The Distributional Wealth Accounts: a new tool for analysing household wealth and debt

The Distributional Wealth Accounts combine micro data from surveys and national accounts data to provide an overview of Spanish household net wealth. These new statistics are updated quarterly and presented in a user-friendly interactive format.

Wealth distribution is a major concern both for the public and for economic policymakers in any country. How is wealth divided among Spanish households today? How does this compare to other European countries? Which households are the most indebted? Are we able to monitor these indicators frequently enough to spot trends and anticipate risks? Until recently, answering these questions was challenging – and doing so on a regular basis was even harder. The newly released Distributional Wealth Accounts of household wealth and debt open up a new avenue to regularly monitor how net wealth is divided among Spanish households and compare this with other euro area countries.

Why do we need the new distributional statistics?

Until now, the main source for understanding how net wealth – i.e. total wealth (assets) less debt (liabilities) – is distributed across Spanish households has been the Spanish Survey of Household Finances (EFF)![]() , produced by the Banco de España. This richly detailed survey makes it possible to examine how wealth and debt are divided among various population groups. However, its complexity and cost limit the frequency with which it is carried out: it is currently published every two years and the data it provides cover the two years prior to publication. This makes it difficult to monitor changes, particularly during periods of heightened economic volatility.

, produced by the Banco de España. This richly detailed survey makes it possible to examine how wealth and debt are divided among various population groups. However, its complexity and cost limit the frequency with which it is carried out: it is currently published every two years and the data it provides cover the two years prior to publication. This makes it difficult to monitor changes, particularly during periods of heightened economic volatility.

Meanwhile, the national accounts – which combine the Financial Accounts of the Spanish Economy![]() , compiled by the Banco de España, and the Non-Financial Accounts for the Institutional Sectors

, compiled by the Banco de España, and the Non-Financial Accounts for the Institutional Sectors![]() , prepared by the National Statistics Institute (INE) – provide more frequent data on households’ overall wealth and debt, but they don’t distinguish between the various population groups. All of this results in an information gap: we have either highly detailed data but spaced out over time, or frequent data but not broken down by population group.

, prepared by the National Statistics Institute (INE) – provide more frequent data on households’ overall wealth and debt, but they don’t distinguish between the various population groups. All of this results in an information gap: we have either highly detailed data but spaced out over time, or frequent data but not broken down by population group.

The Distributional Wealth Accounts (DWA)![]() were created to bridge that gap. Their purpose is to provide quarterly national accounts-consistent data on the distribution of total household wealth and debt across different household groups in each euro area country.

were created to bridge that gap. Their purpose is to provide quarterly national accounts-consistent data on the distribution of total household wealth and debt across different household groups in each euro area country.

The DWA statistics were developed following international recommendations like those issued by the G20 after the global financial crisis. The Data Gap Initiative![]() encouraged the regular collection and dissemination of reliable, high-frequency statistics to support better economic policymaking.

encouraged the regular collection and dissemination of reliable, high-frequency statistics to support better economic policymaking.

In Europe, the DWA are prepared by European central banks (the European System of Central Banks![]() ) and are a key tool for improving analysis of emerging risks and reducing data gaps. These statistics have also been included in the System of National Accounts 2025, which were the focus of a recent blog post

) and are a key tool for improving analysis of emerging risks and reducing data gaps. These statistics have also been included in the System of National Accounts 2025, which were the focus of a recent blog post![]() and will be applicable from 2030.

and will be applicable from 2030.

Methodology: a bridge between micro and macro data

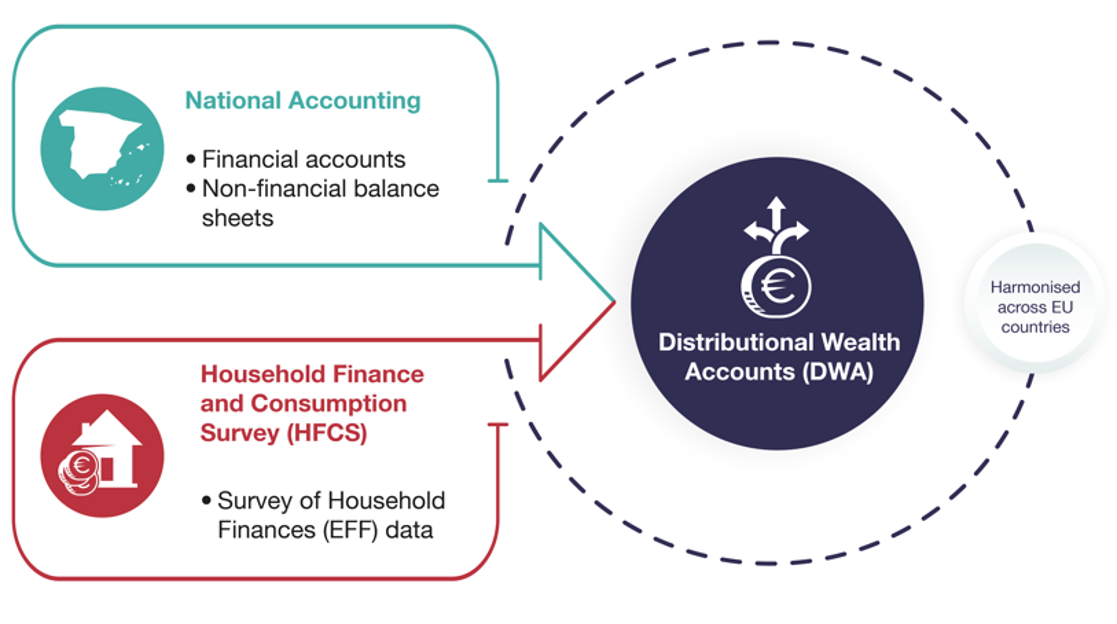

Compiling the Distributional Weatlh Accounts entails a considerable methodological challenge, as they combine data sources of various types and frequencies (Figure 1):

Figure 1

WHAT DATA ARE USED TO CONSTRUCT DISTRIBUTIONAL WEALTH ACCOUNTS?

SOURCE: Banco de España.

NOTES: The DWA (Distributional Wealth Accounts) and the HCFS (Household Finance and Consumption Survey) correspond to European projects in the respective areas. In the case of Spain, HCFS data come from the Survey of Household Finances (EFF).

- First, they rely on micro data (individually disaggregated data) from the ECB’s Household Finance and Consumption Survey (HFCS)

. In the case of Spain this information comes from the EFF

. In the case of Spain this information comes from the EFF .

. - They also include national accounts aggregates, particularly the financial accounts and non-financial balance sheets. The Distributional Wealth Accounts are calculated consistently across the euro area countries.

DID YOU KNOW ...?

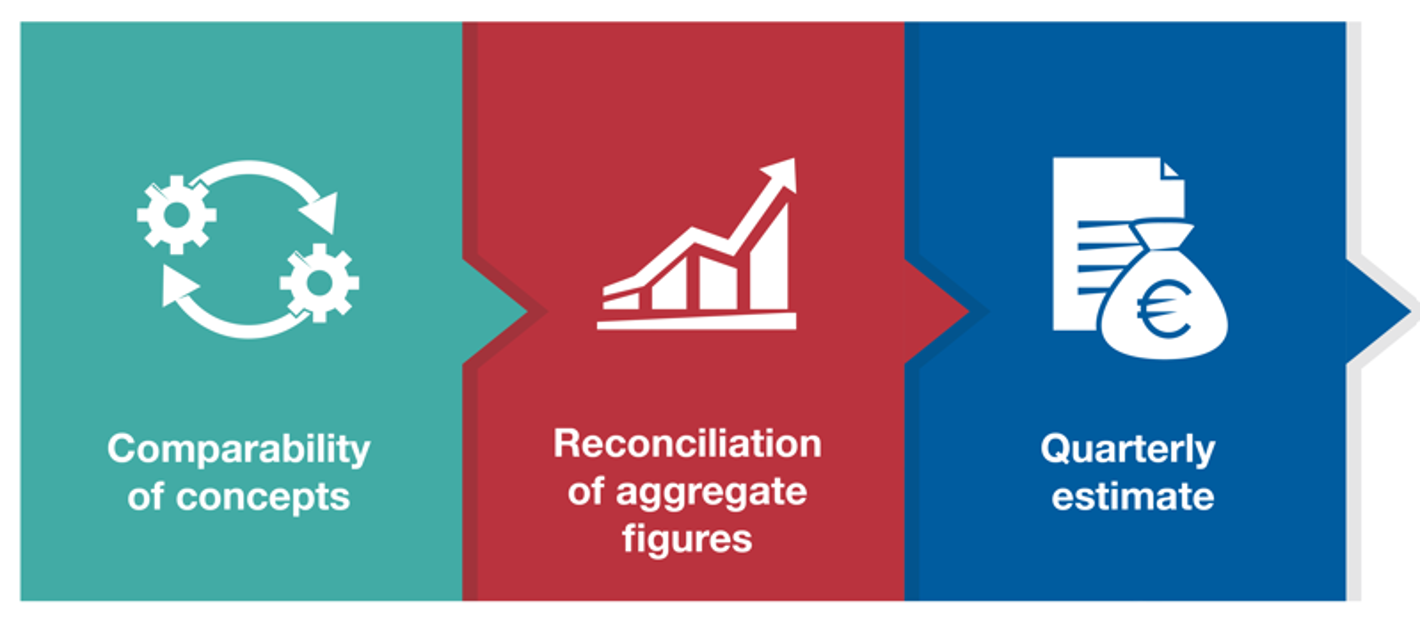

The Distributional Wealth Accounts are prepared in three stages summarised in Figure 2:

- Comparability. First, equivalences are established between the concepts of wealth and debt used in the national accounts and those used in the household survey (HFCS), wherever the respective definitions match. Some national accounts data series are adjusted to obtain household-level metrics, estimate the value of built-up land and exclude houses abroad.

- Reconciliation.The HFCS micro data are then adjusted so that the aggregate figures coincide with those in the national accounts. In particular, the population weightings in the HFCS are adjusted so that total population equals that in the national accounts, and the wealth of the richest households not captured by the HFCS is estimated. Finally, one last adjustment is made (proportional assignment by instrument) to ensure that the micro data totals are the same as the totals in the national accounts.

- Estimation of the quarterly Distributional Wealth Accounts. A linear interpolation is applied for the quarters between HFCS waves and an extrapolation is applied for the periods following the latest HFCS wave. For this, it is assumed that wealth changes gradually and that population changes linearly between periods. This allows quarterly series to be obtained for each population group and type of asset and liability.

Figure 2

STAGES IN THE PREPARATION OF THE DISTRIBUTIONAL WEALTH ACCOUNTS

SOURCE: Banco de España.

A quarterly overview of the distribution of wealth and debt

The main contribution of the Distributional Wealth Accounts is that they make it possible to track net wealth by population group and by component (type of asset or liability) on a quarterly basis and in a manner that is consistent with national accounts. This makes it easier to spot trends and identify changes in the distribution.

The DWA make it possible to track net wealth in a disaggregated manner on a quarterly basis. This allows trends and shifts in its distribution to be spotted early

DID YOU KNOW ...?

The Distributional Wealth Accounts for Spain can be found on the following interactive webpage![]() , where you can explore a range of interesting charts. The page is updated quarterly.

, where you can explore a range of interesting charts. The page is updated quarterly.

Chart 1 is an example of the charts and information you can find.

Chart 1

DISTRIBUTION OF NET WEALTH AND ITS MAIN COMPONENTS BY HOUSEHOLD GROUP

SOURCE:Banco de España, Distributional Wealth Accounts![]() .

.

NOTE:The 50% least wealthy households are those in the bottom half of the wealth distribution (deciles 1-5). Households in the 6th decile include the following 10% of households in terms of wealth, and so on for every other decile, The 10% wealthiest households are those in the top decile (10th decile).

You can see that the distribution of total net household wealth has remained fairly stable since late 2014. This stability, however, conceals important changes at the component level:

- If you select “debt” from the drop-down list, you will see that the share of debt held by the 50% least wealthy households has declined. If you move the cursor over the bars you will see debt falls from 53% to 33.8% of the total, while the share for the 10% wealthiest has risen from 17.1% to 21.6%.

- If you select “housing wealth”, which is households’ main asset, the pattern is similar: it also falls for the least wealthy households (from 18% to 12.5%), while increasing for the 10% wealthiest (from 37.4% to 41.8%)

These changes in households’ liabilities and assets largely offset each other, which explains the stability in the distribution of net wealth.

The Banco de España's new, interactive webpage provides data for net wealth by population group and how it changes over time

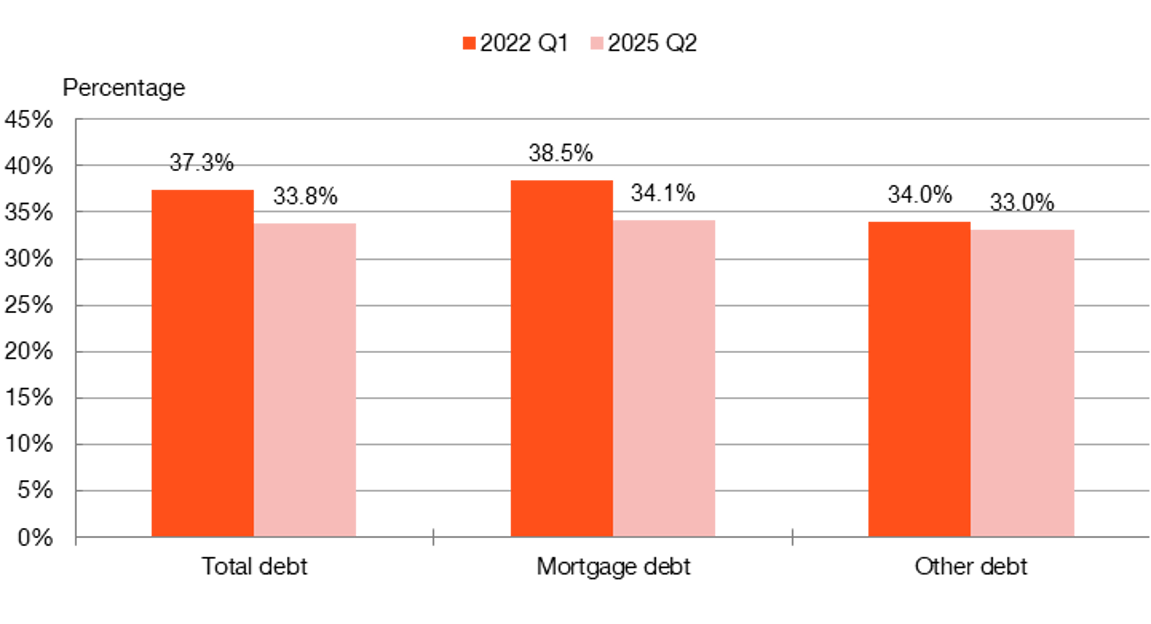

Chart 2 highlights a final point: the relative reduction in the debt of the 50% least wealthy households is due to the sharper decline in these households' mortgage debt (from 57.6% to 34.1%) than in their other debt (just 36.4% to 33%).

Chart 2

RECENT CHANGES IN THE DEBT OF THE LEAST WEALTHY HOUSEHOLDS

SOURCE: Banco de España. Households' Distributional Wealth Accounts![]() .

.

NOTE: The least wealthy households are those below the median (50%) of the distribution.

Limitations and caveats: the experimental nature of the Distributional Wealth Accounts

Keep in mind that the Distributional Wealth Accounts are an experimental statistic. Hence, although the results are reliable enough to be used, they should be interpreted with caution.

The accounts still require improvements and a certain degree of harmonisation, particularly to ensure that all euro area countries are covered and refine the methodology. Consequently, the process of adjusting the micro data used in the methodology may affect the composition of individual households’ wealth and debts. In the case of Spain, the adjustments with the largest quantitative impact on total net wealth are made in the reconciliation stage.

In short, the Distributional Wealth Accounts are an important step forward for analysing the distribution of household wealth and constitute a promising – albeit still experimental – tool. They allow us to have a more frequent and detailed overview of wealth and debt in Spain, which should contribute to a better understanding of present and future economic challenges.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.