How important is cash in our day-to-day payments?

Most of us still use cash to pay for our day-to-day shopping, but digital payment methods continue to gain ground, according to the latest Study on Cash Use Habits published by the Banco de España.

22/11/2024

The last time you were in a shop, how did you pay? In cash? By card? With your phone? Digitalisation has spread to all areas of our daily lives, including the way we pay. So, with ever more digital payment alternatives available, what role does cash play today and how do we expect it to change?

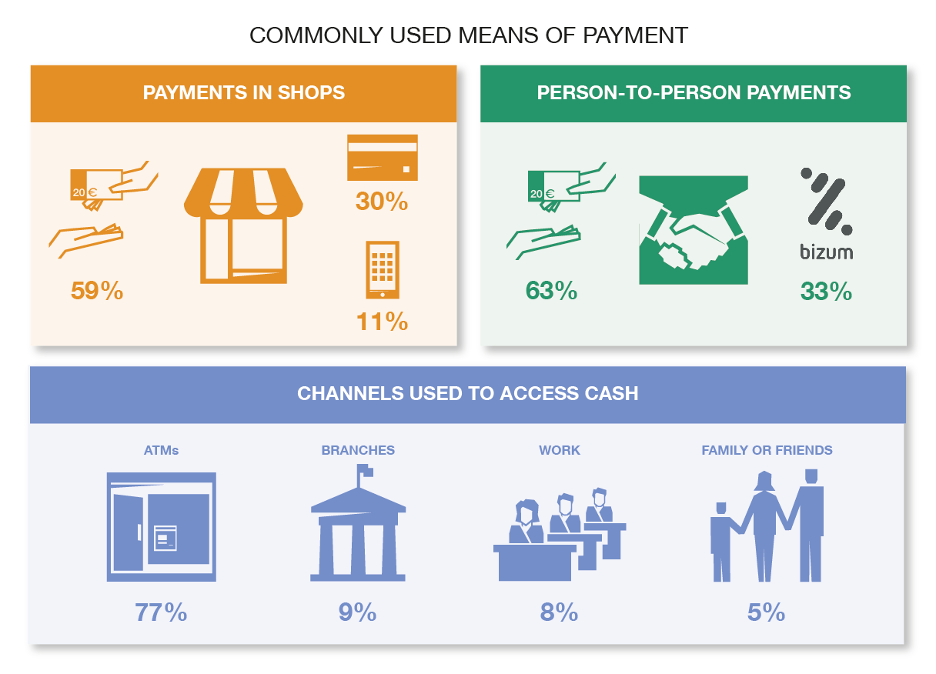

According to the latest edition of the Study on Cash Use Habits![]() , in 2024 cash was still the most common means of payment in Spain in shops (see Figure 1) and for person-to-person payments (such as to friends or family).

, in 2024 cash was still the most common means of payment in Spain in shops (see Figure 1) and for person-to-person payments (such as to friends or family).

Figure 1

CASH USE AND CHANNELS OF ACCESS

SOURCES: Banco de España and Study on Cash Use Habits![]()

That said, cash use has been gradually declining in recent years: in 2024, 57% of the population used cash on a daily basis, down from 65% in 2023. In other words, cash is still the most widely used means of payment, but cash purchases have gradually decreased, especially since the pandemic![]() .

.

Cash is still the most common means of payment for almost 60% of the population, but it is losing ground to digital alternatives

There are various reasons for this:

- Online shopping, which has become increasingly popular in Spain but cannot generally be paid for in cash.

- Alternatives to cash, with a growing range of digital payment options now available to consumers. For instance, 30% of the population regularly pay by card in shops, while 33% prefer to use Bizum

for person-to-person payments.

for person-to-person payments.

Who uses cash and why?

According to the study, cash is the most common means of payment among all the groups surveyed. But usage varies by gender, age and level of education. The study lends support to the widely held belief that these help shape how much individuals’ use cash.

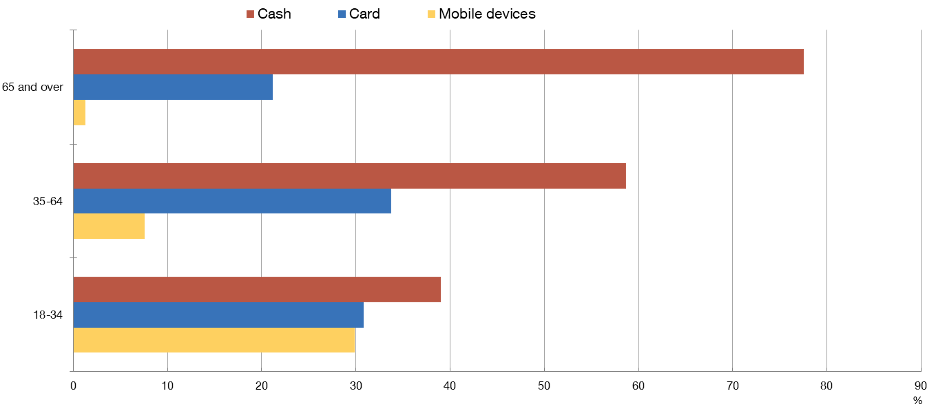

Age is a highly significant factor. Cash is the most common means of payment in shops for 78% of the over-65s, while among young people (18 to 34) the figure falls to 39% (see Chart 1).

Chart 1

MAIN MEANS OF PAYMENT BY AGE GROUP

SOURCES: Banco de España and Study on Cash Use Habits![]()

Where people live is also decisive. Cash use is more prevalent in small municipalities, with fewer than 5,000 inhabitants, where 71% of the population are regular cash users, compared with just 47% in big cities (over 500,000 inhabitants).

Other factors such as level of education, or even living in a rural or urban area, are also important, as analysed in detail in the study.

Why do people use cash? Those who do say that they are used to paying in cash, that it is easier and that it helps them control their personal or household expenses.

How do we get hold of cash? How easy is it?

As cash is still widely used, we need to be able to withdraw and/or deposit cash easily. The study examines how we access cash and how easy it is to do so.

The data in Figure 1 show that we get cash mainly from ATMs (77%), and to a lesser extent in branch (9%), at work (8%) and through family or friends (5%). Again, age is a significant factor: the under-65s make more use of ATMs to withdraw and/or deposit cash, while those over that age prefer to use branches.

Essentially three factors must be analysed to assess how easy it is to access cash:

- Availability: various studies on in-person access to banking services in Spain

show that most of the population have an ATM or branch near where they live.

show that most of the population have an ATM or branch near where they live. - Cost: the figures show that in 2024 most people withdraw cash from ATMs free of charge.

- Difficulties: most people who withdraw cash from an ATM say they usually have no problem doing so.

How could cash use change in the short term?

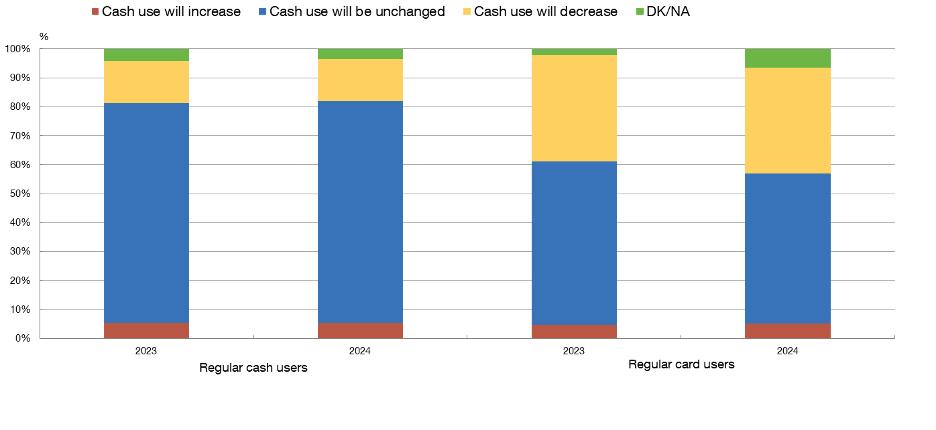

- Most regular cash users expect to continue using cash next year just as they have done in 2024 (see Chart 2).

Chart 2

EXPECTED CHANGE IN CASH USE, 2023-2024

SOURCES: Banco de España and Study on Cash Use Habits![]()

- Similarly to previous years

, more than half of regular card users expect to continue using cash next year.

, more than half of regular card users expect to continue using cash next year.

No major shifts in cash use habits are expected in the short term, although they vary across age groups

Moreover, the older the respondents, the greater the proportion who do not expect their cash use to change:

- Among the younger age groups (18-34), 52% think they will continue to use cash in the same way, compared with 37% who think they will use it less. This suggests a certain willingness to switch to digital means of payment.

- However, among the older age groups (over 65), 79% think they will continue to use cash in the same way, compared with 13% who think they will use it less.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.