Unpacking the International Monetary Fund: eighty years of fostering international financial cooperation

The International Monetary Fund (IMF) plays a key role in maintaining the stability of the global financial system and upholding multilateralism, now under threat. In this post we take a closer look at this long-standing institution that faces substantial challenges in the years ahead.

In 2024 the International Monetary Fund![]() (IMF or “Fund”) celebrated its 80th anniversary. With nearly universal membership, the IMF has consistently played a key role in maintaining the stability of the international financial system and resolving financial crises. Together with the World Bank

(IMF or “Fund”) celebrated its 80th anniversary. With nearly universal membership, the IMF has consistently played a key role in maintaining the stability of the international financial system and resolving financial crises. Together with the World Bank![]() it stands as a cornerstone of the global economic order and multilateralism

it stands as a cornerstone of the global economic order and multilateralism![]() . This global order, which emerged from the Bretton Woods Conference

. This global order, which emerged from the Bretton Woods Conference![]() towards the end of the Second World War, has recently begun to crack. However, the IMF remains unfamiliar to many. What do we know about the IMF? What does it do and how does it work? And what role do Spain and the Banco de España play?

towards the end of the Second World War, has recently begun to crack. However, the IMF remains unfamiliar to many. What do we know about the IMF? What does it do and how does it work? And what role do Spain and the Banco de España play?

What does the IMF do?

The IMF's mission is to promote financial stability, international monetary cooperation and economic policies that foster international trade and economic growth. The Fund’s goal is to achieve sustainable growth and prosperity for its member countries.

The IMF pursues its mission and objectives through three interrelated activities, summarised in Figure 1:

Figure 1

HOW THE IMF CONTRIBUTES TO COUNTRIES’ STABILITY AND GROWTH

SOURCE: Banco de España and IMF.

- Economic surveillance

: the IMF performs a regular health check of members’ economies, including Spain, and identifies potential improvements (known as “Article IV Consultations

: the IMF performs a regular health check of members’ economies, including Spain, and identifies potential improvements (known as “Article IV Consultations ”). It also conducts more detailed examinations of some countries’ financial systems through the Financial Sector Assessment Programme

”). It also conducts more detailed examinations of some countries’ financial systems through the Financial Sector Assessment Programme

(FSAP ). The IMF's comprehensive view of all economies allows it to identify global risks and potential transmission channels, which it describes in its multilateral reports, including the World Economic Outlook

). The IMF's comprehensive view of all economies allows it to identify global risks and potential transmission channels, which it describes in its multilateral reports, including the World Economic Outlook

(WEO ) and the Global Financial Stability Report (GFSR

) and the Global Financial Stability Report (GFSR ). Both are essential reading for economic analysts around the world.

). Both are essential reading for economic analysts around the world. - Lending

: the IMF provides financial assistance to countries during crises or emergencies, as well as on a preventive basis. Since 2022 it has also provided financing to address climate-related risks and pandemic preparedness. Sometimes the IMF’s financing is conditional on a commitment to economic policy measures (known as conditionality

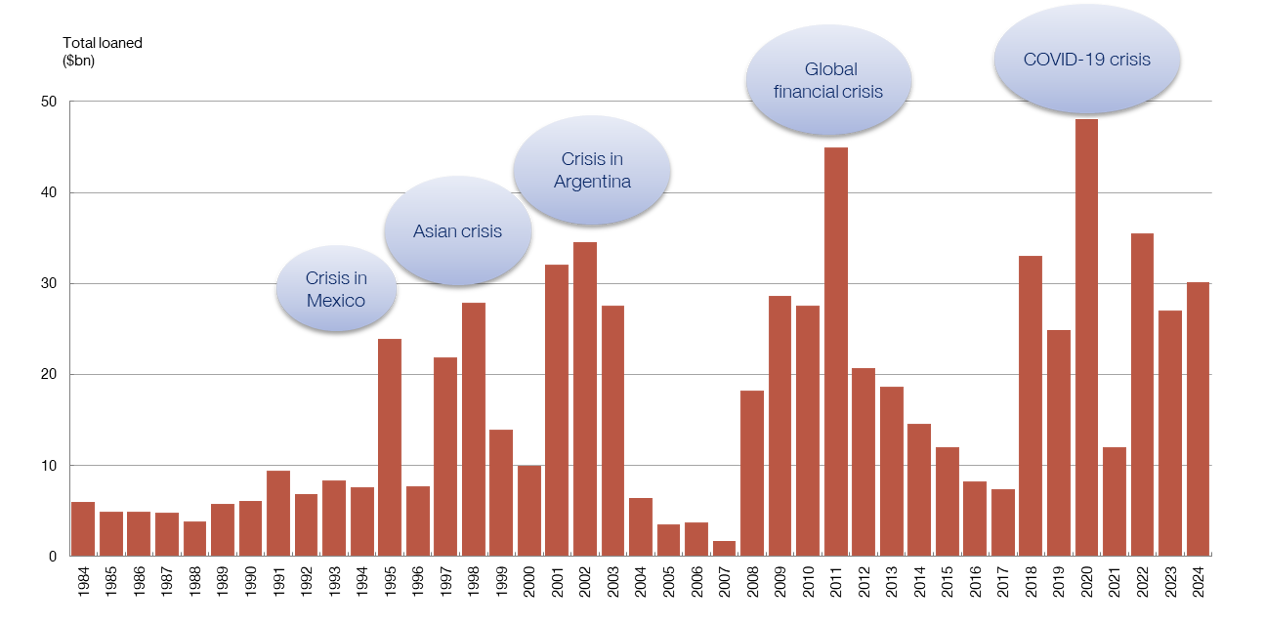

: the IMF provides financial assistance to countries during crises or emergencies, as well as on a preventive basis. Since 2022 it has also provided financing to address climate-related risks and pandemic preparedness. Sometimes the IMF’s financing is conditional on a commitment to economic policy measures (known as conditionality ) intended to help the country overcome its present crisis and prevent future ones. As Chart 1 shows, such financing has risen to significant levels during times of global crisis. Interest is charged on the loans, which is subsidised for the most vulnerable countries (such loans are termed concessional loans).

) intended to help the country overcome its present crisis and prevent future ones. As Chart 1 shows, such financing has risen to significant levels during times of global crisis. Interest is charged on the loans, which is subsidised for the most vulnerable countries (such loans are termed concessional loans).

Chart 1

IMF LENDING INCREASES DURING CRISES

SOURCES: Banco de España and IMF.

NOTE: The original figures are in special drawing rights (SDRs![]() ) and have been converted to dollars at the exchange rate on 2 January 2025 (1 dollar = 0.77 SDRs). Figures in nominal terms, that is, not adjusted for changes in price levels over the period.

) and have been converted to dollars at the exchange rate on 2 January 2025 (1 dollar = 0.77 SDRs). Figures in nominal terms, that is, not adjusted for changes in price levels over the period.

DID YOU KNOW...?

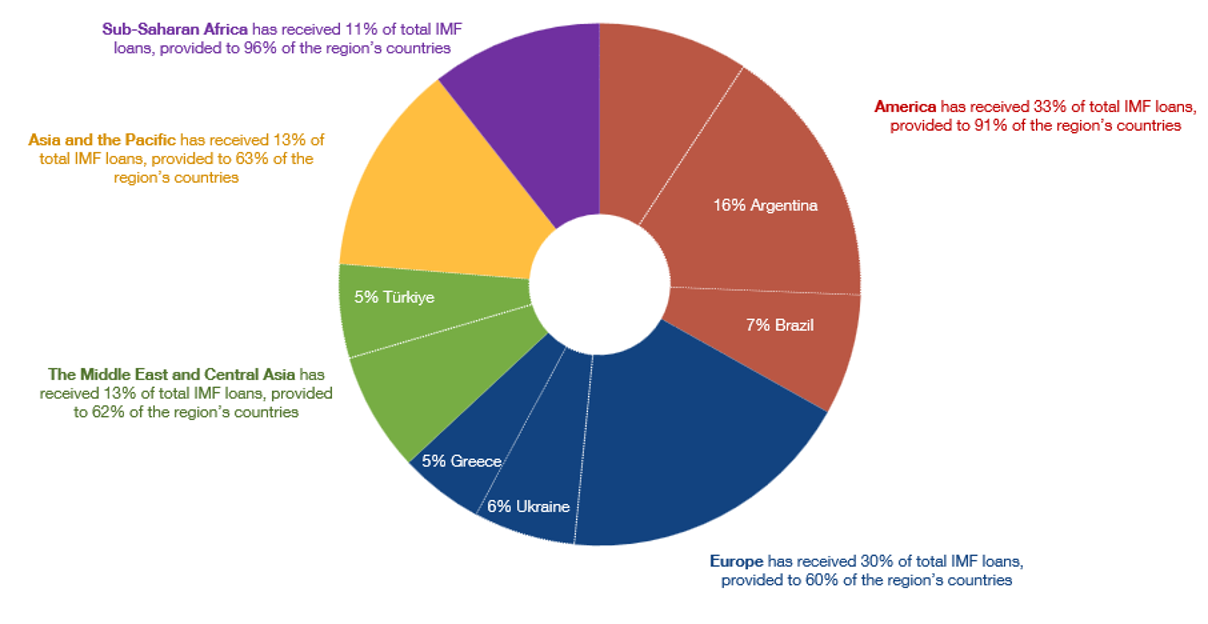

Over the past 40 years the IMF has provided loans to 144 countries. Africa has the highest number of recipient countries but has received the least funding, whereas Latin America and Europe have received the most (Chart 2).

At present, the largest debtors to the IMF are Argentina, Egypt and Ukraine.

IMF FINANCING BY REGION AND COUNTRY (1984-2024)

SOURCES: Banco de España and IMF.

NOTE: The top five recipient countries of IMF loans are shown, with their percentage share of the total. Calculations based on the total amount of loans in the period 1984-2024, not adjusted for changes in price levels over the period.

- Capacity development and technical assistance

: since 2006 the IMF has been assisting countries that request its support in building strong institutions. This assistance is financed by voluntary contributions from its members.

: since 2006 the IMF has been assisting countries that request its support in building strong institutions. This assistance is financed by voluntary contributions from its members.

DID YOU KNOW...?

Around one-third of the IMF’s annual expenditure goes towards technical assistance. The EU and Japan are the largest contributors to these activities.

The IMF has maintained the stability of the international monetary system, especially in times of global crisis, while adapting to meet new challenges

How does the IMF make decisions?

The IMF is governed by its member countries, whose number has grown from the 40 founding members to 191 at present![]() .

.

A quota![]() is calculated for each member country, broadly based on its relative position in the world economy and trade. A country’s quota is key to its participation in the IMF, determining its voting power, financial contribution

is calculated for each member country, broadly based on its relative position in the world economy and trade. A country’s quota is key to its participation in the IMF, determining its voting power, financial contribution![]() and the amount of loans or special drawing rights

and the amount of loans or special drawing rights![]() (SDRs, a reserve asset created by the IMF) that it can obtain from the Fund.

(SDRs, a reserve asset created by the IMF) that it can obtain from the Fund.

The United States has the highest quota (17.4%) and is the only country with the power to veto certain major decisions. Japan has the second highest quota (6.46%), followed by China (6.39%). Spain (2%) stands in thirteenth position.

DID YOU KNOW...?

Spain joined the IMF in September 1958![]() . Cuba, one of the founding members, withdrew from the IMF in 1964 and is among the few countries in the world that are not members.

. Cuba, one of the founding members, withdrew from the IMF in 1964 and is among the few countries in the world that are not members.

Each IMF member country is represented by a “governor” and an “alternate governor”. In Spain’s case these are the Minister for the Economy, Trade and Business and the Governor of the Banco de España, respectively. The member countries manage the IMF through three bodies![]() : the Board of Governors (the highest decision-making body); the International Monetary and Financial Committee (IMFC), which guides the IMF’s work and meets each spring and autumn (at its annual meetings); and the Executive Board, which conducts the IMF’s day-to-day work. To facilitate the discussions, in the latter two bodies the 191 countries are grouped into 25 “chairs

: the Board of Governors (the highest decision-making body); the International Monetary and Financial Committee (IMFC), which guides the IMF’s work and meets each spring and autumn (at its annual meetings); and the Executive Board, which conducts the IMF’s day-to-day work. To facilitate the discussions, in the latter two bodies the 191 countries are grouped into 25 “chairs![]() ”. The members elect a Managing Director, who chairs the Executive Board and manages the institution.

”. The members elect a Managing Director, who chairs the Executive Board and manages the institution.

Spain is included in the sixth largest chair, together with Mexico, Colombia, Costa Rica, El Salvador, Guatemala and Honduras. The Banco de España provides an advisor to Spain’s chair.

DID YOU KNOW...?

In 1994 the IMF held its annual meetings in Madrid, coinciding with the 50th anniversary of the Bretton Woods Institutions![]() .

.

Spain’s Rodrigo Rato served as Managing Director from 2004 to 2007. Since 2011 the position has been held by women.

Jaime Caruana (2006-2008) and José Viñals (2009-2016), both of the Banco de España, served as IMF Financial Counsellors![]() .

.

The IMF regularly visits the Banco de España to gain its insight into Spain’s economic conditions and financial sector

The IMF going forward

The IMF has successfully preserved the stability of the international monetary system and shown its capacity to adapt to change![]() , take on new challenges and support its members. In its early days the IMF facilitated the reconstruction of post-war Europe. It later welcomed the newly independent nations of Africa and supported the transition of former communist republics to a market economy. By creating SDRs, it helped replace the failed gold standard, while it has also assisted its members through domestic and global crises alike, including the COVID-19 pandemic. Throughout its history, the Fund has adapted its policies and tools to address a broad spectrum of issues, reflecting the concerns of its changing membership

, take on new challenges and support its members. In its early days the IMF facilitated the reconstruction of post-war Europe. It later welcomed the newly independent nations of Africa and supported the transition of former communist republics to a market economy. By creating SDRs, it helped replace the failed gold standard, while it has also assisted its members through domestic and global crises alike, including the COVID-19 pandemic. Throughout its history, the Fund has adapted its policies and tools to address a broad spectrum of issues, reflecting the concerns of its changing membership![]() .

.

DID YOU KNOW...?

Since 1999, after a series of crises in Asia, the IMF has strengthened its financial monitoring of member countries.

In response to the COVID-19 pandemic it extended loans to more than 80 countries and made a new allocation of SDRs![]() , tripling the stock in circulation.

, tripling the stock in circulation.

The growing geopolitical and geoeconomic fragmentation is putting multilateralism to the test. Against this backdrop, the IMF’s role in addressing global challenges![]() , such as climate change, inequality and new technologies, is more significant than ever. Ensuring credibility and legitimacy is essential for the IMF to fulfil this role.

, such as climate change, inequality and new technologies, is more significant than ever. Ensuring credibility and legitimacy is essential for the IMF to fulfil this role.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.