We reproduce the EPU indexes proposed by Azqueta-Gavaldon et al. (2023) for Italy, France, Germany, Spain, and the Euro Area (EA) as a whole. These indexes are based on newspaper data and rely on Latent Dirichlet Allocation (LDA), a topic modelling technique that allows to capture the underlying topics and themes that contribute to economic policy uncertainty.

For now, we can compute our index until 2019, due to technical problems related to the download of the newspaper based data. In the following months, we plan to upload the updated version until the present and keep them updated on a regular basis. In addition, we plan to extend this project also to other EA countries - depending on the press coverage - and upload similar EPU indexes for other EA countries on this webpage.

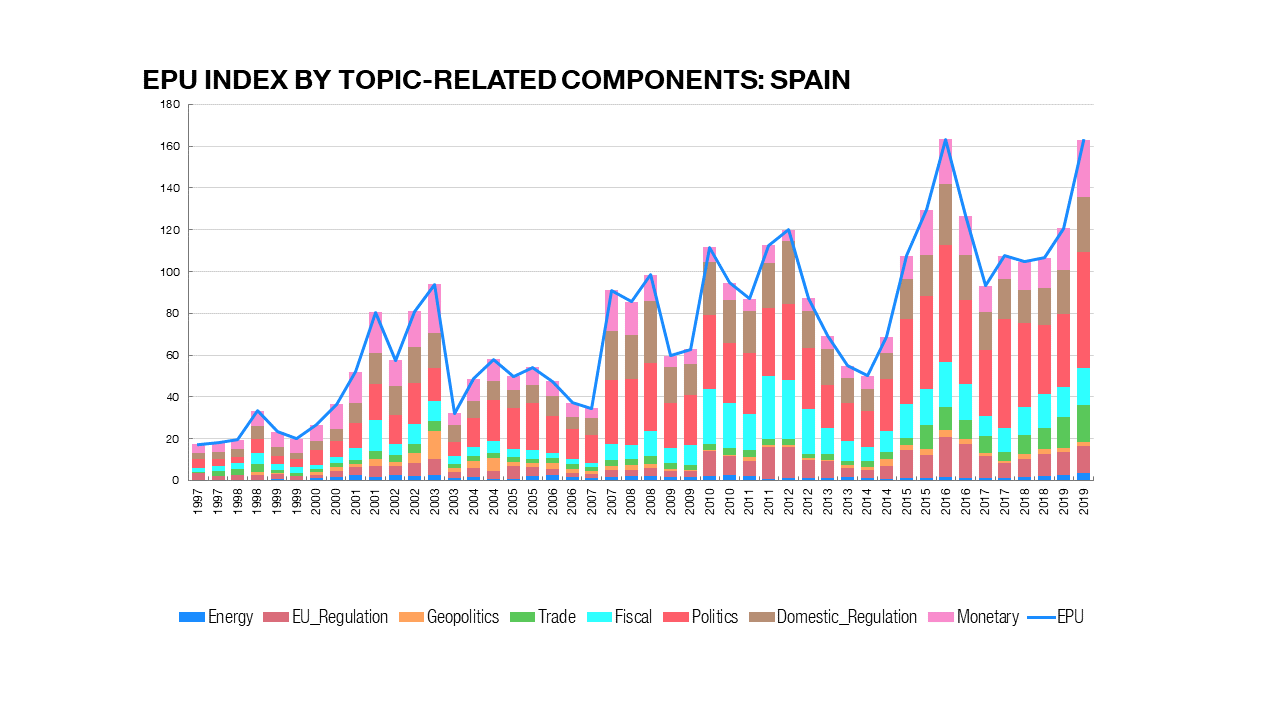

LDA allows endogenously to retrieve components of policy uncertainty, without the need to come up with ad hoc dictionary ex-ante. This allows us to obtain a more nuanced and detailed understanding of the sources of economic policy uncertainty. Based on the LDA output, we select 8 topics that best describe sources of policy uncertainty in the European context: fiscal; monetary; political; geopolitical; trade/manufacturing; European regulation; domestic regulation; and energy.

We then compute 8 sub-indexes for each country that represent these sources of uncertainty. In addition, we aggregate these sub-indexes to construct an overall index of economic uncertainty for each country.

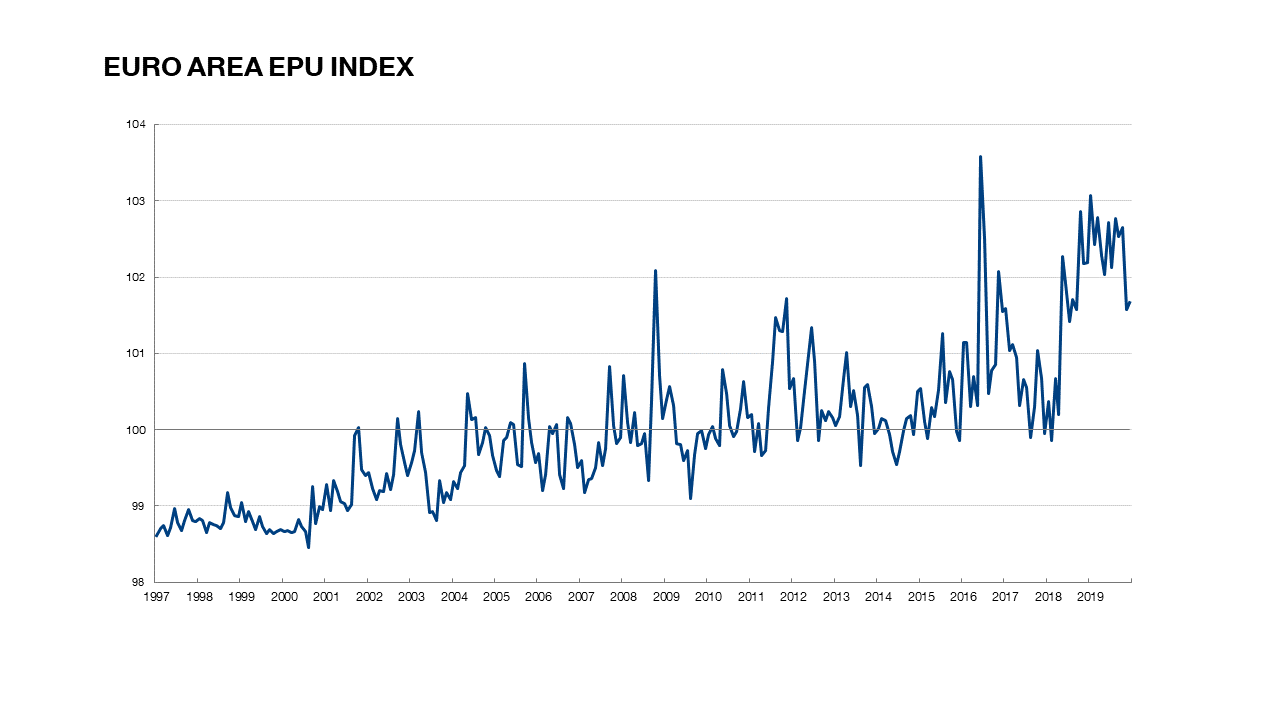

Finally, we construct the full set of uncertainty indicators (topic-specific uncertainty indicators as well as the overall EPU indicator) for the Euro Area, by averaging country-specific indicators, weighting by country GDP.

More details about our methodology can be found in this document: Azqueta-Gavaldon, Diakonova, Ghirelli, and Perez (2023).

These indexes will be regularly updated in this webpage, and can be found here ![]() (958 KB).

(958 KB).