Food security: what role do domestic production and imports play in Spain’s food supply?

In recent years we have seen renewed interest in having a resilient food supply chain that ensures that food continues to reach consumers whatever the circumstances. Strategic food autonomy relies on strengthening domestic production and international trade, especially within the European single market.

Enjoying a variety of foods from across the globe is something we take for granted. Yet, in recent years, the pandemic, the Russian invasion of Ukraine and increasingly frequent extreme weather events have affected the availability of some food commodities. This underlines the strategic importance of ensuring food security![]() . Here we present an overview of Spain’s food supply, based on a recent study

. Here we present an overview of Spain’s food supply, based on a recent study![]() , analysing the risks it faces and how strategic food autonomy can be strengthened.

, analysing the risks it faces and how strategic food autonomy can be strengthened.

There are two food supply channels: domestic production and imports. Food obtained through these channels is consumed in Spain and surplus production is exported. Imports and exports of food commodities act as a buffer for domestic production, enabling a broader and more stable food supply in the face of potential domestic market disruptions.

Coffee, for instance, is available across Europe and Spain thanks to supplies from the “green coffee belt” between the tropics. Some fruits – such as grapes from Chile – are also available out of season thanks to imports. Likewise, Spain exports, among many other products, olive oil and oranges, making them available for consumption in other countries and boosting Spanish economic activity.

Imports add stability to the food supply chain, especially in the case of a poor domestic harvest, and help mitigate price swings. Exports help balance the market in the event of an exceptional harvest, providing additional income from selling surpluses abroad and offsetting declines in domestic market prices.

Trade agreements facilitate imports and exports between countries. Moreover, European Union (EU) membership facilitates the food supply in the area, through the European single market![]() and through EU agreements with third countries, such as the recent one with Mercosur

and through EU agreements with third countries, such as the recent one with Mercosur![]() .

.

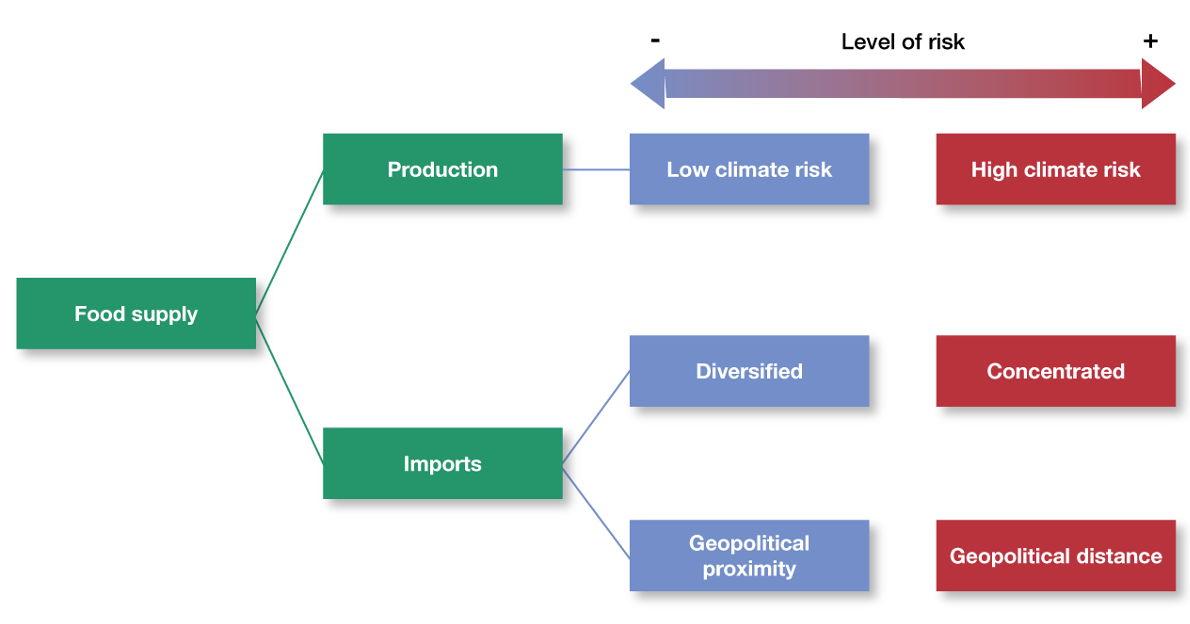

However, as shown in Figure 1, risks to food security and to a stable food supply persist. Climate risk affects both production and imports, while other foreign trade-related risks include product concentration among just a few supplier countries and geopolitical frictions.

Figure 1

FOOD SUPPLY AND MAIN SUPPLY RISKS

SOURCE: Banco de España.

Spanish food commodities: production and trade

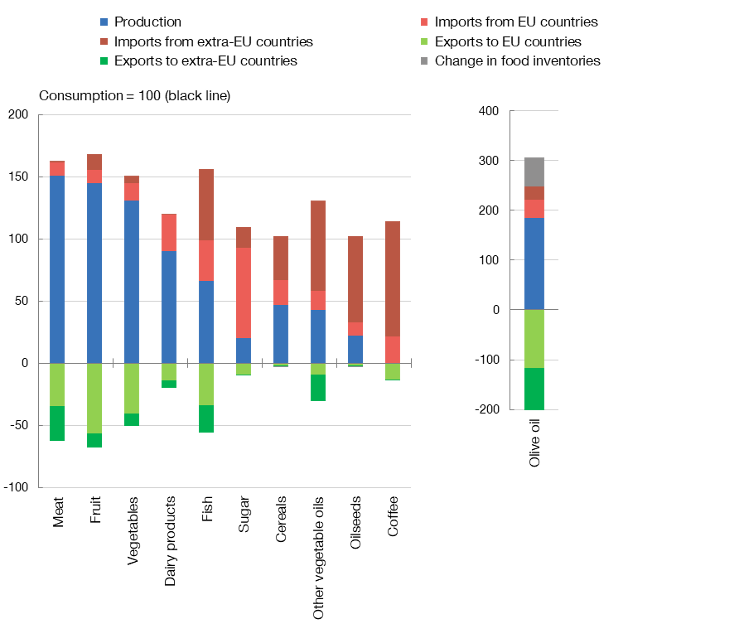

Spain’s production of fruit, vegetables, meat and olive oil allows it to meet domestic consumption and to export these products (Chart 1). By contrast, it has to import cereals, coffee, oilseeds (such as soybean or sunflower seeds), sugar, dairy products and fish, although almost all sugar, dairy products and fish imports come from within the EU.

Chart 1

SPAIN'S FOOD PRODUCTION, CONSUMPTION AND IMPORTS/EXPORTS IN 2022

SOURCE: European Commission, FAO and Banco de España.

NOTES: How to interpret the chart: Consumption (at 100 in all cases) and inventories equal production and imports/exports. Spain produces slightly more than 150% of the amount of meat it consumes, meaning that it exports the equivalent of more than half its consumption to both EU and extra-EU countries. It also imports some meat (around 10% of consumption). The bars in the columns add up to 100, as there are no food inventories, except in the case of olive oil.

Data on fish, olive oil and other vegetable oils refer to 2021.

DID YOU KNOW THAT...?

In the 2022/23 crop cycle, Spain produced 18 million tonnes of cereals but it consumed more than twice that amount (38 million, mostly for fodder), so imports totalled almost 22 million tonnes.

In the same cycle, vegetable production amounted to 16 million tonnes, while domestic consumption was just 12.3 million, so Spain was able to export 3.7 million tonnes.

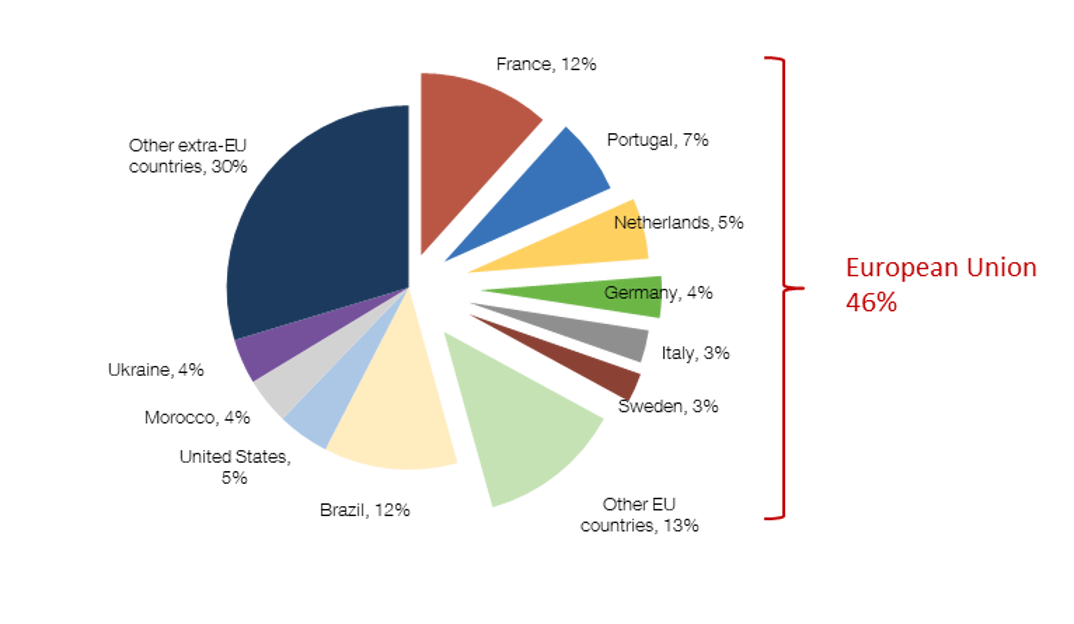

As Chart 2 shows, 46% of Spain’s food imports come from the EU, mainly from France (12% of total imports), followed by Portugal and the Netherlands. Brazil is Spain’s leading extra-EU food supplier (12%), followed at a considerable distance by the United States, Morocco and Ukraine.

Chart 2

SPAIN'S MAIN SUPPLIERS OF FOOD COMMODITIES

SOURCE: BACI-CEPII, Banco de España.

DID YOU KNOW THAT...?

France is our main EU supplier of cereals, oilseeds, sugar, vegetables and other vegetable oils.

Brazil is our main supplier of oilseeds (mainly soybean), meat, sugar, cereals and coffee.

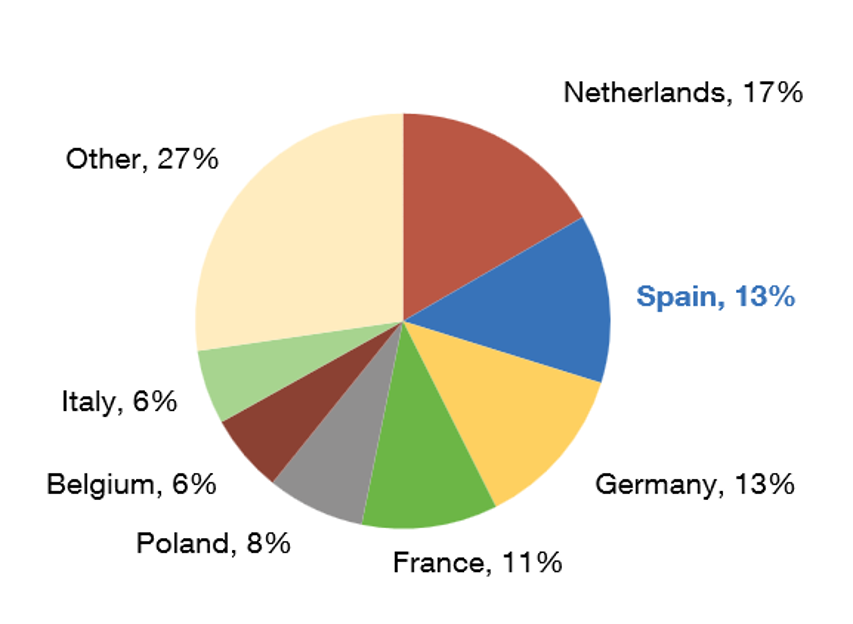

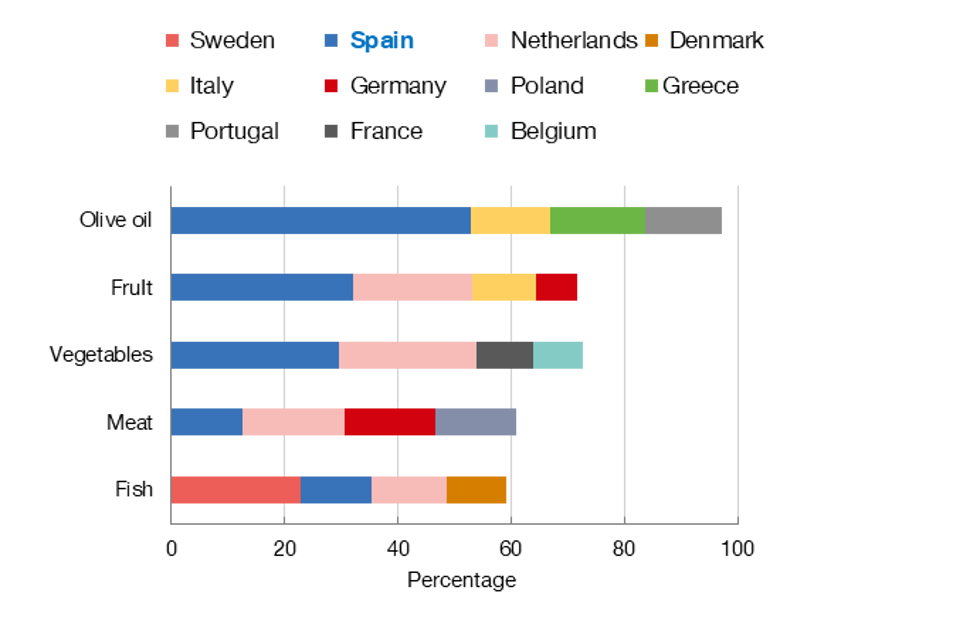

As for our exports (Chart 3), Spain is the EU’s second largest exporter of food commodities and the leading supplier of fruit, vegetables and olive oil.

Spain is the second largest exporter of food commodities in the EU and the leading supplier of fruit, vegetables and olive oil

Chart 3

SPAIN IS A MAJOR SUPPLIER OF FOOD TO THE EU

1. Source of intra-EU imports

2. Share of intra-EU exports of a selection of products

SOURCE: BACI-CEPII, Banco de España.

NOTE: The share of exports is the proportion of total exports to the EU by each EU supplier country, expressed as a percentage.

How to achieve greater food autonomy and security?

In 2022, following Russia’s invasion of Ukraine, the EU set out to strengthen the region’s food autonomy![]() , a strategy that is still ongoing. The pillars of this greater autonomy are:

, a strategy that is still ongoing. The pillars of this greater autonomy are:

- bolstering domestic production;

- further European single market integration;

- trade expansion to ensure and diversify supply sources.

When it comes to strengthening food security, oilseeds represent a weakness for Spain, as we import much of what we consume from a handful of countries, which what’s more are outside the EU. However, Spain has good and stable relationships with the largest suppliers of these seeds (such as Brazil), reducing the risk of potential supply shortages.

For cereals it is somewhat different. Although Spain imports large amounts, the EU has surplus production. So, should problems arise with imports from extra-EU countries, our needs could be met by our European partners, which minimises the risks.

By contrast, olive oil and meat are Spain’s strengths, as we produce more than we consume and exports are highly diversified.

Lastly, food security is not only affected by production and imports/exports. External dependency on some critical inputs for food production, such as fertilisers, can also pose risks to food security.

In short, this analysis shows that Spain enjoys considerable food supply autonomy, with a few exceptions. This autonomy is underpinned by domestic production and Spain’s single market membership.

Spain’s food autonomy is underpinned by its high and diversified domestic production and its single market membership

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.