Desertification and wildfires in Spain. The impact of climate change on bank lending

Desertification and the greater severity and frequency of wildfires pose a major climate risk for Spain. Together they can affect economic activity and also bank lending and financial stability. Conducting rigorous research on these issues allows us to understand their financial risk and helps us mitigate it.

Increasingly scorching summers are a stark reminder that climate change is already upon us. In Spain, dwindling rainfall is causing droughts and speeding up desertification, while extreme events, like massive wildfires![]() and torrential downpours that trigger flash floods, are becoming more and more common. These incidents affect economic activity and heighten risks for the financial sector, as we saw during the flash floods that ravaged the region of Valencia in October 2024

and torrential downpours that trigger flash floods, are becoming more and more common. These incidents affect economic activity and heighten risks for the financial sector, as we saw during the flash floods that ravaged the region of Valencia in October 2024![]() . Among other things, the banking sector may incur losses in the wake of extreme events and see a reduction in borrower solvency. As a central bank tasked with safeguarding the stability of the financial system, it is essential for us to understand how banks respond to these risks. Drawing on our latest research, this blog post focuses on the impact on bank lending of two climate change-related risks: desertification

. Among other things, the banking sector may incur losses in the wake of extreme events and see a reduction in borrower solvency. As a central bank tasked with safeguarding the stability of the financial system, it is essential for us to understand how banks respond to these risks. Drawing on our latest research, this blog post focuses on the impact on bank lending of two climate change-related risks: desertification![]() (a chronic process) and wildfires

(a chronic process) and wildfires![]() (extreme events).

(extreme events).

Average temperatures in Spain have risen by around two degrees over the last 50 years, with the 11 hottest years on record all occurring in the 21st century![]() . Spain is also one of the western countries most vulnerable to climate change, facing serious threats from desertification and wildfires alike. With nearly three-quarters of its territory consisting of arid land prone to desertification

. Spain is also one of the western countries most vulnerable to climate change, facing serious threats from desertification and wildfires alike. With nearly three-quarters of its territory consisting of arid land prone to desertification![]() , Spain is one of Europe’s most exposed countries to this risk. Meanwhile, wildfires have become increasingly destructive

, Spain is one of Europe’s most exposed countries to this risk. Meanwhile, wildfires have become increasingly destructive![]() in recent years, placing Spain as one of the most affected countries in Europe

in recent years, placing Spain as one of the most affected countries in Europe![]() . Indeed, in 2022 around 40% of the hectares ravaged by forest fires in the EU were within Spain’s borders.

. Indeed, in 2022 around 40% of the hectares ravaged by forest fires in the EU were within Spain’s borders.

Moreover, the risks of desertification and wildfires reinforce one another: drier land is more prone to severe forest fires, while fires leave the soil unprotected, reducing its ability to retain water and accelerating its degradation. This interaction creates a vicious cycle of environmental deterioration which, in addition to harming ecosystems, may have long-lasting effects on economic and financial activity.

How does desertification affect bank lending?

The gradual worsening of desertification in Spain is related not only to global warming but also to an imbalance between urban/rural and inland/coastal areas and the spread of water-intensive crops, among other factors.

It is difficult to gauge the overall impact of desertification on bank lending, as it can have opposing effects:

- Negative on the demand side: generally, the more arid the land, the lower its value. Land is often used as collateral when applying for loans, so this reduces its owners’ access to credit.

- Positive on the demand side: the owners of farmland, factories or infrastructure may seek additional credit to finance investments aimed at mitigating the effects of climate change or replacing assets damaged by it. These include, for example, investments in the real estate and tourism sectors to improve buildings’ climate control systems and energy efficiency.

- Negative on the supply side: banks may perceive a greater risk of insolvency, which could reduce their willingness to lend in areas affected by desertification.

One Banco de España paper![]() examined how desertification affects lending to non-financial corporations in Spain, drawing on municipality-level loan data from the Banco de España’s Central Credit Register (CCR

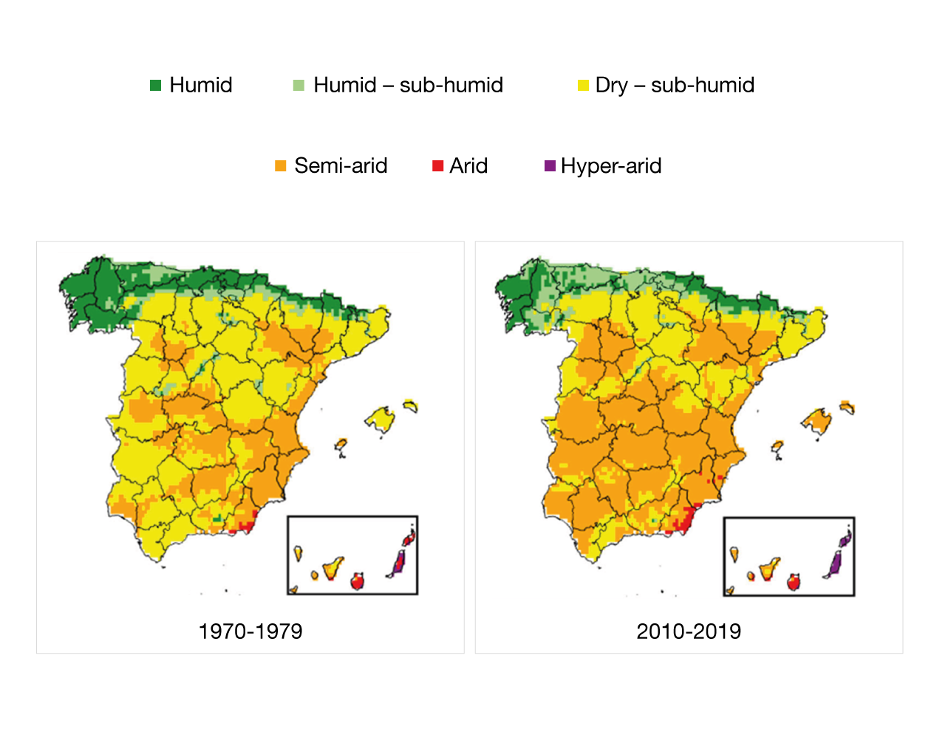

examined how desertification affects lending to non-financial corporations in Spain, drawing on municipality-level loan data from the Banco de España’s Central Credit Register (CCR![]() ) for the period 1984-2019. We conducted a regression analysis to assess how strongly lending responds to changes in our aridity index. Chart 1 overlays the index on the map of Spain, illustrating how desertification has increased in the last few decades.

) for the period 1984-2019. We conducted a regression analysis to assess how strongly lending responds to changes in our aridity index. Chart 1 overlays the index on the map of Spain, illustrating how desertification has increased in the last few decades.

Chart 1

ARIDITY HAS INCREASED IN SPAIN IN RECENT DECADES

SOURCE: Broto and Hubert (2025)![]() , drawing on Copernicus data.

, drawing on Copernicus data.

NOTE: The aridity distribution in Spain is based on the climate zones defined by UNEP (1992)![]() , where the annual aridity index

, where the annual aridity index![]() has been averaged per decade. The climate zones are ranges of the index, from lowest (hyper-arid) to highest (humid). The grid resolution is 0.1°, equivalent to 8.5 km at the latitude of continental Spain.

has been averaged per decade. The climate zones are ranges of the index, from lowest (hyper-arid) to highest (humid). The grid resolution is 0.1°, equivalent to 8.5 km at the latitude of continental Spain.

DID YOU KNOW...

-The aridity index![]() is based on the definition provided by the United Nations Environment Programme

is based on the definition provided by the United Nations Environment Programme![]() (UNEP). The index rises with temperature – which determines the quantity of water that potentially evaporates from the land surface – and declines with precipitation.

(UNEP). The index rises with temperature – which determines the quantity of water that potentially evaporates from the land surface – and declines with precipitation.

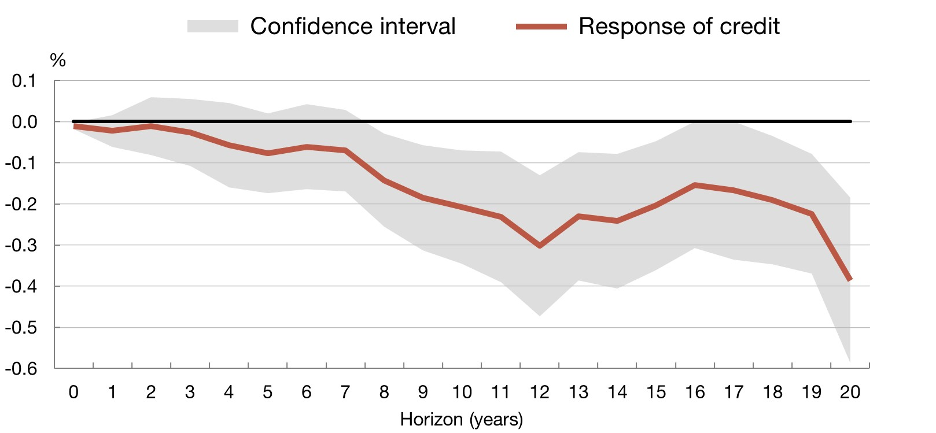

The study found that increased aridity leads to a decrease in lending to firms, albeit a gradual one. As Chart 2 shows, it takes more than eight years for the effect to become statistically significant. For every percentage point increase in aridity, lending decreases by 0.25% between 8 and 20 years later.

Higher aridity reduces lending in the affected municipalities, although the impact takes years to materialise

Chart 2

IMPACT OF RISING ARIDITY IN SPAIN ON CREDIT TO FIRMS

SOURCE: Broto and Hubert (2025)![]()

NOTES:

- The impulse-response functions represent the impact of a 1% increase in the aridity index on lending to non-financial corporations, estimated based on local projections. For more details, see Broto and Hubert (2025)![]() .

.

- The confidence interval indicates the range of impact with a 90% probability. If the grey area does not cross zero on the x-axis, the impact is statistically significant (i.e. non-zero) with a 90% probability.

The impact is uneven across sectors. As one would expect, credit to the agricultural sector is the most affected. Similarly, lending responds differently depending on the climate zone and sector. Interestingly, in the tourism sector, a drier climate (i.e. greater aridity) in Spain’s more humid regions actually boosts lending.

How do wildfires impact firms in the affected areas?

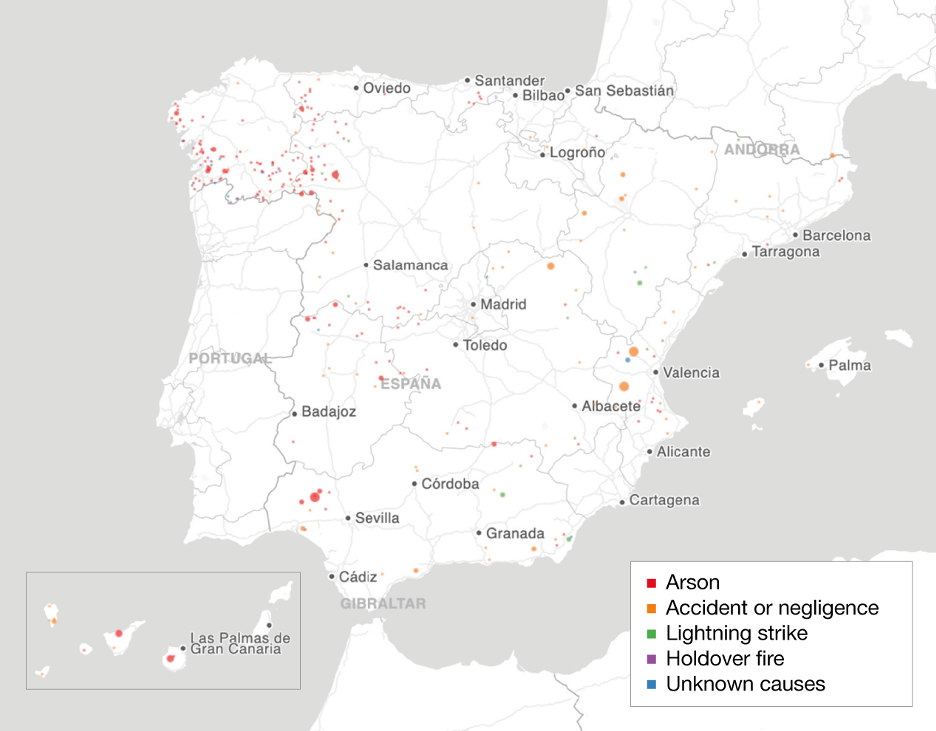

In another recent article![]() we examined the effects of wildfires on firms in fire-hit areas. First, we geolocated both forest fires (Chart 3) and firms to identify which businesses had been affected by wildfires in the period 2004-17. We then compared turnover and lending data for firms located within 10 km of the wildfire with the figures for similar businesses in areas 20-40 km away.

we examined the effects of wildfires on firms in fire-hit areas. First, we geolocated both forest fires (Chart 3) and firms to identify which businesses had been affected by wildfires in the period 2004-17. We then compared turnover and lending data for firms located within 10 km of the wildfire with the figures for similar businesses in areas 20-40 km away.

Chart 3

MAJOR FIRES IN SPAIN AND THEIR CAUSES (2004-2017)

SOURCE: Civio![]()

NOTE: Fires larger than 500 hectares. The size of the dot reflects the size of the area burned.

The key finding was that wildfires lead to a drop in firms’ turnover (by 7 percentage points of total assets), which may also adversely affect their access to finance. We likewise found that employment decreases at these firms relative to unaffected firms.

Our analysis also indicated that wildfires reduce lending to affected firms by around 6% relative to unaffected firms.

Wildfires decrease lending by 6% relative to unaffected areas, although the presence of local banks helps mitigate the impact

One factor that influences the outcome is the presence of local banks (those whose business is concentrated in a specific area). Thanks to their proximity and better understanding of the local context and the effects of the fire (known as “soft information”), these are better positioned to continue lending to the affected firms without incurring higher default rates. The greater flow of credit to firms located in areas with more local banking helps lessen the fires’ adverse impact on employment.

Both sets of research demonstrate the major impact that climate change is already having on activity and economic and financial stability. At the Banco de España we recognise this and are working to incorporate such risks into our analysis and oversight, while encouraging banks to factor them into their own practices.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.