Definition

Investment made by venture capital entities and other collective investment entities in which the divestment/redemptions policy of their shareholders or participants meets the following requirements:

- that divestments/redemptions occur simultaneously for all shareholders or participants, and

- that what is received by each shareholder or participant is based on the rights corresponding to each of them, according to the terms established in their statutes or regulations for each class of shares or units.

Further information

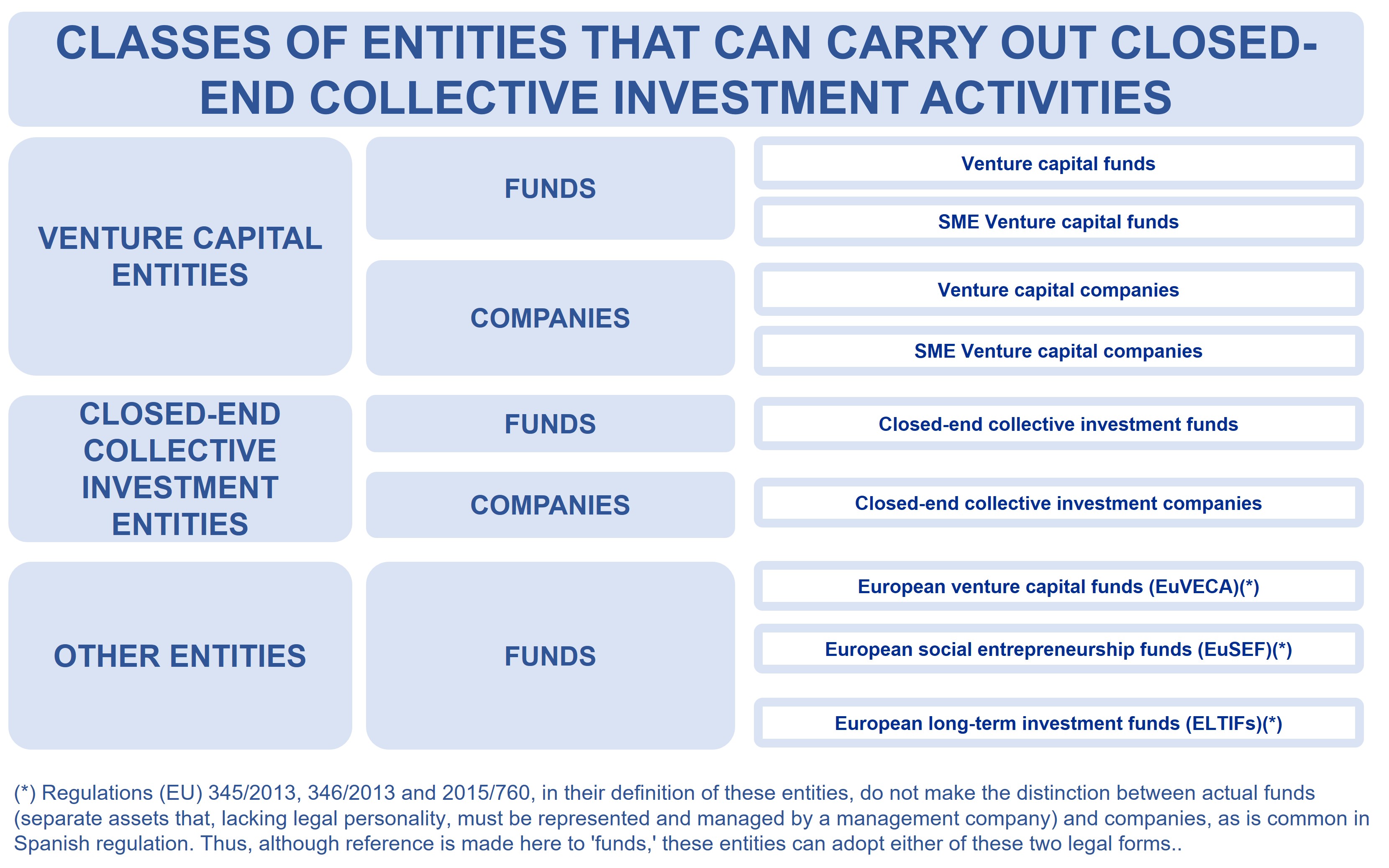

Venture capital entities and other closed-end collective investment entities can be structured as funds or as companies. When they take the former form, they lack legal personality and must necessarily be represented and managed by a management company.

The different types of entities that can carry out closed-end collective investment activities are detailed in the following table:

In general, these entities are included in the subsector ‘non-monetary investment funds’, S.124 in the European System of Accounts 2010, when they are funds, while they are included in the subsector ‘other financial intermediaries, except insurance companies and pension funds’, S.125 in the European System of Accounts 2010, when they are companies.

Venture capital entities

Venture capital entities obtain capital from a series of investors through a commercial activity whose business purpose is to generate profits or returns for the investors. Their main objective is to take temporary stakes in the capital of companies that are neither real estate nor financial in nature, and that are not listed on the primary stock market or on any other equivalent regulated market in the EU or other OECD member countries.

Venture capital funds and companies are included in this general definition.

On the other hand, SME venture capital funds and companies are required to have at least 75% of their assets invested in financial instruments that serve to finance companies which, at the time of investment:

- are not listed on a regulated secondary market or multilateral trading system;

- have fewer than 499 employees;

- do not exceed 43 million euros in annual assets or 50 million euros in turnover;

- are not collective investment institutions, financial companies, or real estate companies; and

- are established in Member States of the European Union or in third countries, provided that such third country is not listed as a non-cooperative country or territory by the Financial Action Task Force on Money Laundering and has signed an agreement with Spain to avoid double taxation with an information exchange clause or a tax information exchange agreement.

Finally, in the case of European venture capital funds, their investment must be materialized, at least 70%, in supporting eligible companies, such as young and innovative SMEs. Additionally, as they must comply with a set of uniform requirements and conditions within the European Union, they are marketable in that geographical area.

Closed-end collective investment entities

Closed-end collective investment entities lack a commercial or industrial objective, and their activity consists of obtaining capital from a series of investors to invest it in all types of financial or non-financial assets, according to a defined investment policy.

In this general definition, closed-end collective investment funds and companies are included.

On the other hand, European social entrepreneurship funds invest at least 70% of their capital in companies whose primary objective is to achieve a positive and measurable social impact, that have responsible and transparent management, and whose shares are not admitted to trading on a regulated market or a multilateral trading system at the time of investment.

Related concepts

- Venture capital funds

- European venture capital funds (EuVECA)

- European social entrepreneurship funds (EuSEF)

- Closed-end investment funds

- Venture capital companies

- Venture capital entities

- Closed-end collective investment entities

- Management companies of closed-end collective investment schemes

References

- Sectorisation table (European System of Accounts 2010).

- European System of Accounts 2010. Interactive version.

Legal frame

Update date: May 2025