Against the tide: the EU-Mercosur trade deal

The European Union has stepped up its trade talks with Latin America in recent years, in response to shifts in geopolitics. One of the more tangible results has been the agreement with Mercosur which, if ratified, will strengthen economic integration between the two regions.

13/03/2025

The last decade has seen an increase in the risks of economic and trade fragmentation, prompted mainly by shifts in geopolitics. And these risks have only escalated with the arrival of the new US Administration. Bucking this trend, however, the trade agreement between the European Union (EU) and Mercosur![]() (comprising Argentina, Brazil, Paraguay and Uruguay) reached in December 2024 represents a landmark for transatlantic economic integration. So, what does this agreement cover? And what will it mean for trade between the two regions, if it is ultimately ratified?

(comprising Argentina, Brazil, Paraguay and Uruguay) reached in December 2024 represents a landmark for transatlantic economic integration. So, what does this agreement cover? And what will it mean for trade between the two regions, if it is ultimately ratified?

The EU has stepped up its talks with Latin America for a number of years, seeking to further diversify trade and achieve greater strategic autonomy![]() by forging closer ties between the two areas. As well as modernising its existing trade agreements with Mexico and Chile in the past two years, the EU has also reached a new and important agreement with the Mercosur

by forging closer ties between the two areas. As well as modernising its existing trade agreements with Mexico and Chile in the past two years, the EU has also reached a new and important agreement with the Mercosur![]() countries. But before the new deal can come into effect, it needs to be ratified by both sides, something which will take some time.

countries. But before the new deal can come into effect, it needs to be ratified by both sides, something which will take some time.

DID YOU KNOW…?

Although trade policy is an exclusive competence of the EU, in recent years trade agreements have expanded to cover competences shared between the EU and its Member States, such as the environment, energy and transport. This is why final ratification of this type of trade agreement![]() in the EU is a complex and drawn-out process, as it requires both European and national approval:

in the EU is a complex and drawn-out process, as it requires both European and national approval:

- The part of the agreement that deals with strictly trade-related issues (lower tariffs and changes to certain non-tariff barriers) needs to be ratified by the Council of the EU![]() (with the support of at least 15 of the 27 Member States representing 65% of the EU population) and by the European Parliament.

(with the support of at least 15 of the 27 Member States representing 65% of the EU population) and by the European Parliament.

- Meanwhile, the parts of the agreement that affect national competences must be approved by the national parliaments of the Member States.

In Mercosur, the trade agreement will be ratified after receiving parliamentary approval from each member country.

In recent trade agreements, though, the trade-specific part has – provisionally – come into effect once approved at European level and by the other country or region. In the case of the trade deal with Canada, this took 11 months.

If it comes into force, the EU-Mercosur trade deal will create a free-trade area of over 770 million people, representing a quarter of world GDP, and the EU will have trade deals with all countries in Latin America, except Bolivia, Cuba and Venezuela.

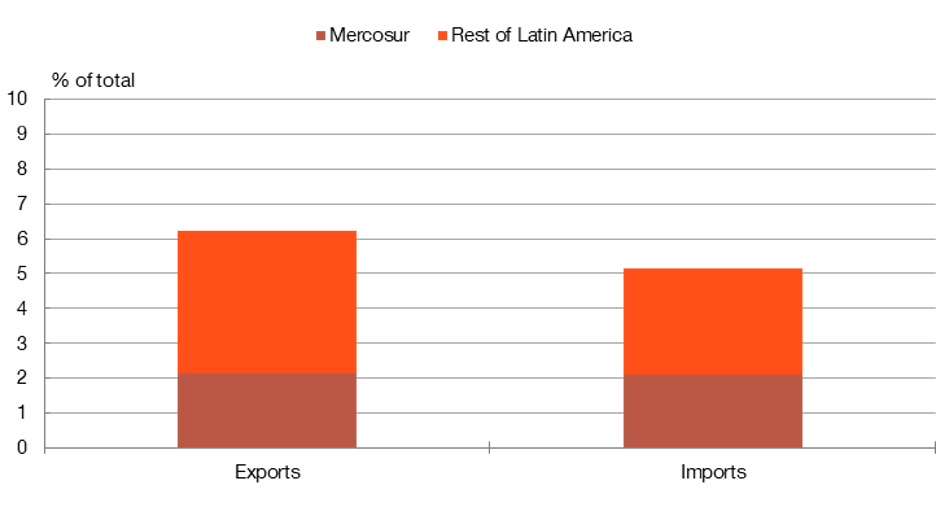

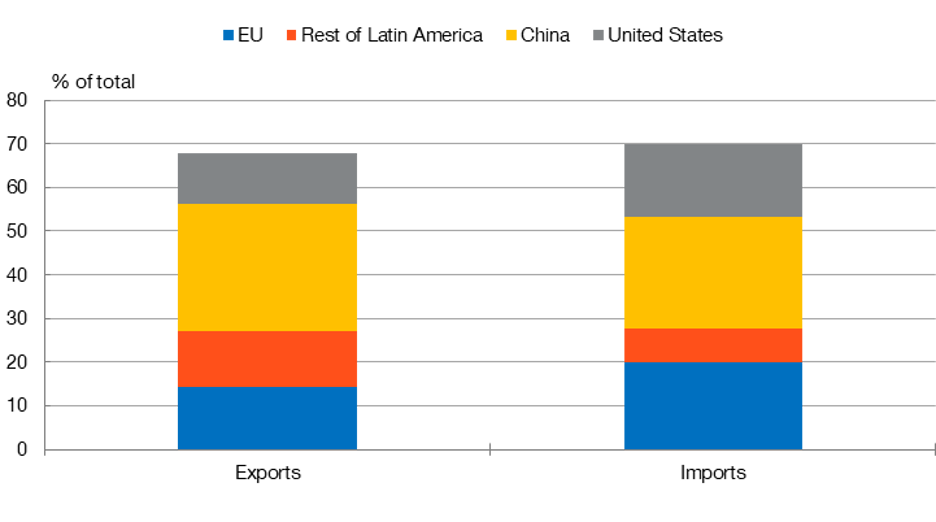

The deal will open up trade between two regions that have strong economic ties. As Chart 1 shows, the EU accounts for over 10% of Mercosur’s trade. While Mercosur only accounts for 2% of the EU's external trade, there are specific and strategic sectors, such as food and commodities, in which its accounts for 13% and 14%, respectively, of EU imports.

Chart 1

EU-MERCOSUR TRADE IN 2023

EU trade with Mercosur and the rest of Latin America

Mercosur trade with the EU and other areas

SOURCES: UN COMTRADE and Banco de España.

If it comes into force, the EU-Mercosur agreement will create a market of over 770 million people, and the EU will have trade deals with nearly all countries in Latin America

Moreover, through this agreement, Mercosur could help the EU reduce the growing economic risks stemming from geopolitical factors, by further diversifying global value chains![]() , particularly those including critical raw materials for the digital transition and the transition to a lower-emissions economy.

, particularly those including critical raw materials for the digital transition and the transition to a lower-emissions economy.

What impact will the agreement have on trade between the two regions?

Bilateral trade relations between the EU and Mercosur are currently subject to the most-favoured-nation![]() tariff under World Trade Organization rules

tariff under World Trade Organization rules![]() . Each area or country sets this tariff at a single rate for each import, which it applies to all countries with which it has no trade deal.

. Each area or country sets this tariff at a single rate for each import, which it applies to all countries with which it has no trade deal.

In 2023 the EU applied an average tariff of 5% on imports from Mercosur, while Mercosur applied an average tariff of around 11% (more than double) on those from the EU (the average tariff depends on both the tariff set by each country for each product and the types of products imported).

Tariffs on specific products may be much higher. For instance, Mercosur imposes tariffs of between 14% and 35% on various food and manufactured goods imports from Europe. Such food imports include dairy products, chocolate and confectionery, spirits and wine, while those of manufactured goods include car parts, machinery, chemical products, pharmaceuticals, textiles and footwear.

The EU-Mercosur agreement will lead to the gradual removal of tariffs on over 90% of the products traded between the two regions. For most products, trade will be liberalised over a period of up to ten years.

The agreement will reduce tariffs on 90% of products and is one of the most ambitious in terms of labour standards and environmental sustainability

However, tariffs on some products, such as beef, poultry meat and rice, will not be completely removed. They will only be reduced for a specific volume , or “quota”![]() , of imports, which has been set at levels close to the volume traded with the current tariffs. Tariffs on imports above that quota will remain unchanged. In these cases, the liberalisation could take up to 15 years.

, of imports, which has been set at levels close to the volume traded with the current tariffs. Tariffs on imports above that quota will remain unchanged. In these cases, the liberalisation could take up to 15 years.

The trade deal will also lower non-tariff barriers in various key areas: although sanitary, phytosanitary and technical rules will remain in place, the agreement will ensure that they are aimed at protecting consumers, rather than unduly restricting international trade. It will also make it easier to access public tenders and trade in services.

Moreover, the agreement protects geographical indications for more than 350 European![]() and 220 Mercosur foodstuffs whose qualities are specifically linked to the area of production.

and 220 Mercosur foodstuffs whose qualities are specifically linked to the area of production.

This agreement is one of the most ambitious worldwide in terms of labour standards and environmental sustainability: it ensures respect for labour rights, based on the International Labour Organisation’s recommendations![]() , and includes specific obligations to combat climate change and deforestation, following the Paris Agreement

, and includes specific obligations to combat climate change and deforestation, following the Paris Agreement![]() .

.

How will the EU-Mercosur deal affect trade between the two regions? Several studies by our researchers (like this one![]() and this one

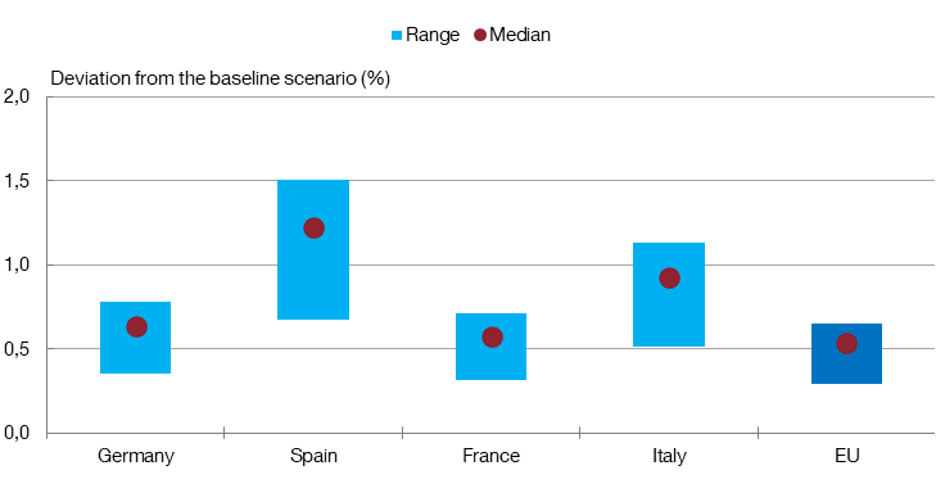

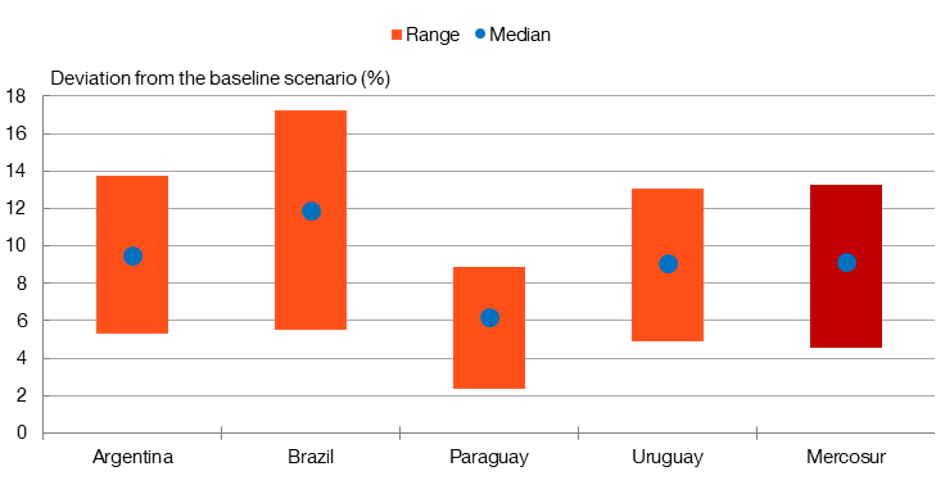

and this one![]() ) calculate that trade between the two regions will increase by more than one-third in the long run. This means that Mercosur’s total trade will grow by between 5% and 13%, while the increase for the EU will be lower than 1% (see Chart 2). The growth in trade for Spain will be more than twice the European average. These differences are due to the varying relative importance of each region in the other region’s trade, as shown in Chart 1.

) calculate that trade between the two regions will increase by more than one-third in the long run. This means that Mercosur’s total trade will grow by between 5% and 13%, while the increase for the EU will be lower than 1% (see Chart 2). The growth in trade for Spain will be more than twice the European average. These differences are due to the varying relative importance of each region in the other region’s trade, as shown in Chart 1.

Chart 2

IMPACT OF THE EU-MERCOSUR BILATERAL TRADE AGREEMENT

For the European Union

For Mercosur

SOURCES: UN COMTRADE and Banco de España.

NOTES: The baseline scenario does not consider the trade agreement. The range and the median have been calculated drawing on the results of the simulations in Timini and Viani (2022)![]() and Berganza, Campos, Estevadeordal, Talvi and Timini (2024)

and Berganza, Campos, Estevadeordal, Talvi and Timini (2024)![]() . The averages for the two regions, “Mercosur” and “EU”,·are the simple averages of the impact calculated for each country in each region.

. The averages for the two regions, “Mercosur” and “EU”,·are the simple averages of the impact calculated for each country in each region.

But the potential economic impact could be much greater for both regions. While the estimations do not take into account the potential short-term adverse effects, such as job losses in some of the sectors most exposed to the greater international competition, nor do they consider other possible long-term benefits, such as access to advanced technologies, stronger global value chains and increased investment.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.