Independent evaluations: a tool for transparency, improvement and modernisation

The Banco de España is conducting independent evaluations of its functions and activities through its Evaluation and Strategic Planning Office. This initiative places us at the vanguard of central banking in key aspects such as continuous improvement and transparency.

Modernising any institution involves building on lessons learned to make it more effective as part of a process of continuous improvement. The challenge is how to achieve this. For the Banco de España, independent evaluations are a key tool. The Evaluation and Strategic Planning Office is responsible for managing the Evaluation Programme![]() . Since 2022, four evaluations have been completed. What have they covered? What do they seek to achieve?

. Since 2022, four evaluations have been completed. What have they covered? What do they seek to achieve?

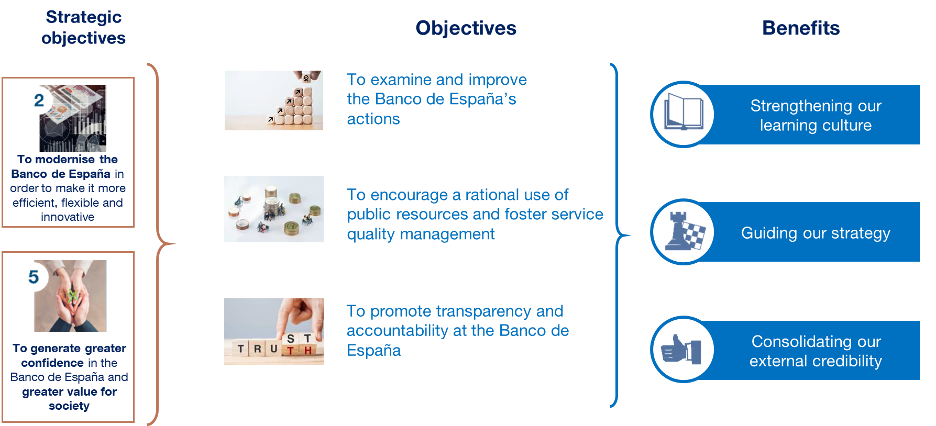

Conducting independent evaluations of the Banco de España’s chief functions and creating an organisational structure to manage them are two of the initiatives envisaged in our Strategic Plan 2024![]() . Specifically, they were designed to achieve two of our strategic objectives:

. Specifically, they were designed to achieve two of our strategic objectives:

- “to modernise the Banco de España in order to make it more efficient, flexible and innovative”;

- “to generate greater confidence in the Banco de España and greater value for society”.

Objectives and evaluation process

The objectives of the independent evaluations (see Figure 1) are:

- to examine and improve the Banco de España’s actions;

- to encourage a rational use of public resources and foster service quality management;

- to promote transparency and accountability.

FIGURE 1

OBJECTIVES AND BENEFITS OF INDEPENDENT EVALUATIONS

SOURCE: Banco de España Strategic Plan 2024![]() and Evaluation Programme

and Evaluation Programme![]() .

.

NOTE: The strategic objectives and their numbers are taken from the Banco de España’s Strategic Plan.

How do the evaluations help us meet these aims? The first step is to select the functions to be assessed, to make sure the programme has broad and relevant coverage. The scheduled evaluations are set out in annual plans that are approved by the Governing Council![]() . Wherever possible, the evaluations are performed by a team of external evaluators. This is key to ensure that the evaluations achieve their purpose, as this external viewpoint strengthens the principle of independence and provides a fresh and different perspective. All evaluation team members are persons of recognised professional competence.

. Wherever possible, the evaluations are performed by a team of external evaluators. This is key to ensure that the evaluations achieve their purpose, as this external viewpoint strengthens the principle of independence and provides a fresh and different perspective. All evaluation team members are persons of recognised professional competence.

The team of external evaluators is a key component, providing a fresh and different perspective

The team assesses the efficacy, efficiency and quality of the functions concerned, analysing documentation and conducting numerous interviews. The outcome is a report that includes an assessment of how the Banco de España performs those functions, along with recommendations and improvements that are deemed appropriate. These reports are presented to the Banco de España’s Governing Council.

Once the evaluation report is published, the next question is how to make sure that the improvements identified are implemented. This is where the Action Plan and its implementation come in.

Each Action Plan is drawn up based on the proposals submitted by the area evaluated, in response to the recommendations and conclusions contained in the report. And how is it ensured that these plans are implemented? Through the monitoring of the Action Plan by the Governing Council. For this purpose, the Evaluation and Strategic Planning Office periodically gathers relevant information from the units concerned.

Beyond their specific objectives, the evaluations have other important benefits for the Banco de España:

- they strengthen our learning culture, by analysing best practice, to allow us to adapt to a continuously changing environment;

- they guide our strategy towards actions that will foster cultural change in the institution;

- they consolidate our external credibility as they increase our transparency.

Independent evaluations strengthen our learning culture, guide our strategy and consolidate our external credibility

Independent evaluations at the Banco de España: present and future

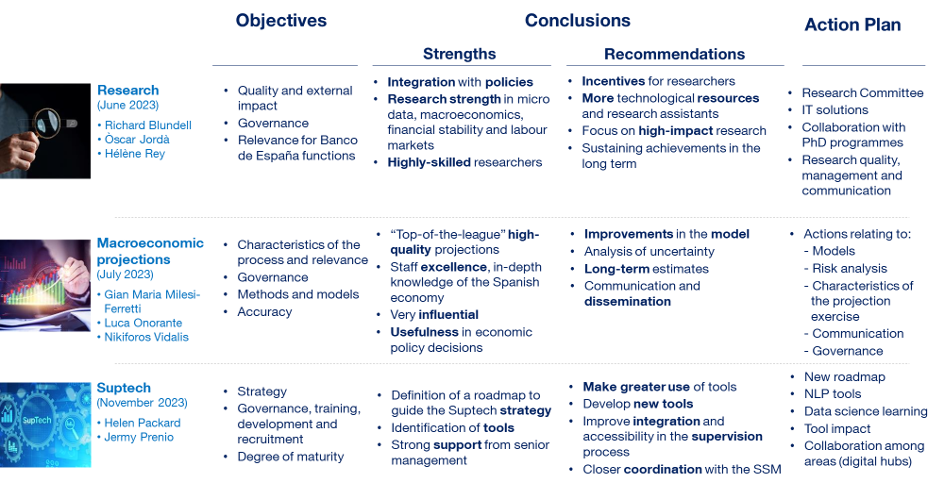

The reports on the three evaluations included in the Annual Assessment Plan 2022-2023 ![]()

![]()

![]() were published in 2023 (see Figure 2 for a summary):

were published in 2023 (see Figure 2 for a summary):

- Banco de España research activities

. The evaluation team highlighted the seamless integration of the research function in the monetary, economic and financial policy-making decision process.

. The evaluation team highlighted the seamless integration of the research function in the monetary, economic and financial policy-making decision process. - Banco de España macroeconomic projections

. The report emphasised the high quality of our projections, the clarity of the narrative and the ability to adapt to changing circumstances.

. The report emphasised the high quality of our projections, the clarity of the narrative and the ability to adapt to changing circumstances. - Suptech

. The external evaluators underlined the support that Suptech – the use of innovative technology in prudential supervision – has received from senior management and the existence of an explicit Suptech strategy and roadmap (see this blogpost

. The external evaluators underlined the support that Suptech – the use of innovative technology in prudential supervision – has received from senior management and the existence of an explicit Suptech strategy and roadmap (see this blogpost ).

).

FIGURE 2

COMPLETED EVALUATION PLAN 2022-2023

SOURCE: Banco de España. Evaluation Plan 2022-2023![]() and the respective evaluation reports

and the respective evaluation reports![]() .

.

NOTE: The first column indicates the date on which the evaluation was submitted to the Governing Council and the members of the evaluation team. NLP = natural language processing.

These reports show how instructive the evaluations have been for the Banco de España, which considers the ensuing action plans to be of great strategic importance.

In addition, under Annual Evaluation Plan 2023-2024![]() , three new external evaluations are now under way to identify strengths and potential areas for improvement in:

, three new external evaluations are now under way to identify strengths and potential areas for improvement in:

- Conduct supervision

- The macroprudential policy decision-making framework

- International cooperation at the Banco de España

The evaluation reports and subsequent actions plans will be published in 2024.

Looking ahead, and as the evaluations gradually cover more and more functions, we hope that they can become an engine for the modernisation and continuous improvement of the Banco de España.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.