Suptech: how innovative technology helps us supervise banks

The Banco de España seeks to promote innovative technology. Incorporating suptech into supervisory activity is a top priority. One of the pillars of our strategy is to capitalise on our rich data sources using tools like artificial intelligence (AI).

"What makes the desert beautiful, said the little Prince, is that somewhere it hides a well"

Antoine de Saint Exupéry

The purpose of banking supervision is to ensure that the financial system is stable and functions smoothly, and therefore contributes to sustainable economic development and social well-being. Technological developments, such as artificial intelligence (AI), the phenomenon of the moment, have enormous transformative potential. The banking sector is aware of this and seeks to incorporate technological innovations to become more efficient. How can the Banco de España supervise an ever-changing and ever more complex banking sector efficiently? Innovative technology applied to supervision (suptech) can help. Here’s how.

Leveraging technology to perform our functions is in our DNA in the Directorate General Supervision.

- First, we have long-standing experience in using vast amounts of granular information to analyse things like credit risk.

- Second, we have been forming multidisciplinary teams of inspectors and IT experts to conduct inspections since the 1990s.

The Banco de España is strongly committed to using new technology to work more effectively

The exponential growth of technology, especially AI, not only generates challenges, but also opportunities. This is why in the 21st century we cannot afford not to use these new technologies to carry out our functions as effectively and efficiently as possible.

The Banco de España’s firm commitment to suptech is embodied in its Strategic Plan![]() . This incorporates a plan for the promotion of technological innovation as a central plank of modernisation, while it also seeks to position the Banco de España “as a leading prudential supervision institution, especially in terms of credit and technology risks”.

. This incorporates a plan for the promotion of technological innovation as a central plank of modernisation, while it also seeks to position the Banco de España “as a leading prudential supervision institution, especially in terms of credit and technology risks”.

How can we meet these goals?

Our roadmap includes four courses of action until end-2024:

- Participating in the Single Supervisory Mechanism (SSM)’s suptech initiative. Our specialists collaborate with the SSM in the creation of technological tools and we encourage their use internally. We have also been selected as a suptech centre, so that some of the tools we have created at the Banco de España can be shared with the other SSM supervisors.

- Developing suptech tools. We have created an integrated approach around our information sources. Of particular note is the Central Credit Register (CCR)

, with highly detailed information about financial institutions’ risks.

, with highly detailed information about financial institutions’ risks. - Fostering a culture of innovation. We have an internal forum of experts for exchanging best practices and we collaborate with the Bank’s IT area on a digital transformation programme and a new analysis hub.

- Data science training. In the form of internal courses given by our own staff, which are also shared with other bodies, such as the Association of Supervisors of Banks of the Americas

and the SSM.

and the SSM.

Data, data, data... and how we harness their potential

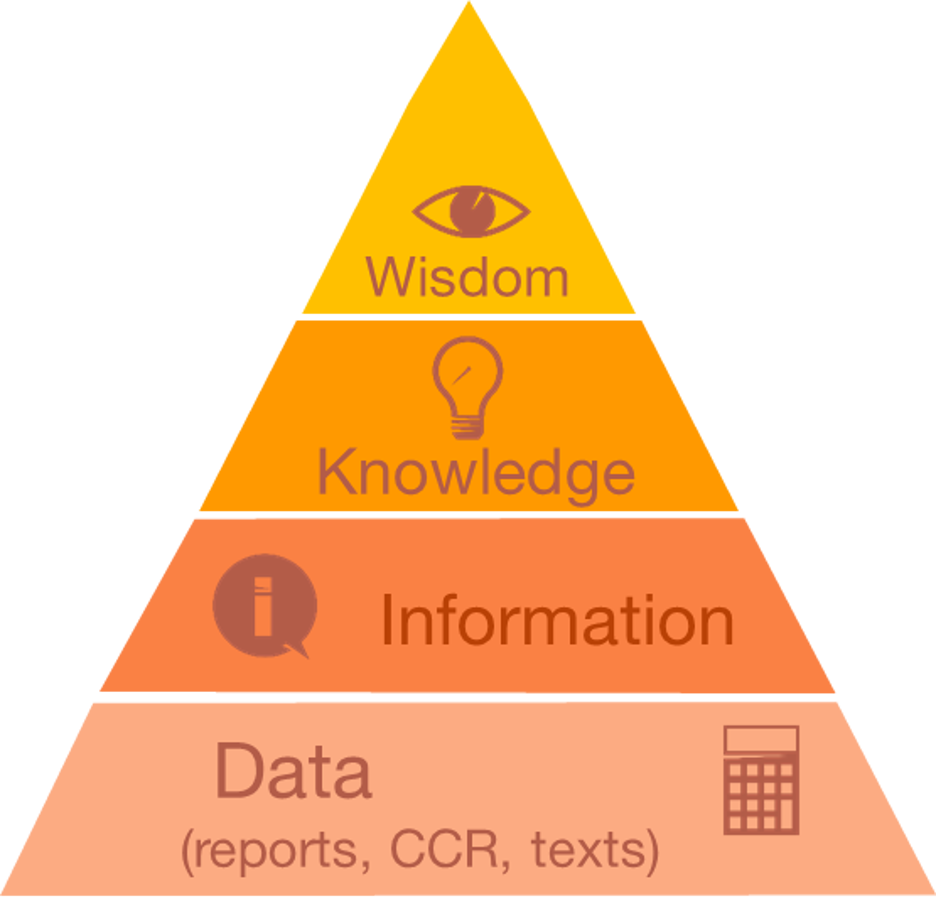

The information pyramid (Figure 1) is a helpful illustration of our work. Our tools take in the data and use them to generate insights that help users take decisions.

Figure 1

THE INFORMATION PYRAMID – BUILT ON DATA

SOURCE: Banco de España.

NOTE: Data refers to the main data sources used in supervision work: confidential reports, the Central Credit Register (CCR) and unstructured textual sources.

Three major sources of data are at the centre of our strategy: confidential reports, loan data from the CCR and texts

As supervisors, we have access to three major sources of data, mostly reported by banks. These are at the very centre of our strategy, as shown in Figure 2:

- Aggregate data collected in confidential reports, which include extensive information on banks’ accounting and finances.

- Highly detailed granular data on loans, drawn mainly from the CCR.

- Unstructured data in the form of texts, such as news articles, contracts and reports.

Figure 2

OUR COURSES OF ACTION, BASED ON DATA SOURCES, FEED INTO EACH OTHER

SOURCE: Banco de España.

NOTE: CCR = Spanish Central Credit Register; (confidential) reports.

We have established four basic courses of action that feed into each other to leverage these valuable data:

- Improving the quality of the information held in the CCR. The CCR is a strategic priority, which means that the quality of the data reported by banks is of crucial importance. The Banco de España is a pioneer in one of the ways in which we are improving the CCR – monthly reconciliation of the data submitted to the CCR to the items in the confidential returns.

- Detecting changes in trends and unusual data. For example, using tools that detect significant changes in mortgage lending.

- Using advanced visualisation techniques for big data sets. For example, we have a tool

to model and help analyse economic groups.

to model and help analyse economic groups. - Designing predictive tools. A good example here is our transition matrix tool, which detects broad-based downturns in payments. Elsewhere, we are working on language analysis, to get as much information as possible from text-based sources, and generative AI tools, to aid in content creation.

The ongoing work of adapting to new technologies is key to fulfilling our supervisory mission. In this connection, an external evaluation![]() of our suptech function has been implemented. The report will be published in the next few months and will highlight areas for improvement to help us plan our next steps.

of our suptech function has been implemented. The report will be published in the next few months and will highlight areas for improvement to help us plan our next steps.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.