Law 7/2020, of 13 November, for the digital transformation of the financial system![]() , establishes a set of measures to foster financial innovation in Spain, including the creation of a controlled testing environment, known internationally as a sandbox.

, establishes a set of measures to foster financial innovation in Spain, including the creation of a controlled testing environment, known internationally as a sandbox.

This environment is a controlled and delimited space in which to test projects involving a technology-based financial innovation applicable to the financial system that must be safe for participants and where risks to the financial system and the participants have been dully mitigated or minimised.

Status of the process: “Next call for applications”

The General Secretariat of the Treasury and International Financing (SGTFI) has called the eleventh cohort for applications of projects to the sandbox through this resolution![]() .

.

The call for applications for access to the sandbox through the Treasury website will be opened from the 2nd of March 2026 to the 14th of April 2026.

More info available at:

The sandbox allows testing, with all the necessary guarantees and under the supervision of the supervisory authority, technology-based financial innovations, provided that they comply, in the opinion of the supervisory authority, with the access requirements set out in Law 7/2020.

The sandbox thus aims to ensure that financial authorities have adequate instruments to continue performing their functions optimally in the new digital context and to facilitate the innovation process in Spain.

In addition, care will be taken to ensure that participation in the sandbox does not impede the full guarantee of public policy objectives in three particularly sensitive areas: the protection of personal data, the protection of users of financial services and the prevention of money laundering and the financing of terrorism.

The requirements for access to the sandbox are laid down in Article 5 of Law 7/2020:

- Projects must provide a technology-based innovation applicable in the financial system and must be sufficiently advanced to be tested.

- Innovative projects must provide potential added value in at least one of the following aspects: a) Facilitating regulatory compliance; b) Entailing a benefit for users of financial services; c) Increasing the efficiency of entities or markets; or, d) Providing mechanisms to improve regulation or financial supervision work.

- For the purposes of access to the regulatory sandbox, the supervisory authorities will take into consideration the impact that the project in question could have on the Spanish financial system.

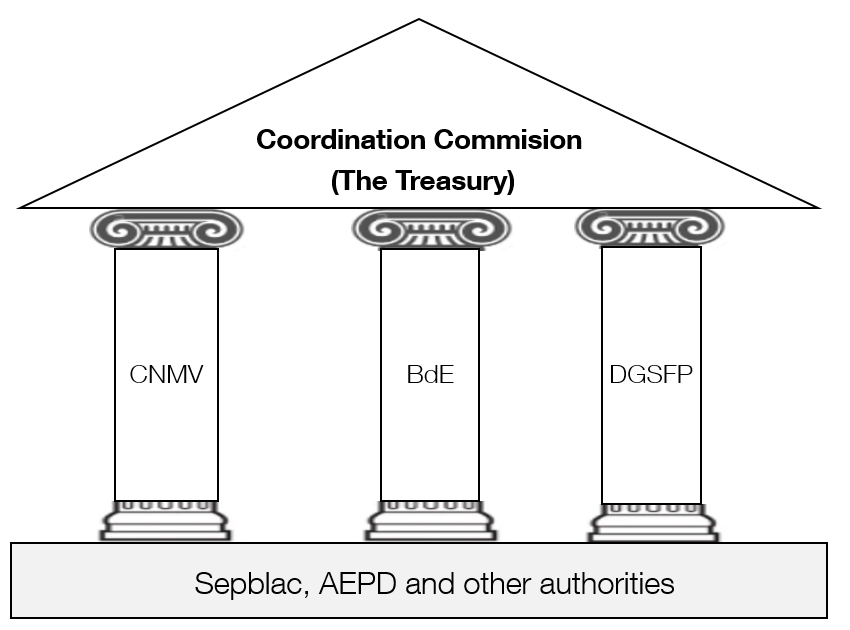

The sandbox is coordinated by the General Secretariat of the Treasury and International Financing (SGTFI, from its initials in Spanish), who chairs the Coordination Commission![]() .

.

The Commission is composed of representatives of the supervisory authorities (Banco de España-BdE-, the National Securities Market Commission-CNMV- and the Directorate General for Insurance and Pension Funds-DGSFP) and of other authorities such as the Executive Service of the Commission for the Prevention of Money Laundering and Monetary Offences (Sepblac) or the Spanish Data Protection Agency (AEPD).

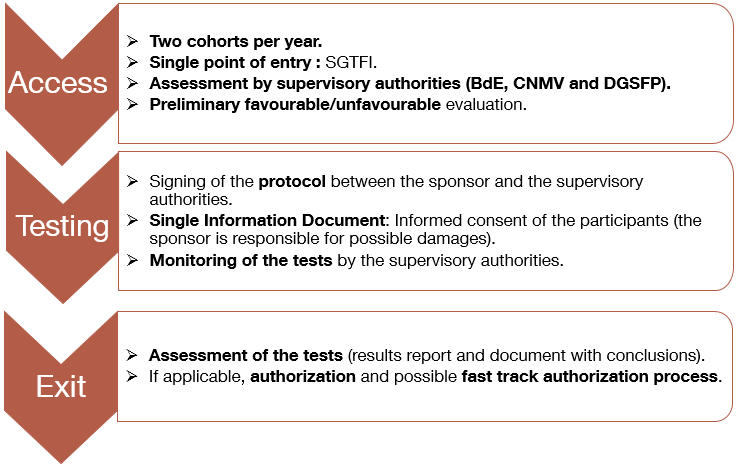

The sandbox consists of three main stages: access, testing and exit.

- Access is requested by submitting an application to the SGTFI (see next section). The supervisory authorities carry out the evaluation of the project by means of a reasoned favourable or unfavourable report on the basis of the access requirements set out in Law 7/2020. The report is forwarded to the SGTFI, which publishes the list of provisionally admitted projects to the sandbox.

- In order to start the testing phase, it is required that the sponsor or group of sponsors, along with the supervisory authorities, subscribe to a protocol specifying the rules and conditions of the tests. In the case of involving real participants in these tests, the sponsor must also gather the informed consents of such participants by obtaining "unique informational documents" and activate the guarantee and compensation schemes.

- Regarding the exit regime, the law provides for the possibility of reducing the procedure times in the event that a license or authorisation is required for the subsequent exercise of the professional activity. This occurs when the competent authorities for granting such authorization deem that the information and knowledge acquired during the testing phase allow for a simplified analysis of compliance with the requirements established by current legislation. In the document with conclusions, possible regulatory barriers that hinder financial innovation may be identified.

Access to the sandbox or the performance of tests within a pilot project shall not under any circumstances entail the granting of authorisation to start the exercise of a reserved activity or for the regular provision of financial services on a professional basis.

The law foresees two annual cohorts to apply for access to the sandbox and that any sponsor, or group of sponsors, whether natural or legal persons, can apply to enter the sandbox. The deadlines for each cohort are published on the SGTFI website.

Interested parties must submit their application, within the term established, through the electronic office of the SGTFI, attaching a supporting report in accordance with the provisions of Article 6 of Law 7/2020.

The SGTFI has published a guide on how to access the sandbox, which can be found at this link:

The first call for applications ran from 12 January to 23 February 2021 and a total of 66 applications were received, of which around two thirds were initially assigned to Banco de España, alone or together with other supervisory authorities. Of the projects reviewed by Banco de España, 10 projects received a preliminary favourable evaluation, and 6 proceeded to testing, following the signature of the corresponding protocol.

The second call was open from 1 September to 13 October 2021 and a total of 13 applications were received. Of these requests, 8 were initially assigned to Banco de España and 1 was subject to a preliminary favourable evaluation by this institution.

The third call was open from 1 March to 12 April 2022. Of the projects reviewed by Banco de España, 2 projects received a preliminary favourable evaluation.

The fourth call was open from 1 September to 13 October 2022. Of the projects reviewed by Banco de España, 2 projects received a preliminary favourable evaluation. In one of them, this institution will act as an observer authority.

The fifth call for proposals took place from March 1st to April 12th, 2023. Out of the projects reviewed by this institution, 4 have received a favourable preliminary evaluation.

The sixth call for submitting projects was open from the 1st of September to the 13th of October 2023.

The seventh call for submitting projects was open from the 1st of March to the 15th of April 2024. Of the projects reviewed by Banco de España, one has received a favourable preliminary evaluation.

The eighth cohort was open from the 2nd of September to the 11th of October 2024. Of the projects reviewed by the Bank of Spain, one received a favorable preliminary evaluation, and this institution will act as an observing authority.

The ninth call was open from the 3rd of March to the 11th of April 2025. One project has received a favourable preliminary evaluation.

The application period for the tenth cohort was open from September 1 to October 10, 2025.

The Banco de España drafts, in accordance with article 17.3 of Law 7/2020, a conclusions’ document assessing the development and the results of the tests of those projects that have completed them. Below, you can consult the documents with conclusions of the following projects:

Conclusions reports 1st cohort

- Vottun-Intercompany

(327 KB)

(327 KB) - Custodia digital en blockchain

(431 KB)

(431 KB) - Dalion

(359 KB)

(359 KB) - Ithium 100

(280 KB)

(280 KB) - NeuroDecision Technology - IA explicable en la gestión de riesgos

(302 KB)

(302 KB) - Anillos

(243 KB)

(243 KB)

Conclusions reports 2nd cohort

Conclusions reports 3rd cohort

Conclusions reports 4th cohort

Conclusions reports 5th cohort

- Tarjeta Openbank en DNI-Wallet

(238 KB)

(238 KB) - Onboarding financiero con DNI-Wallet

(245 KB)

(245 KB) - Segundo Factor autenticacion con DNI-Wallet

(239 KB)

(239 KB) - Identificacion fisica en oficina con DNI-Wallet

(238 KB)

(238 KB)

This list will be updated as soon as other projects complete the tests and their corresponding documents with conclusions are approved.

Should you have more questions about the procedure or the entry requirements of our sandbox, read our answers to the most frequently asked questions ![]() (430 KB).

(430 KB).

You may contact us through our form for queries on technology-based financial innovation![]() .

.

Please bear in mind that we can’t confirm if your application to the sandbox would be successful should you apply to the sandbox in any future cohort.