Competition and financial stability in the fintech era

Technological innovation in financial services (known as fintech) is changing the way we manage our finances. Understanding its potential impact on financial stability is a key concern for the Banco de España and other financial supervisors around the world.

What is fintech? Short for financial technology, it refers to firms that provide financial services using cutting-edge technologies. Perhaps you’ve heard of or even used some of them, like crowdfunding![]() sites or online investment and lending platforms, offered not by traditional banks but by neobanks

sites or online investment and lending platforms, offered not by traditional banks but by neobanks![]() . While neobanks provide conventional financial services, such as payment accounts, cards and loans, they do so exclusively through digital channels, which makes them part of the fintech ecosystem. Fintech firms are notably forging a presence in the investment and lending market. In this post, we focus on their role in lending.

. While neobanks provide conventional financial services, such as payment accounts, cards and loans, they do so exclusively through digital channels, which makes them part of the fintech ecosystem. Fintech firms are notably forging a presence in the investment and lending market. In this post, we focus on their role in lending.

These new financial intermediaries may be beneficial for customers, but they might also have an impact on financial stability – a concern for us as supervisors of the banking system. Although fintech does not currently pose a threat to financial stability, we must not lower our guard. We explore here the link between fintech and financial stability through its impact on competition in the lending market.

DID YOU KNOW ...?

- There are fintech platforms that connect investors directly with businesses and entrepreneurs in need of funds, bypassing traditional intermediaries such as banks.

- Fintech firms operating in Spain include:

- Crowdfunding/Crowdlending

: EvenFi, La Bolsa Social and Urbanitae

: EvenFi, La Bolsa Social and Urbanitae - Investment platforms: Inbestme

- Business lending: Twinco Capital and Novicap

- Neobanks: Trade Republic, MyInvestor

- Crowdfunding/Crowdlending

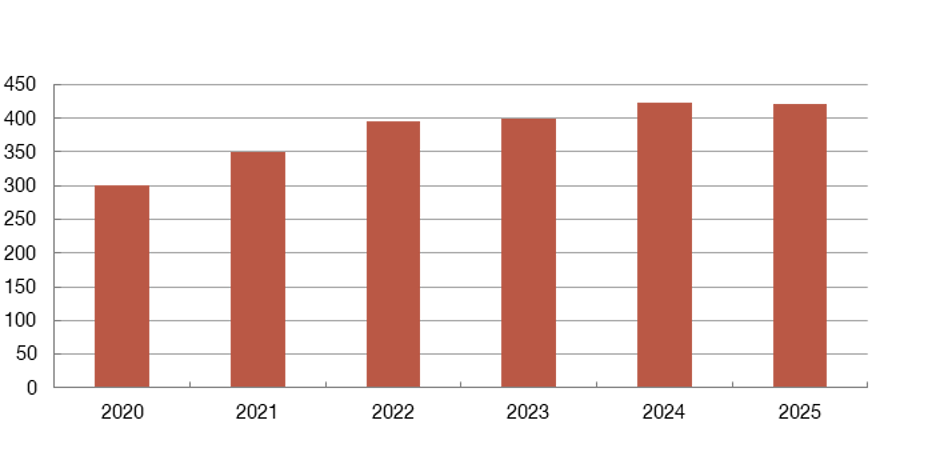

- The fintech industry is booming worldwide, and Spain is no exception. Since 2020 the number of fintech firms in the country has risen by 40%, to 421 in 2025 (Chart 1).

- Despite this rapid growth, fintech still only accounts for a tiny fraction of the lending market: in 2023 (the latest year for which data are available) fintech loans totalled €665.7 million, less than 0.1% of total bank lending to the private sector.

Chart 1

THE NUMBER OF FINTECHS IN SPAIN HAS INCREASED IN RECENT YEARS

SOURCE: Banco de España.

NOTE: Based on information available at September 2025.

The rise of fintechs could benefit us all as users, by fostering competition and efficiency and granting access to new financial products. However, their potential impact on financial stability![]() is a key concern for supervisors. Worldwide, there is no evidence

is a key concern for supervisors. Worldwide, there is no evidence![]() that the sector poses a threat to financial stability in the short term. However, its continued growth and potential impact on profitable traditional banking segments, such as retail loans and deposits, demand careful monitoring.

that the sector poses a threat to financial stability in the short term. However, its continued growth and potential impact on profitable traditional banking segments, such as retail loans and deposits, demand careful monitoring.

How does competition affect the stability of the financial system?

The growth of fintech could have a bearing on financial stability through increased competition in the lending market.

Although the academic debate on the link between competition and financial stability is ongoing![]() , the existing research provides a useful basis for evaluating fintech's potential impact.

, the existing research provides a useful basis for evaluating fintech's potential impact.

Increased competition driven by fintechs may have opposing effects on financial stability, fostering it by driving down the cost of loans, but undermining it if it leads to less prudent behaviour

Some theories![]() argue that greater competition fosters financial stability, especially through its impact on loan interest rates. Why? The rise of fintech firms, with their strong digital presence, gives borrowers access to a broader range of financial services, removing geographical constraints. Assuming other lending terms remain largely unchanged, increased competition should drive down interest rates. Lower interest payments mean fewer defaults, helping borrowers to meet their financial obligations. This results in greater stability for financial institutions and the system overall.

argue that greater competition fosters financial stability, especially through its impact on loan interest rates. Why? The rise of fintech firms, with their strong digital presence, gives borrowers access to a broader range of financial services, removing geographical constraints. Assuming other lending terms remain largely unchanged, increased competition should drive down interest rates. Lower interest payments mean fewer defaults, helping borrowers to meet their financial obligations. This results in greater stability for financial institutions and the system overall.

By contrast, there are theories![]() suggesting that increased competition could undermine financial stability, especially through its impact on banks’ income and profits, as Figure 1 shows. This is because, in less competitive environments, profits tend to be higher and banks are likely to make more prudent investment decisions: they have more to lose if they fail, so they tend to avoid excessive risk-taking. Nonetheless, stronger competition – potentially driven by a growing fintech sector – could erode banks’ profits, leading them to increase their risk exposure in pursuit of higher returns. This could compromise their stability and that of the financial system as a whole.

suggesting that increased competition could undermine financial stability, especially through its impact on banks’ income and profits, as Figure 1 shows. This is because, in less competitive environments, profits tend to be higher and banks are likely to make more prudent investment decisions: they have more to lose if they fail, so they tend to avoid excessive risk-taking. Nonetheless, stronger competition – potentially driven by a growing fintech sector – could erode banks’ profits, leading them to increase their risk exposure in pursuit of higher returns. This could compromise their stability and that of the financial system as a whole.

Figure 1

EFFECT OF GREATER COMPETITION FROM FINTECHs ON FINANCIAL STABILITY

SOURCE: Devised by authors.

Another aspect to consider is how traditional banks are investing in advanced technologies![]() , spurred on by competition from fintechs. This will not only boost their operational efficiency, but may also enhance

, spurred on by competition from fintechs. This will not only boost their operational efficiency, but may also enhance![]() their ability to assess borrowers’ creditworthiness, helping them make sounder lending decisions.

their ability to assess borrowers’ creditworthiness, helping them make sounder lending decisions.

Are fintechs driving competition in the financial sector? The international evidence

The available evidence suggests that fintechs generally complement traditional bank lending. According to various studies, the boom in fintechs has promoted financial inclusion![]() , providing an alternative source of lending for sectors that are generally underserved by traditional banks. In addition, the relationship between banks and fintechs has become more collaborative

, providing an alternative source of lending for sectors that are generally underserved by traditional banks. In addition, the relationship between banks and fintechs has become more collaborative![]() , showing that strategic alliances are an effective way for the latter to expand their customer base.

, showing that strategic alliances are an effective way for the latter to expand their customer base.

Nonetheless, other countries’ experience also points![]() to growing competition, albeit still with a limited effect

to growing competition, albeit still with a limited effect ![]() on banks’ income. While fintechs are gaining ground, banks continue to enjoy advantages that are not easily replicated, such as using the vast amount of information obtained from their repeated interactions with borrowers, which strengthens

on banks’ income. While fintechs are gaining ground, banks continue to enjoy advantages that are not easily replicated, such as using the vast amount of information obtained from their repeated interactions with borrowers, which strengthens![]() their risk models. The fintech sector thus appears to have limited scope to make major inroads into the banking business in the near term. However, the adoption of open banking models, which foster openness and secure access to data, could heighten

their risk models. The fintech sector thus appears to have limited scope to make major inroads into the banking business in the near term. However, the adoption of open banking models, which foster openness and secure access to data, could heighten![]() competition from fintechs.

competition from fintechs.

Fintechs do not currently pose a threat to financial stability, but their expansion and potential for competing with traditional banks demand careful monitoring

In short, despite the strong growth of the fintech sector, there is no conclusive international evidence linking this expansion to significant shifts in financial stability![]() , possibly due to its small size and scant impact on banks’ income. In Spain, it has had only a small effect on the credit market and, in any event, the banking sector’s strong

, possibly due to its small size and scant impact on banks’ income. In Spain, it has had only a small effect on the credit market and, in any event, the banking sector’s strong![]() financial position means that it is well-placed to address the challenge.

financial position means that it is well-placed to address the challenge.

Looking ahead, it is essential that we continue to analyse developments in the fintech sector and their effects – as yet unclear – on financial stability, also bearing in mind other potential channels of transmission![]() not addressed in this post. For instance, the emergence of fintechs focused on payment services

not addressed in this post. For instance, the emergence of fintechs focused on payment services![]() which, although not operating in the lending market, could influence it indirectly, reducing bank profitability as a result of the downward pressure they exert on fees and commissions in this segment.

which, although not operating in the lending market, could influence it indirectly, reducing bank profitability as a result of the downward pressure they exert on fees and commissions in this segment.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.