How do we measure and compare economies? What's new in 2025

Not all data can be used to measure, and compare, different countries’ economies. We need to use the same yardstick: international statistical standards that assess economic and financial activity consistently across countries. Besides, they should also adapt to constantly changing scenarios. The 2025 standards measure digitalisation, globalisation, sustainability and inequality better.

To compare different economies, we need to ensure that we are measuring the same things in all of them. Economic and financial aggregates must be measured with the same yardstick, both across countries and over time. Only then will we be able to compare, for instance, the Spanish and Japanese budget deficits or Spain’s per capita income in 1980 and 2025.

Economic and financial aggregates must be measured with the same yardstick, both across countries and over time

This is achieved through the adoption by all countries of the same international statistical standards, an international cooperation effort initiated around 1947. Such consistency across times and locations is the essential basis for economic and financial analysis.

How are common measurement standards set?

International statistical standards are the definitions used by all countries to organise and present their data in a comparable manner. They encompass the definition of sectors, economic agents, instruments and transactions and, most importantly, how to quantify them in nominal and real terms![]() .

.

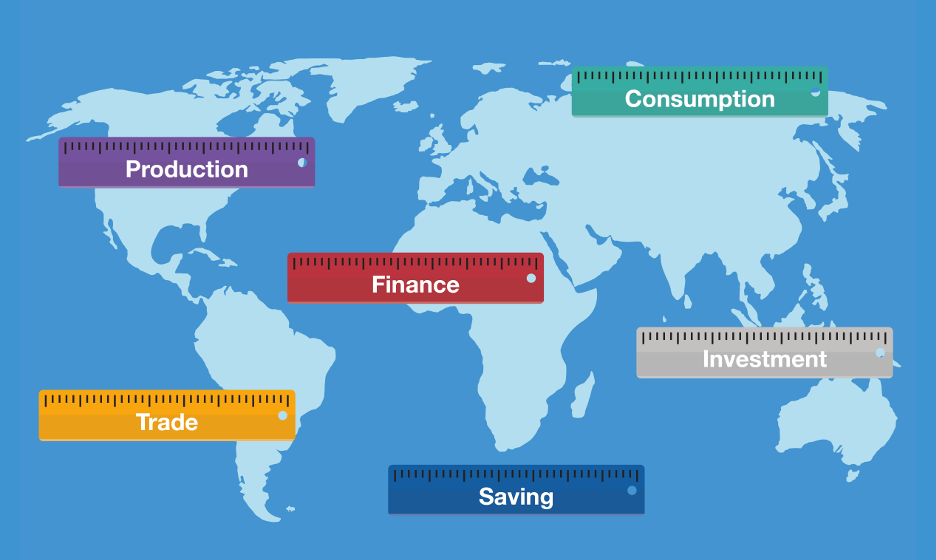

The measurement standards for macroeconomic statistics (Figure 1) are essentially organised in two manuals, covering, respectively:

- economic and financial activities of all kinds, in terms of changes and cumulative levels (or stocks). The System of National Accounts (SNA)

adopted by the UN Statistical Commission is the standards manual, which serves as a basis for each country’s “National Accounts”

adopted by the UN Statistical Commission is the standards manual, which serves as a basis for each country’s “National Accounts” .

. - economic relations between a country’s residents and non-residents, whose international common measurement is set out in the IMF’s Balance of Payments and International Investment Position manual

(MBP).

(MBP).

Figure 1

ONE SINGLE YARDSTICK

SOURCE: Banco de España

In order to conduct consistent national and international analyses, both accounting frameworks must be consistent and complementary. Indeed, they are.

A necessary update

This internationally accepted yardstick is updated from time to time to incorporate changes in economic and financial developments. There have been successive revisions since the first National Accounts and Balance of Payments manuals were adopted in 1947 and 1948, respectively. As regards the 2025 revision (both manuals: 2025 SNA ![]() and MBP7

and MBP7![]() ), a special effort has been made to fully align them.

), a special effort has been made to fully align them.

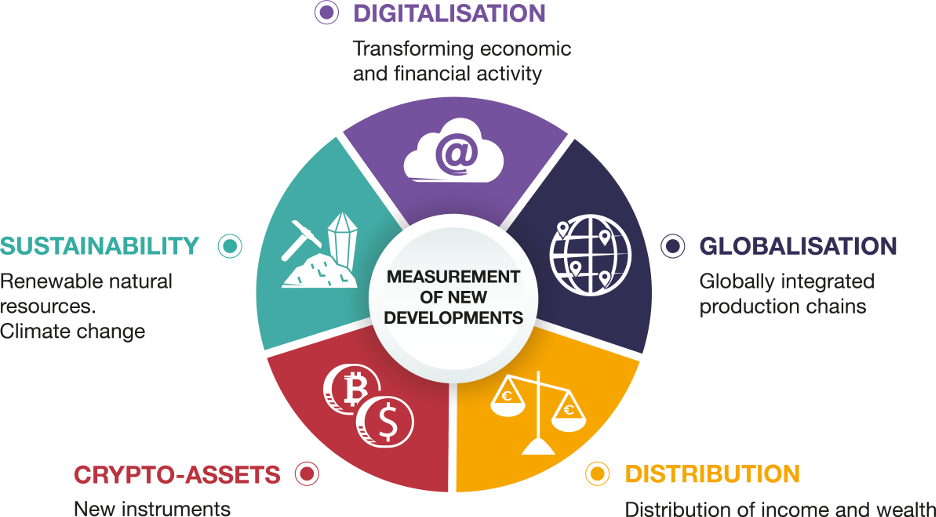

The 2025 international statistical standards update prioritises areas that have gained importance in analyses and public policies in recent years (Figure 2).

Figure 2

A CHANGING ENVIRONMENT

SOURCE: Banco de España

Digitalisation of the economy, trade and finance. Technology has transformed how we produce, consume, trade, save and invest. A digital economy has emerged whose numbers need crunching to avoid underestimating economic and financial activity. For this reason, activities that are now commonplace, such as shopping over the internet or using cloud services, are to be measured and included in a comprehensive and comparable manner in all countries’ statistics.

Globalisation. Economic and financial processes are becoming increasingly global. The components of your phone or of the aeroplanes in which you travel do not come from a single country or even a single continent. They are often designed in one country, manufactured in several, assembled in others and finally sold in most of them. US, Chinese and European firms participate in one single product. This is what we mean when we talk about “global value chains”![]() . The new standards will help to better identify these processes geographically and reflect multinationals’ positions in them and in the global economy.

. The new standards will help to better identify these processes geographically and reflect multinationals’ positions in them and in the global economy.

Sustainability (natural resources, the environment and climate change). The greatest concern for sustainable development is reflected in new classifications for quantifying economic activity related to the direct exploitation of natural resources or the type of energy used. The emphasis on sustainable economic growth redirects the focus towards Net Domestic Product (NDP)![]() , which, by discounting capital consumption and depletion of non-renewable natural capital (such as minerals, fossil fuels and forests) from Gross Domestic Product (GDP) gives a better idea of whether or not a country’s growth is sustainable.

, which, by discounting capital consumption and depletion of non-renewable natural capital (such as minerals, fossil fuels and forests) from Gross Domestic Product (GDP) gives a better idea of whether or not a country’s growth is sustainable.

Income-wealth distribution. Echoing the growing social and political interest in these issues, more attention is now paid to economic welfare and to equity, not just aggregate growth. New accounts are added that should reflect how income is generated, distributed and used, and how wealth is accumulated by institutional sector (households, firms and governments).

Crypto-assets. The focus in 2025 is on cryptocurrencies![]() ; statistical definitions are established to differentiate them by risk, liquidity and role in the digital economy. For example, Bitcoin

; statistical definitions are established to differentiate them by risk, liquidity and role in the digital economy. For example, Bitcoin![]() (decentralised and volatile, and used as a speculative asset more than a means of payment) is distinguished from stablecoins

(decentralised and volatile, and used as a speculative asset more than a means of payment) is distinguished from stablecoins![]() (linked to real currencies or assets to maintain a stable value), which are recorded as a financial asset.

(linked to real currencies or assets to maintain a stable value), which are recorded as a financial asset.

From manuals to data

Once the new international measurement standards have been agreed, they must be implemented. Every country’s statistical production should be adapted to them and this, in turn, requires:

- the collaboration of statisticians in incorporating the changes

- an extensive update of statistical sources (surveys, administrative data, etc.)

- familiarising users with them

How quickly a country adapts to these new types of measurement largely depends on its statistical capacity, i.e. on the material and human resources available to producers of statistics (such as the Banco de España![]() and the Spanish National Statistics Institute

and the Spanish National Statistics Institute![]() ). In the EU

). In the EU![]() , all the changes presented will be fully and comprehensively implemented in a highly coordinated manner and will be legally binding for all Member States by 2030. Before then, estimates of the changes will be published as they become available for use.

, all the changes presented will be fully and comprehensively implemented in a highly coordinated manner and will be legally binding for all Member States by 2030. Before then, estimates of the changes will be published as they become available for use.

The implementation of the new 2025 measurement standards in national statistical systems will contribute to more reliable economic and financial data and sounder economic policies

New economic and financial developments over the past two decades have made it necessary to adapt the measurement standards. The implementation of this revision of standards from 2025 onwards will contribute to more reliable economic and financial data and thus facilitate more robust analyses and sounder economic policies.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.