How are ECB interest rates passed through to the financial system? The Eurosystem’s new operational framework

The ECB’s monetary policy decisions are implemented under the operational framework, that steers market rates to bring them into line with the Eurosystem’s key interest rates. The ECB reviewed this framework in March 2024 to adapt it to the changing monetary policy environment.

The primary objective of the European Central Bank (ECB) is to maintain price stability. Specifically, to reach an inflation rate of 2% in the medium term. Monetary policy is used to keep inflation in check. In the euro area, monetary policy decisions are taken centrally by the Governing Council of the ECB![]() , but are implemented by each Eurosystem

, but are implemented by each Eurosystem![]() national central bank individually. How are these decisions implemented in practice? The Eurosystem’s operational framework defines how the key interest rates are set and how they are passed through to the financial system and then to the rest of the economy. In this post we explain what this operational framework is, how it has changed and what its recent review

national central bank individually. How are these decisions implemented in practice? The Eurosystem’s operational framework defines how the key interest rates are set and how they are passed through to the financial system and then to the rest of the economy. In this post we explain what this operational framework is, how it has changed and what its recent review![]() might mean.

might mean.

What is the Eurosystem’s operational framework and how has it changed?

The Eurosystem’s single monetary policy operational framework is essential for monetary policy transmission, as outlined in Figure 1. It is the mechanism and set of tools used to implement the ECB's monetary policy decisions.

Figure 1

THE OPERATIONAL FRAMEWORK ENSURES THE TRANSMISSION OF MONETARY POLICY DECISIONS TO THE FINANCIAL MARKETS

SOURCE: Banco de España

The main monetary policy tool is the set of three key interest rates![]() . Defining them is helpful for understanding how this operational framework works:

. Defining them is helpful for understanding how this operational framework works:

- The interest rate on the main refinancing operations (MROs)

determines how much it will cost banks to borrow money from the Eurosystem for one week.

determines how much it will cost banks to borrow money from the Eurosystem for one week. - The marginal lending facility (MLF) rate

defines the cost at which banks can borrow overnight;

defines the cost at which banks can borrow overnight; - The deposit facility rate (DFR)

defines the interest banks receive for depositing money.

defines the interest banks receive for depositing money.

The operational framework is based on the type and amount of operations used to provide liquidity to private banks (monetary policy loans and, at specific stages, asset purchases). Other aspects, such as the criteria for selecting the banks participating in these operations or the collateral required to obtain liquidity have changed less over the years.

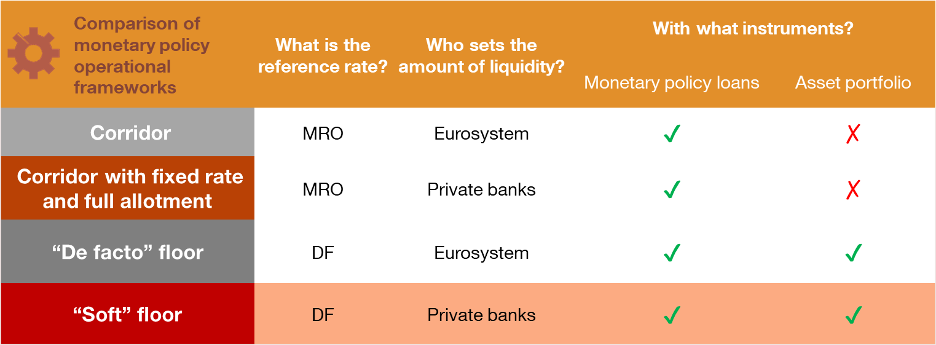

The monetary policy operational framework has gone through successive phases or systems: corridor, fixed-rate full allotment corridor, “de facto” floor and the recently announced “soft” floor

The operational framework can be used to steer short-term market rates towards to ECB's target, in step with the key interest rates. Since the start of monetary union in 1999, this framework has gone through several stages, as shown in Table 1 and Figure 2.

Table 1

MAIN FEATURES OF THE SUCCESSIVE EUROSYSTEM OPERATIONAL FRAMEWORKS

SOURCE: Banco de España

NOTE: MROs = weekly main refinancing operations for banks; DF = deposit facility for Eurosystem banks. The last row (in orange) refers to the features of the revised operational framework.

Figure 2

CHANGES IN THE OPERATIONAL FRAMEWORK. FROM CORRIDOR TO FLOOR

SOURCE: ECB and Banco de España.

NOTE: The chart shows the interest rate corridor made up of the ECB’s three key interest rates: marginal lending facility (MLF), main refinancing operations (MROs) and deposit facility (DF). The position of the money market rate, which is set by banks, varies in relation to the corridor, depending on the operational framework in place.

1) Corridor system (1999-2008)

Before the 2008 global financial crisis, the framework in place was known as the “corridor system” (in reference to the three key interest rates). Under this framework, the banking system had a structural liquidity deficit, meaning that banks had to systematically use the Eurosystem’s main refinancing operations (MROs) to cover their liquidity needs![]() .

.

Thus, the Eurosystem decided how much liquidity had to be provided each week (based on its estimates of this deficit) and banks requested liquidity at different interest rates. If the Eurosystem’s estimates of liquidity needs were correct, the interest rate on the MROs matched the rate set by the ECB to anchor all other market rates at the inflation target.

2) Corridor system with a fixed rate and full allotment (2008-2015)

After the global financial crisis hit in 2008, liquidity needs became far more volatile, and therefore harder to predict. In response to this situation![]() , the Eurosystem began to provide liquidity at a fixed rate, allotting banks all the liquidity they asked for (Fixed Rate Full Allotment or FRFA). The interest rate on operations was set under this framework but the amount of liquidity was determined by the participating banks, subject to the provision of sufficient collateral

, the Eurosystem began to provide liquidity at a fixed rate, allotting banks all the liquidity they asked for (Fixed Rate Full Allotment or FRFA). The interest rate on operations was set under this framework but the amount of liquidity was determined by the participating banks, subject to the provision of sufficient collateral![]() .

.

3) “De facto” floor system (2015-…)

Starting in 2015, at a time when there was little scope for cutting interest rates, and with the deposit facility rate even entering negative territory![]() , the Eurosystem central banks began to buy bonds (mainly government debt) as part of the asset purchase programmes

, the Eurosystem central banks began to buy bonds (mainly government debt) as part of the asset purchase programmes![]() (APP). Thanks to this decision, the operational framework became a “de facto" floor system

(APP). Thanks to this decision, the operational framework became a “de facto" floor system![]() .

.

With these purchases, the amount of liquidity injected into the financial system was once again up to the Eurosystem. Only now, given the sheer scale of such purchases, liquidity far outstripped the demand from banks. In this situation of excess liquidity![]() , what matters to banks is the return they can get on the surplus deposits they hold at the central bank (i.e. the deposit facility (DF) rate, the lowest of the three key interest rates). This explains why market rates were anchored to the deposit facility rate (the corridor’s floor), rather than to the MRO rate (the middle of the corridor).

, what matters to banks is the return they can get on the surplus deposits they hold at the central bank (i.e. the deposit facility (DF) rate, the lowest of the three key interest rates). This explains why market rates were anchored to the deposit facility rate (the corridor’s floor), rather than to the MRO rate (the middle of the corridor).

So where do we go from here? The new operational framework

The changes to the operational framework announced by the Governing Council of the ECB will affect how banks are supplied with liquidity, as the Eurosystem central banks’ balance sheets gradually shrink![]() .

.

This new operational framework is founded on six core principles, listed in Figure 3.

Figure 3

THE SIX PRINCIPLES OF THE NEW OPERATIONAL FRAMEWORK

SOURCE: ECB and Banco de España.

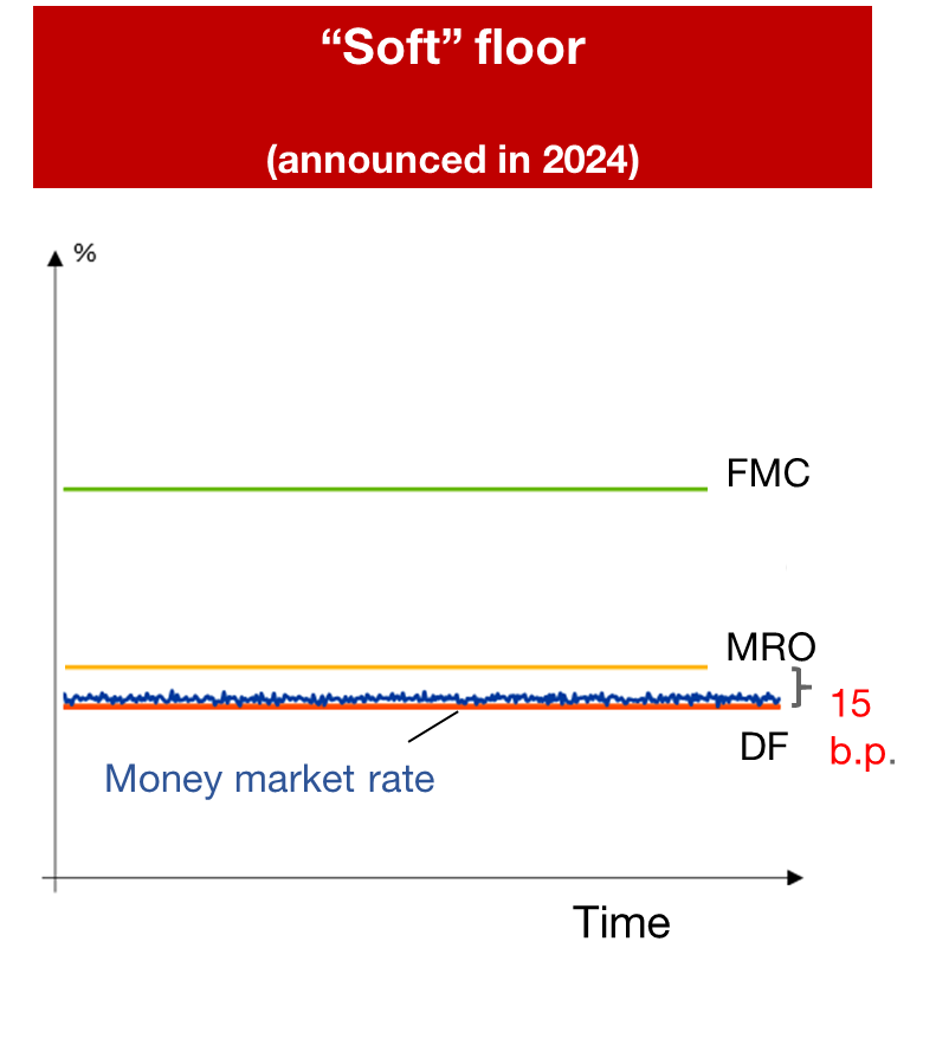

These principles mean that the new operational framework can be described as a “soft” floor system![]() , with three key characteristics:

, with three key characteristics:

1) Liquidity is provided through fixed-rate, full allotment lending: it will be up to banks to request the liquidity they need in the form of main refinancing operations (MRO) at a pre-set rate, as was the case between 2008 and 2015.

2) A floor system will remain in place (see Figure 4): the Eurosystem expects that the deposit facility rate will continue to be the reference rate that steers market rates. It has also been decided to reduce the spread between the DF rate and the MRO rate to only 15 basis points, from September 2024. This will make it cheaper for banks to use MROs, helping to ensure that liquidity is sufficiently plentiful and that the money market interest rate remains anchored to the floor.

Figure 4

THE REVISED FRAMEWORK AND THE “SOFT” FLOOR SYSTEM

SOURCE: Banco de España.

NOTE: Under the new framework, the spread between the rate on the MROs and the deposit facility rate is reduced to 15 basis points from 50 basis points. Given the ongoing situation of excess liquidity, the money market rate is expected to remain close to the floor of the corridor.

3) Use of a broad mix of instruments: the framework will not rely entirely on short-term lending operations (specifically, MROs) to satisfy banks’ reserve demand. While the marginal unit of liquidity (i.e. the last euro of liquidity) is provided through these operations, structural operations, including asset purchases, will also help to cover the banking system’s structural liquidity needs.

The transition to the new operational framework will be gradual and will ensure the correct implementation of monetary policy moving forward

Nonetheless, the transition will be a gradual one. The changes to the operational framework will not become apparent until the current excess liquidity has sufficiently declined.

When and how is this expected to happen?![]() In the coming years, as and when both the longer-term lending operations (TLTROs

In the coming years, as and when both the longer-term lending operations (TLTROs![]() ) and the asset purchase programmes (APP and PEPP

) and the asset purchase programmes (APP and PEPP![]() ) that still account for the lion’s share of the Eurosystem central banks’ balance sheets mature (see Chart 1).

) that still account for the lion’s share of the Eurosystem central banks’ balance sheets mature (see Chart 1).

Chart 1

EUROSYSTEM BALANCE SHEET. PROVISION OF LIQUIDITY (ASSET) AND EXCESS LIQUIDITY (LIABILITY)

SOURCE: Banco de España.

NOTES:

-The Eurosystem provides liquidity to the banking system through monetary policy loans and the asset portfolio, which are part of the Eurosystem's balance sheet assets.

-The banking system's excess liquidity![]() is calculated on the basis of two liability items. First, excess bank reserves

is calculated on the basis of two liability items. First, excess bank reserves![]() , i.e. the amount of liquidity held by banks at their central bank in excess of the minimum reserve requirements. And, second, the deposit facility, which is the amount of liquidity that banks deposit overnight at their central bank to obtain the corresponding remuneration.

, i.e. the amount of liquidity held by banks at their central bank in excess of the minimum reserve requirements. And, second, the deposit facility, which is the amount of liquidity that banks deposit overnight at their central bank to obtain the corresponding remuneration.

After a long and complex review process, the new operational framework has thus been adapted to the Eurosystem balance sheet normalisation phase, and the new needs of the banking system. With this operational framework (which won’t be fully up and running for some time yet), the Eurosystem has ensured that its monetary policy will be correctly implemented moving forward.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.