The costs of inflation warrant the firm monetary response. What lies ahead?

The Governor, Pablo Hernández de Cos, kicks off our blog, explaining the importance of keeping inflation under control, as well as the firm monetary policy response and how it may evolve going forward. The benefits of price stability outweigh the short-term costs of temporarily high interest rates.

6 min

Times change, and so does the way we communicate. The Banco de España’s new blog aims to familiarise the general public with our work, using simple and clear language and a more accessible format. This first blog post takes a look at inflation and the monetary policy response. Why is inflation high and why is this a concern? What are we doing to bring it down? What lies ahead?

As a member of the Eurosystem, the Banco de España’s main mission is to maintain price stability in the euro area. Our annual inflation target is 2% over the medium term (around two years).

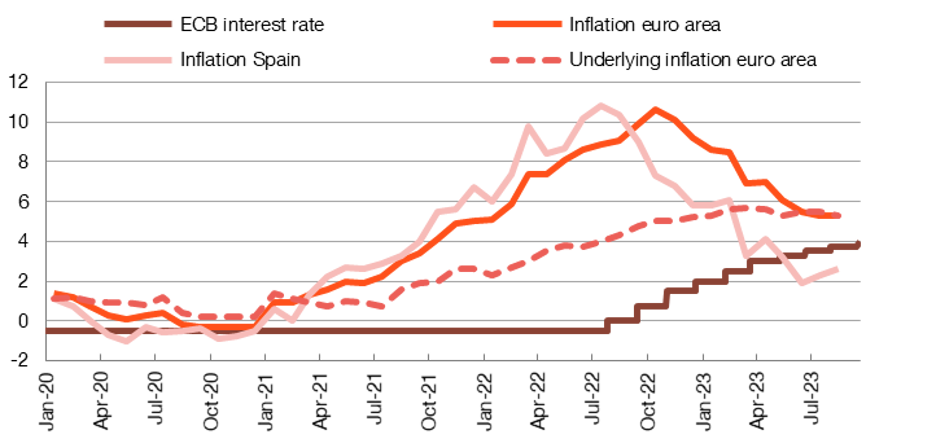

Inflation has been rising significantly and persistently since 2021 (see Chart 1). There are several factors behind this sharp increase ![]() (2 MB): the supply disruptions associated with the pandemic; the subsequent rapid economic reopening and recovery; and the Russian invasion of Ukraine in February 2022. The initial inflationary pressures were concentrated first on oil prices and then on food prices, before gradually passing through to the rest of the consumption basket, feeding underlying inflation. In recent quarters, inflation – especially oil inflation – has begun to ease.

(2 MB): the supply disruptions associated with the pandemic; the subsequent rapid economic reopening and recovery; and the Russian invasion of Ukraine in February 2022. The initial inflationary pressures were concentrated first on oil prices and then on food prices, before gradually passing through to the rest of the consumption basket, feeding underlying inflation. In recent quarters, inflation – especially oil inflation – has begun to ease.

Chart 1

INFLATION HAS PEAKED AND INTEREST RATES ARE AT ALL-TIME HIGHS

SOURCES: Banco de España and Refinitiv Datastream.

NOTE: The interest rate is the ECB’s deposit facility rate. Inflation for the euro area and for Spain is the year-on-year rate of growth in their respective Harmonised Index of Consumer Prices (HICP). Underlying inflation excludes energy and food.

Why is inflation a concern?

In the short term, higher inflation makes us poorer: it means our wages and savings are worth less. But persistently high inflation is even more worrying, because of its medium and long-term effects.

Once the inflation genie is out of its lamp, the harder it is to get it back in

First, because once the inflation genie is out of its lamp, the harder it is to get it back in:

- Wage increases to restore purchasing power put further pressure on production costs. Firms try to pass these higher costs on to their selling prices, to protect their margins. These second-round effects could trigger runaway price and wage spirals.

- In this setting, economic agents may believe that inflation will remain high and revise up their expectations. This would fuel the price spiral and make it more difficult to reduce inflation.

Second, because inflation is especially harmful in the long term:

- In market economies, prices are key to the allocation of resources as they provide essential signals for determining supply and demand. With high inflation, which is generally also more volatile, price signals become more difficult to read. This is why price stability is key for economies to function correctly.

- Past experience shows that economies with persistently high inflation record lower growth.

- Inflation has redistributive effects

(346 KB) that can drive up inequality. It hits poorer households harder.

(346 KB) that can drive up inequality. It hits poorer households harder.

We cannot afford persistently high inflation

In short, we cannot afford persistently high inflation. The long-term benefits of low inflation more than outweigh the short-term costs (lower growth and activity) of the monetary policy measures needed to reduce inflation, and warrant the Eurosystem’s response.

What are we doing to fight inflation in the euro area?

The European Central Bank (ECB) has tightened monetary policy sharply and swiftly. In barely 12 months, the main interest rate (the deposit facility rate) has risen from ‑0.5% to 4%, an unprecedented increase in the history of the euro. In addition, the ECB has begun to shrink its balance sheet.

The interest rate has risen from ‑0.5% to 4%, an unprecedented increase

As Figure 1 shows, rate hikes help reduce inflation through several channels.

Figure 1

HOW INTEREST RATE RISES PUSH DOWN INFLATION. MAIN CHANNELS

SOURCE: Banco de España

The ECB makes its decisions by analysing each of these channels and how they affect the economic growth and inflation outlook, bearing in mind that rate rises take time to have full effect (18 to 24 months according to our estimates). This is another reason why the inflation target is a medium-term target.

What lies ahead?

Uncertainty about the economy and inflation remains high, heavily influenced by factors, such as the war in Ukraine, whose future course is difficult to predict.

On the information currently available, maintaining the present level of interest rates for a sufficiently long time should be broadly consistent with achieving our inflation target of 2%

In any event, on the information currently available, maintaining the present level of interest rates for a sufficiently long time should be broadly consistent with achieving our inflation target of 2% over the medium term. This is also the majority view of financial markets and analysts.

What is the basis for this conclusion?

- First, the strength of the transmission of tighter monetary policy to financial conditions and credit, which appears to be greater than in past episodes. And that transmission is by no means complete.

- Second, the sluggish economic growth in the euro area in the first part of the year, which has extended into the third quarter and across all economic sectors, even though employment has remained strong. Indeed, the ECB has revised down its economic growth forecasts significantly. GDP at end-2025 is now expected to be 1% lower than estimated just three months ago. And the risks are on the downside.

- Third, the decline in recent months, in line with our projections, in the indicators of underlying inflation, which is more stubborn than headline inflation. Wages are gradually regaining lost ground and margins, which have slowed after growing sharply in 2022, have also performed in line with forecasts. In addition, medium-term inflation expectations remain anchored around 2%. All of which leads us to believe that inflation may decline as envisaged in the ECB’s projections, reaching 2.1% in 2025, close to our target.

- Moreover, the risks to inflation are now balanced. A number of factors could drive up inflation more than expected, for instance, renewed inflationary pressures on energy and food prices, or higher than expected growth in wages or margins. But others, such as weaker demand or stronger monetary policy transmission, could accelerate its decline.

In this setting, it is essential that future monetary policy decisions are based on a painstaking analysis of the incoming data. This will prevent insufficient tightening, which would stop us from reaching our inflation target, and also excessive tightening that could cause unnecessary damage to activity and employment.