Measuring economic uncertainty. The role of artificial intelligence

Uncertainty is part and parcel of our lives. It affects our decisions and economic activity too. That’s why identifying and measuring economic uncertainty is key for economists. The Banco de España has developed various indicators of uncertainty, such as the EPU indexes, that help assess the risks and quantify their possible impact on activity.

"Uncertainty: a state of doubt about the future or about what is the right thing to do. Synonyms: insecurity, concern, unease, indecision, hesitancy, doubt, apprehension, suspicion, unsureness."

Collins English Dictionary

Uncertainty is unavoidable and affects virtually all our economic decisions. How much we spend or save and our investment decisions depend on the degree and type of uncertainty that we face. That’s why identifying the different sources of uncertainty and measuring it is important for performing a sound economic analysis. How does uncertainty affect you? And economic activity? How do we measure it? How does artificial intelligence help identify different sources of uncertainty?

What is uncertainty and how does it affect economic decisions?

In economics, uncertainty refers to the difficulty in predicting the future course of some economic variables or of economic activity as a whole. Disruptive, unexpected and/or infrequent events tend to trigger increases in uncertainty. The COVID-19 pandemic is a good example of this: an extraordinary event whose impact and economic implications were very hard to assess and which sent uncertainty levels sky-rocketing. Uncertainty normally declines when this type of situation is assimilated or resolved.

Uncertainty is important for all of us because all our economic decisions involve making assumptions about the future of the economy, either our own or the country’s. Even if the outlook is bleak, if we have certainty over the future we can ready ourselves and take decisions that are consistent with those expectations. By contrast, if the future is uncertain, we will put off or fail to take some decisions.

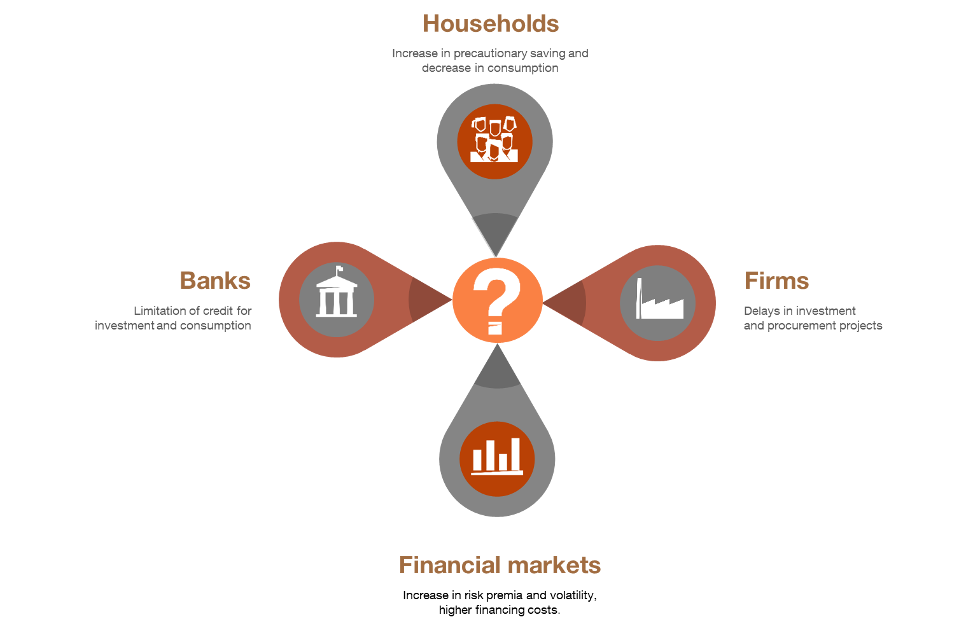

Uncertainty affects us all and impacts economic activity adversely

We know from economic theory and numerous empirical studies that an increase in uncertainty affects households’, firms’ and financial institutions’ decision-making differently (see Figure 1) and that it has an adverse impact on economic activity![]() . For example, higher uncertainty tends to prompt firms to delay their investment and procurement projects. This impact tends to be larger at those firms with greater financial constraints

. For example, higher uncertainty tends to prompt firms to delay their investment and procurement projects. This impact tends to be larger at those firms with greater financial constraints![]() , such as younger, smaller and more indebted firms.

, such as younger, smaller and more indebted firms.

Figure 1

HOW UNCERTAINTY AFFECTS DIFFERENT ECONOMIC AGENTS

SOURCE: Banco de España.

How is uncertainty measured?

As economists, how do we tackle the challenge of measuring uncertainty? Broadly speaking, we use one or more of the following three main approaches:

- We quantify financial market volatility.

- We survey economic agents on their predictions about an economic variable. The dispersion of views serves as an indicator of uncertainty.

- We analyse newspaper coverage of situations reflecting uncertainty.

This blog post focuses on the third of these methodologies: searching for keywords using logical relationships, i.e. Boolean operators![]() .

.

An example of this approach is the Economic Policy Uncertainty (EPU) Index![]() . This index is constructed by searching for keywords related to uncertainty and economic policy in a large database of press articles.

. This index is constructed by searching for keywords related to uncertainty and economic policy in a large database of press articles.

The Banco de España has developed this type of EPU indicator for Spain![]() and the main Latin American countries

and the main Latin American countries![]() , which it updates monthly and can be downloaded on our website.

, which it updates monthly and can be downloaded on our website.

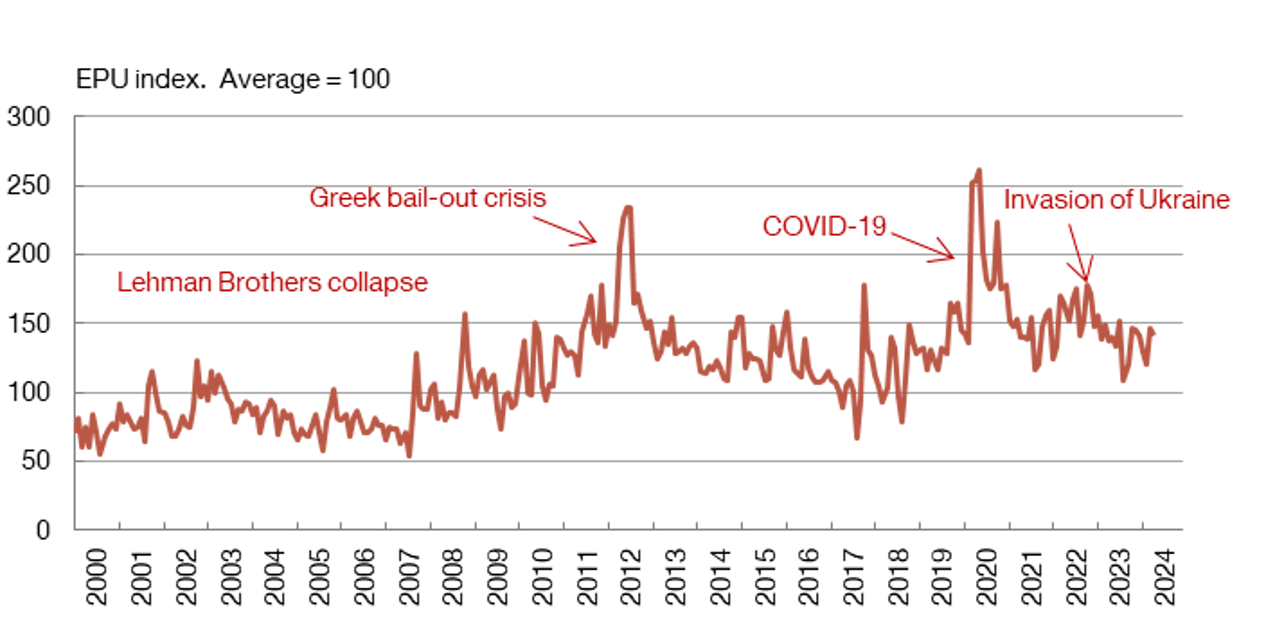

Chart 1 shows the course of economic policy uncertainty in Spain over recent decades. Economic policy uncertainty was relatively low before the financial crisis of 2007-2008 and hit very high levels during the sovereign debt crisis![]() in 2012 and the COVID-19 pandemic. Although uncertainty has fallen since then, it remains at comparatively high levels. This is unsurprising given the size of the challenges that the Spanish, European and global economy have faced and that lie ahead.

in 2012 and the COVID-19 pandemic. Although uncertainty has fallen since then, it remains at comparatively high levels. This is unsurprising given the size of the challenges that the Spanish, European and global economy have faced and that lie ahead.

Chart 1

EPU INDEX FOR SPAIN

SOURCES: Factiva and Banco de España.

NOTES: The EPU index is a textual indicator of economic policy uncertainty. It calculates the percentage of news that mentions words related to "uncertainty" "economic" and "economic policy". It is expressed as the deviation from its historical average, which is equal to 100.

How do we use these indicators in practice? We incorporate them into our macroeconomic models to show the relationship between uncertainty and economic activity. We are thus able to estimate the impact of uncertainty on variables such as economic growth, investment, unemployment and the financial markets. We also use this analysis in our economic projections![]() , both to estimate expected GDP growth and to assess the risks to forecasts.

, both to estimate expected GDP growth and to assess the risks to forecasts.

These indicators allow us to identify and quantify uncertainty, and to estimate its effects on the economy

How does artificial intelligence help to assign uncertainty to certain topics?

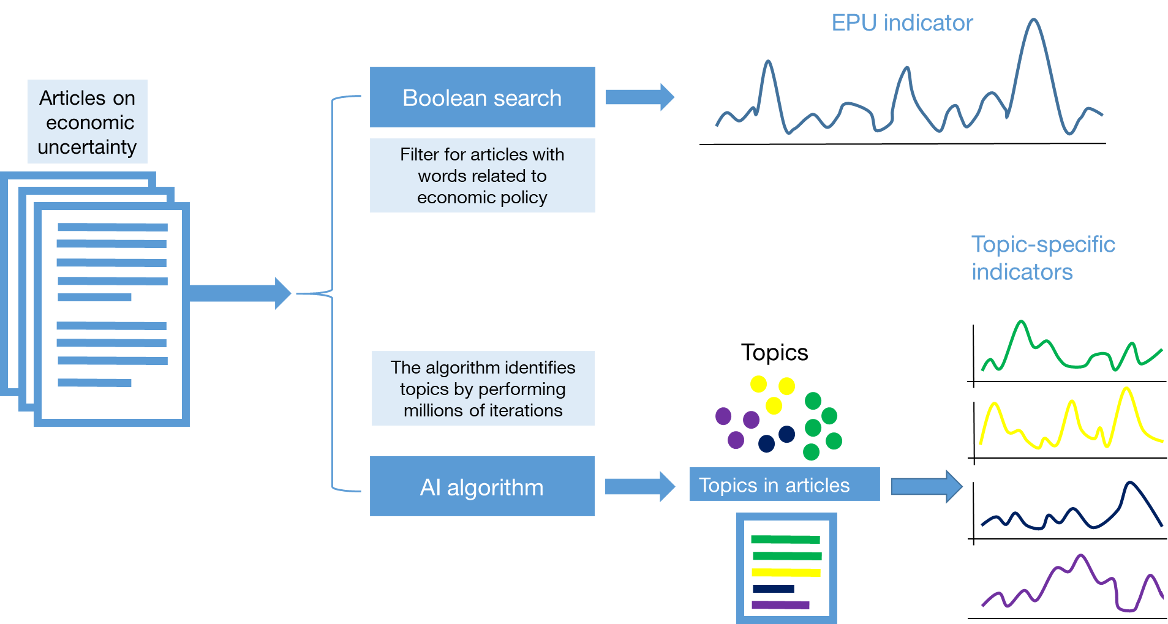

Artificial intelligence (AI)![]() is also starting to be used to measure uncertainty. Machines (or algorithms

is also starting to be used to measure uncertainty. Machines (or algorithms![]() ) learn automatically and autonomously about the different types of uncertainty that appear in news coverage. Figure 2 shows the differences between the EPU indicators described above and those obtained using AI.

) learn automatically and autonomously about the different types of uncertainty that appear in news coverage. Figure 2 shows the differences between the EPU indicators described above and those obtained using AI.

Figure 2

SEARCH FOR UNCERTAINTY-RELATED WORDS AND TOPICS. DIFFERENCE BETWEEN EPU INDICATORS AND TOPIC-SPECIFIC INDICATORS

SOURCE: Banco de España.

NOTE: EPU = Economic policy uncertainty indicator. AI = Artificial intelligence.

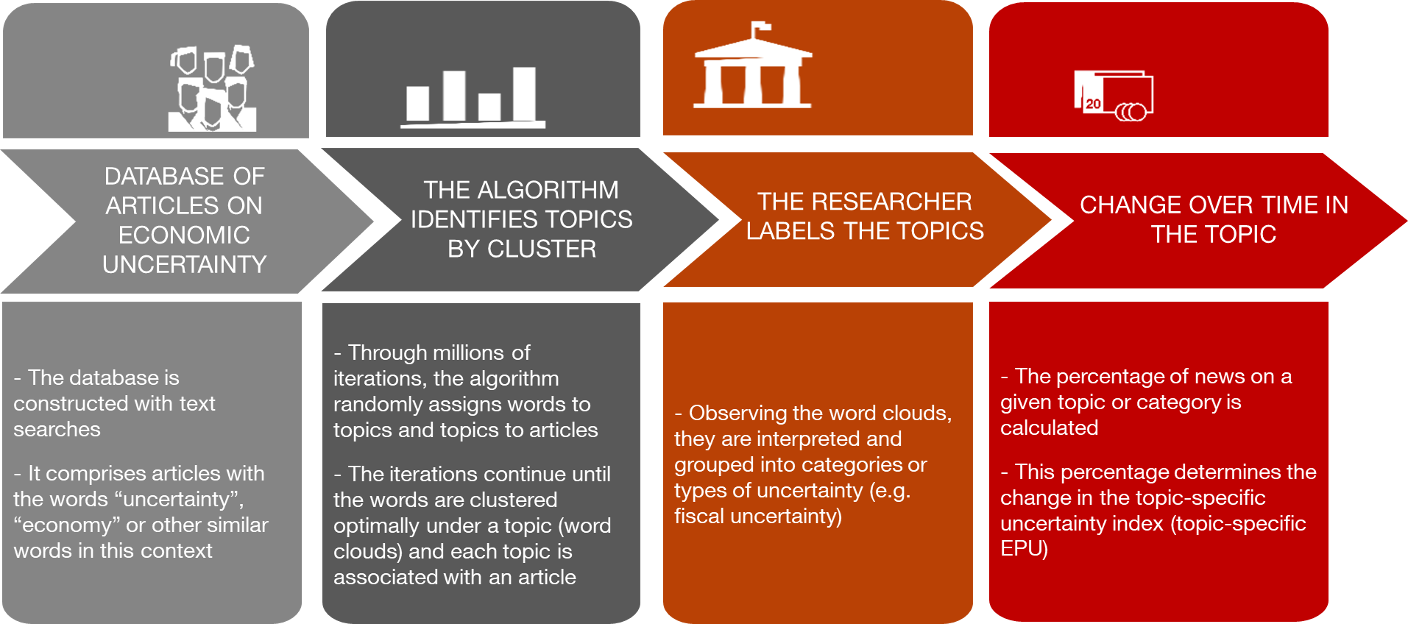

How does AI identify and assign this topic-specific uncertainty? Figure 3 explains this in detail. Drawing on the same database of articles as that used to construct the conventional EPU index, the algorithm detects words that usually appear together and generates topics based on these words. For example, the algorithm associates words such as “conflict”, “war” and “sanction” with a specific topic, and others such as "energy”, “oil” and “electricity” with another topic. AI then associates these topics with each article.

Figure 3

HOW IS THE TOPIC-SPECIFIC UNCERTAINTY EPU INDICATOR CONSTRUCTED?

SOURCE: Banco de España.

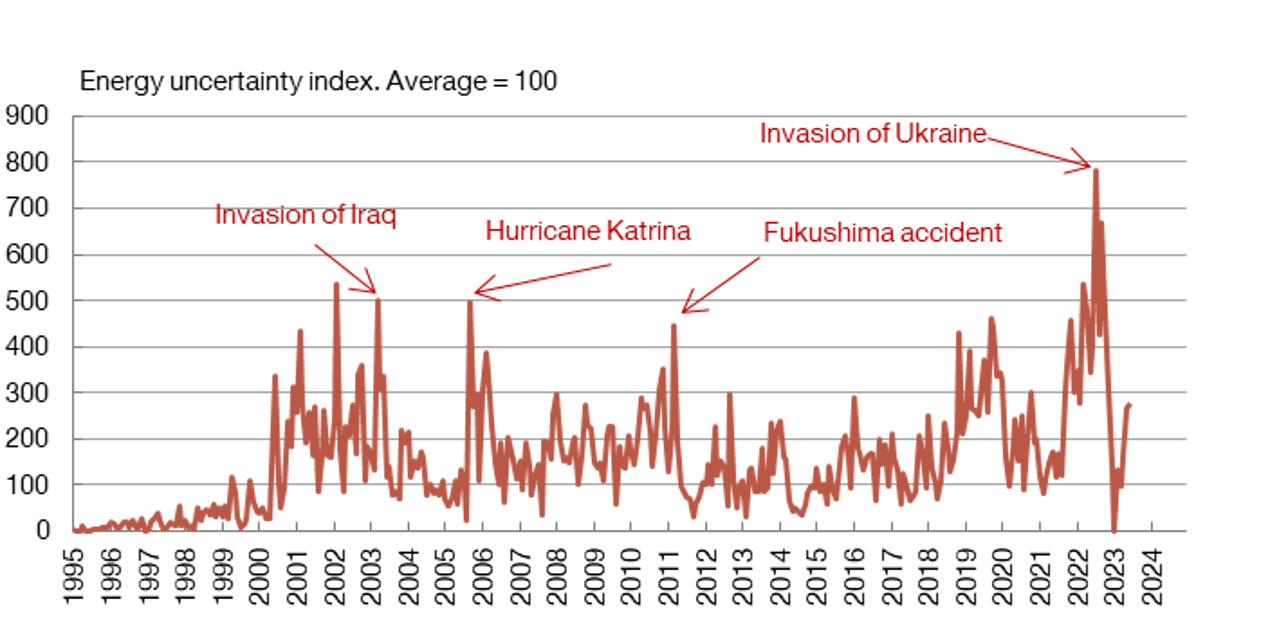

In the subsequent phase, researchers label the topics. Thus, continuing with the above example, they will link the first group of words to geopolitical uncertainty and the second group to energy uncertainty, to construct topic-specific indicators that can be monitored over time. For example, Chart 2 shows the changes in the energy uncertainty index for Spain in recent years. This and other similar indicators for various topics and euro area countries![]() are available on the Banco de España’s website.

are available on the Banco de España’s website.

Chart 2

ENERGY UNCERTAINTY INDEX FOR SPAIN

SOURCE: Banco de España.

NOTE: The energy uncertainty index is calculated based on the percentage of news referring to uncertainty in relation to energy. The index is expressed as the deviation from its historical average, which is equal to 100.

EPU and AI's topic-specific indicators provide constant information about the nature and extent of, and changes over time in, uncertainty. They allow economists to better assess the risks to the economic environment and to quantify their possible impact on activity. Uncertainty is inevitable, but measuring it and incorporating it into our analysis helps us tackle its consequences.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.