The 2025 Nobel Prize in Economics: how technological innovation drives economic growth

The 2025 Nobel Prize in Economics has been awarded to Professors Mokyr, Aghion and Howitt. Their analysis explains why economic growth only took off after the industrial revolution. The resulting social and economic environment prompted a cascade of innovations and speeded up growth. A timely award just when that environment seems to be changing.

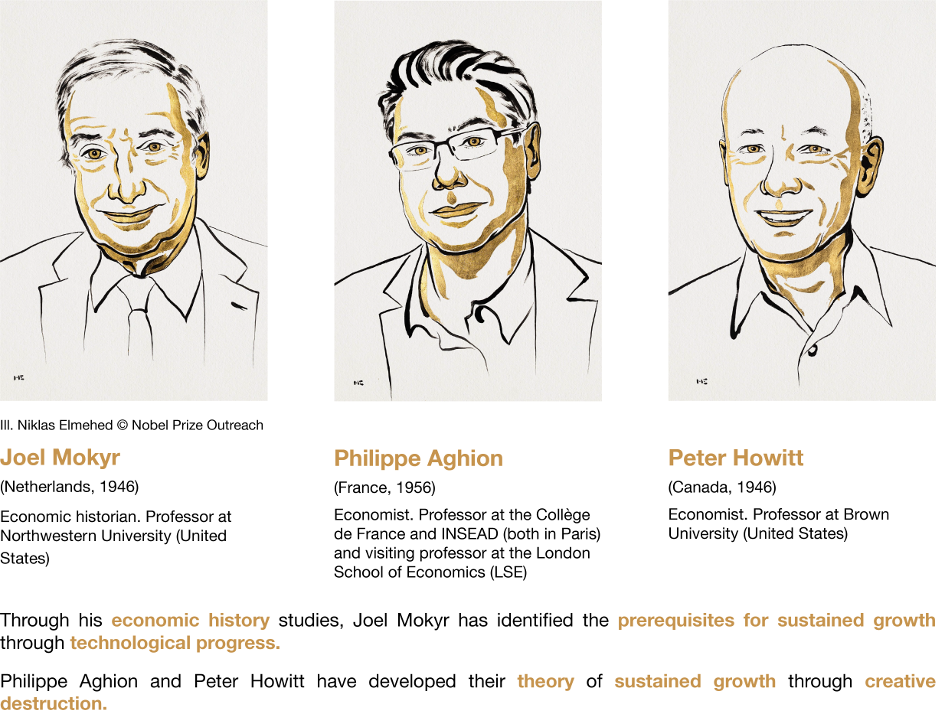

Technological progress has been a constant throughout history, yet it is only in the last two centuries that it has generated high and sustained economic growth. Why is this? What drives the continuous series of innovations that fuel economic growth? This year the Nobel Prize in Economics recognises three economists who have studied these issues: Joel Mokyr![]() , whose work draws on historical analyses, and Philippe Aghion

, whose work draws on historical analyses, and Philippe Aghion![]() and Peter Howitt

and Peter Howitt![]() , who have developed theoretical models that link sustained growth to creative destruction and competition (Image 1). At a time marked by large-scale technological shifts but lacklustre growth, particularly in Europe, the Nobel laureates help us identify growth drivers and the barriers to innovation.

, who have developed theoretical models that link sustained growth to creative destruction and competition (Image 1). At a time marked by large-scale technological shifts but lacklustre growth, particularly in Europe, the Nobel laureates help us identify growth drivers and the barriers to innovation.

Image 1

THE 2025 NOBEL PRIZE. THE RELATIONSHIP BETWEEN INNOVATION AND ECONOMIC GROWTH

SOURCE: The Nobel Foundation

How have the 2025 laureates helped us understand economic growth?

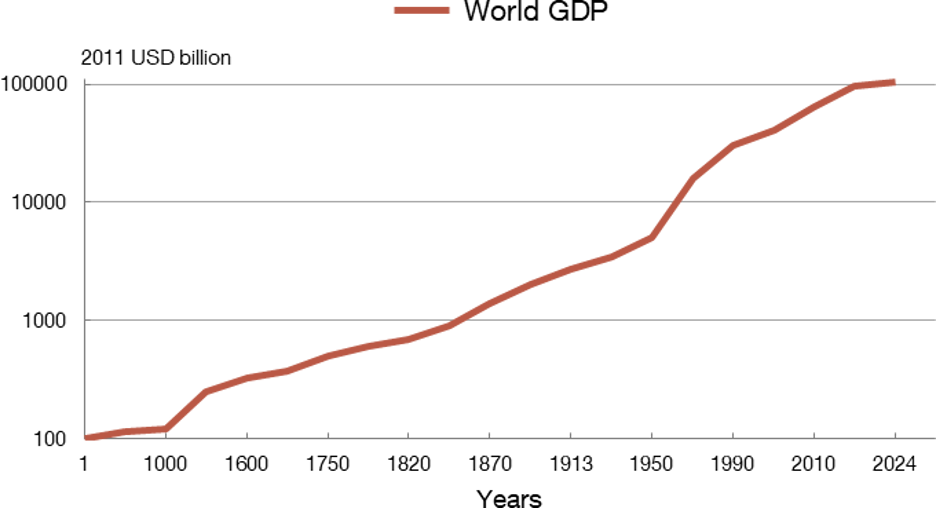

We have become used to seeing economic growth almost every year. We tend to assume that this has always been the case. But as Chart 1 shows, from a historical standpoint it is an exception. Economic growth only began to increase exponentially from 1820 and continued to accelerate in the second half of the 20th century. Indeed, growth is, in itself, a modern-day innovation.

Rapid and sustained growth is also an industrial age innovation; until the 19th century, decades passed with no measurable economic growth

Chart 1

ECONOMIC GROWTH ONLY ACCELERATED AFTER THE INDUSTRIAL REVOLUTION

SOURCE: Maddison Project Database![]()

NOTES: The data are presented on a log scale, which means that the slope of the curve between the years on the horizontal axis determines the annual average rate of growth for each period. On these data, between the year 1000 and 1820 growth amounted to barely 0.2%, between 1820 and 1950 it stood at 1.5% and between 1950 and 2000 it was over 5%. Since that year, owing to a succession of economic crises and various other factors, it has decreased considerably.

Why is economic growth much higher now than in the past? Technological changes since the industrial revolution are one obvious reason. But major technological innovations in the past – such as transoceanic travel or the printing press – did not trigger waves of innovation or accelerated growth as they have in the last two centuries.

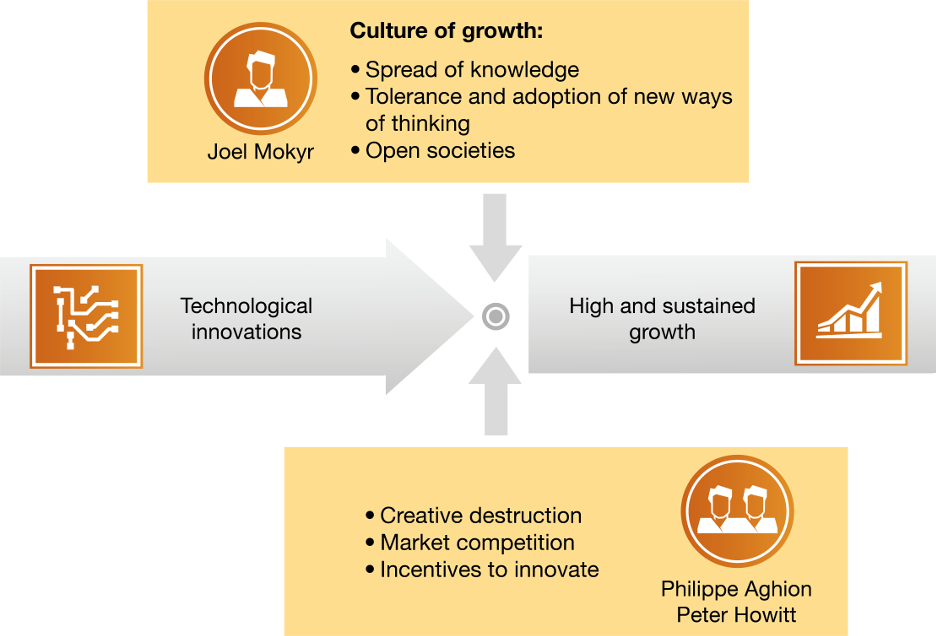

What are the drivers of this greater innovation and higher and more sustainable growth? This year’s laureates have studied these issues. Professor Mokyr has focused on the prerequisites for innovations to multiply and translate into growth. Professors Aghion and Howitt have examined the incentives for innovation and the economic conditions for continued growth. Their contributions are summarised in Figure 1.

DID YOU KNOW…?

- This year's award is closely linked to last year's, which recognised the importance of institutions for economic growth

.

. - One of Peter Howitt’s colleagues at Brown is Roberto Serrano, the last winner of the King of Spain Prize in Economics

.

. - One half of the award goes to Joel Mokyr, while the other half is divided equally between Philippe Aghion and Peter Howitt.

- Where to find out more about their work?

- Joel Mokyr sets out his main research in his book "A Culture of Growth"

(2016).

(2016). - Philippe Aghion and Peter Howitt made their key contribution in their paper entitled “A Model of Growth Through Creative Destruction”

(1992).

(1992). - Philippe Aghion develops and expands on these ideas in his book "The Power of Creative Destruction"

(2021).

(2021).

- Joel Mokyr sets out his main research in his book "A Culture of Growth"

Figure 1

THE NOBEL LAUREATES’ CONTRIBUTION: HOW INNOVATION TRANSLATES INTO SUSTAINED ECONOMIC GROWTH

SOURCE: Devised by the author.

Drawing on historical data, Professor Mokyr has shown how, from the early 19th century, science and technology have fuelled each other. This is thanks to what he calls the “culture of growth”, which laid the foundations for the development, accumulation and spread of technological advances needed to trigger sustained economic growth. The main elements of this culture are:

- intellectual freedom and tolerance for new ways of thinking;

- the spread of knowledge through established channels;

- societies that encourage pluralism and are adaptable and open to innovation.

The contributions of the other two laureates, Aghion and Howitt, focus on the economic processes and incentives that foster innovation, thus complementing this research. Their mathematical models analyse the decisions of entrepreneurs and innovators and their aggregate impact on the economy. This work reveals a link between innovation and economic growth, driven by three key elements:

- Creative destruction

, a term coined by Schumpeter

, a term coined by Schumpeter in the mid-20th century, which describes how innovations replace outdated technologies, rendering old firms and methods obsolete. Business births and deaths (each accounting for just over 9% of total firms per year in Spain) energise the economy. Less innovative firms tend to disappear, while more innovative ones thrive, fuelling innovation and growth.

in the mid-20th century, which describes how innovations replace outdated technologies, rendering old firms and methods obsolete. Business births and deaths (each accounting for just over 9% of total firms per year in Spain) energise the economy. Less innovative firms tend to disappear, while more innovative ones thrive, fuelling innovation and growth. - Market competition is vital for this process to work. The prospect of future profits encourages firms and entrepreneurs to innovate. When dominant firms prevent their competitors from entering the market, they can continue to turn a profit without innovating. By contrast, competition forces the leading firms to continue innovating to retain their position, giving new innovative players the chance to enter the market and gain a stronghold. However, too much competition may reduce innovation incentives, as rewards are quickly captured by other entrepreneurs and innovators.

- Protection of innovation involves mechanisms like patents and public policies such as financial incentives to innovation and educational and scientific policies to foster and sustain it.

A culture of growth, creative destruction, competition and protection of innovation are the key elements for technological progress to lead to sustained growth

Why is this Nobel prize relevant in the current context?

In recent decades economic growth has slowed across advanced economies. In Europe in particular the challenge of fostering innovation and sustaining strong economic growth has become a central economic policy concern. The Draghi report, featured in one of our previous blog posts![]() , draws inspiration from the contributions of this year’s Nobel laureates; it provides a sobering analysis of the economic and institutional barriers to innovation in Europe.

, draws inspiration from the contributions of this year’s Nobel laureates; it provides a sobering analysis of the economic and institutional barriers to innovation in Europe.

Moreover, the United States is currently spearheading the introduction of barriers to trade, which reduce international competition through protectionist measures. The United States is also scaling back policies supporting research and innovation and the attraction of foreign talent, against all economic logic.

The relationship between innovation and growth is at the heart of several current economic trends. For example, artificial intelligence (AI) is set to reshape both scientific and technological progress and employment![]() and economic processes, with the potential to boost growth. The transition to a green economy also relies on technological innovation. And on the financial front, financial digitalisation is transforming payment systems, changing the way we use money and manage our finances.

and economic processes, with the potential to boost growth. The transition to a green economy also relies on technological innovation. And on the financial front, financial digitalisation is transforming payment systems, changing the way we use money and manage our finances.

The contributions of this year’s Nobel prize winners serve as a reminder that providing incentives to the private sector through well-designed public policies is key to unlocking the full potential of these economic and technological revolutions.

What do these contributions mean for a central bank? The primary objective of the Banco de España and the Eurosystem is price stability. But in order to achieve this, we need to know where the economy and the labour market stand. When the economy is growing above its sustainable rate – specifically, above its potential growth rate – pressures on employment and inflation are more likely. And what we have learnt is that innovation affects this potential growth. From the standpoint of financial stability – another key central bank mandate – understanding how financial innovation will affect financial systems and the economy going forward is essential.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.