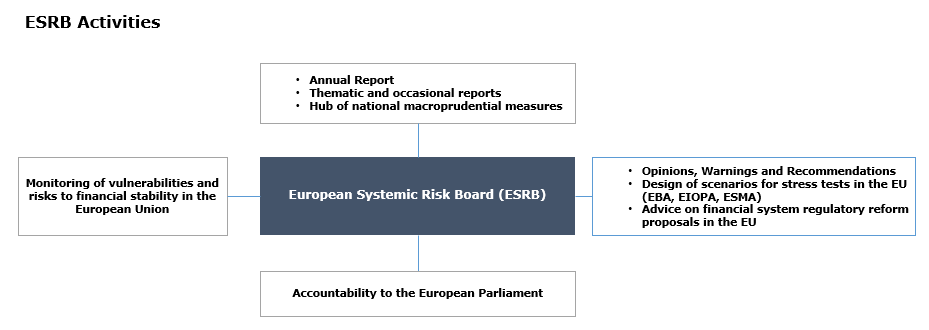

Since its establishment in 2011, the European Systemic Risk Board![]() (ESRB) has been entrusted with macroprudential oversight of the European Union financial system in order to help prevent and mitigate systemic financial stability risk. To do so, the ESRB can issue recommendations and warnings on identified risks, in addition to opinions on proposed national macroprudential measures.

(ESRB) has been entrusted with macroprudential oversight of the European Union financial system in order to help prevent and mitigate systemic financial stability risk. To do so, the ESRB can issue recommendations and warnings on identified risks, in addition to opinions on proposed national macroprudential measures.

The ESRB has no binding powers over its member institutions and its recommendations are subject to the “act or explain” principle.

The ESRB has a Secretariat located at the ECB. Its decision-making body is the General Board, which is assisted and advised by a framework of working groups, including notably the Advisory Technical Committee (ATC).

Regular publications:

Other publications: