What does a shrinking central bank balance sheet mean for your pocket?

The balance sheets of the European Central Bank (ECB) and the other euro area central banks have been shrinking since 2022 due to the phasing out of the past decade’s expansionary monetary policy measures. This has an impact on interest rates in the economy and therefore affects everyone directly.

4 min

The Eurosystem is reducing the size of its balance sheet![]() . What does this mean for you? This may seem like an odd question, as a central bank’s balance sheet is not obviously connected to people’s everyday lives. But they are in fact linked, and this matters if you have a mortgage or savings in the bank. If you do, then read on. If not, keep reading anyway, and you will pick up some basic notions about monetary policy and financial markets you should be familiar with.

. What does this mean for you? This may seem like an odd question, as a central bank’s balance sheet is not obviously connected to people’s everyday lives. But they are in fact linked, and this matters if you have a mortgage or savings in the bank. If you do, then read on. If not, keep reading anyway, and you will pick up some basic notions about monetary policy and financial markets you should be familiar with.

What is the Eurosystem’s balance sheet?

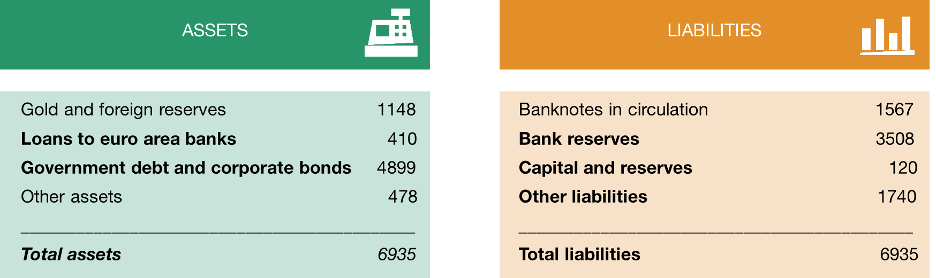

The Eurosystem’s balance sheet![]() reflects all the assets and liabilities of euro area central banks (including the Banco de España). As Figure 1 shows, the asset side is currently made up mostly of euro area countries’ government and corporate debt and, to a lesser degree, of loans to banks. The liability side mainly contains commercial bank deposits held in Eurosystem central banks (known as bank reserves).

reflects all the assets and liabilities of euro area central banks (including the Banco de España). As Figure 1 shows, the asset side is currently made up mostly of euro area countries’ government and corporate debt and, to a lesser degree, of loans to banks. The liability side mainly contains commercial bank deposits held in Eurosystem central banks (known as bank reserves).

Figure 1

CONSOLIDATED BALANCE SHEET OF THE EUROSYSTEM, END-2023

SOURCE: European Central Bank.

NOTE: Billions of euro.

The balance sheet grew significantly over the past decade as a result of the ECB’s asset purchase programmes and long-term loans to banks in the wake of the global financial crisis and the sovereign debt crisis, and during the pandemic. These measures were intended to ease financing conditions in the euro area and, ultimately, deliver on the price stability target.

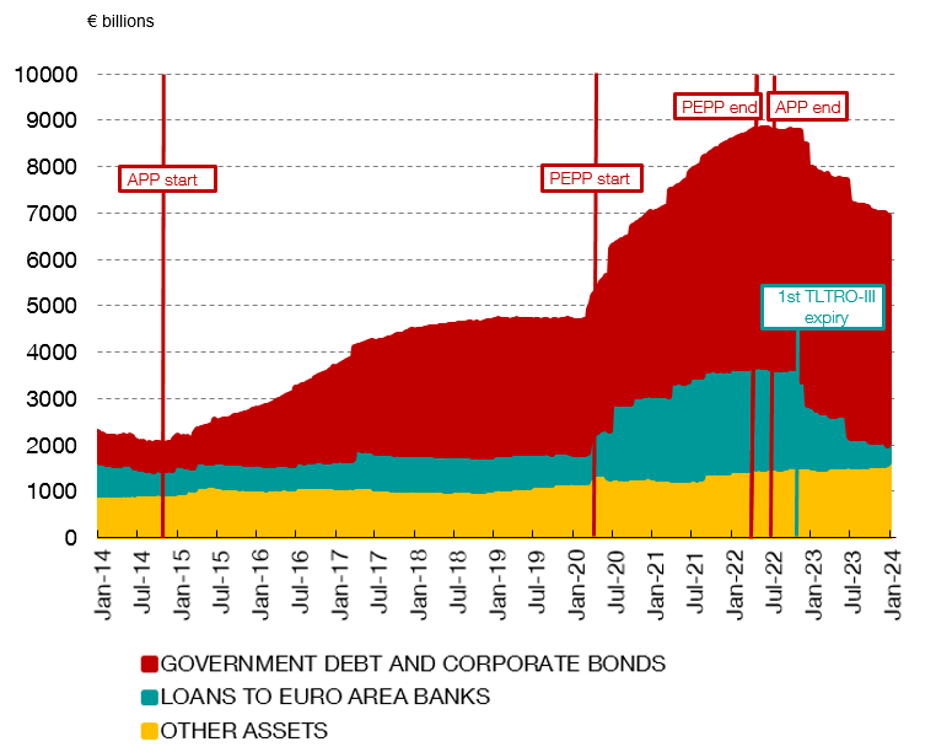

The ECB began phasing out these expansionary measures in December 2021![]() , against a backdrop of rising inflation in the euro area. As a result, the Eurosystem’s balance sheet has already shrunk (Chart 1), from almost €9 billion to under €7 billion.

, against a backdrop of rising inflation in the euro area. As a result, the Eurosystem’s balance sheet has already shrunk (Chart 1), from almost €9 billion to under €7 billion.

Chart 1

THE GROWTH AND REDUCTION OF THE EUROSYSTEM'S BALANCE SHEET OVER THE LAST DECADE

SOURCES: Banco de España and ECB.

NOTES: The ECB's asset purchase programmes and long-term loans to banks explain the size of the Eurosystem's balance sheet. The vertical lines depict the main milestones.

-The Asset Purchase Programme (APP) began in 2014. Asset purchases under the APP were discontinued in July 2022, but were reinvested upon maturity until July 2023.

-The Pandemic Emergency Purchase Programme (PEPP) began in March 2020. In December 2021 the ECB announced that it would discontinue purchases in March 2022. Reinvestments will continue until end-2024 (in full during the first half of the year, and partially in the second half).

-The targeted longer-term refinancing operations (TLTRO) have been launched in three series: TLTRO-I in 2014, TLTRO-II in 2016 and TLTRO-III in 2019, with conditions improved in 2020 in response to the pandemic. The reduction in the loans derives from the maturity of the first TLTRO-III in September 2022 and subsequent operations.

The Eurosystem’s balance sheet and interest rates

Gradually running down the balance sheet helps reinforce the increases in the ECB’s policy interest rates, which are our main monetary policy tool and have the strongest effect on market rates. The policy rates hikes that the ECB has made since July 2022 have sought to tame rising inflation, as the Governor of the Banco de España explained in a previous blog post![]() .

.

The Eurosystem’s balance sheet impacts financing conditions because of the relationship between interest rates and the size and composition of the balance sheet, which responds to basic concepts of supply and demand.

Take, for example, a balance sheet expansion due to an increase in medium and long-term bond holdings, as happened when the asset purchase programmes began in 2014.

If central banks buy some of the debt issued by governments and firms in the form of bonds, demand increases relative to supply, pushing up the price. Because there is an inverse relationship between the interest rate (or yield) of a bond and its price, a higher bond price means a lower interest rate.

The opposite is also true: when central banks wind down their bond purchases (as they are doing now), there is a drop in both demand and price, prompting higher interest rates. The actual mechanics involved are rather more complicated, but if you are interested in learning more, check out Box 3.1 in Chapter 3 of our latest Annual Report![]() .

.

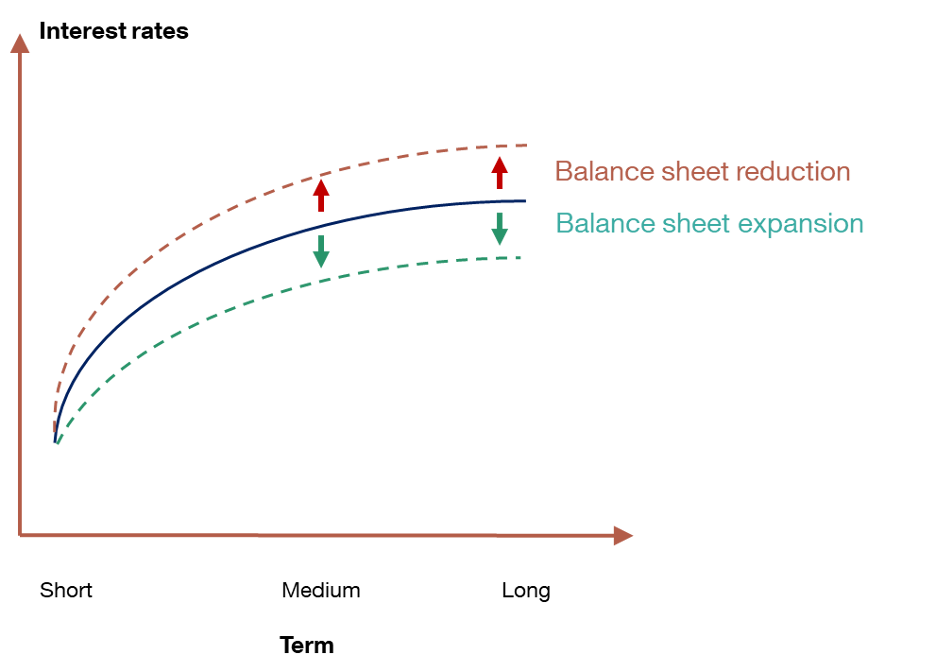

Reducing the balance sheet raises medium and long-term interest rates, which means the yield curve steepens

A balance sheet reduction raises medium and long-term interest rates. As Figure 2 shows, this leads to the yield curve![]() steepening, unlike when policy rates are hiked, which tends to push up interest rate levels across the entire curve. Both measures result in higher interest rates, but at different terms. This helps reduce spending and, ultimately, inflation (click here

steepening, unlike when policy rates are hiked, which tends to push up interest rate levels across the entire curve. Both measures result in higher interest rates, but at different terms. This helps reduce spending and, ultimately, inflation (click here![]() for a basic explanation of how monetary policy works).

for a basic explanation of how monetary policy works).

Figure 2

THE YIELD CURVE STEEPENS WHEN THE SIZE OF THE BALANCE SHEET IS REDUCED

SOURCE: Banco de España.

NOTES: The yield curve![]() is the graphical representation of the relationship between the interest rate on a country’s sovereign bonds and their maturity. The curve tends to have a positive slope, reflecting that long-term interest rates are higher than short-term rates. The positive slope derives from the term premium demanded by investors for interest rate risk, which grows with the maturity. The balance sheet reduction raises medium and long-term rates, steepening the curve.

is the graphical representation of the relationship between the interest rate on a country’s sovereign bonds and their maturity. The curve tends to have a positive slope, reflecting that long-term interest rates are higher than short-term rates. The positive slope derives from the term premium demanded by investors for interest rate risk, which grows with the maturity. The balance sheet reduction raises medium and long-term rates, steepening the curve.

What does shrinking the balance sheet mean specifically for you?

Price stability benefits everyone because it is a precondition for sustained growth. And all European citizens benefit from a reduction in the Eurosystem’s balance sheet, because it helps monetary policy achieve its main target: inflation of 2% over the medium term.

By helping monetary policy to reduce inflation, shrinking the balance sheet benefits everyone. But if you are a borrower, you will have to pay more on your loans

If you are a borrower, higher interest rates mean paying more on your loans. But if, on the other hand, you have savings, you can get a higher return on them.

Although it is shrinking, the Eurosystem’s balance sheet is still bigger than it was before the crises. How far should it be reduced? And what should it look like in the future? These are important questions, which are being studied by the Eurosystem and by other central banks. There will likely be news on this front in the coming months as part of the work to define a new operational framework for the Eurosystem, which we will report on in this blog.

DISCLAIMER: The views expressed in this blog post are those of the author(s) and do not necessarily coincide with those of the Banco de España or the Eurosystem.