The flash floods in Spain, one year on: the economic impact of a natural disaster

Natural disasters like the Valencia floods bring economic activity to a standstill. The reconstruction effort is helping GDP recover and replacing damaged assets with more productive capital may boost growth. But the heavy losses in the stock of wealth and capital could have a lasting negative effect on GDP growth in the region.

Extreme rainfall can have devastating social and economic effects and take a heavy toll in human terms. This was the case a year ago, on 29 October 2024, when Spain was hit by a “cut-off low”, a meteorological phenomenon that caused severe flash floods, particularly in Valencia province![]() . Not only were there tragic consequences in terms of human lives (close to 230 deaths

. Not only were there tragic consequences in terms of human lives (close to 230 deaths![]() in that province), but the disaster has also had a profound and long-lasting economic impact in the region, disrupting the normal course of economic activity and affecting factors of production and household wealth. Nonetheless, economic reconstruction in the region could lead to a recovery in activity and improvements in productive capacity, with significant implications over the medium and long term.

in that province), but the disaster has also had a profound and long-lasting economic impact in the region, disrupting the normal course of economic activity and affecting factors of production and household wealth. Nonetheless, economic reconstruction in the region could lead to a recovery in activity and improvements in productive capacity, with significant implications over the medium and long term.

How does a natural disaster like the flash floods affect the economy?

When a natural disaster occurs, the economy suffers, owing to the negative impact on economic flows and the stock of wealth. To properly understand the impact of the floods, it is important to understand the difference between flow and stock variables.

DID YOU KNOW...?

Stock variables represent inventories or goods or assets built up at a specific point in time. For instance:

-A household’s assets or wealth, including their home, built up over time with the income of each household member;

-A firm’s factors of production, such as its workers and capital (machinery, facilities); capital is built up through investments in retained earnings or loans.

Flow variables are usually economic flows arising from stock variables and are quantified in units over time.

-The main flow variable is gross domestic product (GDP)![]() , which measures the monetary value of the goods and services produced in a given place over a period of time. GDP measures the output of the factors of production.

, which measures the monetary value of the goods and services produced in a given place over a period of time. GDP measures the output of the factors of production.

Flow and stock variables are closely linked and feed into each other. Picture a running tap (the flow) that fills up a bathtub (the stock). But the tap doesn’t create water out of nowhere – it draws from the bathtub’s supply.

Figure 1 outlines the impact channels of the flash floods and their positive or negative effects over time:

Figure 1

THE ECONOMIC IMPACT OF THE FLASH FLOODS OVER TIME: GDP, CAPITAL AND WEALTH (click the boxes to see more)

SOURCE: Banco de España.

The immediate impact

Highly negative, both on production flows and on the assets of those affected:

- Disruption of economic activity: the standstill in sectors such as the wholesale and retail trade, transportation, tourism and construction in the weeks following the flash floods triggered a temporary drop in GDP, as indicated in our end-2024 projections

.

.

-

- Commuter difficulties as a result of the mobility restrictions, which halted production at various firms.

- Problems in accessing banking services and with means of payment (including damaged banknotes) hampered activity. The Banco de España monitored these problems closely and helped mitigate them

.

. - Damage to roads and railways led to disruptions in the transportation of goods. For example, the diversion of traffic due to motorway closures

led to supply delays and higher production costs.

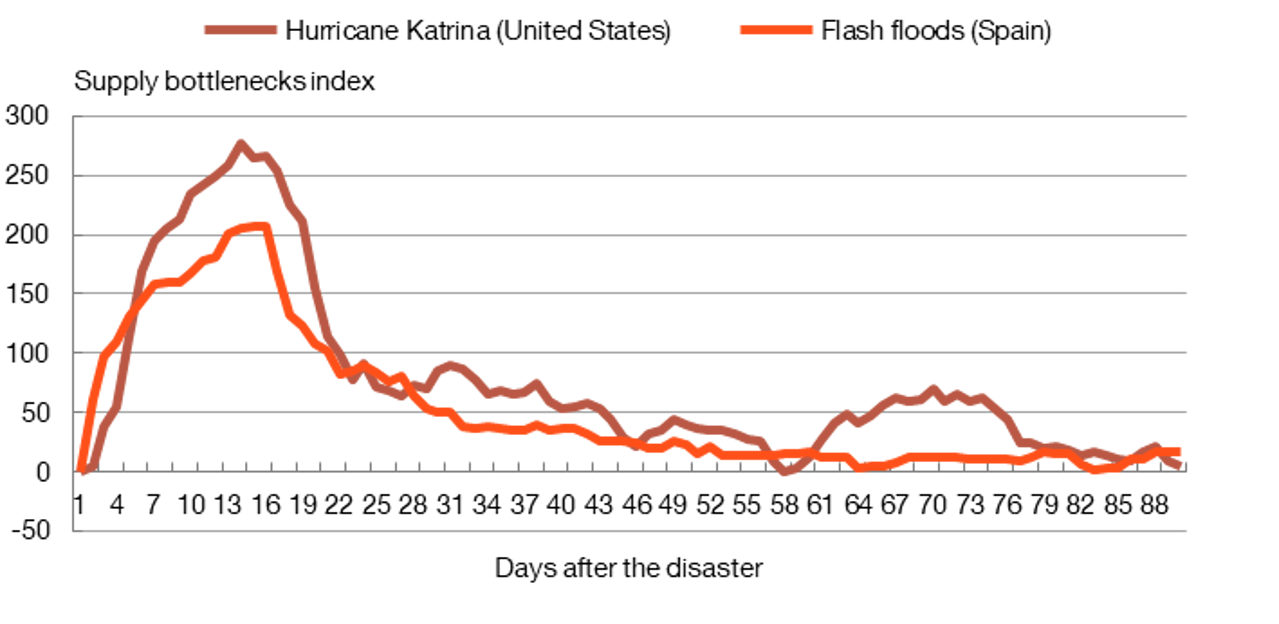

led to supply delays and higher production costs. - Chart 1 shows the sharp spike in the “supply bottlenecks

” index following the flash floods (similar to that observed after Hurricane Katrina in 2005

” index following the flash floods (similar to that observed after Hurricane Katrina in 2005 ), which gradually diminished after a fortnight.

), which gradually diminished after a fortnight. - Damage to infrastructures and tourist establishments and beaches led to a decline in hotel and restaurant reservations in the region.

Chart 1

THE FLASH FLOODS IN SPAIN AND HURRICANE KATRINA IN THE UNITED STATES CAUSED COMPARABLE SUPPLY PROBLEMS

SOURCE: Banco de España, based on Burriel, Kataryniuk, Moreno Pérez and Viani (2024)![]() .

.

NOTE: The bottlenecks index measures the share of newspaper articles in affected countries that report on supply problems. The series depict the 15-day moving average of the index in Spain and the United States since the disaster: from 28 August 2005 for Hurricane Katrina and from 28 October 2024 for the flash floods.

- Destruction of capital stock and wealth: a wide range of physical assets were damaged or destroyed in the flood-stricken areas, affecting the wealth of households (e.g. homes and vehicles

), firms (e.g. commercial premises, factories, lorries and machinery) and public infrastructure (e.g. transport networks, educational institutions and government facilities).

), firms (e.g. commercial premises, factories, lorries and machinery) and public infrastructure (e.g. transport networks, educational institutions and government facilities).

It is important to note that GDP does not account for this loss of capital and assets. In fact, the hit to wealth is much greater than the impact of the flash floods as reflected in the GDP, which comes to mere fractions of a percent. Some estimates point to the wealth lost in Valencia province amounting to more than €17 billion![]() – more than 20% of its GDP in 2023.

– more than 20% of its GDP in 2023.

While the flash floods have caused an extraordinary loss of wealth and capital in the affected areas, they have had little negative impact on GDP

Short term

In the wake of the disaster, the replacement of damaged capital and State aid for reconstruction jump-starts economic activity. This positive flow effect could cause GDP to rebound, as explored below.

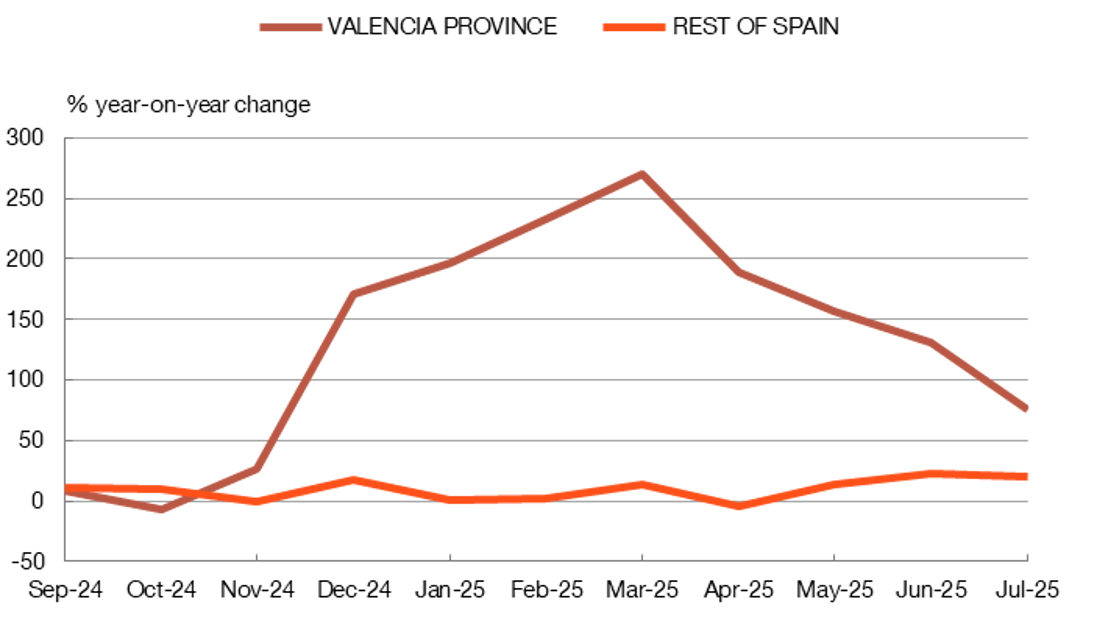

- Increased spending to replace damaged durable goods: firms and households increase spending in the wake of natural disasters to repair or replace damaged goods. Victims of the flash floods have been forced to repair and rebuild homes and commercial premises, driving demand for construction and professional services. Likewise, replacing household appliances, furniture and cars has caused private spending to spike, reinvigorating the local economy. Chart 2 shows new car registrations in Valencia shooting up from December 2024.

Chart 2

NEW PRIVATE VEHICLE REGISTRATIONS SHOT UP IN VALENCIA AFTER THE FLASH FLOODS

SOURCE: Asociación Española de Fabricantes de Automóviles y Camiones.

2. Reconstruction aid: private endeavours are backed by public support measures. In the case of the flash floods![]() , extraordinary resources have been mobilised, including direct aid, compensation from the Insurance Compensation Consortium, state guarantees

, extraordinary resources have been mobilised, including direct aid, compensation from the Insurance Compensation Consortium, state guarantees![]() for firms and payment moratoria

for firms and payment moratoria![]() for loans. These measures amount to significant fiscal transfers and the evidence

for loans. These measures amount to significant fiscal transfers and the evidence![]() from similar situations suggests that they are key to economic recovery after a disaster.

from similar situations suggests that they are key to economic recovery after a disaster.

The aid for reconstruction and spending on replacing damaged goods and capital may cause GDP to rebound in the following quarters

Medium term

The loss of resources and assets can weigh on economic activity, but renewing capital can invigorate it.

- A loss of productive capacity and wealth limits activity. Damage to the assets of firms and families can negatively affect their financial soundness and even lead to business closures. This also results in greater difficulties in accessing external financing

. The outcome is a diminished capacity not only for production, but also for spending and consumption. All these factors can have a lasting negative impact on GDP.

. The outcome is a diminished capacity not only for production, but also for spending and consumption. All these factors can have a lasting negative impact on GDP. - Replacement with more productive capital: in the longer term, floods could have a positive impact on productivity as surviving firms replace old capital with more modern and efficient alternatives

. For instance, a factory might replace damaged production lines with new automated robots and begin to leverage artificial intelligence to optimise production.

. For instance, a factory might replace damaged production lines with new automated robots and begin to leverage artificial intelligence to optimise production.

In conclusion, natural disasters like the flash floods significantly damage the assets and wealth of households, firms and the public sector, with an immediate negative impact on activity. This downturn can be corrected in the following months by a rebound effect: GDP often falls for a time before picking up. However, analysing the long-term impact on the activity of the affected area is far more complex, as the potential loss of productive capacity may be offset by replacement with more productive capital.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.