What is MREL?

Entities must maintain a sufficient amount of capital and debt instruments as to absorb losses and restore capital as part of the implementation of the resolution tool that the authorities determine as most appropriate.

This requirement, called "Minimum Requirement for own funds and Eligible Liabilities (MREL)" guarantees that instruments are available at all times in case they need to be used, and is independent from any other capital requirements determined by the supervisor.

The purpose of the MREL is therefore to ensure that shareholders and creditors of the entities, with some exceptions, are the first to bear the losses and, when appropriate, to procure the recapitalization of those entities.

SRB. Insolvency ranking in the jurisdictions of the Banking Union![]()

and the TLAC?

The Loss-absorbing capacity" (TLAC) is a set of instruments that an entity must hold and that can be written off or converted into equity in the event of resolution. The FSB states that the TLAC requirement should consist of instruments that are legally and effectively converted into shares in the event of resolution (18% of RWAs and 6.75% of leveraged assets since January 1, 2022). Therefore, in general, equity instruments and long-term unsecured subordinated debt are the instruments that can make up the TLAC requirement.

On November 9 2015, the FSB published the “Total Loss-absorbing Capacity (TLAC) Term Sheet” (hereinafter referred to as the "TLAC standard"), which was approved by the G-20 at the summit in November 2015 in Turkey. The TLAC standard requires global systemically important banks to have a sufficient amount of high loss-absorption liabilities (usable in bail-in) to facilitate a rapid and adequate loss absorption and a recapitalisation in the event of resolution.

The incorporation of the TLAC standard into Union law must take into account the current MREL requirement, established in Directive 2014/59/EU of the European Parliament and of the Council. Since the TLAC standard and the MRELs pursue the same objective of ensuring that entities have sufficient loss-absorption capacity, both requirements are complementary components of a common framework.

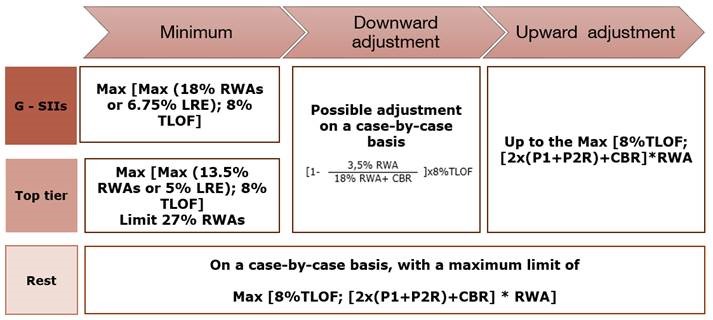

The general rule for MREL calibration is as follows:

The general rule for subordination requirement is as follows:

RWA – total risk exposure amount

LRE – total exposure measure

TLOF – total liabilities and own funds

CBR – combined buffer requirement

LR – leverage ratio

LAA – loss-absorption component

RCA – recapitalisation component

The following table summarizes the MDA vs sanctions for non-compliance with MREL

MDA – Maximum Distributable Amount