Trouble with your bank? When to turn to the Banco de España

Thousands of bank customers lodge complaints with the Banco de España. Although these often fall outside its remit, 80% of the opinions it is able to provide are accepted by banks. Knowing when (and when not) to bring complaints to the Banco de España's Complaints Service will help make this public service even more effective.

Having problems with a banking or payment service? Not happy with your bank’s response? The Banco de España’s Complaints Service can provide an expert opinion in a quick, cost-free procedure. While banks usually accept our opinion, we can only provide it on certain matters. This post explains what types of complaint the Banco de España can assist you with.

If you have a problem with a banking or payment product or service, you must first contact your bank’s customer service department. If you’re not satisfied with their response, you can turn to alternative dispute resolution (ADR![]() ) and contact the Banco de España’s Complaints Service. If your complaint falls within its remit, the Banco de España can provide you with an expert opinion before you pursue legal action.

) and contact the Banco de España’s Complaints Service. If your complaint falls within its remit, the Banco de España can provide you with an expert opinion before you pursue legal action.

What does the Banco de España’s Complaints Service do?

Complaints by financial services customers are regulated under a single piece of legislation in Spain![]() , but they are handled by three different authorities:

, but they are handled by three different authorities:

- the Banco de España

deals with complaints about banking products;

deals with complaints about banking products; - the National Securities Market Commission

(CNMV) handles complaints about financial securities;

(CNMV) handles complaints about financial securities; - the Directorate General of Insurance and Pension Funds

processes complaints about such products.

processes complaints about such products.

The Banco de España’s Complaints Service![]() receives thousands of complaints about matters over which it has no say. To understand its remit, we should look back to its foundation in 1987, amid the liberalisation of interest rates and fees in the financial markets

receives thousands of complaints about matters over which it has no say. To understand its remit, we should look back to its foundation in 1987, amid the liberalisation of interest rates and fees in the financial markets![]() . The new setting demanded measures to ensure greater transparency. One such measure was the creation of a complaints service to which customers, having unsuccessfully complained directly to their bank, could resort to uphold their rights and interests under banking transparency legislation.

. The new setting demanded measures to ensure greater transparency. One such measure was the creation of a complaints service to which customers, having unsuccessfully complained directly to their bank, could resort to uphold their rights and interests under banking transparency legislation.

DID YOU KNOW ...?

The Spanish model was the first to recognise the need for expert bodies to review customers' problems with banking services.

In other European countries this role is typically performed by institutions specialising in mediation and arbitration, rather than the central bank. The Banco de España stands as an exception, having fully assumed this responsibility itself.

Complaints you should (and shouldn’t) bring to the Banco de España

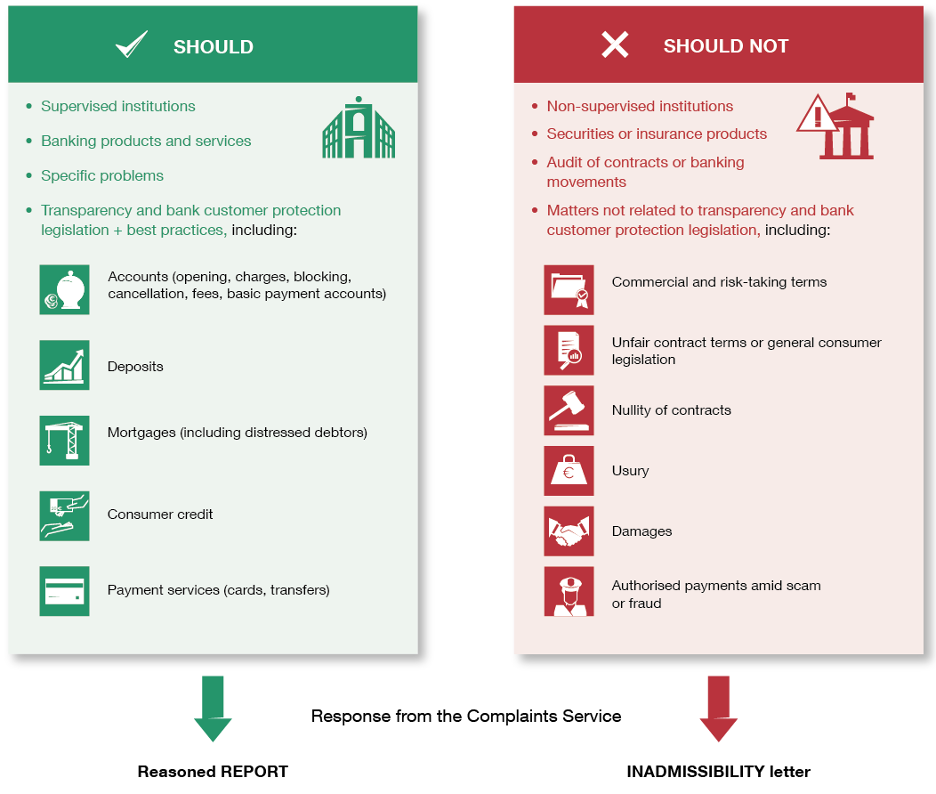

As a bank customer, it is worth knowing what complaints you can take to the Banco de España, confident of receiving a helpful response that may strengthen your position against your bank and potentially in court. If your complaint concerns potential breaches of legislation within the Banco de España’s remit, you will receive a “reasoned report” determining whether or not your bank has acted correctly. However, if it concerns failure to comply with general legislation, beyond our jurisdiction, your complaint will be rejected, and you will receive an “inadmissibility letter”. The complaints the Banco de España can and can't help with are illustrated in Figure 1 and summed up in this video![]() .

.

Figure 1

COMPLAINTS YOU SHOULD (AND SHOULDN’T) BRING TO THE BANCO DE ESPAÑA

SOURCE: Banco de España

What complaints should you bring to the Banco de España? Specific problems with banking products or services provided by supervised institutions![]() relating to breaches of conduct, transparency and bank customer protection regulations or failure to comply with “best practices”.

relating to breaches of conduct, transparency and bank customer protection regulations or failure to comply with “best practices”.

As a bank customer, you may have current accounts, cards, a mortgage, a consumer loan or use payment services. Or you might run an SME that has taken out a loan. All these banking products are governed by specific legislation that banks must comply with and, to that extent, fall within the Banco de España’s remit. As Figure 1 shows, complaints can be filed in relation to any phase of the contract cycle, from issues relating to pre-contractual information to product cancellation (e.g. if your bank charges a fee not stipulated in your contract or changes the contract terms without prior notice).

The Banco de España's remit also covers “best banking practices”, certain standards required to ensure responsible, diligent and customer-friendly practices. Although not legally enforceable, the Bank has the authority to establish such standards in specific cases and can use them to influence banks’ policies and conduct. Examples of best banking practices include not raising fees on dedicated accounts for mortgage payments or issuing a certificate of no outstanding debt at no extra cost once a loan has been repaid.

What complaints should you not bring to the Banco de España? Possible breaches by banks of general (non-banking) legislation applicable to all companies, such as that governing consumer protection, damages or liability in the event of wrongdoing or negligence. For example, the Banco de España cannot express an opinion about any problems you may have as a tenant when the landlord is a bank, since property law is not within its remit. Nor does it have a say when a legal assessment of issues such as customer responsibility is required, for instance in cases of unfair contract terms or when users are tricked by fraudsters into authorising payments.

The Complaints Service is effective: 80% of its opinions were accepted by banks between 2021 and 2024

Key figures

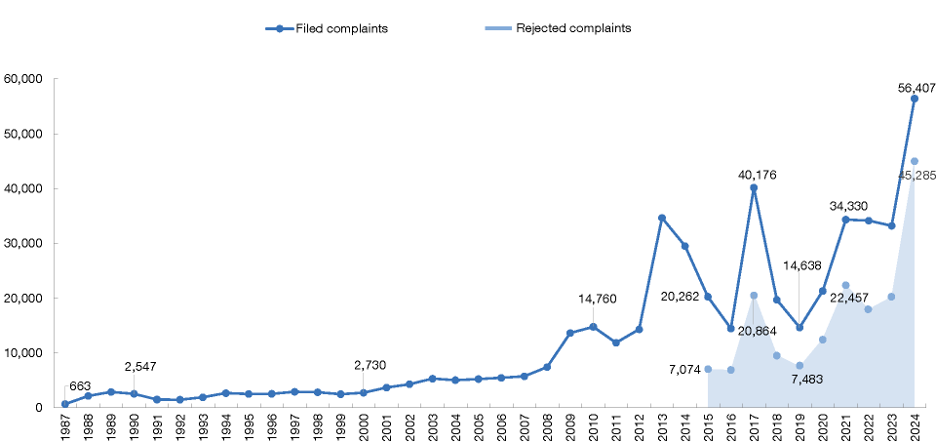

Over its 38-year history, the Complaints Service has handled more than 480,000 cases (Chart 1). In the last decade, an average of around 30,000 complaints have been filed each year. Many of these have been rejected (60% of complaints were considered inadmissible). 2024 was a record year in terms of the number of complaints received (56,400) and rejected (almost 80%): a great many related to claims for the reimbursement of mortgage arrangement fees charged under unfair contract terms, in aspects which fall outside the Banco de España’s remit.

Chart 1

COMPLAINTS: 1987-2024

SOURCE: Banco de España

NOTE: Provisional 2024 data (as at 31.12.2024). Rejected complaints: data for a consistent series only from 2015.

Even though significant resources are dedicated to reviewing complaints that are ultimately rejected, the Complaints Service is clearly effective in resolving cases it can act upon: its opinions were accepted by banks in 80% of cases between 2021-2024.

Social value and accountability

Above all, this is an accessible, user-friendly and free public service.

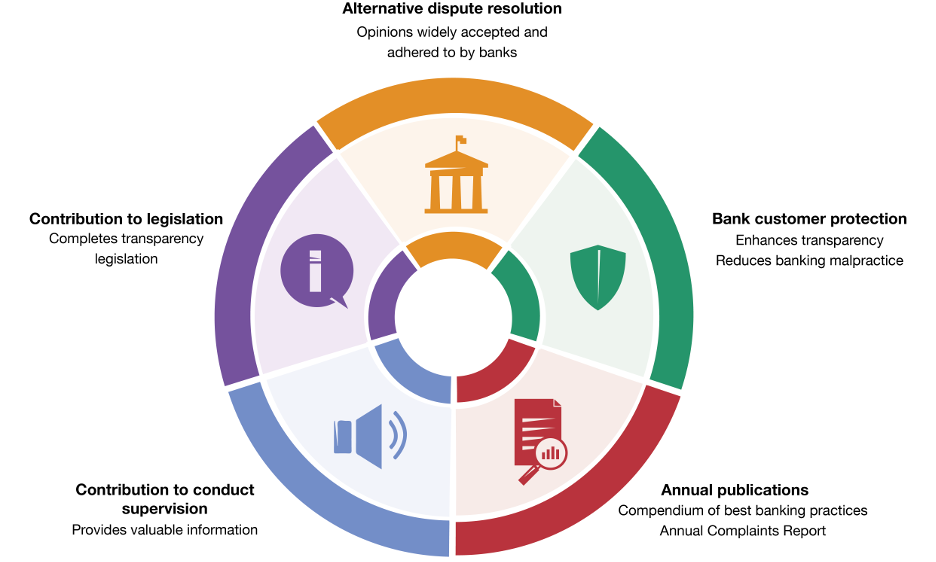

Moreover, in its analysis of the complaints filed, the Banco de España generates information that benefits society in multiple ways (Figure 2)

Figure 2

THE VALUE OF THE COMPLAINTS SERVICE

- The Banco de España acts transparently, providing accountability to the public in its annual Complaints Report

. Since 2024, it has also published the Compendium of best banking practices

. Since 2024, it has also published the Compendium of best banking practices .

. - The Institutions' Conduct Department, to which this service belongs, includes this information in its analyses. It thus aids in designing and implementing supervisory policies, conduct regulation and financial education programmes.

- Customer concerns and best banking practices are part of the Banco de España's regular dialogue with banks.

- Internationally, the information is valuable for sharing experiences with similar bodies in Europe (FIN-NET

, a network for settling finance-related complaints) and worldwide (INFO NETWORK

, a network for settling finance-related complaints) and worldwide (INFO NETWORK ).

).

The closer complaints align with the Banco de España’s remit, the more effective the service will be and the greater the benefits for bank customers. Greater public awareness and confidence in this service will make its contribution to society all the more valuable.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.