Advancing towards the future of our money: the digital euro

Why all the talk about the digital euro? Since 2021 the Eurosystem has been working on a digital version of the euro, so the public can enjoy the benefits of cash in their digital payments. The Governing Council of the ECB has decided to move to the next phase of the project. You may be wondering what the digital euro means for you.

Since 2021 the Eurosystem has been working on a digital version of the single currency: the digital euro. Rather than replacing banknotes and coins, the aim is to provide an alternative form of public money for the digital era. With cash use in decline and the need for a pan-European solution for payments in shops or online – one that does not rely on non-European providers – there are compelling reasons to issue a digital euro, once the necessary legal framework is in place. Consequently, the Governing Council of the European Central Bank has decided to move to the next phase of the project. But what would the digital euro mean for the general public? How would it change the way we pay?

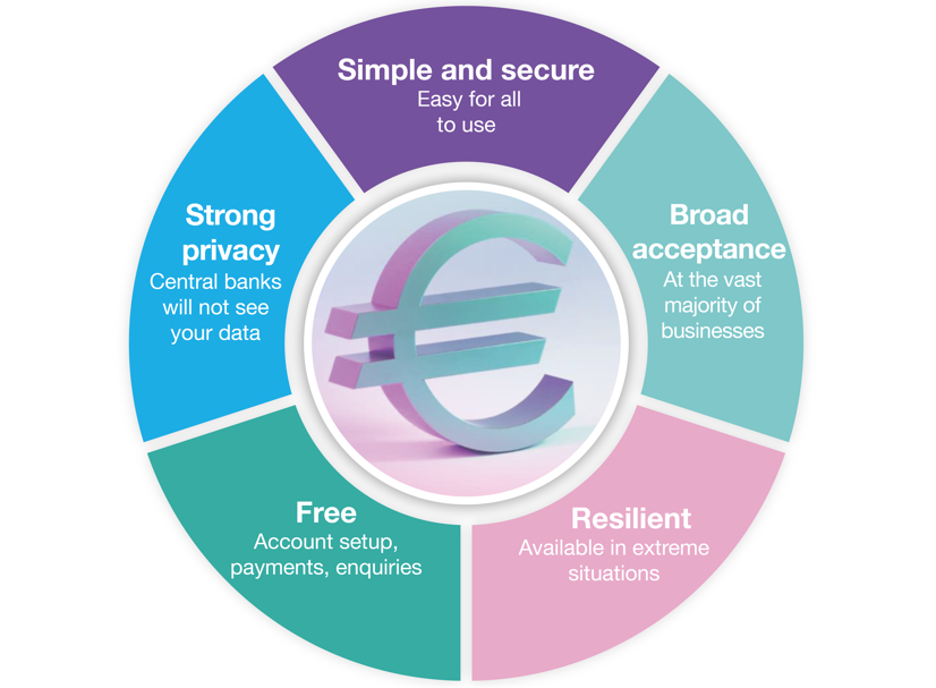

Key benefits of the digital euro

The digital euro will serve as a means of payment for everyday transactions, whether in shops, online or between friends. Being able to use the same payment instrument for all these transactions is itself entirely new and a clear benefit for users. But the digital euro’s true strength lies in the fact that it is a public good. And why does that matter? Because it means it is backed by central banks, ensuring free, universal access to the public, without reliance on non-European providers. Exactly like the cash in your pocket, but ready for use in digital environments.

The digital euro is intended to serve the public as a complement to banknotes and coins

The digital euro is being designed with society’s needs and preferences in mind and as a complement to banknotes and coins. People will be able to open a digital euro account at their bank, which will function much like traditional bank accounts but with the central bank’s backing. Payments from a digital euro account will be secure and straightforward, even for users who are less familiar with technology. Moreover, the most frequent operations (setting up an account, transfers, payments in shops, etc.) will be free for consumers. And as legal tender, just like cash, you can be sure it will be accepted by all euro area businesses, whether in physical stores or online. Put simply, the digital euro’s features are its main strengths (Figure 1).

Figure 1

MAIN FEATURES OF THE DIGITAL EURO

Source: Banco de España

To replicate the characteristics of cash as closely as possible, the digital euro has been designed to include one particularly innovative functionality. In addition to digital euro accounts, offline wallets will be available, allowing users to store digital euro directly on their mobile phones or cards. Such wallets could be used for proximity payments (but not for remote transactions, such as in e-commerce) and would work without internet connection or even power supply. In offline wallet payments the digital euro will travel from device to device, much like a Bluetooth file transfer but with the amount removed from the sender’s device. Since no financial intermediary would be involved, the payment would have a cash-like level of privacy.

The purpose of the digital euro is to ensure that there is a public alternative for making payments in any digital environment

The offline functionality will not only provide the public with a convenient solution, it will also strengthen Europe’s payment system, making it more resilient to extreme situations like the deadly floods in Valencia or the April blackout. Ultimately, the aim is to cover any situation where a public digital payment option might be needed.

Main doubts about the digital euro

As occurs with any new development, the digital euro raises doubts that should be clarified. Let’s discuss some of the most common.

If a digital euro is issued ...

- Will I be obliged to use it? No. The public will be free to decide whether to use it or not. Only merchants will be required to accept it, just like cash.

- Will I have to open an account at the Banco de España? No. Even though the digital euro is issued by euro area central banks, users will open their accounts (as well as their offline wallets) at banks, which will manage their transactions.

- Will the government see my digital euro balances and movements? No. Neither governments nor central banks will know who specific balances belong to or who is behind each transaction. As occurs currently with other digital means of payment, only banks will have access to this information, and in the case of offline wallets, only users will.

- Will the government control what I spend? No. Under no circumstances will digital euro expire or will it be possible to restrict their use. Users will be the only ones to decide the amount of their balance and how to use it.

- Will the digital euro replace cash? No. Banknotes and coins will continue to play an important role for many people and the Eurosystem is firmly committed to keeping them in circulation.

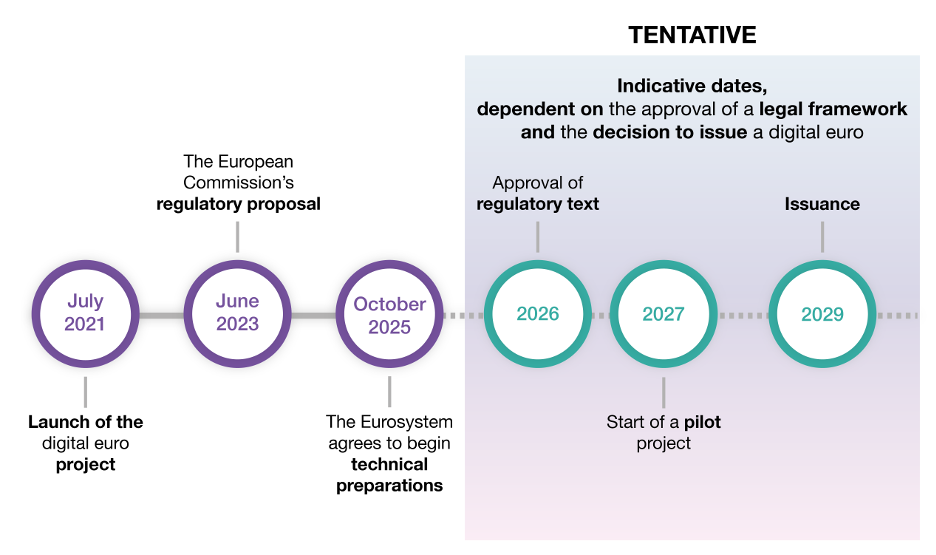

A tentative schedule

The time horizon for this project is another recurring doubt. For the time being, however, any timeline is necessarily tentative (Figure2). It is important to underline that no decision to issue a digital euro can be made until the proposed regulation presented by the European Commission has been approved.

The decision to issue a digital euro has not yet been made. A legal framework providing legal certainty must first be defined

While the co-legislators (the Council of the European Union and the European Parliament) reach a consensus on the text of the regulation, the Eurosystem will continue to make headway developing the technical foundations. This will help minimise the time gap between the decision and the envisaged issuance date. Figure 2 shows a tentative work schedule. According to the ECB press release![]() , if legislation were in place over the course of 2026, a pilot exercise could start in 2027 and the digital euro could be put into circulation in 2029.

, if legislation were in place over the course of 2026, a pilot exercise could start in 2027 and the digital euro could be put into circulation in 2029.

Figure 2

THE DIGITAL EURO: SCHEDULE

Source: Banco de España

This timeline is indicative and subject to change. However, the Eurosystem is firmly committed to the project and will continue working to uphold public trust in central bank money, including in the digital era.