Better safe than sorry: how prudent lending standards lead to fewer corporate defaults

Banks implementing more prudent standards when lending to firms helps reduce corporate vulnerability and default risk, strengthens financial stability and supports economic recovery after crises.

24/10/2024

Firms rely on bank lending to manage their payments and revenues, undertake investment projects and, ultimately, support economic activity. But there is a risk that an easing of lending standards, especially when the economy is booming, leads to excessive and lower-quality lending. We saw this happen in Spain in the run-up to the 2008 global financial crisis![]() , and the consequences for the Spanish economy were severe and long-lasting. So, how should we determine a firm’s credit quality and ability to repay at the time a loan is granted? How do potential problems feed through to the economy? And as regulators, in this case the Banco de España, what can we do to improve credit quality and strengthen financial stability?

, and the consequences for the Spanish economy were severe and long-lasting. So, how should we determine a firm’s credit quality and ability to repay at the time a loan is granted? How do potential problems feed through to the economy? And as regulators, in this case the Banco de España, what can we do to improve credit quality and strengthen financial stability?

A firm struggling to pay back its loans could find its very survival at risk, while the banks that provided the loans could suffer substantial losses.

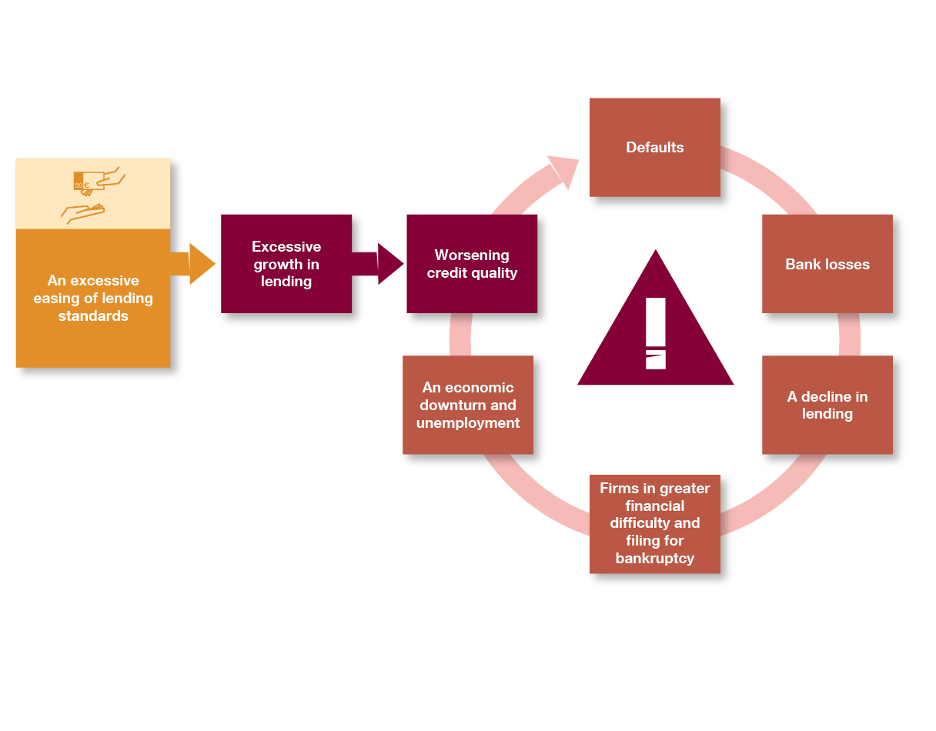

Figure 1 shows how an excessive easing of bank lending standards reduces credit quality, makes it harder for firms to repay their loans in the future and leads to an increase in defaults. These defaults, in turn, have an impact on banks. They can also have knock-on effects for other firms, economic activity, employment and financial stability more broadly, in a vicious circle that is difficult to escape.

Figure 1

HOW AN EASING OF LENDING STANDARDS FEEDS THROUGH TO THE ECONOMY

SOURCE: Banco de España.

In Spain, we saw excessive growth rates for bank lending to both firms and households![]() in the years leading up to the global financial crisis. Corporate debt rose significantly as a result.

in the years leading up to the global financial crisis. Corporate debt rose significantly as a result.

We use two main indicators to assess a firm’s credit quality at the time a loan is granted: the debt-to-asset ratio and the interest coverage ratio

How can we assess a firm’s credit quality at the time a loan is granted? Two indicators are particularly useful.

- The debt-to-asset ratio measures a firm’s level of debt in relation to its total assets. A higher debt-to-asset ratio is a sign of lower credit quality.

- The interest coverage ratio indicates how many times a firm could cover the interest on its debt using its earnings. A lower interest coverage ratio also indicates lower credit quality.

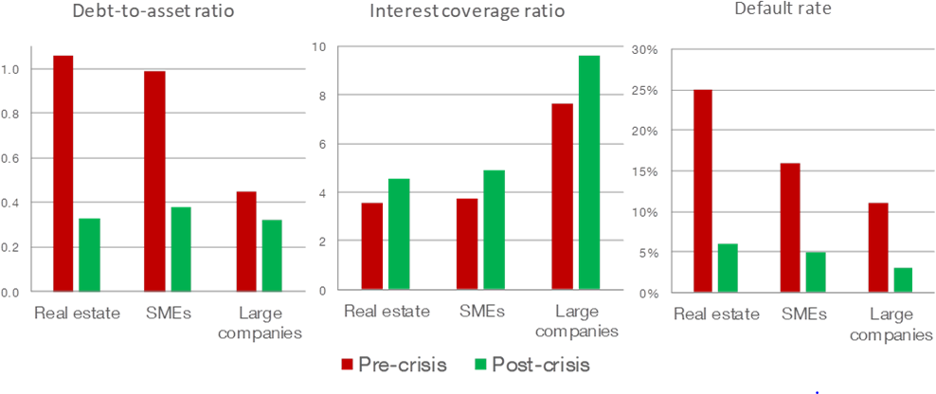

As we can see from Chart 1, these indicators show that, before the global financial crisis, a large number of loans were granted in Spain to firms that had high levels of debt in relation to their size (a high debt-to-asset ratio) and low levels of debt interest coverage (a low interest coverage ratio).

Chart 1

POORER LENDING STANDARDS AND HIGHER DEFAULT RATES FOR LOANS GRANTED IN THE PRE-CRISIS PERIOD

SOURCE: Fernández Lafuerza and Galán (2024)![]() .

.

NOTES:

-The chart shows the median debt-to-asset ratio, interest coverage ratio and default rate for the loans granted in each period to firms in the specified sector.

-The pre-crisis period is 2000-08. The post-crisis period is 2014-20.

-The balance sheet data (assets and earnings) relate to the year-end immediately before each loan is granted. The default rate represents the percentage of loans that have been considered non-performing for more than three consecutive months since the loan was granted.

These weaker bank lending standards were particularly visible in the real estate and construction sector and for small and medium-sized enterprises (SMEs). In these sectors the debt-to-asset ratio was three times higher than it was for loans granted after the economic recovery, and the interest coverage ratio was 20% lower.

This excessive easing of lending standards resulted in high default rates when the crisis hit. As Chart 1 also shows, default rates rose to around 25% for real estate and construction companies, above 15% for SMEs and above 10% for large companies. These figures were three to four times greater than after the crisis, across all sectors.

The process shown in Figure 1 unfolded rapidly in Spain. The consequences were severe, with banks failing and lending severely squeezed, which exacerbated firms’ financial difficulties and the economic crisis.

What can 11 million loans tell us about credit quality and defaults?

We have seen that easing lending standards excessively in periods when the economy is booming increases the probability of defaults in the future. Which firms are affected the most, and to what extent?

We find a positive and significant correlation between a loosening of lending standards when a loan is granted and the probability of default in the future

In a recent paper![]() , we explored these questions using a sample of nearly 11 million bank loans extended to companies in Spain between 2000 and 2020. We found a positive correlation between weaker lending standards (i.e. a higher debt-to-asset ratio and a lower interest coverage ratio) at the time a loan is granted and the probability of default. This correlation remains statistically significant

, we explored these questions using a sample of nearly 11 million bank loans extended to companies in Spain between 2000 and 2020. We found a positive correlation between weaker lending standards (i.e. a higher debt-to-asset ratio and a lower interest coverage ratio) at the time a loan is granted and the probability of default. This correlation remains statistically significant![]() even after controlling for a range of characteristics relating to the firm, the loan and the bank extending the loan.

even after controlling for a range of characteristics relating to the firm, the loan and the bank extending the loan.

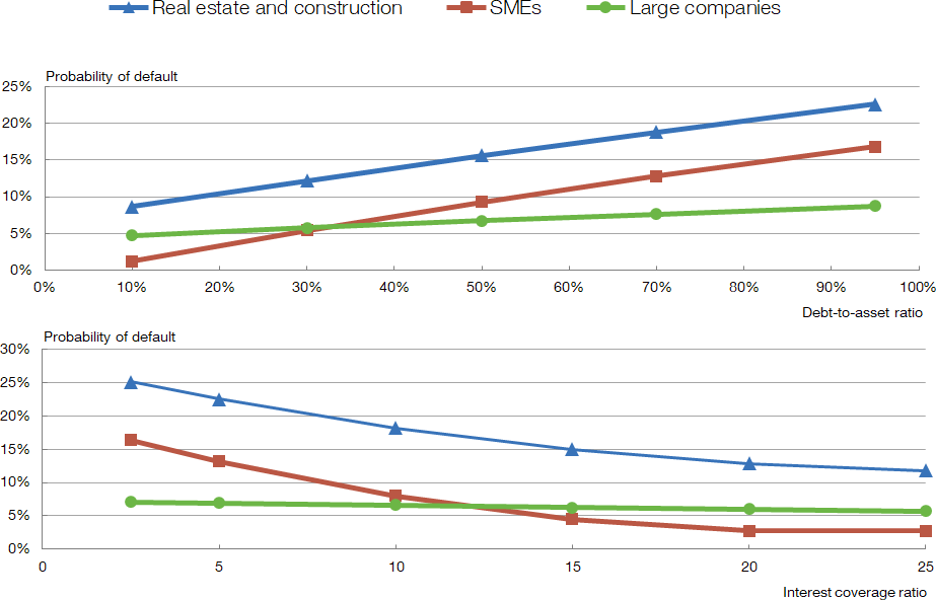

The correlation is especially strong in the real estate and construction sector and for SMEs (see Chart 2).

Chart 2

FIRMS WITH HIGHER LEVELS OF DEBT WHEN A LOAN IS GRANTED HAVE A HIGHER PROBABILITY OF DEFAULT

SOURCE: Fernández Lafuerza and Galán (2024)![]() .

.

NOTES:

-The chart shows the correlation between the debt-to-asset ratio or the interest coverage ratio when a loan is granted and the probability of default, for the three sectors indicated.

-Generally, a higher debt-to-asset ratio and a lower interest coverage ratio lead to a higher probability of default.

In the real estate and construction sector, highly indebted companies (those with a debt-to-asset ratio of 95%) have a 23% probability of default, which is 14 percentage points higher than estimated for those with low debt (a debt-to-asset ratio of 10%). Similarly, firms with a low interest coverage ratio (2.5) have a 25% probability of default, 13 percentage points more than those with a high interest coverage ratio (25).

Sensitivity to these indicators is also particularly marked among SMEs. Indeed, the probability of default rises from just over 1% for SMEs with low debt to around 17% for those with high debt. We see a similar pattern for the interest coverage ratio. In this case, the estimated probability of default increases from less than 3% for SMEs with a high interest coverage ratio to more than 16% for those with a low ratio.

Enhancing the quality of bank lending

This research underscores the importance of monitoring banks’ corporate lending standards regularly. This monitoring helps determine whether measures to encourage more prudent lending practices are warranted, particularly in more vulnerable sectors such as real estate. However, the benefits of fewer defaults should be weighed against the costs in terms of lower lending growth![]() , which could act as a brake on economic activity.

, which could act as a brake on economic activity.

The Banco de España currently has the authority to set limits on lending standards, as detailed in this Circular![]() . These limits are intended for situations where a loosening of lending standards could heighten systemic risk in the financial system

. These limits are intended for situations where a loosening of lending standards could heighten systemic risk in the financial system![]() .

.

While other European countries often apply such measures to mortgage lending![]() , few regulatory frameworks

, few regulatory frameworks![]() envisage their use for corporate lending.

envisage their use for corporate lending.

The Banco de España’s macroprudential regulation![]() leads the way in this respect. These measures have not yet been activated in Spain, given that no systemic risks have been identified since their introduction. However, having a regulatory framework and a methodology for monitoring lending standards should enable more effective action if any signs of risk are detected.

leads the way in this respect. These measures have not yet been activated in Spain, given that no systemic risks have been identified since their introduction. However, having a regulatory framework and a methodology for monitoring lending standards should enable more effective action if any signs of risk are detected.

Encouraging prudent corporate lending practices can help avoid debt repayment difficulties and strengthen financial stability. Our research sheds light on how effective measures that safeguard credit quality during lending booms can be. It also underscores the need for such measures to consider the traits of firms than can either mitigate or exacerbate their vulnerabilities.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.