Size does matter. The challenge of company growth in Spain

Spain faces a structural challenge: the small size of its firms. This limitation curtails productivity, innovation and employment. Why do our firms grow less than European ones? Understanding this is key to building a more dynamic and productive economy.

A country’s business sector is the backbone of its economy, as it largely underpins its productivity, economic growth and, ultimately, its collective well-being. Spanish firms have, on average, fewer employees than those of our European counterparts, and they are growing more slowly. These characteristics act as a drag on economic growth. Although Spanish firms have been scaling up in the past decade, the challenge to upsize remains. Understanding why our firms are smaller and what factors hinder their growth helps us reflect on how we can help them expand.

(Too) small firms

Let us first compare where Spain stands vis-à-vis other European economies and with respect to previous years. Considering these two angles is essential to properly understand the business size challenge in Spain.

Analysis of the data tells us that Spanish firms had, on average, 8.8 employees in 2023, compared with 12.1 in the European Union (EU). The small average size of Spanish firms is mainly due to two factors:

- A larger proportion of microfirms

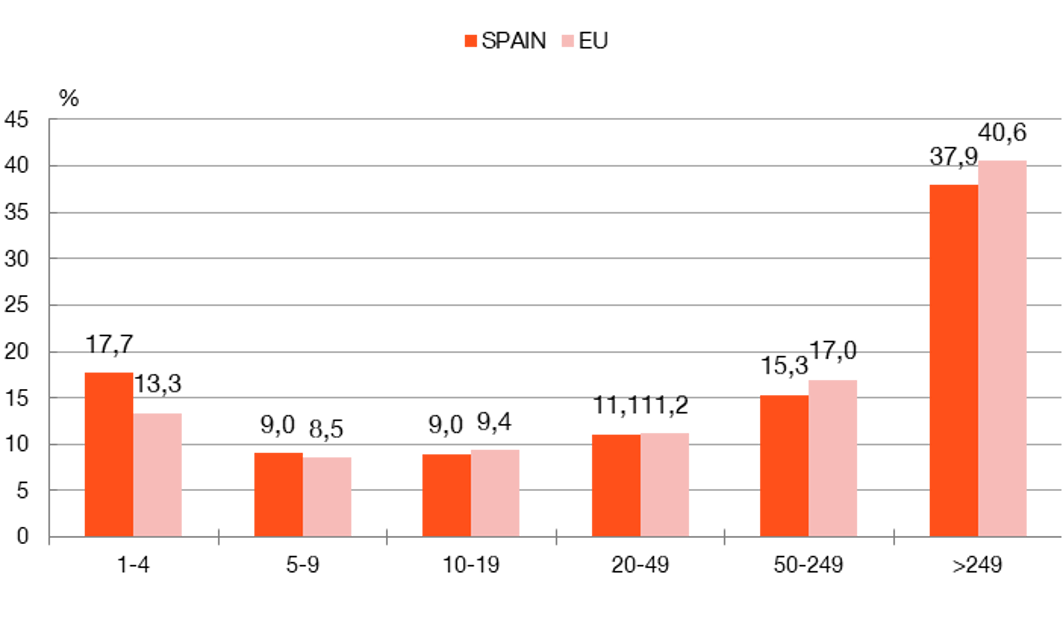

(fewer than ten employees). As Chart 1 shows, microfirms represent 89% of all firms with employees and 27% of jobs in Spain, figures that are lower for the EU as a whole (85% of firms and 22% of jobs). The disparity is even greater for those with fewer than five employees, which represent 77% of firms and 18% of jobs in Spain, compared with 71% and 13% in the EU.

(fewer than ten employees). As Chart 1 shows, microfirms represent 89% of all firms with employees and 27% of jobs in Spain, figures that are lower for the EU as a whole (85% of firms and 22% of jobs). The disparity is even greater for those with fewer than five employees, which represent 77% of firms and 18% of jobs in Spain, compared with 71% and 13% in the EU.

Chart 1

LARGER SHARE OF SMALL FIRMS IN EMPLOYMENT IN SPAIN THAN IN THE EUROPEAN UNION

SOURCE: Eurostat.

NOTE: The sectors include industry, construction and market services (except public administration and defence; compulsory social security; activities of membership organisations). Data refer to 2023 and to firms with employees.

- Smaller firms with more than 10 employees. In Spain, such firms have 59 employees on average compared with 65 in our European counterparts.

This difference is important because business size has a direct impact on productivity, employment, innovation and indirectly affects growth and economic well-being.

In Spain, 77% of firms have fewer than five employees, compared with 71% in the EU. This size gap constrains productivity and growth

DID YOU KNOW...?

Larger firms tend to be more productive, as they can make use of opportunities that are not available to small firms, such as:

- Better access to finance: large firms can usually raise more funds at a lower cost. And they have more sources of funding beyond just bank credit, like issuing bonds or resorting to the capital markets.

- Economies of scale, specialisation and management: large firms can spread fixed costs to boost production and enhance their value chains

. In addition, they generally have more labour specialisation and professional management processes, which increase efficiency and productivity.

. In addition, they generally have more labour specialisation and professional management processes, which increase efficiency and productivity. - Innovation: both these factors enable them to invest in product and process innovation, driving business growth and generating positive effects throughout the wider economy.

Higher productivity benefits everyone. In a competitive market, large firms usually pay better wages, create more jobs and offer quality goods and services at more affordable prices.

Why are Spanish firms smaller?

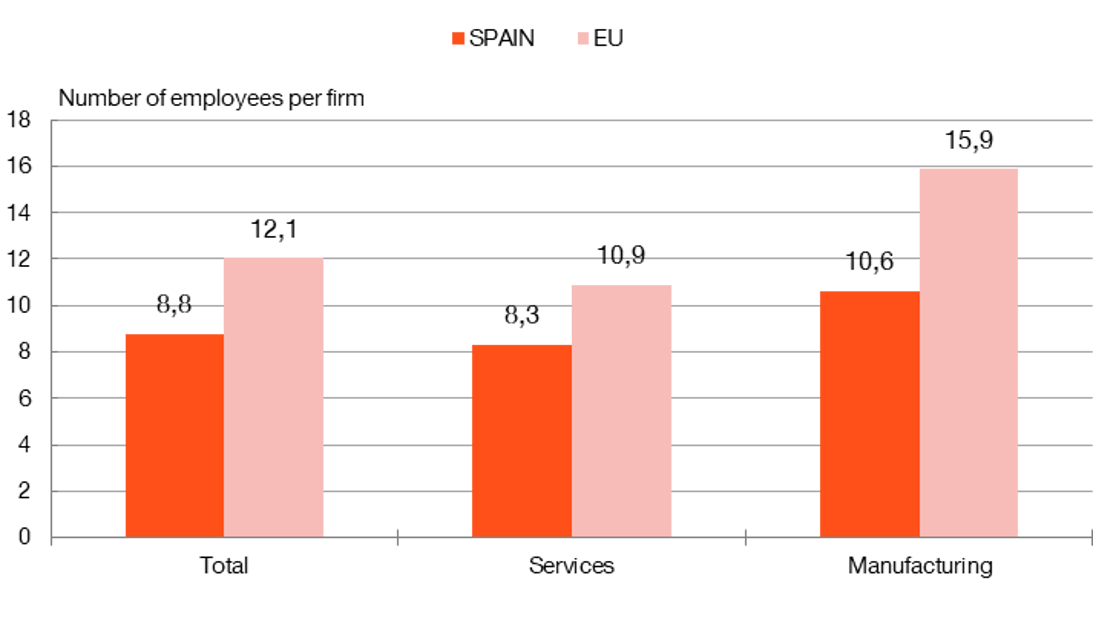

While this could be attributed to Spain's specialisation in sectors such as services, where small firms are prevalent, the economy’s sectoral structure does not appear to be the main reason. The difference in firm size is found in most sectors. Chart 2 shows that an average firm in Spain’s services sector has 8.3 employees, compared with almost 11 in the EU. But in the manufacturing sector, the gap is even more pronounced, with 10.6 versus an average of 15.9 (a difference of more than five employees).

Chart 2

LOWER AVERAGE NUMBER OF EMPLOYEES IN SPAIN THAN IN THE EU, BOTH IN SERVICES AND MANUFACTURING

SOURCE: Eurostat.

NOTE: Sectors include industry, construction and market services (except public administration and defence; compulsory social security; activities of membership organisations). Data refer to 2023, using Eurostat´s sector classification, and to firms with employees. Manufacturing includes sections B (and quarrying), C (manufacturing), D (energy), E (water and waste) and F (construction), while services encompass activities of sections G to S, such as wholesale and retail trade, transportation, accommodation and food service activities, finance, health and education.

Nor is the size gap explained by a lack of business momentum, i.e. the churn rate (business births and deaths). In this respect, Spain is on a par with the European average. The business birth rates are similar (9.4% in Spain versus 8.7% in the EU for firms with employees), as are those of business deaths, which account for 9.3% of Spanish firms every year, compared with 8% in the EU. These rates are comparable in firms with no employees.

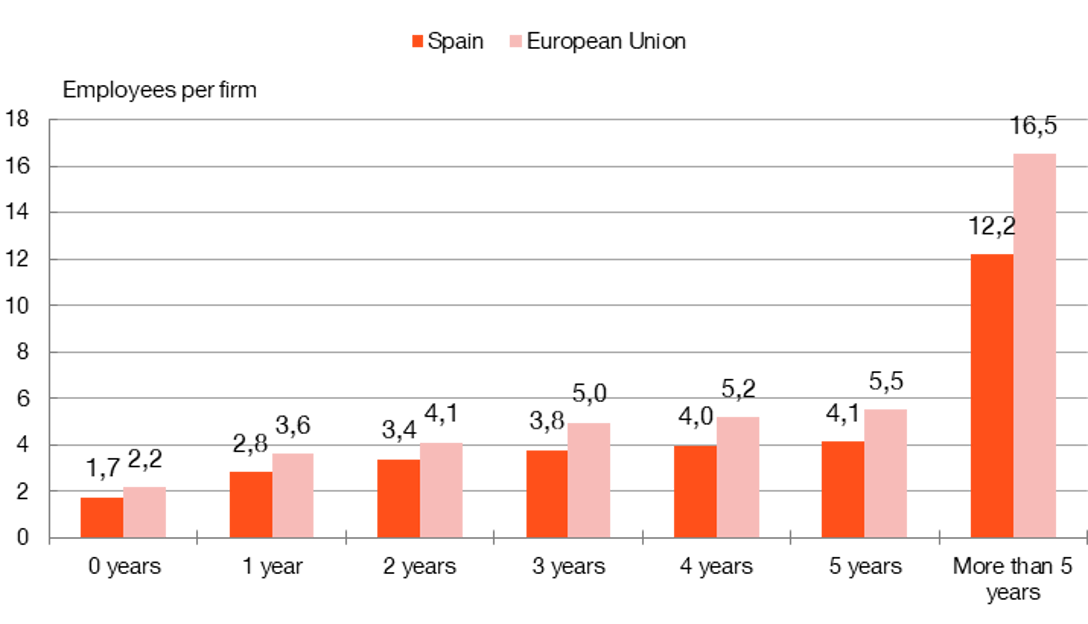

Nonetheless, a clear difference can be found in firms’ growth capacity. Interestingly, as Chart 3 shows, when they start up, Spanish and European firms with employees are similar in size (with an average of around two employees), but over time the Spanish ones lose ground. After five years, the gap widens, with an average of 17 employees in European firms and just 12 in Spanish firms. The weak growth of Spanish firms when compared with their European counterparts is not only due to the large share of small businesses in Spain. Firms that start up with ten or more employees also eventually trail behind European firms, accounting for almost 30% of the size gap after five years.

Chart 3

LOWER GROWTH OF SPANISH FIRMS THROUGHOUT THEIR LIFE CYCLE

SOURCE: Eurostat.

NOTE: Sectors include industry, construction and market services (except public administration and defence; compulsory social security; activities of membership organisations). Data refer to 2023 (in Romania, to 2022) and to firms with employees.

Spanish firms grow less than European ones. When they start up, they are similar in size, but over time the size gap gradually widens

Some hopeful signs

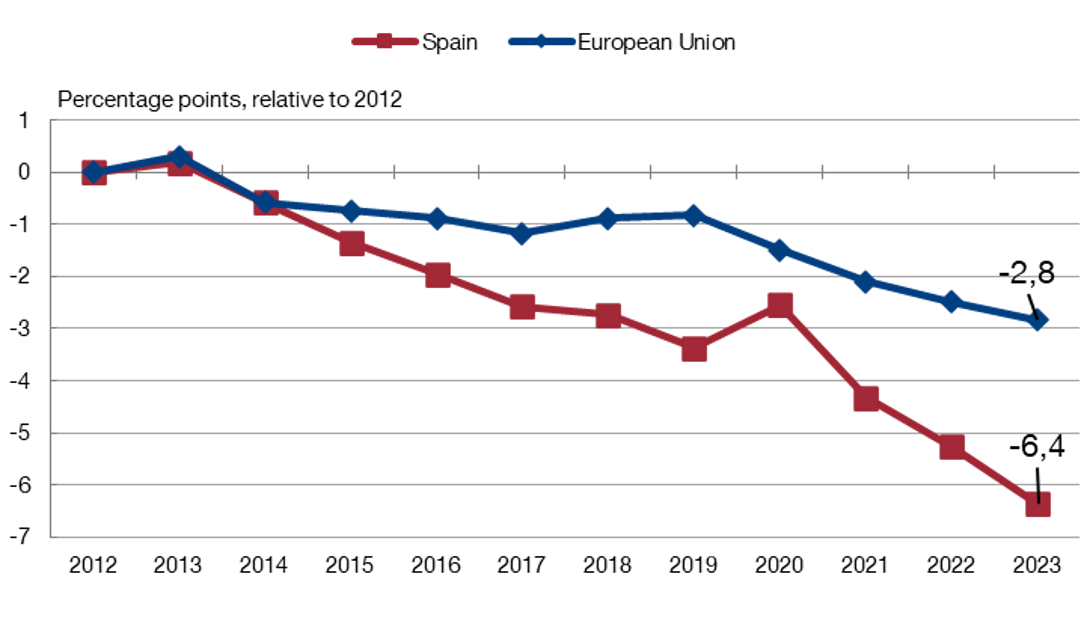

Although small businesses remain a structural feature of the Spanish economy, we have seen some encouraging signs in the last decade. Between 2012 and 2023, the number of firms with fewer than five employees as a percentage of total employment continued to fall, both in Spain and in the EU as a whole. However, this decline has been more pronounced in Spain. Employment at such firms fell by around six percentage points in Spain compared with a drop of approximately three percentage points in the EU (Chart 4). In light of our previous discussion, the lower relative weight of small firms could be contributing to productivity growth in the economy as a whole.

Chart 4

DECLINE IN THE SHARE IN EMPLOYMENT OF FIRMS WITH UNDER FIVE EMPLOYEES BETWEEN 2012 AND 2023

SOURCE: Eurostat.

NOTE: Includes fewer sectors and countries than the other charts. This chart draws on information on 11 EU countries (Austria, Croatia, Czech Republic, France, Germany, Hungary, Italy, Latvia, Netherlands, Romania and Spain) and does not include the activities of households as employers and domestic services, financial and insurance activities, or employment placement or temporary employment agency activities. Based on this sample, the share in employment of firms with 1-4 employees in 2023 was 17.4% in Spain and 12.9% in the EU, compared with 17.7% and 13.3% in Chart 1.

The challenge is to help firms grow

To achieve lasting change, Spanish firms need favourable conditions in which to grow:

- providing a dynamic and thriving economic environment;

- ensuring access to sufficient financing and ability to attract talent, particularly in the case of SMEs;

- reducing the regulatory and administrative burden to avoid it being a drag on growth

.

.

An in-depth analysis to understand what is limiting (and how to drive) business growth in Spain is the cornerstone for designing the right policies to achieve such growth. That is why we must drill down further in our research using firm-level disaggregated data (microdata![]() ) that can be compared across countries. The ultimate goal is to narrow Spain’s business size gap with Europe, to build a more dynamic, productive and resilient economy.

) that can be compared across countries. The ultimate goal is to narrow Spain’s business size gap with Europe, to build a more dynamic, productive and resilient economy.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.