The exercise to identify the global systemically important institutions (G-SIIs) and the domestic systemically important institutions, dubbed other systemically important institutions (O-SIIs), is performed yearly.

The institutions identified as G-SIIs and O-SIIs are subject to additional capital buffers. The aim of these buffers is for too-big-to-fail banks not to benefit from the expectation of public support in the event of difficulties. The goals are to:

When an institution is identified as both a G-SII and an O-SII, the highest of the two buffers applies.

Latest announcements:

- 05.12.2025. The Banco de España designates a Global Systemically Important Institution and sets its macroprudential capital buffer rate for 2027

(198 KB)

(198 KB) - 30.07.2025. The Banco de España updates the list of other systemically important institutions and sets their macroprudential capital buffer rates for 2026

(152 KB)

(152 KB)

- 05.12.2024. The Banco de España designates a Global Systemically Important Institution and sets its macroprudential capital buffer rate for 2026

(188 KB)

(188 KB) - 22.11.2024. The Banco de España updates the list of other systemically important institutions and sets their macroprudential capital buffer rates for 2025

(156 KB)

(156 KB) - 14.12.2023. The Banco de España designates a Global Systemically Important Institution and establishes its macroprudential capital buffer rate for 2025

(200 KB)

(200 KB) - 29.09.2023. The Banco de España updates the list of other systemically important institutions and sets their macroprudential capital buffer rates for 2024

- 16.12.2022. The Banco de España designates a Global Systemically Important Institution and establishes its macroprudential capital buffer rate for 2024

(129 KB)

(129 KB) - 22.07.2022. The Banco de España updates the list of other systemically important institutions and sets their macroprudential capital buffer rates for 2023

(123 KB)

(123 KB) - 20.12.2021. Banco de España designates a Global Systemically Important Institution and establishes its macroprudential capital buffer rate for 2023

(165 KB)

(165 KB) - 29.07.2021. Banco de España updates the list of other systemically important institutions and sets their macroprudential capital buffer rates for 2022

(188 KB)

(188 KB) - 27.11.2020. Banco de España updates the list of systemically important institutions and sets their macroprudential capital buffers

(201 KB)

(201 KB) - 25.11.2019. Banco de España updates the list of systemically important institutions and sets their capital buffers

(202 KB)

(202 KB) - 21.11.2018. Banco de España updates the list of systemically important institutions and sets their capital buffers

(1 MB)

(1 MB) - 24.11.2017. Banco de España updates the list of systemically important institutions and sets their capital buffers

(252 KB)

(252 KB) - 14.12.2016. The Banco de España designates Banco Santander as a global systemically important institution in 2018

(130 KB)

(130 KB) - 07.11.2016. Banco de España designates the systemically important institutions in 2017 and sets their capital buffers

(245 KB)

(245 KB) - 11.01.2016. Briefing note on the setting of the capital buffers for systemic institutions and the countercyclical capital buffer for 2016

(123 KB)

(123 KB) - 28.12.2015. The Banco de España sets the capital buffers for systemic institutions and the countercyclical capital buffer for 2016

(123 KB)

(123 KB)

Level of systemic importance and macroprudential capital buffer rates

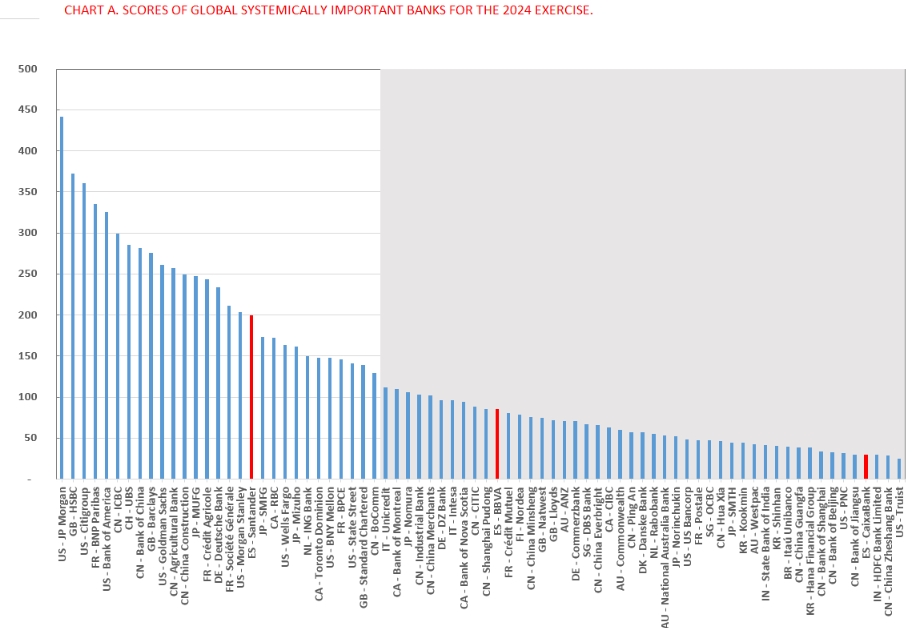

Chart A depicts the systemic importance of the main banks around the world, ordered by decreasing systemic footprint. Systemic importance is calculated using a series of indicators linked to balance sheet size, interconnectedness with the banking and non-banking financial system, the substitutability of the services provided by each institution, the complexity of the activities pursued and the volume of cross-border business. One Spanish banking group, Banco Santander, qualifies as global systemically important. By contrast, BBVA and CaixaBank do not surpass the identification threshold of 130 basis points.

SOURCE: Bank for International Settlements.

Notes: 1) The institutions of the shaded area (score lower than 130 bp or expert judgement) are not considered G-SIBs/G-SIIs. 2) Identification performed by the Basel Committee on Banking Supervision in 2024 (based on data at the end of 2023) to establish the list of G-SIBs and their associated macroprudential capital buffer rates for 2026.

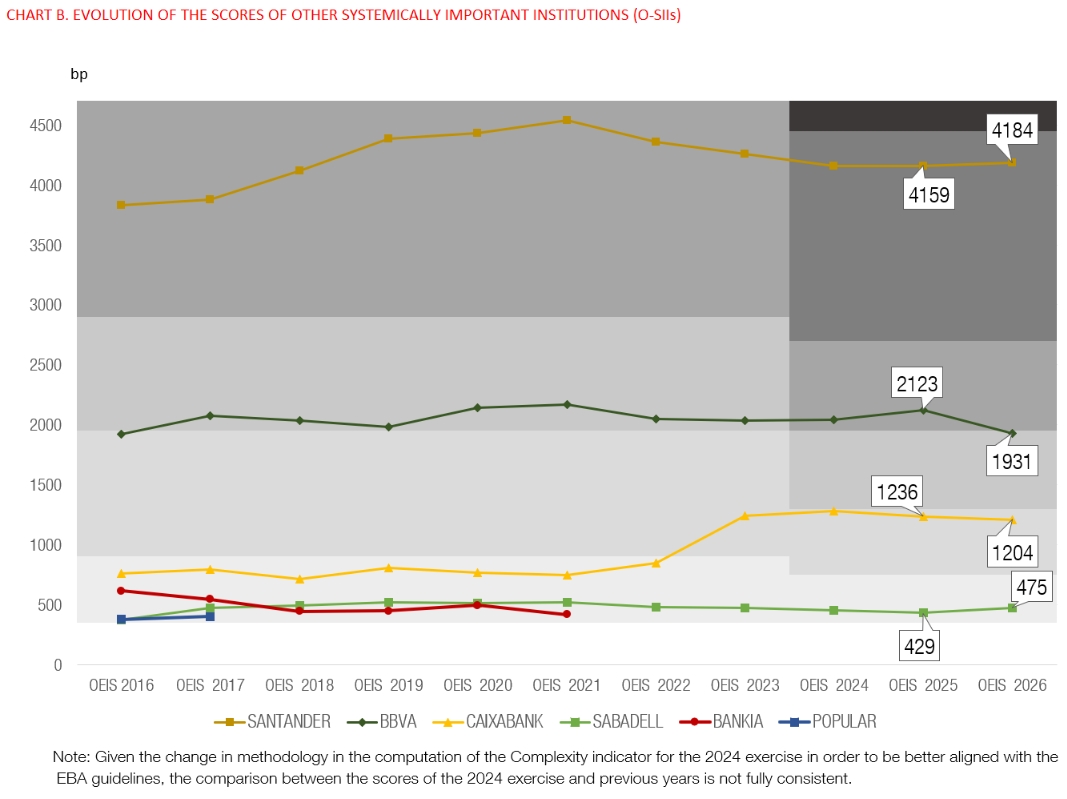

Chart B depicts the evolution of the O-SII scores of Spanish credit institutions, which are relatively stable. O-SIIs’ systemic importance is assessed using a set of indicators measuring the size, interconnectedness, substitutability of the services provided and complexity of banks.

SOURCE: Banco de España.

Notes: 1) Banco Popular was acquired by Santander in June 2017 and Bankia merged into CaixaBank in March 2021. 2) The shadings show the subcategories that determine the O-SIIs buffer rate applicable to each institution depending on their score (0.25%, 0.5%, 0.75%, 1%, 1.25% and 1.5%). 3) Latest data have been obtained in the exercise performed in 2025, based on data at end-2024, to determine the list of O-SIIs and their buffer rates applicable in 2026. 4) Given the change in methodology in the computation of the Complexity indicator for the 2024 exercise in order to be better aligned with the EBA guidelines, the comparison between the scores of the 2024 exercise and previous years is not fully consistent.

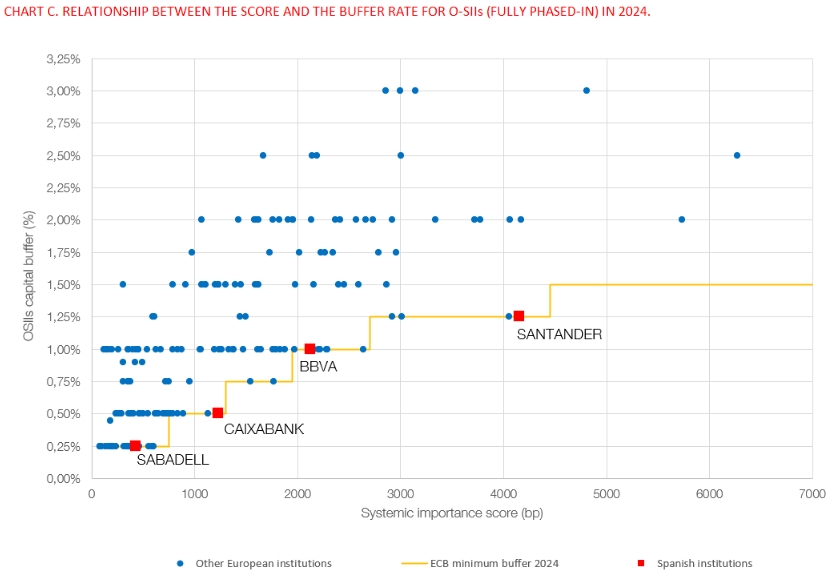

Chart C depicts the relationship between the scores of the institutions identified as O-SIIs in countries of the European Banking Union and the buffer rates set by their national authorities. The yellow line shows the level of minimum O-SII rates set by the ECB. The Spanish O-SIIs are marked in red and other (European) O-SIIs in blue.

SOURCES: European Banking Authority, European Central Bank and Banco de España.

Note: The chart displays the score obtained by each institution in 2024, based on data at end-2023, to determine the list of O-SIIs and their capital buffer rates applicable in 2025.