital and green transitions and the need to double down on defence – require the mobilisation of vast funds, which, largely, can only be raised through the capital markets.

The recent publication of various contributions on the future of the CMU diagnosing the situation and outlining possible solutions are part of this drive. These notably include statements by the ECB Governing Council![]() and the Eurogroup

and the Eurogroup![]() in March (detailed in Figure 2) and the European Council

in March (detailed in Figure 2) and the European Council![]() in April, and the reports by Enrico Letta

in April, and the reports by Enrico Letta![]() and Christian Noyer

and Christian Noyer![]() , commissioned by the EU Council and the French Government, respectively.

, commissioned by the EU Council and the French Government, respectively.

Figure 2

INITIATIVES FOR RELAUNCHING THE CAPITAL MARKETS UNION. EUROGROUP STATEMENT, MARCH 2024

SOURCES: Eurogroup and Banco de España.

What’s needed?

These proposals do not always prioritise the same solutions, but contain some common lines of action, sharing the idea that Europe needs to eliminate the obstacles preventing savings from flowing towards their most productive uses. What do they involve?

- Supervisory and regulatory convergence of capital markets across Europe;

- Harmonisation of national legislation on insolvency proceedings (making outcomes more consistent and predictable across countries) and taxation;

- Reviewing aspects of domestic tax systems that favour debt financing over equity financing;

- Development of retail savings instruments on capital markets;

- Relaunching the European securitisation

market;

market; - Increasing the integration of asset trading and settlement infrastructures.

One key component of a fully fledged CMU that has featured less in the recent discussions is the existence of a pan-European financial asset![]() , characterised by high trading volumes and low risk, meaning that it can act as a safe asset during turbulent times.

, characterised by high trading volumes and low risk, meaning that it can act as a safe asset during turbulent times.

Such a European asset would provide a common anchor to set the prices of the other financial assets on the continent. The bonds issued by the European Commission to fund NextGenerationEU![]() opened up a possible avenue to explore, but whether or not they will continue to exist is uncertain, as there is no consensus in this regard among the Member States.

opened up a possible avenue to explore, but whether or not they will continue to exist is uncertain, as there is no consensus in this regard among the Member States.

In short, the CMU is key to Europe strengthening its future economic growth outlook. It is up to the authorities of the Member States to convert the recent proposals into ambitious actions that drive the project forward.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.